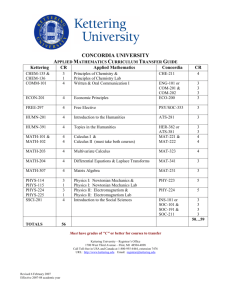

United Healthcare Plan Document - Kettering City School District

advertisement