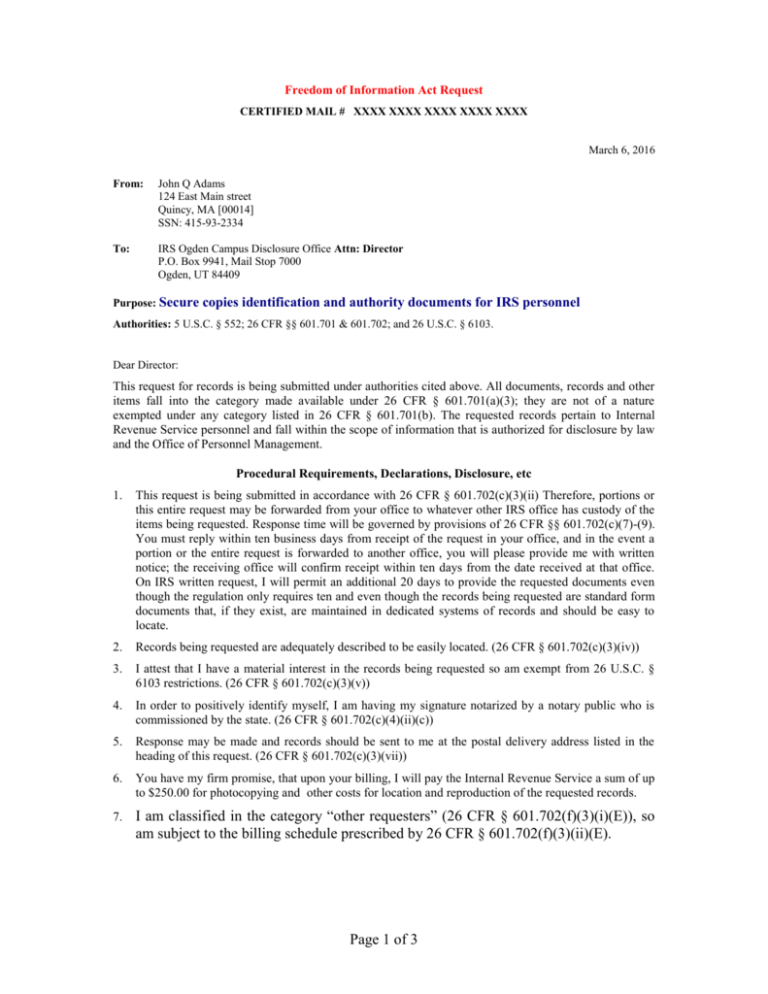

Freedom of Information Act Request

CERTIFIED MAIL # XXXX XXXX XXXX XXXX XXXX

March 6, 2016

From:

John Q Adams

124 East Main street

Quincy, MA [00014]

SSN: 415-93-2334

To:

IRS Ogden Campus Disclosure Office Attn: Director

P.O. Box 9941, Mail Stop 7000

Ogden, UT 84409

Purpose: Secure

copies identification and authority documents for IRS personnel

Authorities: 5 U.S.C. § 552; 26 CFR §§ 601.701 & 601.702; and 26 U.S.C. § 6103.

Dear Director:

This request for records is being submitted under authorities cited above. All documents, records and other

items fall into the category made available under 26 CFR § 601.701(a)(3); they are not of a nature

exempted under any category listed in 26 CFR § 601.701(b). The requested records pertain to Internal

Revenue Service personnel and fall within the scope of information that is authorized for disclosure by law

and the Office of Personnel Management.

Procedural Requirements, Declarations, Disclosure, etc

1.

This request is being submitted in accordance with 26 CFR § 601.702(c)(3)(ii) Therefore, portions or

this entire request may be forwarded from your office to whatever other IRS office has custody of the

items being requested. Response time will be governed by provisions of 26 CFR §§ 601.702(c)(7)-(9).

You must reply within ten business days from receipt of the request in your office, and in the event a

portion or the entire request is forwarded to another office, you will please provide me with written

notice; the receiving office will confirm receipt within ten days from the date received at that office.

On IRS written request, I will permit an additional 20 days to provide the requested documents even

though the regulation only requires ten and even though the records being requested are standard form

documents that, if they exist, are maintained in dedicated systems of records and should be easy to

locate.

2.

Records being requested are adequately described to be easily located. (26 CFR § 601.702(c)(3)(iv))

3.

I attest that I have a material interest in the records being requested so am exempt from 26 U.S.C. §

6103 restrictions. (26 CFR § 601.702(c)(3)(v))

4.

In order to positively identify myself, I am having my signature notarized by a notary public who is

commissioned by the state. (26 CFR § 601.702(c)(4)(ii)(c))

5.

Response may be made and records should be sent to me at the postal delivery address listed in the

heading of this request. (26 CFR § 601.702(c)(3)(vii))

6.

You have my firm promise, that upon your billing, I will pay the Internal Revenue Service a sum of up

to $250.00 for photocopying and other costs for location and reproduction of the requested records.

7.

I am classified in the category “other requesters” (26 CFR § 601.702(f)(3)(i)(E)), so

am subject to the billing schedule prescribed by 26 CFR § 601.702(f)(3)(ii)(E).

Page 1 of 3

Records Request

In one fashion or another, I have received correspondence from or have otherwise had direct contact with

each Internal Revenue Service officer or agent named below. Per FEDERAL CROP INSURANCE CORP.

v. MERRILL ET AL., (1947) 332 U.S. 380; 68 S. Ct. 1; 92 L. Ed. 10, at 384, “Whatever the form in which

the Government functions, anyone entering into an arrangement with the Government takes the risk of

having accurately ascertained that he who purports to act for the Government stays within the bounds of

his authority. The scope of this authority may be explicitly defined by Congress or be limited by

delegated legislation, properly exercised through the rule-making power. And this is so even though, as

here, the agent himself may have been unaware of the limitations upon his authority. See, e. g., Utah

Power & Light Co. v. United States, 243 U.S. 389, 409; United States v. Stewart, 311 U.S. 60, 70, and see,

generally, The Floyd Acceptances, 7 Wall. 666.” Therefore, I need to verify that IRS personnel named

below are who they say they are and have authority they have exercised or are attempting are attempting to

exercise.

The request is for information regarding the following IRS personnel:

1.

Scott Prentky (ID# Unknown), Field Director, Compliance Services

Please provide true and correct copies of the following:

1. Provide a copy of the appointment or promotion instrument that designates the precise title of this

IRS officer, agent or employee named above (“revenue officer”, “revenue agent”, “appeals

officer”, “special agent”, etc.).

2. If different than the appointment certificate, provide copies of documentation that includes the

pocket commission number, including classification designation (Administrative or

Enforcement) for this of the IRS officer, agent or employee named above.

3. Provide a copy of the constitutional oath of office taken by this officer, agent or employee named

above, as required by Article VI, Paragraph 3 of the Constitution of the United States and 5

U.S.C. § 3331, taken at the time the officer or agent began working for the Internal Revenue

Service (Form 61).

4. Provide a copy of the properly executed civil commission of this officer named above that verifies

that he or she is a collection officer for the Government of the United States, as required by

Article II § 3 of the Constitution of the United States and attending legislation (only officers, not

employees, will have civil commissions required by Article II of the Constitution).

5. Provide the personal affidavit in which this officer, agent or employee named above declared that

he or she did not pay for or otherwise make or promise consideration to secure the office (5

U.S.C. § 3332), assuming the affidavit is different than the Form 61 oath.

6. Provide the personal surety bond of the principal appointed officer under whom this officer or

agent named above works.1 If one of those named above is an appointed officer required to have

a personal surety bond, provide a copy of his or her bond.

7. Provide copies of the documentation that establishes the

complete line of delegated authority

to take collection actions or carry out property seizures, for this officer, agent or employee

named above, including all intermediaries such as the Assistant Commissioner (International).

8. Provide all IRC sections that authorize this officer by title, to perform any functions under

Subtitle A or Subtitle C of the IRC.

1

See 28 U.S.C. § 1737: “Any person to whose custody the bond of any officer of the United

States has been committed shall, on proper request and payment of the fee allowed by any Act of

Congress, furnish certified copies thereof, which shall be prima facie evidence in any court of the

execution, filing and contents of the bond.”

Page 2 of 3

Conclusion and Demand

Please comply with response time requirements prescribed by 26 CFR § 601.702. This matter is urgent,

and if possible, should receive priority treatment as my substantive rights are in peril and I have reason to

believe Internal Revenue Service personnel are engaged in criminal conduct under color of authority of

the United States. Per IRS one-step service policy, please forward this request to the post of duty where

any given officer or agent named above is located if he or she is not located at your office.

All Rights Reserved,

__________________________________________

Date: ____________________

J. Q. Adams

Cc:

FOIA Appeals

Internal Revenue Service

6377 Riverside Ave., Ste. 110

Riverside, CA 92506-3155

Notary Public

I certify that on the date set out below, John Q Adams, known to me, signed this Freedom of

Information Act request.

__________________________________

Notary Public

_________________________

Date

My commission expires _______________________________________ SEAL:

Page 3 of 3