Taxes Lesson Plan

advertisement

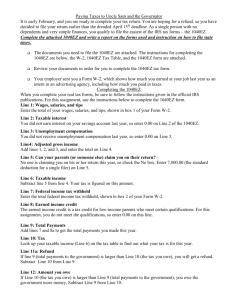

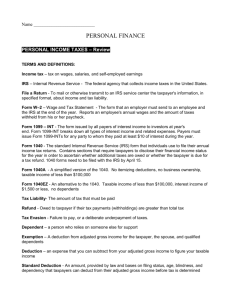

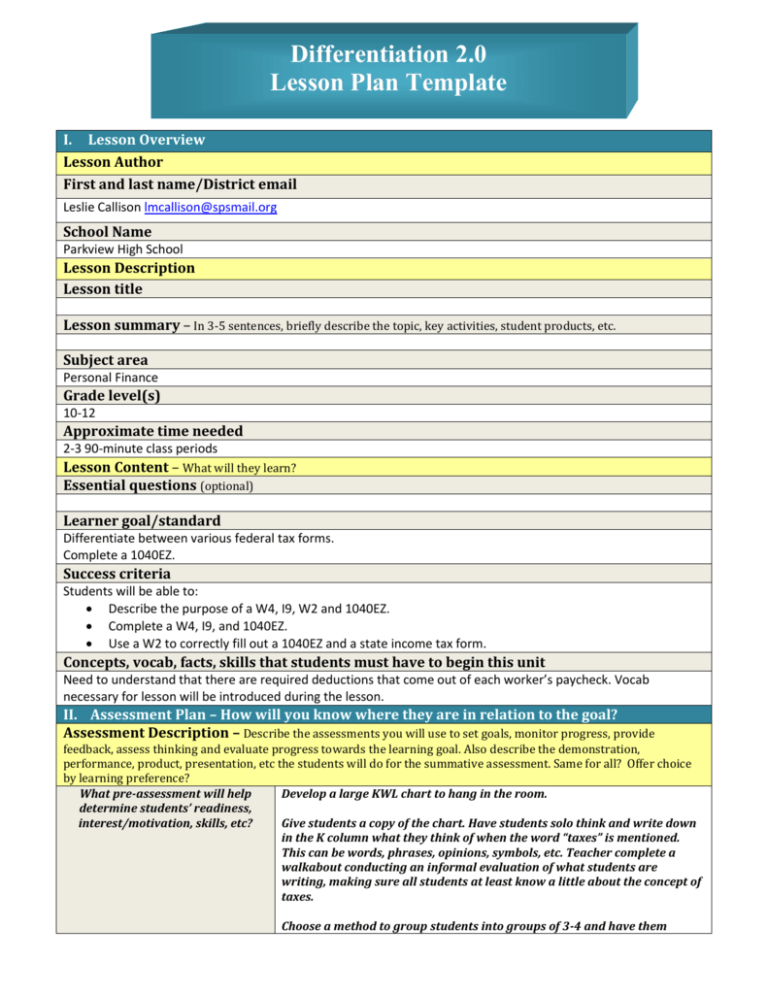

Differentiation 2.0 Lesson Plan Template I. Lesson Overview Lesson Author First and last name/District email Leslie Callison lmcallison@spsmail.org School Name Parkview High School Lesson Description Lesson title Lesson summary – In 3-5 sentences, briefly describe the topic, key activities, student products, etc. Subject area Personal Finance Grade level(s) 10-12 Approximate time needed 2-3 90-minute class periods Lesson Content – What will they learn? Essential questions (optional) Learner goal/standard Differentiate between various federal tax forms. Complete a 1040EZ. Success criteria Students will be able to: Describe the purpose of a W4, I9, W2 and 1040EZ. Complete a W4, I9, and 1040EZ. Use a W2 to correctly fill out a 1040EZ and a state income tax form. Concepts, vocab, facts, skills that students must have to begin this unit Need to understand that there are required deductions that come out of each worker’s paycheck. Vocab necessary for lesson will be introduced during the lesson. II. Assessment Plan – How will you know where they are in relation to the goal? Assessment Description – Describe the assessments you will use to set goals, monitor progress, provide feedback, assess thinking and evaluate progress towards the learning goal. Also describe the demonstration, performance, product, presentation, etc the students will do for the summative assessment. Same for all? Offer choice by learning preference? What pre-assessment will help Develop a large KWL chart to hang in the room. determine students’ readiness, interest/motivation, skills, etc? Give students a copy of the chart. Have students solo think and write down in the K column what they think of when the word “taxes” is mentioned. This can be words, phrases, opinions, symbols, etc. Teacher complete a walkabout conducting an informal evaluation of what students are writing, making sure all students at least know a little about the concept of taxes. Choose a method to group students into groups of 3-4 and have them combine their ideas in a poster. Combine info from student posters in the K column of the large poster. Have students return to their original seat, and give them additional solo think time to come up with at least one specific question they would like to know about taxes. Have students group again and write each unique question on an 8.5x11 piece of paper that can be taped to the L column of the large poster. What formative (on-going) assessments will help monitor students’ progress towards the learner goal? Indicate where in the lesson you recommend these checkpoints occur. What summative assessment will provide information concerning students’ attainment of the learner goal and determine next steps for student needs? Maintain the KWL chart throughout the lesson. Socrative quizzes Individual white boards will help with informal assessments to get an overall picture of how the class is grasping the content After W4, W2, I9, and 1040EZ are all introduced: If individual white boards are not available, make at least two individual cards per student. One side of card A needs to have W4, the other side W2. The second card will have I9 on one side; 1040EZ on the other. Students can then hold up their answer when a descriptor is read. After introducing the 1040EZ: Show the “IRS Confused” picture on the SmartBoard. Hand out the exit pass with the same picture and a sliding scale of 0-5. Have students mark on the scale where they are in terms of agreeing with the picture: 0 being “I don’t agree at all, I’ve got this tax thing”; 5 being “I completely agree with him, I don’t understand anything we’ve done today.” Students will complete 1040EZ forms on their own filing both as a dependent and an independent. What specific criteria will be listed on the rubric you use for evaluating student progress? III. Lesson – Provide details of the stages of the lesson Anticipatory Set – What is the plan for engaging the learner/accessing prior knowledge? Initial unit AS: Have students complete the preassessment activity listed in Section II. Additional ideas for content reconnect: Give students a few minutes to research ridiculous ways government spends money. Can do Stand Up, Hand Up, Pair Up to give students a chance to share at least one thing they found. Instruction (Input) – How will they learn it? Single strategy that engages all? More than one learning preference or modality (MI/Learning Styles)? Direct instruction or inquiry method? Whole class direct instruction: Cloze notes with pages included for mind-mapping, brainstorming, etc. Hand out vocab graphic organizer on which students can take notes Model how to fill out tax documents Practice What strategy(s) will you use for guided practice (How will they learn?) Same for all? Offer choice by learning preference? Be prepared to tier for challenge, based on your on-going assessment, by creating less or more complex tasks for your students. DAY 1 Define tax. Have students complete mind map either individually or with shoulder partner using the prompt “What do taxes pay for?” After a set amount of time, have them popcorn answers or write them on the SmartBoard. Emphasize taxes benefit everyone. Go over required deductions. Show paystub. Explain gross versus net pay. Ask students “Who has held a job or is currently in a job where you get an actual paycheck?” Have students who have stand up. Ask them to remain standing if they remember filling out a W4 or I9 form when they were hired. Ask students to remain standing if they know why they had to fill out those forms. If any students remain standing, ask them to offer an explanation to the class of the purpose of the W4 and/or I9. If no student knew the answer for the purpose of a W4, ask students how their employer(s) know how much to take out of their paycheck. Fill in graphic organizer section on W4. Have students turn to W4 in packet. Give students small Post-it notes and highlighter. (Completed W4 in iShare folder.) Explain what to fill in and how allowances affect income tax withheld. Show students pictures of completed W4s and have them circle which one would have more tax withheld. (Document in iShare as W4 Circle) Choose a strategy to have students pair up (shoulder partner, etc.). Choose one student to go first (longest hair, most jewelry, etc.) and that student gets to choose to answer one of two questions: 1. What is the purpose of a W4? or 2. How does the number of allowances you take on your W4 affect your takehome pay? The other student will answer whichever question was not chosen by his/her partner. Have students turn to graphic organizer in notes and fill in section on I9. Turn to I9 in packet and have students highlight portions they will fill out. Have them highlight the documents on the back of the page that they currently have and could bring with them for their employer to copy. Students revisit KWL chart and jot down at least 3 things they learned during the day’s lesson. DAY 2 Hand out individual white boards and markers (if these are not available, have student write answers in large size on piece of paper). Ask simple review questions about Day 1 content and have students hold up their answers after each question. Have students turn to graphic organizer and fill in section on W2. Show completed W2 and give students independent time to answer questions about information on the W2. (Form and answer key are on iShare as “W2 Can you find me” and “W2 Can you find me Answer Key”) Give students a chance to share/compare answers with a partner. Have students go back to graphic organizer in notes. Fill in section on 1040EZ and 1040A. Students will need white boards or Answer Cards (in iShare). Teacher reads descriptor statement about one of the four forms and students hold up the card they think corresponds with the description. Have students turn to blank 1040EZ form in student packet. Students will need at least two different color highlighters or they can trade with a shoulder partner if there are not enough for two per student. Teacher will walk students through how to fill out the form using one of the W2s in the packet. Have students highlight corresponding sections on the 1040EZ and W2. For example, students would highlight line 1 on the 1040EZ in pink and would also highlight Box 1 on the W2. Students would then highlight line 7 on the 1040EZ in yellow and would highlight Box 2 on the W2 in yellow, as well. Have students complete two forms on their own. Can give them the final answers so they know if they completed the forms correctly. Use Smart Notebook activity and have students volunteer to drag numbers to correct spot on 1040EZ. What strategy(s) will you use for independent practice (How will they demonstrate their learning?) Same for all? Offer choice by learning preference? Be prepared to tier for challenge, based on your on-going assessment, by creating less or more complex tasks for your students. Choice board: in order to help students identify and explain the relationships between W4, W2 and 1040EZ forms, they will create one of three products: 1. Can create a relationship want ad from the perspective of one of the forms. 2. Can create a drawing or comic. 3. Can create a written product such as a rap, song, poem, short story. Students will complete 1040EZ forms on their own. Anchor Activity – Self-paced, purposeful, content-driven activities that students can work on independently after a lesson or throughout a unit, a grading period, or longer. What activity might you have for students to move to after they finish their task? Closure – How will you reinforce what they’ve learned? Socrative quiz Independent practice with 1040EZ forms. IV. Materials and resources needed for lesson – Will this require the same resources for all students or possibly tiered resources? Might this be an opportunity to provide your students with choice? Technology Internet access, if possible Printed Resources – cubes, tiered activities, exit slips, rubrics, etc. If Internet is not available to all students, print appropriate pages of tax table so students can find the income tax for the 1040EZs Ancillary Resources – textbooks, curriculum guides, story books, lab manuals, reference materials, articles, etc. Supplies (other than everyday items common to all classrooms) White boards, dry erase markers Internet Resources irs.gov External Resources – experiments, guest speakers, mentors, other students, community members, parents, etc. V. Considerations for managing differentiation in this lesson Describe your plans to: Offer choice Group students flexibly Offer less or more complex tasks Provide additional support from the teacher Support learning modalities with tools like graphic organizers, etc Use anchor activities for early assignment completion and/or support students who need extra time Students will use a KWL chart for preassessment. VI. Reflecting on your practices What might be next for your students? Use any of the following questions to reflect on how your students are doing in relation to the learning goal. Are there students who need more instruction, time, or practice? Have the majority of students accomplished the learning goals? Is there a need in the next class session for tiered assignments to reinforce learning? Is the class ready to move to another curriculum goal? If you were to teach this lesson again, what plus/delta reflections might you want to keep in mind? Use any of the following questions to reflect on your lesson. What worked best about your lesson? What adaptations to the lesson would you make next time to better accommodate your students’ needs? What management tips might make this lesson go smoother? As you consider elements of the Learning Model, how has this lesson incorporated rigor, the three capabilities and the four processes?