kagan capital partnership agreement 11-8-12

advertisement

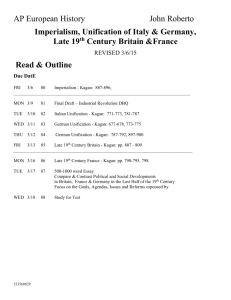

PARTNERSHIP AGREEMENT Of Kagan Capital Table of Contents I. Formation ..................................................................................................................................... 3 II. Name .......................................................................................................................................... 3 III. Term........................................................................................................................................... 3 IV. Purpose ..................................................................................................................................... 3 V. Meetings ..................................................................................................................................... 4 VI. Capital Accounts ........................................................................................................................ 4 VII. Capital Contributions ................................................................................................................. 4 VIII. Membership Fee ...................................................................................................................... 5 IX. Valuation of the Partnership ....................................................................................................... 5 X. Trial Period ................................................................................................................................. 5 XI. Partner Status ............................................................................................................................ 5 XII. Member Status ......................................................................................................................... 5 XIII. Investor Status ......................................................................................................................... 5 XIV. Management ........................................................................................................................... 5 XV. Sharing of Profits and Losses ................................................................................................... 6 XVI. Book of Account ...................................................................................................................... 6 XVII. Annual Accounting and Partnership Audit Committee ............................................................. 6 XVIII. Bank Account ........................................................................................................................ 7 XIX. Broker Account (Option House) ............................................................................................... 7 XX. No Compensation ..................................................................................................................... 7 XXI. Additional Partners .................................................................................................................. 7 XXII. Transfers to a Trust ................................................................................................................ 7 XXIII. Removal of a Partner ............................................................................................................. 7 XXIV. Termination of Partnership .................................................................................................... 7 XXV. Voluntary Withdrawal (Partial or Full) of a Partner (Suspended during trial period) ................ 8 XXVI. Death or Incapacity of a Partner ............................................................................................ 8 XXVII. Terms of Payment ................................................................................................................ 8 XXVIII. Forbidden Acts .................................................................................................................... 9 XXIX. Tax Logistics ......................................................................................................................... 9 XXX. Traders & Leadership ........................................................................................................... 10 XXXI. Earnings Distribution ........................................................................................................... 10 XXXII. Investment Logistics (Suspended during Trial Period) ........................................................ 10 XXXIII. Trade Strategy .................................................................................................................. 10 XXXIV. Standard Operating Procedure (Created During Trial Period) ........................................... 10 XXXV. Liability/Disclaimer ............................................................................................................. 11 XXXVI. Signatures ........................................................................................................................ 11 This AGREEMENT of PARTNERSHIP is made as of the 7th of May 2012 by and between the undersigned partners. I. Formation The undersigned hereby form a General Partnership in, and in accordance with the laws of, the State of Virginia. II. Name The name of the Partnership shall be Kagan Capital. III. Term The Partnership shall begin on the 7th of May 2012 and shall continue until December 31st of the same year and there after from year to year unless earlier terminated as hereinafter provided. IV. Purpose The purpose of the Partnership shall be to invest the assets of the Partnership in options, stocks, bonds, and securities for the financial and educational benefit of the Partners, while employing fundamental principles and techniques of sound investment practices. Everyone has the ability to invest independently. However, when investing independently, most people only manage to break even. One of the reasons for this is they are limited in their ability to research many different ideas. They are stuck just being able to make an investment in one sector every now and then because they do not have the time to research multiple sectors. Another way that they are limited is in the amount of money they are able to invest. This limits one’s ability to properly diversify one’s portfolio. Kagan Capital is a collaborative group investment portfolio. It is built using research performed by a select number of participants (ideally 10-30 people). The idea is to divide the investors up into groups assigned to research stocks in different sectors (Consumer, Services, Healthcare, Energy, Technology, Financial, Industrial, Materials, and Utilities). This will give us the ability to build a portfolio that is intelligently designed using research performed on multiple market sectors. Having this research will not only let us make better investments, but it will also allow us to build a more diversified portfolio. With 10-30 people, we can divide up into four to five teams that will each be responsible for following different sectors. Contact among the teams does not have to happen daily, just enough so that ideas are being collaborated on and sectors are being sufficiently researched. Each week, between all of the groups, we come up with one (or more if there are many great ideas) new investment opportunities. The diversification may start slow, but at least we will start with a very well researched and strong portfolio. Over time this will build into the well diversified and informed portfolio that we are envisioning. Since we all are busy with our everyday lives, we will set goals and develop strategies as we go based on what the group as a whole desires. We view this as a learning experience that will help all of us to grow as investors and hopefully come out with a little more money in our pockets. We cannot promise anything in terms of monetary gain, but we can promise that you will gain hands-on investment knowledge which will help you build your future. V. Meetings Weekly Investment meetings shall be held every Sunday to discuss the coming week’s trading strategies and opportunity Quarterly meetings (Both online and in person) shall be held every three months and deemed necessary by the partners of Kagan Capital VI. Capital Accounts *Calendar year 2012 will be a trial period. Your account value will be based on your beginning contribution percentage divided by Kagan Capital’s end of year value. Example: Invest $500 into a $10,000 original portfolio results in a 5% equity in the portfolio. If the ending value of the portfolio is $15,000 then your new account value is worth $750 *The following is intended for calendar year 2013 There shall be maintained a capital account in the name of each Partner. Any increase or decrease in the value of the Partnership on any valuation date shall be credited or debited, respectively, to each Partner's capital account on that date. Any other method of valuating each Partner's capital account may be substituted for this method, provided the substituted method results in exactly the same valuation as previously provided herein. Each Partner's contribution to, or capital withdrawal from, the Partnership shall be credited or debited, respectively, to that Partner's capital account. This will be done through an online investing club accounting software which will allow us to have more flexibility in managing individual accounts. VII. Capital Contributions The starting investment amount for each person will be a minimum of $500. This is not a fantasy football, poker or NCAA bracket league where you throw some money into it just for fun. Kagan Capital is supposed to be just as fun as any of the aforementioned hobbies but not as risky. Do not compare this investment to what you would invest into a fantasy football league. In order to invest yourself online, you usually need a minimum of $1000 - $1,500. Kagan Capital is allowing you to invest for less than that. With 10-30 people, this will give us an estimated total portfolio worth of $5000-$15,000. This is probably way more than each of us would be willing to risk on our own and it also gives us the ability to better capitalize on our investments. *Calendar year 2012 is a trial period. The following will take place starting in calendar year 2013 Each quarter (every three months) there will be an additional investment of $100 per person which is to be paid by the third day after the quarterly meeting. Members are allowed to make optional additional contributions in any $100 increment(s). We will send out a reminder no fewer than 2 weeks prior to the dues being payable. The purpose of the additional investment is to ensure that members maintain their interest in the exchange and also to increase our investing power. Partner’s status members will each make mandatory quarterly investments of $100 at regular quarterly meetings. Partners may also make optional additional contributions in any $100 increment(s). Regular monthly contributions, normally collected at meetings, are due prior to the scheduled meeting in the case of any planned absence, or by the end of the third day after the meeting from anyone who was unable to attend that monthly meeting due to an emergency or illness. The purpose of the mandatory additional investment is to ensure that partners maintain their interest in the exchange and also to increase our investing power. VIII. Membership Fee There will be a membership of $25. This money will be used for paying administration and research costs. IX. Valuation of the Partnership The current value of the assets of the Partnership, less the current value of the debts and liabilities of the Partnership (hereinafter referred to as the "value of the Partnership") shall be determined within a week prior to the quarterly meeting and the breakdown will be disseminated at the quarterly meeting. X. Trial Period As mentioned above, calendar year 2012 will be a trial period for Kagan Capital. What this means is there will be no additional capital added to the portfolio during the trial period. At the end of the trial period you will have the option to continue on with Kagan Capital or leave with no penalty. The purpose of having a trial period is to be able to work through any growing pains. The aim is for the trial period to have less of a financial commitment. If you are a part of Kagan Capital during the trial period you will have Partner status (explained below). XI. Partner Status Partner status means that you are a partner in the management of Kagan Capital. This is different than signing this partnership agreement. A partner in Kagan Capital will be able to make managerial decisions and be in line for managerial titles. You will have equity stake in Kagan Capital itself. You will be able to vote and elect both new management and new members joining Kagan Capital. XII. Member Status Member status means that you are a member in the investment decision of Kagan Capital. You will have a say in only the investing decision in Kagan Capital XIII. Investor Status Investor status means that you are only an investor in Kagan Capital. You have no say in the investing decision of Kagan Capital. There are no membership fees or required meetings. Your goal is to have Kagan Capital manage your money and provide a return. XIV. Management Except as otherwise determined, all decisions shall be made by the Partners whose capital accounts total a majority of the value of the capital accounts of all the Partners. Current Titles: Founders: Kristopher Kagan, Doug Swiatocha, Daniel Kagan President and CEO: Kristopher R Kagan Managing Trading: Kristopher R Kagan Chief Accounting Officer: Doug Swiatocha Treasurer: Doug Swiatocha CFO: Daniel Kagan Open Positions: Secretary Chief Operating Controller: (Job is to be objective and to ensure the integrity of Kagan Capital. Will prevent emotional decisions) Board Members Vice President Lead Trader Junior Trader *XV, XVI, and XVII will be unofficial during the trial period. They will be forgo during this time. XV. Sharing of Profits and Losses Net profits and losses of the Partnership shall inure to, and be borne by, the Partners, members and investors, in proportion to the value of each of their capital accounts. XVI. Book of Account The Book of Account shall be a complete set of accounts, consisting of assets, liabilities, individual Partnership accounts, and appropriate revenue and expense accounts. It shall use the double-entry accounting system. The Book of Account of the transactions of the Partnership shall be kept and at all times be available and open to inspection and examination by any Partner. XVII. Annual Accounting and Partnership Audit Committee Each calendar year, a full and complete account of the condition of the Partnership shall be made to the Partners. At this time a complete list of trades and analysis will be provide to every participant of Kagan Capital. A review of mistakes, lessons and strategies learned throughout the year will be revealed. The CEO will announce the current condition of Kagan Capital and provide an outlook and trading strategy for the coming year. All financial transactions and trades shall be reviewed semi-annually by a Partnership Audit Committee. The purpose of this is to determine any major or striking flaw in our accounting processes and our trading strategies. It is to allow us to maintain a partnership that is based around friendship, trust and integrity. XVIII. Bank Account The Partnership will select a bank for the purpose of opening a bank account. Funds in the bank account shall be withdrawn by checks signed by any Partner designated by the Partnership. XIX. Broker Account (Option House) All securities shall be purchased in the name of the Partnership. For the trial period Option House will be the online brokerage that will be used. Option House has been chosen for its familiarity among Partners and its low cost structures. Option House also limits us to stocks and options. Other sites such as TD Ameritrade and Interactive Brokers allow for Forex, futures and bonds as well. Kagan Capital’s strategy is to focus on what we know best (options and stocks). We will review at the end of the trial our current brokerage. XX. No Compensation No Partner shall be compensated for services rendered to the Partnership, except for reimbursement of expenses. XXI. Additional Partners Additional Partners may be admitted at any time, upon the unanimous consent of the Partners, so long as the number of primary partners does not exceed the CEO’s partnership limit. There will be no limit to the number of secondary partners/members. XXII. Transfers to a Trust A Partner may, after giving written notice to the other Partners, transfer interest in the Partnership to a revocable living trust, of which the Partner is the grantor and sole trustee. XXIII. Removal of a Partner Any Partner may be removed by agreement of the Partners whose capital accounts total a majority of the value of all Partners' capital accounts. Written notice of a meeting where removal of a Partner is to be considered shall include a specific reference to this matter. The removal shall become effective upon payment of the value of the removed Partner's capital account. XXIV. Termination of Partnership The Partnership may be terminated by agreement of the Partners whose capital accounts total a majority in value of the capital accounts of all the Partners. Written notice of a meeting where termination of the Partnership is to be considered shall include a specific reference to this matter. Written notice of the decision to terminate the Partnership shall be given to all the Partners. Payment shall then be made of all the liabilities of the Partnership, and a final distribution of the remaining assets, either in cash or in kind, shall be made promptly to the Partners or to their personal representatives in proportion to each Partner's capital account. XXV. Voluntary Withdrawal (Partial or Full) of a Partner (Suspended during trial period) Any Partner may withdraw a part or all of the value of the Partner’s capital account in the Partnership, and the Partnership shall continue as a taxable entity. The Partner withdrawing a part or all of the value of such capital account shall give notice of such intention in writing to the Secretary at least two weeks prior to their withdrawal. Written notice shall be deemed to be received as of the first meeting of the Partnership at which it is presented. If written notice is received between meetings, it will be treated as received at the first following meeting. Any partner who wishes to buy out the withdrawing partner’s share they are withdrawing may do so to prevent liquidating positions. The Partnership will not be liable for any payments owed between partners involved in the buyout. In making payment, the value of the Partnership as set forth in the valuation statement prepared for the first meeting following the meeting at which notice is received from a Partner requesting a partial or full withdrawal will be used to determine the value of the Partner's account. The Partnership shall pay the Partner who is withdrawing a portion or all of the value of his capital account in the Partnership in accordance with the Terms of Payment section below in this agreement. Full cash out will only be allowed during the quarterly dues period. We must be informed of your desire to cash out 2 week prior to the date on which the dues are payable (two weeks prior to the last day of the month prior to the start of the quarter) and we will have your money mailed no later then one week after the start of the quarter. Emergencies will be handled on a case to case basis. In the case where you need some money in an emergency but you still wish to participate there will be a maximum temporary withdrawal of $500 or half of the partner’s liquid assets. If someone pulls out there will be a mandatory restructuring meeting that will take place within 6 weeks from the following Monday (or closest business day). The purpose of this is to understand the impact on our portfolio’s diversification. *There will be a maximum 5% penalty charged for any early cash out in addition to cost of selling securities XXVI. Death or Incapacity of a Partner In the event of the death or incapacity of a Partner (or the death or incapacity of the grantor and sole trustee of a revocable living trust), receipt of notice shall be treated as a notice of full withdrawal. XXVII. Terms of Payment In the case of a full or partial withdrawal, payment will be made in cash. When cash is transferred, the Partnership shall transfer to the Partner (or other appropriate entity) withdrawing a portion or all of his interest in the Partnership, an amount equal to the lesser of (i) ninety-seven percent (97%) of the value of the capital account being withdrawn, or (ii) the value of the capital account being withdrawn, less the actual cost to the Partnership of selling securities to obtain cash to meet the withdrawal. The amount being withdrawn shall be paid within 10 days after the valuation date used in determining the withdrawal amount. If the Partner withdrawing a portion or all of the value of his capital account in the Partnership desires an immediate payment in cash, the Partnership at its earliest convenience may pay eighty percent (80%) of the estimated value of his capital account and may then settle the balance in accordance with the valuation and payment procedures set forth above.. XXVIII. Forbidden Acts No Partner shall: ● ● ● ● ● Have the right or authority to bind or obligate the Partnership to any extent whatsoever with regard to any matter outside the scope of the Partnership purpose. Except as provided in this agreement, without the unanimous consent of all the other Partners, assign, transfer, pledge, mortgage, or sell all or part of his or her interest in the Partnership to any other Partner or other person whomsoever, or enter into any agreement as the result of which any person or persons not a Partner shall become interested in the Partnership. Purchase an investment for the Partnership where less than the full purchase price is paid for same. Use the Partnership name, credit, or property for other than Partnership purposes. Do any act detrimental to the interests of the Partnership or any act that would make it impossible to carry on the business or affairs of the Partnership. XXIX. Tax Logistics Club files Form 1065. However, as a partner in the club, you must report on your individual return your share of the club's income, gains, losses, deductions, and credits for the club's tax year. (Its tax year generally must be the same tax year as that of the partners owning a majority interest.) You must report these items whether or not you actually receive any distribution from the partnership. You will receive a copy of Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, Etc., from the partnership. The amounts shown on Schedule K-1 are your share of the partnership's income, deductions, and credits. Report each amount on the appropriate lines and schedules of your income tax return. The club's expenses for producing or collecting income, for managing investment property, or for determining any tax are listed separately on Schedule K-1 and can be deducted by the individual partners if the partners itemize their deductions on Schedule A (Form 1040). These expenses are listed on line 22 of Schedule A along with other miscellaneous deductions subject to the 2% limit. Passive activity losses. Rules apply that limit losses from passive activities. Your copy of Schedule K-1 (Form 1065) and its instructions will tell you where on your return to report your share of partnership items from passive activities. If you have a passive activity loss from a partnership, you must complete Form 8582, Passive Activity Loss Limitations, to figure the amount of the allowable loss to enter on your tax return. XXX. Traders & Leadership As for the placement of trades there will be two traders. One person will be the primary trader on the account and the other will serve as a backup junior trader. In order to prevent problems, the people who make the trades will not have control of the money when it is transferred to an outside account. We will have a separate person who will be in control of distributing earnings and managing any issues with someone wanting to cash out. XXXI. Earnings Distribution At year end, if the group decides that we want to distribute earnings yearly and not reinvest them, we will distribute the earnings minus applicable taxes, fees, etc. and thus we will not collect additional investment dues. XXXII. Investment Logistics (Suspended during Trial Period) We will be maintaining a 10 percent liquid assets margin on the account and will be adjusting the liquid assets quarterly to keep up with earnings/losses. If someone decides to cash out early, there will be a two week period from the following Monday (or closest business day) to return to this margin. To start, we will be investing in stocks and options and will be allowing for a max ratio of 65/25 options to stocks. This is to allow us the room to grow our earnings. We will asses this distribution and our investment vehicles periodically and make informed group decisions regarding any changes we wish to make to our current portfolio. ● Max percentage invested in options is 65% ( Max 65/25 ratio options to stocks) XXXIII. Trade Strategy Our main trade strategy will be intermediate long-term investments. In the case of speculation on the future performance of a stock we will follow the current trend of the stock price. XXXIV. Standard Operating Procedure (Created During Trial Period) Operating procedures will be decided upon after the partnership is established with the agreement of all partners. This information will be outlined in an additional document to be created once the general agreement is signed, but prior to the execution of any trades. The standard operating procedures document must be signed by all partners prior to any trades being executed. XXXV. Liability/Disclaimer Investments in stocks/options/etc. involves risks and is not suitable for all investors. In addition, electronic trading poses unique risk to investors. System response and access times may vary due to market conditions, system performance and other factors. The partnership in no way guarantees monetary gains and will not be held liable to any losses to any Partner. By signing this agreement, each partner accepts any and all risks involved in investing and will not, in any way, hold the Partnership or it’s members responsible for any loss suffered. This Agreement of Partnership shall be binding upon the respective heirs, executors, administrators, and personal representatives of the Partners. The Partners have caused this Agreement of Partnership to be executed on the dates indicated below, effective as of the date indicated above. XXXVI. Signatures Partner (Printed Name) Partner (Signature) Date Signed Partner (Printed Name) Partner (Signature) Date Signed