Contemporary Memo - University of Baltimore

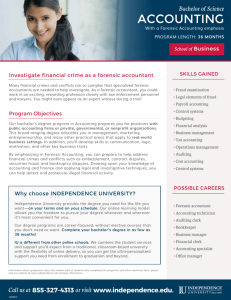

advertisement

Text from MSB Memorandum Dated 3/29/05 for presentation to University Council, 5/27/05 Curriculum Change Proposals The purpose of this cover memo is to outline three sets of curriculum changes approved by the appropriate faculty committees, the Merrick School of Business Faculty Senate, and endorsed by Dean Anne McCarthy. Associated with each numbered item below, page numbers are referenced, which represent the locatin of that item in this proposal. The four items are 1. Changing the requirements for the Certificate in Technology Commercialization. Not for UC review. 2. Changing the course descriptions and/or course titles for courses regularly offered in the INSS subject area by Merrick School faculty to students in the M.B.A. and M.S./M.I.S. programs. In the opinion of the faculty and the dean’s office these changes are not substantial and do not alter the underlying structure of any degree or specialization. The Merrick School will take the responsibility to ensure that these changes are reflected in the graduate catalog at each appropriate instance. Not for UC review. 3. Creation of four new courses, each with topics relating to forensic accounting. These courses are proposed to be added to our M.B.A. program and will be part of the Graduate Certificate in Forensic Accounting (#4 below). On the following pages please find a “New Course Form” and a “Sample Syllabus” for each of the four proposed courses. 1 NEW COURSE FORM Contact Person: Name: Phil Korb, Department Chair School/College; Division/Department: Merrick School of Business Department of Accounting and Management Information Systems Contact information: E-mail: pkorb@ubalt.edu (410-837-5080) Sent to Provost (date): Level: Course Number: Course Name: Credit Hours: Monday April 4, 2005 Graduate ACCT 601 Forensic Accounting Principles 3 Title Abbreviation (use a maximum of 20 spaces including punctuation and blanks): Forensic Acct Prin Course Description (for catalog): This course will provide students with an overview of the field of Forensic Accounting. Specifically this course will cover the following areas: The roles, responsibilities, and requirements of a forensic accountant in both litigation and fraud engagements Basic litigation and fraud examination theory Identification of financial fraud schemes The legal framework for damages and fraud Damage Assessments and Methodologies Earnings Management and Financial Reporting Fraud Computer Forensics Corporate Governance & Ethics Actual litigation and fraud cases will be discussed to highlight the evolving roles of forensic accountants. Reason For Offering This Course: The increased complexity of business coupled with advent of new technologies have created an environment where professionals need some background in forensic accounting to better understand their organizations and themselves. Recent interest has bee fueled by well publicized scandals major corporations in the U.S. and abroad. This course may be included in a proposed credential in this important and growing area of interest to professionals. Learning Objectives (what skills or knowledge will the student acquire?): Ability to identify the roles and responsibilities of a forensic accountant Understand the legal framework in which forensic analysis takes place Describe sound investigative strategies Identify appropriate damage methodologies Understand issues of ethics as related to corporate governance In-depth understanding of financial statements in search of fraud and/or accounting abuse 2 Assessment Procedure (how will the success of the learning objectives be assessed): Class assignments, case analysis, inclusion of examples from the students’ workplace, and exams. Frequency of offering the course: Course will be offered once every two years. Suggested maximum class size: Consistent with other courses in the Merrick School of Business, an expected minimum enrollment of 15 will be required to justify offering the course; enrollment will be capped at 35 students per section. Staff qualified to teach the course: Full-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Part-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Prerequisites: ACCT 504 or course equivalent, or permission of Chair, Dept. of Accounting and Management Information Systems Is course required? Course will exist as an elective in the M.B.A. program open to all interested students meeting prerequisites Lab Fees (if any, give amount): None Grading Options: Students permitted to elect grading options open to all University of Baltimore graduate students. Can the student repeat for credit? No Concurrent Enrollment? Students permitted to enroll in other courses, prior fulfillment of prerequisite requirement necessary. Materials required for student purchase: Equivalent to other courses in M.B.A. program normally including textbooks, notebooks, cases. 3 Relationship of course to other UB courses or departments, if applicable: Conceptually, forensic accounting tools are applicable to other disciplines including management, finance, law and legal studies, and human resources. Enrollment in these courses is open to any UB graduate or law student who meets the prerequisites above. The topics in ACCT 601 are related to all graduate business courses with the exception of technically oriented courses in finance and management information systems. While related, faculty in the other disciplines, via their approval of this course proposal, have been made aware of this new course and relied on existing coverage of related topics in their own courses in this subject area. ACCT 601 may be taken as a graduate level accounting elective by some students in the M.S. in Accounting and Business Advisory Services program and by some students in the M.S. in Business/Finance program at the discretion of their program advisors. Relationship to career of professional aspirations of the student: ACCT 601, in conjunction with other related courses, will provide for career advancement by encouraging the student to focus on a specialized niche. Additionally, ACCT 601 will fulfill continuing professional education requirements for practicing CPA’s who wish to maintain currency in their credential. Library consulted for adequacy of resources: Faculty conducted searches of the library’s holdings and current subscriptions and determined that the resources currently available are adequate when supplemented with materials available online, provided by textbook publishers, available from professional organizations, or created by faculty for instructional purposes. Sample Syllabi: Attached please see next page includes identification of a) learning objectives, b) required textbooks and other required materials (if any), c) course requirements, and d) topics/units descriptions. 4 Sample Syllabus ACCT 601 Forensic Accounting Principles Instructor: Semester: Joe Lunchbucket jlunchbucket@ubalt.edu, 410 837-9999 Office Hours: M,W, 4:00-5:25 and by appt. Fall 2005 Course Overview This course will provide students with an overview of the field of Forensic Accounting. Specifically this course will cover the following areas: The roles, responsibilities, and requirements of a forensic accountant in both litigation and fraud engagements Basic litigation and fraud examination theory Identification of financial fraud schemes The legal framework for damages and fraud Damage Assessments and Methodologies Earnings Management and Financial Reporting Fraud Computer Forensics Corporate Governance & Ethics Actual litigation and fraud cases will be discussed to highlight the evolving roles of forensic accountants. Required Materials: Financial Investigation and Forensic Accounting, George A. Manning, CRC Press, Bacon Raton FL, 2000. ISBN: 0-8493-0435-0 The New Forensics: Investigating Corporate Fraud and the Theft of Intellectual Property, Joe Anastasi, New York, John Wiley, 2003. ISBN: 0-471-26994-8 Harvard Business School Case Numbers HBS-1, HBS-2, HBS-3 available via the world wide web or at UB bookstore Access to items placed on reserve in UB’s Langsdale Library drawn from the popular press Student Responsibilities (% of course grade): Regular class attendance and participation (15%) Bi-weekly briefing paper (7 @ 2% - 15%) Midterm Exam, Date (25%) Cumulative final exam (45%) There are no make up exams and all briefing papers are due within 5 minutes of the start of the class in which they are to be collected. Electronically transmitted papers are not accepted. Learning Objectives – ACCT 601 Ability to identify the roles and responsibilities of a forensic accountant Understand the legal framework in which forensic analysis takes place Describe sound investigative strategies Identify appropriate damage methodologies Understand issues of ethics as related to corporate governance In-depth understanding of financial statements in search of fraud and/or accounting abuse 5 Sample Topical Schedule ACCT 601 Week 1: Week 2: Week 3: Week 4: Week 5: Week 6: Week 7: Week 7: Week 8: Week 9: Week 10: Week 11: Week 12: Week 13: Week 14: Week 15: Introduction of major course topics, preview of their integration. Distribution of course syllabus The roles, responsibilities, and requirements of a forensic accountant in boty litigation and fraud engagements. Briefing Paper 1 due In theory, basic litigation and fraud examination inclusion of the game theoretic construct of “the core” Group analysis case 1 In practice, basic litigation and fraud examination Briefing Paper 2 due Identificaition of financial fraud schemes The legal framework for damages and fraud Briefing Paper 3 due Group analysis case 2 Detailed examinition of framework for damages and fraud Midterm Exam Damage Assessments and Methodologies Techniques – Damage Assessments and Methodologies Briefing Paper 4 due Earnings management and reporting, corporations and individuals Financial reporting, fraud schemes Briefing Paper 5 due Financial reporting, fraud detection Computer forensics Briefing Paper 6 due Corporate governance and reporting issues within the ethical domain Final Examination 6 NEW COURSE FORM Contact Person: Name: Phil Korb, Department Chair School/College; Division/Department: Merrick School of Business Department of Accounting and Management Information Systems Contact information: E-mail: pkorb@ubalt.edu (410-837-5080) Sent to Provost (date): Level: Course Number: Course Name: Credit Hours: Monday April 4, 2005 Graduate ACCT 602 Dissecting Financial Statements 3 Title Abbreviation (use a maximum of 20 spaces including punctuation and blanks): Disctng Fin Statemts Course Description (for catalog): Students will learn how to review, detect, and investigate possible financial statement concerns of publicly and privately held businesses, as well as nonprofit organizations and family businesses. Topics covered include: legal elements of financial statement fraud; management's and auditor's responsibilities; improper revenue/sales recognition; inadequate disclosure of related-party transactions; improper asset valuation; improper deferral of costs and expenses; financial statement red flags; and inadequacies in management's discussion and analysis. Students will learn how to detect and investigate possible financial statement problems by addressing such factors as off balance sheet activity, liquidity, financial performance indicators, unreported intangibles, and lease auditing. Reason For Offering This Course: The increased complexity of business coupled with advent of new technologies have created an environment where professionals need some background in forensic accounting to better understand their organizations and themselves. Recent interest has bee fueled by well publicized scandals major corporations in the U.S. and abroad. This course may be included in a proposed credential in this important and growing area of interest to professionals. Learning Objectives (what skills or knowledge will the student acquire?): Identify the roles of financial information in an organization. Understanding the role of financial statements in recent corporate scandals Demonstration of sound financial reporting practices Ability to identify known techniques of those practicing financial fraud Develop an ability to detect potential fraud from financial statements. Place best and current practices in an ethical framework suitable for presentation to a client. Assessment Procedure (how will the success of the learning objectives be assessed): Class assignments, case analysis, inclusion of examples from the students’ workplace, and exams. 7 Frequency of offering the course: Course will be offered once every two years. Suggested maximum class size: Consistent with other courses in the Merrick School of Business, an expected minimum enrollment of 15 will be required to justify offering the course; enrollment will be capped at 35 students per section. Staff qualified to teach the course: Full-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Part-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Prerequisites: ACCT 504 or course equivalent, or permission of Chair, Dept. of Accounting and Management Information Systems Is course required? Course will exist as an elective in the M.B.A. program open to all interested students meeting prerequisites Lab Fees (if any, give amount): None Grading Options: Students permitted to elect grading options open to all University of Baltimore graduate students. Can the student repeat for credit? No Concurrent Enrollment? Students permitted to enroll in other courses, prior fulfillment of prerequisite requirement necessary. Materials required for student purchase: Equivalent to other courses in M.B.A. program normally including textbooks, notebooks, cases. Relationship of course to other UB courses or departments, if applicable: Conceptually, forensic accounting tools are applicable to other disciplines including management, finance, law and legal studies, and human resources. Enrollment in these courses is open to any UB graduate or law student who meets the prerequisites above. The topics in ACCT 602 are related to all graduate business courses with the exception of technically oriented courses in finance and management information systems. While related, faculty in the other disciplines, via their approval of this course proposal, have been made aware of this new course and relied on existing coverage of related topics in their own courses in this subject area. ACCT 602 may be taken as a graduate level 8 accounting elective by some students in the M.S. in Accounting and Business Advisory Services program and by some students in the M.S. in Business/Finance program at the discretion of their program advisors. Relationship to career of professional aspirations of the student: ACCT 602, in conjunction with other related courses, will provide for career advancement by encouraging the student to focus on a specialized niche. Additionally, ACCT 602will fulfill continuing professional education requirements for practicing CPA’s who wish to maintain currency in their credential. Library consulted for adequacy of resources: Faculty conducted searches of the library’s holdings and current subscriptions and determined that the resources currently available are adequate when supplemented with materials available online, provided by textbook publishers, available from professional organizations, or created by faculty for instructional purposes. Sample Syllabi: Attached please see next page includes identification of a) learning objectives, b) required textbooks and other required materials (if any), c) course requirements, and d) topics/units descriptions. 9 Sample Syllabus ACCT 602 Dissecting Financial Statements Instructor: Semester: Tim Ber tber@ubalt.edu 410 837-9999 Office Hours: M,W, 4:00-5:25 and by appt. Fall 2005 Course Overview Students will learn how to review, detect, and investigate possible financial statement concerns of publicly and privately held businesses, as well as nonprofit organizations and family businesses. Topics covered include: legal elements of financial statement fraud; management's and auditor's responsibilities; improper revenue/sales recognition; inadequate disclosure of related-party transactions; improper asset valuation; improper deferral of costs and expenses; financial statement red flags; and inadequacies in management's discussion and analysis. Students will learn how to detect and investigate possible financial statement problems by addressing such factors as off balance sheet activity, liquidity, financial performance indicators, unreported intangibles, and lease auditing. Required Text: Fraud Examination [2003 Edition] by W. S. Albrecht. Published by Thompson-Southwestern, ISBN 0-032416296-0, available in UB bookstore. Student also responsible for having access to AICPA cases found on that institutions website. Student Responsibilities (% of course grade): Regular class attendance and participation (15%) Midterm Exam, Date (25%) Cumulative final exam (25%) Term paper (35%) There are no make up exams and all briefing papers are due within 5 minutes of the start of the class in which they are to be collected. Electronically transmitted papers are not accepted. Learning Objectives – ACCT 602 Identify the roles of financial information in an organization. Understanding the role of financial statements in recent corporate scandals Demonstration of sound financial reporting practices Ability to identify known techniques of those practicing financial fraud Develop an ability to detect potential fraud from financial statements. Place best and current practices in an ethical framework suitable for presentation to a client. Potential Term Paper Topics – One student per topic, you may suggest additional topics subject to Professor’s approval by 3rd week of class, faliure to have approved topic by then results in the professor assigning you a topic. Anatomy of Various E-Commerce Fraud Types The 10 Most Famous Financial Accounting Frauds of The Last 50 years: Lessons Learned? Electronic Evidence Investigation Techniques Using ACL to Investigate large Data Files Bank and Financial Institution Frauds Overview and 10 Examples 10 Indirect Methods of Proof – The Net Worth and Expenditures Methods Compared Litigation Support services by National CPA Firms Money Laundering Techniques: Past and Present Week 1: Week 2: Week 3: Week 4: Week 5: Week 6: Week 7: Week 8: Week 9: Week 10: Week 11: Week 12: Week 13: Week 14: Week 15: Introduction to forensic accounting, text chapter 1, problems C1-1, C1-2, C1-3, C1-4, C1-6 Who commits fraud and who fights it, text chapters 2, 3, AICPA Case 1, C1-11, C2-5, C2-12, C2-17 Preventing and recognizing fraud, text chapters 4,5 AICPA Case 2, problems C4-2, C4-5, C4-11, C5-2 Detecting Fraud, text chapter 6 AICPA Case 3, problems C6-1, C7-2, C7-5, C8-1, C8-7 Investigations, text chapters 7,8 problems C7-1, C7-2, C8-1, C8-7 Fraud Reports, text chapter 9 problems C9-1, C9-3, C9-5, AICPA Case 5 Midterm Examination Spring or Thanksgiving Break Financial Statement Fraud, text chapter 10 Revenue and Inventory Frauds, text cahpter 11 C11-6, C11-7 AICPA case 7 Liability and Disclosure Frauds, text chapter 12 problems c12-1, C12-5, C12-6, C12-7 AICPA case 8 Fraud Against Organizations, Bankruptcy, and Divorce Frauds, text chapters 13, 14 AICPA case 9 E-Commerce Frauds, text chapter 15, AICPA case 10 Student Term Paper Presentations Final Exam (or term paper presentations, final exam may be due 3 days later) 11 NEW COURSE FORM Contact Person: Name: Phil Korb, Department Chair School/College; Division/Department: Merrick School of Business Department of Accounting and Management Information Systems Contact information: E-mail: pkorb@ubalt.edu (410-837-5080) Sent to Provost (date): Level: Course Number: Course Name: Credit Hours: Monday April 4, 2005 Graduate ACCT 603 Investigative Accounting and Fraud Examination 3 Title Abbreviation (use a maximum of 20 spaces including punctuation and blanks): Inv Acct Fraud Exam Course Description (for catalog): Topics include the in-depth review of: sophisticated fraud schemes; how fraudulent conduct can be deterred; how allegations of fraud should be investigated and resolved; the recovery of assets; methods of writing effective reports, complying with SAS 82 and other fraud standards. Fraud and investigation topics cover acts of skimming, cash larceny, check tampering, register disbursement schemes, billing schemes, payroll and expense reimbursement schemes, improper accounting of inventory and other assets, corruption, bribery, conflicts of interest, security fraud, insurance fraud, anti-terrorist financing, and money laundering. Reason For Offering This Course: The increased complexity of business coupled with advent of new technologies have created an environment where professionals need some background in forensic accounting to better understand their organizations and themselves. Recent interest has bee fueled by well publicized scandals major corporations in the U.S. and abroad. This course may be included in a proposed credential in this important and growing area of interest to professionals. Learning Objectives (what skills or knowledge will the student acquire?): Identification of various, well known fraud schemes Identification of accepted methodology for conducting fraud investigations Ability to apply various interview techniques Demonstration of basic IT skills Understanding the use of computerized tools in fraud investigation and digital evidence recovery Assessment Procedure (how will the success of the learning objectives be assessed): Class assignments, case analysis, inclusion of examples from the students’ workplace, and exams. Frequency of offering the course: Course will be offered once every two years. Suggested maximum class size: 12 Consistent with other courses in the Merrick School of Business, an expected minimum enrollment of 15 will be required to justify offering the course; enrollment will be capped at 35 students per section. Staff qualified to teach the course: Full-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Part-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Prerequisites: ACCT 504 or course equivalent, or permission of Chair, Dept. of Accounting and Management Information Systems Is course required? Course will exist as an elective in the M.B.A. program open to all interested students meeting prerequisites Lab Fees (if any, give amount): None Grading Options: Students permitted to elect grading options open to all University of Baltimore graduate students. Can the student repeat for credit? No Concurrent Enrollment? Students permitted to enroll in other courses, prior fulfillment of prerequisite requirement necessary. Materials required for student purchase: Equivalent to other courses in M.B.A. program normally including textbooks, notebooks, cases. Relationship of course to other UB courses or departments, if applicable: Conceptually, forensic accounting tools are applicable to other disciplines including management, finance, law and legal studies, and human resources. Enrollment in these courses is open to any UB graduate or law student who meets the prerequisites above. The topics in ACCT 603 are related to all graduate business courses with the exception of technically oriented courses in finance and management information systems. While related, faculty in the other disciplines, via their approval of this course proposal, have been made aware of this new course and relied on existing coverage of related topics in their own courses in this subject area. ACCT 603 may be taken as a graduate level accounting elective by some students in the M.S. in Accounting and Business Advisory Services program and by some students in the M.S. in Business/Finance program at the discretion of their program advisors. Relationship to career of professional aspirations of the student: 13 ACCT 603, in conjunction with other related courses, will provide for career advancement by encouraging the student to focus on a specialized niche. Additionally, ACCT 603 will fulfill continuing professional education requirements for practicing CPA’s who wish to maintain currency in their credential. Library consulted for adequacy of resources: Faculty conducted searches of the library’s holdings and current subscriptions and determined that the resources currently available are adequate when supplemented with materials available online, provided by textbook publishers, available from professional organizations, or created by faculty for instructional purposes. Sample Syllabi: Attached please see next page includes identification of a) learning objectives, b) required textbooks and other required materials (if any), c) course requirements, and d) topics/units descriptions. 14 Sample Syllabus ACCT 603 Investigative Accounting and Fraud Examination Instructor: Semester: Chuck Wagon cwagon@ubalt.edu 410 837-9999 Office Hours: M,W, 4:00-5:25 and by appt. Fall 2005 Course Overview Topics include the in-depth review of: sophisticated fraud schemes; how fraudulent conduct can be deterred; how allegations of fraud should be investigated and resolved; the recovery of assets; methods of writing effective reports, complying with SAS 82 and other fraud standards. Fraud and investigation topics cover acts of skimming, cash larceny, check tampering, register disbursement schemes, billing schemes, payroll and expense reimbursement schemes, improper accounting of inventory and other assets, corruption, bribery, conflicts of interest, security fraud, insurance fraud, anti-terrorist financing, and money laundering. Required Text: Principles of Fraud Examination, Joseph T. Wells, 2004, Wiley Publishing Fraud Examination and Prevention, 2004, W. Steve Albrecht and Chad O. Albrecht Student Responsibilities (% of course grade): Regular class attendance and participation (15%) Two Midterms Exam, Date (50%) Cumulative final exam (35%) Homework Assignments (10%) There are no make up exams and all briefing papers are due within 5 minutes of the start of the class in which they are to be collected. Electronically transmitted papers are not accepted. Learning Objectives ACCT 603 Identification of various, well known fraud schemes Identification of accepted methodology for conducting fraud investigations Ability to apply various interview techniques Demonstration of basic IT skills Understanding the use of computerized tools in fraud investigation and digital evidence recovery Week 1: Week 2: Week 3: Week 4: Week 5: Week 6: Week 7: Week 8: Week 9: Introduction to course Skimming Cash Larceny and Check Tampering Register Disbursement Schemes Exam 1 Billing Schemes Payroll Schemes, Expense Reimbursement Schemes Non-cash Misappropriations Corruption 15 Week 10: Week 11: Week 12: Week 13: Week 14: Week 15: Exam 2 Accounting Principles and Fraud Fraudulent Financial Statements Fraudulent Financial Statement Schemes Interviewing Witnesses Final Exemption 16 NEW COURSE FORM Contact Person: Name: Phil Korb, Department Chair School/College; Division/Department: Merrick School of Business Department of Accounting and Management Information Systems Contact information: E-mail: pkorb@ubalt.edu (410-837-5080) Sent to Provost (date): Level: Course Number: Course Name: Credit Hours: Monday April 4, 2005 Graduate ACCT 604 Litigation Support 3 Title Abbreviation (use a maximum of 20 spaces including punctuation and blanks): Lit Sup Course Description (for catalog): This course will address the relationship between the forensic accounting professional and the litigation process of which they may play a role. Specifically, this course will cover: the litigation process, the legal framework for damages and fraud, damage assessment methodologies, issues related to the presentation of evidence through expert testimony, practices used in supporting divorce cases, and basic rules of evidence as they apply to forensic accountants. Reason For Offering This Course: The increased complexity of business coupled with advent of new technologies have created an environment where professionals need some background in forensic accounting to better understand their organizations and themselves. Recent interest has bee fueled by well publicized scandals major corporations in the U.S. and abroad. This course may be included in a proposed credential in this important and growing area of interest to professionals. Learning Objectives (what skills or knowledge will the student acquire?): Ability to identify the elements of the litigation process Demonstration of an understanding of the framework for damages and fraud Ability to apply methodologies of damage assessment in instances involving lost profits, lost wages, intrinsic imputed values of services, and other appropriate topics Present evidence through expert testimony, including construction and documentation of demonstrative exhibits Assessment Procedure (how will the success of the learning objectives be assessed): Class assignments, case analysis, inclusion of examples from the students’ workplace, and exams. Frequency of offering the course: Course will be offered once every two years. 17 Suggested maximum class size: Consistent with other courses in the Merrick School of Business, an expected minimum enrollment of 15 will be required to justify offering the course; enrollment will be capped at 35 students per section. Staff qualified to teach the course: Full-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Part-time: Members of the accounting faculty have developed various sections of this proposed course based on their own experience, training, and interest levels. While we don’t anticipate full-time faculty assigned this course to teach, several have backgrounds adequate in this specialized area. A more likely outcome would be to team teach the course pairing in some way a full-time faculty member with a member of the local professional community. Prerequisites: ACCT 504 or course equivalent, or permission of Chair, Dept. of Accounting and Management Information Systems Is course required? Course will exist as an elective in the M.B.A. program open to all interested students meeting prerequisites Lab Fees (if any, give amount): None Grading Options: Students permitted to elect grading options open to all University of Baltimore graduate students. Can the student repeat for credit? No Concurrent Enrollment? Students permitted to enroll in other courses, prior fulfillment of prerequisite requirement necessary. Materials required for student purchase: Equivalent to other courses in M.B.A. program normally including textbooks, notebooks, cases. Relationship of course to other UB courses or departments, if applicable: Conceptually, forensic accounting tools are applicable to other disciplines including management, finance, law and legal studies, and human resources. Enrollment in these courses is open to any UB graduate or law student who meets the prerequisites above. The topics in ACCT 604 are related to all graduate business courses with the exception of technically oriented courses in finance and management information systems. While related, faculty in the other disciplines, via their approval of this course proposal, have been made aware of this new course and relied on existing coverage of related topics in their own courses in this subject area. ACCT 604 may be taken as a graduate level accounting elective by some students in the M.S. in Accounting and Business Advisory Services program and by some students in the M.S. in Business/Finance program at the discretion of their program advisors. 18 Relationship to career of professional aspirations of the student: ACCT 604, in conjunction with other related courses, will provide for career advancement by encouraging the student to focus on a specialized niche. Additionally, ACCT 604 will fulfill continuing professional education requirements for practicing CPA’s who wish to maintain currency in their credential. Library consulted for adequacy of resources: Faculty conducted searches of the library’s holdings and current subscriptions and determined that the resources currently available are adequate when supplemented with materials available online, provided by textbook publishers, available from professional organizations, or created by faculty for instructional purposes. Sample Syllabi: Attached please see next page includes identification of a) learning objectives, b) required textbooks and other required materials (if any), c) course requirements, and d) topics/units descriptions. 19 Sample Syllabus ACCT 604 Litigation Support Instructor: Semester: Jane Doe JPDOE@ubalt.edu 410 837-9999 Office Hours: M,W, 4:00-5:25 and by appt. Fall 2005 Course Overview This course will address the relationship between the forensic accounting professional and the litigation process of which they may play a role. Specifically, this course will cover: the litigation process, the legal framework for damages and fraud, damage assessment methodologies, issues related to the presentation of evidence through expert testimony, practices used in supporting divorce cases, and basic rules of evidence as they apply to forensic accountants. Required Text: Fraud Examination, Albrecht Financial Shenanigans, Schilit, 2nd Edition Student Responsibilities (% of course grade): Regular class attendance and participation (15%) Two Midterms Exam, Date (50%) Cumulative final exam (35%) Homework Assignments (10%) There are no make up exams and all briefing papers are due within 5 minutes of the start of the class in which they are to be collected. Electronically transmitted papers are not accepted. Learning Objectives ACCT 604 Ability to identify the elements of the litigation process Demonstration of an understanding of the framework for damages and fraud Ability to apply methodologies of damage assessment in instances involving lost profits, lost wages, intrinsic imputed values of services, and other appropriate topics Present evidence through expert testimony, including construction and documentation of demonstrative exhibits Week 1: Week 2: Week 3: Week 4: Week 5: Week 6: Week 7: Week 8: Week 9: Week 10: Week 11: Week 12: Week 13: Introduction to course The Tools of Litigation Support Guest Speaker, Forensic Accountant Techniques for presenting data Exam 1 Frameworks for Damage Determination Framework for Fraud Damage Assessment Capturing Non-cash Misappropriations Assessing Lost Profits Exam 2 Instances of corporate fraud Quantifying corporate fraud Workshop of Testimony – guest speaker 20 Week 14: Week 15: Interviewing Witnesses Final Examination 21 4. Creation of a new certificate program, a Graduate Certificate in Forensic Accounting, building upon the assumed approval of the four courses in item 3. above. It is my understanding that creation of this certificate will require notification of MHEC given that it is introduced as part of our existing, fully-accredited M.B.A. program The mission of the Merrick School of Business, University of Baltimore emphasizes the need to “create and deliver a leading edge curriculum with practical learning experiences in innovative and flexible ways.” When approved, the Graduate Certificate in Forensic Accounting will represent another example of our ability to provide a leading edge curriculum and provide a useful, career oriented practical learning experience to a wider mix of professionals than currently served by our graduate programs. The Graduate Certificate in Forensic Accounting extends our M.B.A. program and will complement general electives available therein. Admission to the Graduate Certificate in Forensic Accounting will not require admission into any graduate program within the Robert G. Merrick School of Business, University of Baltimore. Further, professionals in the community will be encouraged to take the courses comprising the certificate program or the certificate in its entirety. The certificate presents students with ideas, skills, and methodologies that are currently in demand throughout the economy, especially given the recent issues arising out of reporting requirements, corporate governance, and ethical behavior and the adoption by all organizations of processes to be compliant with Sarbanes-Oxley legislation. The required courses provide a unique vantage point from which to understand the roles and responsibilities of the forensic accountant, a practical understanding of the legal framework within which damages and fraud are defined, an in-depth familiarity with the nature of financial statements and ways to investigate this data with an emphasis on credibility, and, a deeper exposure into the granular components of corporate governance issues and their interaction with ethical behavior. Admission to the Graduate Certificate in Forensic Accounting requires proof of a bachelor’s degree from a business or business related (such as corporate communications and health systems management) program with a 3.0 Grade Point Average, two letters of recommendation, a letter of intent, submission of a transcript showing an earned bachelor’s degree, completion of a University of Baltimore application, and a planned course of study approved by the Merrick Advising Office. Automatic admission, requiring only an application and appropriate transcripts, is granted if the applicant holds a graduate degree from an AACSB-International accredited institution. Application for graduation must be made prior to completing the last three credits of the certificate program. All twelve credits required in the certificate program must be taken at the University of Baltimore. ACCT 504, Introduction to Accounting, or its equivalent is a pre-requisite for each course in the certificate program. Graduate Certificate in Forensic Accounting Course Requirements (12 credits) ACCT 601 ACCT 602 Forensic Accounting Principles (3 credits) Dissecting Financial Statements (3 credits) 22 ACCT 603 ACCT 604 Investigative Accounting & Fraud Examination (3 credits) Litigation Support (3 credits) Students may not be simultaneously enrolled in any University of Baltimore Graduate or Graduate Level Program and the Graduate Certificate in Forensic Accounting Program. Students who have satisfactorily completed some or all of the required coursework above, through prior coursework at UB, are subject to a six credit residency requirement for the certificate and will have suitable courses approved by the department chair of the Accounting and Management Information Systems Department to fulfill the six credit residency requirement. Students with related coursework at other institutions may not transfer credits into the certificate program; but may, with the approval of the Accounting and Management Information Systems Department Chair, make two course substitutions within the above list. 23