1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

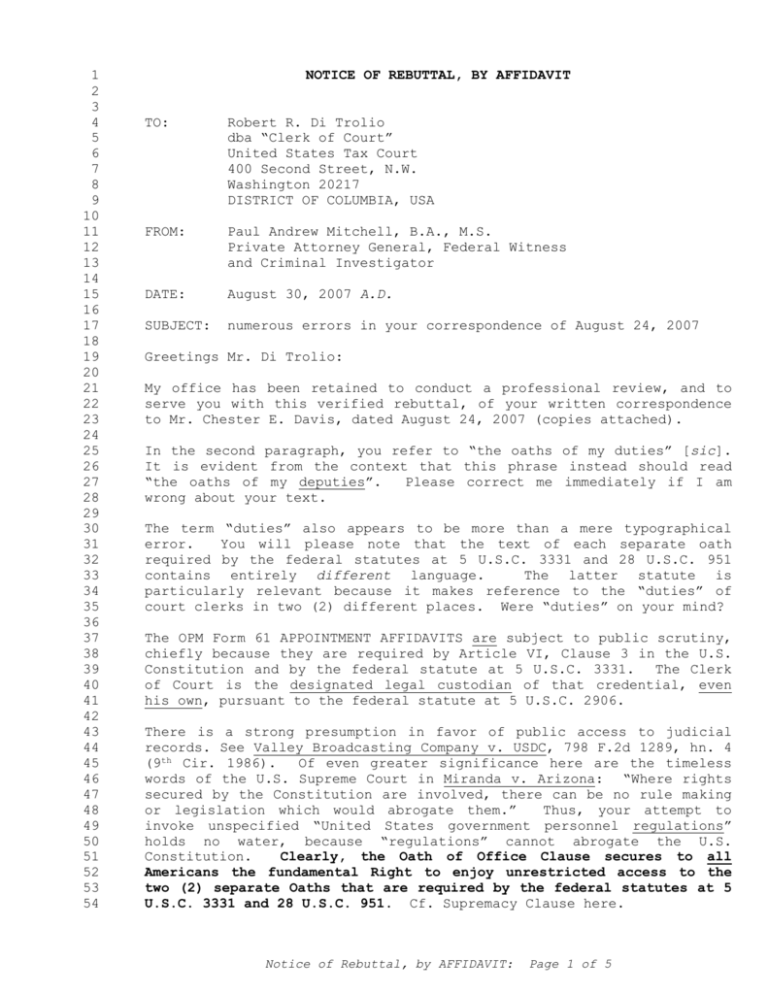

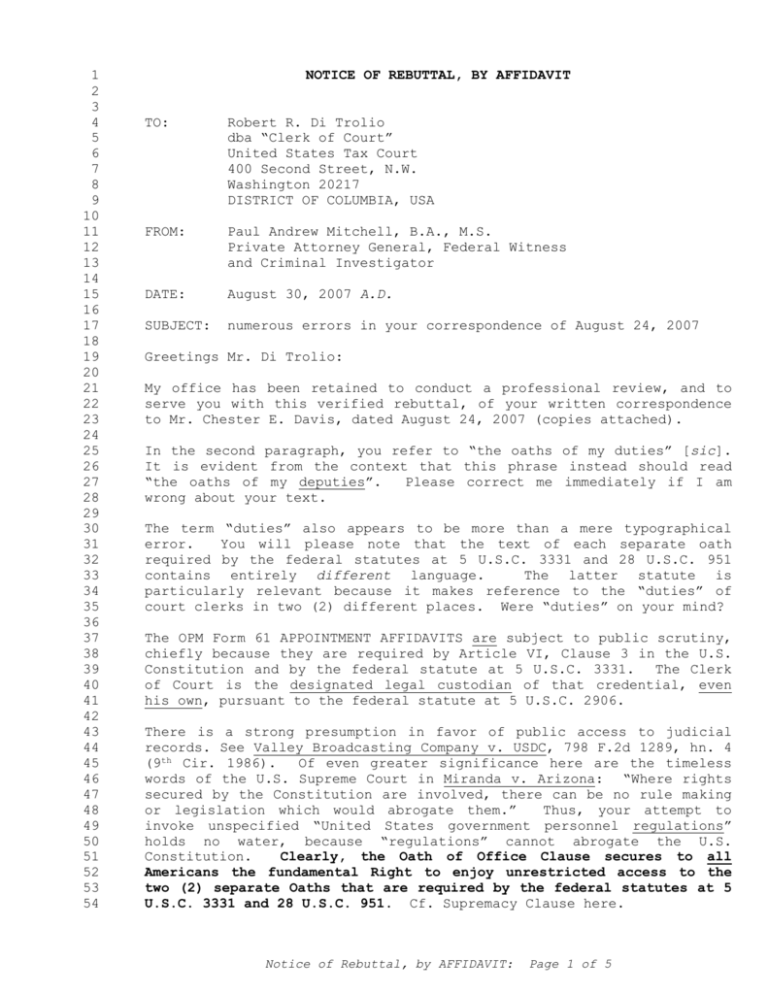

NOTICE OF REBUTTAL, BY AFFIDAVIT

TO:

Robert R. Di Trolio

dba “Clerk of Court”

United States Tax Court

400 Second Street, N.W.

Washington 20217

DISTRICT OF COLUMBIA, USA

FROM:

Paul Andrew Mitchell, B.A., M.S.

Private Attorney General, Federal Witness

and Criminal Investigator

DATE:

August 30, 2007 A.D.

SUBJECT:

numerous errors in your correspondence of August 24, 2007

Greetings Mr. Di Trolio:

My office has been retained to conduct a professional review, and to

serve you with this verified rebuttal, of your written correspondence

to Mr. Chester E. Davis, dated August 24, 2007 (copies attached).

In the second paragraph, you refer to “the oaths of my duties” [sic].

It is evident from the context that this phrase instead should read

“the oaths of my deputies”.

Please correct me immediately if I am

wrong about your text.

The term “duties” also appears to be more than a mere typographical

error.

You will please note that the text of each separate oath

required by the federal statutes at 5 U.S.C. 3331 and 28 U.S.C. 951

contains entirely different language.

The latter statute is

particularly relevant because it makes reference to the “duties” of

court clerks in two (2) different places. Were “duties” on your mind?

The OPM Form 61 APPOINTMENT AFFIDAVITS are subject to public scrutiny,

chiefly because they are required by Article VI, Clause 3 in the U.S.

Constitution and by the federal statute at 5 U.S.C. 3331. The Clerk

of Court is the designated legal custodian of that credential, even

his own, pursuant to the federal statute at 5 U.S.C. 2906.

There is a strong presumption in favor of public access to judicial

records. See Valley Broadcasting Company v. USDC, 798 F.2d 1289, hn. 4

(9th Cir. 1986).

Of even greater significance here are the timeless

words of the U.S. Supreme Court in Miranda v. Arizona: “Where rights

secured by the Constitution are involved, there can be no rule making

or legislation which would abrogate them.”

Thus, your attempt to

invoke unspecified “United States government personnel regulations”

holds no water, because “regulations” cannot abrogate the U.S.

Constitution.

Clearly, the Oath of Office Clause secures to all

Americans the fundamental Right to enjoy unrestricted access to the

two (2) separate Oaths that are required by the federal statutes at 5

U.S.C. 3331 and 28 U.S.C. 951. Cf. Supremacy Clause here.

Notice of Rebuttal, by AFFIDAVIT:

Page 1 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

You, on the other hand, have cited no authority for your claim that

the latter credentials “are not subject to public scrutiny.”

Thus,

you appear to have fabricated that claim out of thin air, and you also

appear to be protecting all deputies who presently lack either an

APPOINTMENT AFFIDAVIT and/or an OATH OF OFFICE.

Impersonating an officer of the United States (federal government) is

a federal felony violation of 18 U.S.C. 912. Aiding and abetting such

impersonation is a felony violation of 18 U.S.C. 2.

Falsifying or

concealing a material fact that is within the jurisdiction of any

branch of the federal government is another felony violation of 18

U.S.C. 1001. Transmitting false and/or fraudulent court “process” via

U.S. Mail is mail fraud, another felony violation of 18 U.S.C. 1341.

Moreover, mail fraud is also one of the RICO “predicate acts” itemized

at 18 U.S.C. 1961 et seq. See also 28 U.S.C. 1691 in this context.

Your third paragraph also makes a number of serious legal errors. You

wrote that “all of these are courts established pursuant to Article

III of the United States Constitution.”

Do you even bother to read

the statutes in question, before drafting such erroneous claims?

Yes, it is correct that the Supreme Court was originally established

by Article III.

As such, it is the only federal court that was

actually created by the U.S. Constitution.

Consequently all other

federal courts must be created by one or more Acts of Congress.

The federal statutes which established the Courts of Appeal do not

identify their constitutional origins.

See 28 U.S.C. §§ 41-49.

So,

we must confer with standing Supreme Court decisions to supply the

missing information. In Old Colony Trust Co. v. C.I.R., 279 U.S. 716,

722 (1929), the high Court held that all Circuit Courts are

constitutional courts i.e. created under Article III.

Similarly, the federal statute which established the United States

District Courts (“USDC”) inside the 50 States of the Union does not

identify their constitutional origins either.

See 28 U.S.C. 132.

Again, we must confer with standing Supreme Court decisions to supply

the missing information. In Balzac v. Porto Rico, 258 U.S. 298, 312

(1922), the Supreme Court held that the USDC originate in the

Territory Clause at Article IV, Section 3, Clause 2.

Bankruptcy courts are expressly established as “units” of the USDC.

See 28 U.S.C. 151. As such, their constitutional origin must also be

the Territory Clause, likewise pursuant to Balzac supra and similar

standing decisions of the Supreme Court, of which there are several.

The federal statute establishing the Court of Federal Claims states

expressly that its constitutional origin is Article I not Article III.

See 28 U.S.C. 171: “The court is declared to be a court established

under article I of the Constitution of the United States.”

You are partially correct to argue that the Tax Court is established

under Article I, because the federal statute which created it

expressly identifies Article I as its present constitutional origin.

Notice of Rebuttal, by AFFIDAVIT:

Page 2 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

See IRC 7441:

“There is hereby established, under article I of the

Constitution of the United States, a court of record to be known as

the United States Tax Court.”

Your citation to “26 U.S.C. 7441” is

not legally enforceable as such, however, because Title 26 of the U.S.

Code has never been enacted into positive law by any Act of Congress.

See 1 U.S.C. 101 in this context (defines “Act of Congress”).

You then try to draw more erroneous conclusions from your pivotal

errors above when you claim that “neither I nor my deputy clerks are

required to execute the Oath of Office mandated by 28 U.S.C. 951.” In

clear contradiction to your erroneous conclusions, that federal

statute makes no exceptions for the United States Tax Court, because

it refers expressly to “each clerk of court and his deputies”. Your

letterhead reads “Clerk of Court” and the title you are claiming -“Clerk of Court” -- is exhibited immediately below your signature.

You also err again when you claim an exemption under the section

552(f) of the Freedom of Information Act (“FOIA”).

5 U.S.C. 552(f)

does not tell the whole story when defining an “agency” because that

subsection refers to another federal statute at 5 U.S.C. 551(1). The

latter statute expressly excludes “the courts of the United States” at

5 U.S.C. 551(1)(B).

If you are claiming exemption from the FOIA

because of that specific exemption, then the U.S. Tax Court must be a

“court of the United States” whose clerks are required by 28 U.S.C.

951 to execute a separate OATH OF OFFICE, in addition to the

APPOINTMENT AFFIDAVIT required by 5 U.S.C. 3331.

You can’t have it

both ways: is it a “court” when you want it to be, and “not a court”

when you don’t want it to be? We don’t think so!

You also state that you “will certify that a proper oath of office was

executed by each of my deputies.” When “will” you do that? However,

because your letter contains no CERTIFICATION or VERIFICATION

paragraph that conforms to 28 U.S.C. 1746(2), it does not “certify”

anything, your protestations to the contrary notwithstanding.

And,

you cannot “certify” that claim in good faith now, because you have

already argued -- incorrectly -- that your deputies are not required

to comply with the separate OATH OF OFFICE mandated by 28 U.S.C. 951.

We now take that to mean they don’t have any such OATHS OF OFFICE.

Particularly relevant are the Historical and Statutory Notes under 28

USCA 951, which are identical to those Notes as published on the

Internet at Cornell’s electronic version of the U.S. Code:

“This

section is applicable to the Supreme Court and to all courts

established by Act of Congress” [emphasis added]. Since the Tax Court

was established by Act of Congress at IRC 7441, 28 U.S.C. 951 is

applicable to all clerks and deputy clerks who are now, or were,

employed by the Tax Court. See Acts at 68A Stat. 879 (Aug. 16, 1954)

and 83 Stat. 730 (Dec. 30, 1969).

Similarly, at 28 USCA 951 under “Research References” we find a

citation to 15A Am.Jur.2d (2000): Clerks of Court, Section 3:

Eligibility and Qualifications, to wit: “The form of oath to be taken

by clerks of federal courts is prescribed by statute.”

Then, that

Section 3 of Am.Jur.2d directly cites 28 USCA 951!

Notice of Rebuttal, by AFFIDAVIT:

Page 3 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

For your information, we also investigated The Constitution Annotated

as published by the Government Printing Office.

Under the Oath of

Office Clause we found citations to McCulloch v. Maryland, 17 U.S.

316, 416 (1819); Ex parte Garland, 71 U.S. 333, 337 (1866); and Bond

v. Floyd, 385 U.S. 116 (1966). As you should know, these are binding

Supreme Court decisions i.e. binding on you!

35

36

37

38

39

40

41

42

43

44

I, Paul Andrew Mitchell, Sui Juris, hereby verify, under penalty of

perjury, under the laws of the United States of America, without the

“United States” (federal government), that the above statement of

facts and laws is true and correct, according to the best of My

current information, knowledge, and belief, so help me God, pursuant

to 28 U.S.C. 1746(1).

See Supremacy Clause (Constitution, Laws and

Treaties of the United States are all the supreme Law of the Land).

The alleged OPM Standard Form 61 that you attached to your letter to

Mr. Davis also exhibits serious problems.

First of all, there is

evidently no OMB control number or expiration date on the Form 61 that

you signed. Pursuant to the clear legislative intent of the Paperwork

Reduction Act, this missing OMB control number automatically renders

that form a “bootleg request”. In other words, it’s a counterfeit.

Moreover, a valid APPOINTMENT AFFIDAVIT must be administered by a

person specified at 5 U.S.C. 2903.

Your “Form 61” has completely

removed that requirement, when it is clearly stated on all APPOINTMENT

AFFIDAVITS that we have received to date from DOJ, in reply to our

numerous FOIA Requests for the credentials of federal court officers.

Therefore, it does not appear that one “Donna Lewis” dba “Human

Resources Specialist” is qualified to witness your “Form 61” because

she is not a person specified at 5 U.S.C. 2903. It’s a counterfeit!

For all of the reasons stated above, your erroneous letter dated

August 24, 2007 and counterfeit “Form 61”, as transmitted via U.S.

Mail to Mr. Chester E. Davis, are hereby formally refused.

Please take note that the following is a legally proper and sufficient

VERIFICATION paragraph, based on our many YEARS of litigation

experience as a Private Attorney General under 18 U.S.C. 1964(a):

VERIFICATION

Dated:

August 30, 2007 A.D.

45

46

47

48

49

50

Signed:

/s/ Paul Andrew Mitchell

__________________________________________________________

Printed: Paul Andrew Mitchell, B.A., M.S., Private Attorney General

All Rights Reserved without Prejudice

Notice of Rebuttal, by AFFIDAVIT:

Page 4 of 5

1

PROOF OF SERVICE

2

I, Paul Andrew Mitchell, B.A., M.S., Sui Juris, hereby certify, under

3

penalty of perjury, under the laws of the United States of America,

4

without the “United States” (federal government), that I am at least

5

18 years of age, a Citizen of ONE OF the United States of America, and

6

that I personally served the following document(s):

7

8

9

NOTICE OF REBUTTAL, BY AFFIDAVIT

by placing one true and correct copy of said document(s) in first

10

class United States Mail, with postage prepaid and properly addressed

11

to the following:

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

Robert R. Di Trolio

dba “Clerk of Court”

United States Tax Court

400 Second Street, N.W.

Washington 20217

DISTRICT OF COLUMBIA, USA

Office of Chief Judge

United States Tax Court

400 Second Street, N.W.

Washington 20217

DISTRICT OF COLUMBIA, USA

Mr. Chester E. Davis

c/o P.O. Box 2110

Clackamas 97015

OREGON, USA

U.S. Postal Inspection Service

Attention: Postmaster General

c/o U.S. Post Office

Washington 20217

DISTRICT OF COLUMBIA

Judiciary Committee

U.S. House of Representatives

Washington 20515

DISTRICT OF COLUMBIA, USA

Judiciary Committee

U.S. Senate

Washington 20510

DISTRICT OF COLUMBIA, USA

[See USPS Publication #221 for addressing instructions.]

Dated:

August 30, 2007 A.D.

36

37

38

39

40

Signed:

/s/ Paul Andrew Mitchell

__________________________________________________________

Printed: Paul Andrew Mitchell, B.A., M.S., Private Attorney General

All Rights Reserved without Prejudice

Notice of Rebuttal, by AFFIDAVIT:

Page 5 of 5