8thCir: Manager's reports of harassment were not a

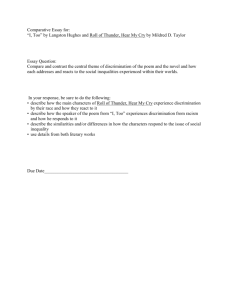

advertisement