Tenancy In Severalty or Separate Property

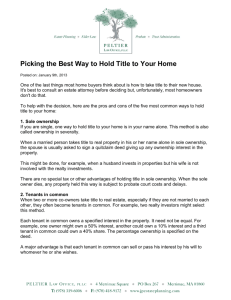

advertisement

(Put Practices – purch & sale beginning) Determining the Form of Title Tenancy In Severalty or Separate Property - This form of ownership only has one owner. Since there is only one owner, the 4 Unities are not applicable. One person enjoys all rights of the property. (1) Single Owner - The single owner could have purchased the property prior to getting married. This would remain separate property after the marriage. Even in a community property State such as California, property acquired prior to marriage is retained as separate property. Even after marriage, if a person acquired ownership through an inheritance or gift from an individual it is considered separate property; only one owner. (2) Commingling - If an owner of separate property commingled property with joint property during the marriage, the courts could rule the separate property as community property in a divorce. Example: If a spouse paid the property tax on her separate property with a joint checking account, the courts might rule the separate property as community property. (3) Tenancy In Severalty - Upon the death of a single owner under Tenancy in Severalty, the property would pass to the individual heirs, charity, trust, etc. that the owner specifies in his/her will. (On the next page put slides Practices – Purch – Sale – Page 001 & 001A) 1 ii. Tenancy by Entirety and Community Property - This form of tenancy deals with ownership of property by married couples. The use of either has to do with their residency in a given State. States establish ownership by one or the other form; never both within the same State. Most States utilize the English system of government and laws. They do not utilize municipalities. They do not have community property laws. The eight (8) western States utilize the Spanish form of government and laws. They have municipalities and community property laws. (1) Tenancy By The Entirety - Under this old English form of common law, all property acquired by a husband and wife have a survivorship arrangement. The 4 Unities are present. Each owns 50% of the property. Each has equal possession. They must have acquired the property at the same time and both their names must be on the title. When the first spouse dies, the surviving spouse obtains the deceased spouse’s interest; the surviving spouse gets the entire estate. (2) Community Property - In a community property State, all property acquired by a couple is considered community property UNLESS the property was acquired by a separate effort. If a spouse utilizes assets that are separate property to acquire new property, the new property will not be community property. At death, this separate property can be passed on to individuals, charities, trusts, etc. other than the spouse. If the property is acquired by a joint effort, the property is always community property. When a spouse dies, he or she can pass on their interest to a person of their choosing. The surviving spouse does not necessarily gain the deceased spouse’s share. The deceased spouse has to will their share of ownership to the other spouse. (On the next page put slides Practices – Purch – Sale – Page 002 & 002A) 2 iii. Co-Tenancy or Concurrent Tenancy - This form of tenancy/ownership is for those who are joint owners , but are NOT married. Example: Two brothers inherit a cabin from their mother upon her death. Joint ownership can be set up on a survivorship arrangement (survivor gets it all) OR it can be titled as an inheritable tenancy (deceased owners passing their interest to heirs). (1) Joint Tenancy - This form of tenancy/ownership among non-married individuals is exactly the same as Tenancy by the Entirety for married couples. Each owner enjoys the 4 Unities and the surviving owner ends up with the entire estate. Each owner must acquire the property at the same TIME, must all be listed on the TITLE, must have equal INTEREST, and equal POSSESSION of the property. An owner CANNOT pass on their interest to a person of their choosing. The surviving owner(s) will obtain their interest at death; a survivorship designation. (2) Tenancy In Common - This is the only form of multiple ownership that does not require the 4 Unities. Owners under Tenancy in Common can have UNEQUAL interest/ownership. One owner could own 10% and the other own 90% of the property. They do not have to acquire ownership at the same time or all be listed on one recorded document. One owner may have acquired their ownership by inheritance from their uncle. The other owner may have purchased from the uncle 5 years prior. The only Unity that is required is EQUAL Possession. Each owner can utilize the property equally as far as use and possession. (On the next page put slides Practices – Purch – Sale – Page 003 & 003A) 3 iv. Tenancy/Ownership by a Trust or Corporation - Trusts and Corporations can only own property by Tenancy in Severalty as a single owner or as Tenants in Common with other owners. Obviously a trust or corporation cannot get married and so they cannot own property under Tenancy by Entirety. A trust or corporation does not die and so neither can hold property in Joint Tenancy which has a survivorship clause. (On the next page put slides Practices – Purch – Sale – Page 004 & 004A) 4 (1) Commingling - If an owner of separate property commingled property with joint property during the marriage, the courts could rule the separate property as community property in a divorce. Example: If a spouse paid the property tax on her separate property with a joint checking account, the courts might rule the separate property as community property. (2) Tenancy In Severalty - Upon the death of a single owner under Tenancy In Severalty, the property would pass to the individual heir, charity, trust, etc. that the owner specifies in his/her will. (On the next page put slides Practices – Purch – Sale – Page 005 & 005A) 5 Forms of Earnest Money Buyer's Consideration - The buyer’s consideration to seller under contract requirements. E/M Deposit - Check - The attached earnest money deposit is an up-front payment that shows a commitment by the buyer to the seller. Additional E/M - Any additional earnest money due if offer accepted. Usually the buyer will make an immediate deposit and then specify additional Earnest Money deposits to be made in the immediate future. Example: G writes a check out for $4,000 with the offer (E/M deposit). She also specifies that if the offer is accepted, she will deposit an additional $26,000 within 30 days. This scenario is fairly common. (On the next page put slides Practices – Purch – Sale – Page 006 & 006A) 6 Other Forms of Earnest Money Promissory Note - Payable at closing. Title to Other Property - The buyer could offer title to his/her real property as a show of earnest money. Cash Saving Account - An assignment of available cash upon acceptance, Super Bowl Tickets - A person in Seattle placed his Super Bowl tickets into escrow to entice the seller to action. The purpose of the buyer’s earnest money to show the seller that he/she is serious and is willing to place the specified item into escrow. (On the next page put slides Practices – Purch – Sale – Page 007 Only) 7 Different Purchase and Sale Agreements There are several different residential purchase and sale agreements. The different forms specify the type of real property being purchased and sold. 1. Residential Purchase and Sale Agreement 2. Condominium Purchase and Sale Agreement 3. Vacant Land Purchase and Sale Agreement 4. Manufactured Home Purchase and Sale Agreement 5. New Construction Purchase and Sale Agreement (On the next page put slides Practices – Purch – Sale – Page 008 & 008A) 8 Pre-qualified Buyers In the past, a number of our licensees have required tentative buyers to obtain a pre-qualified loan before seriously making offers on property (they do not do that, now). This, however, is a suggestion that can move things along with a purchase and sale agreement with possible sellers. Maximum Price - This pre-qualified status will show the maximum that a buyer/ purchaser can pay for a home. This can save you a lot of wasted time if the buyer cannot qualify for a loan. Software Budgeting Some agents sit down with buyers and show them what amount they can comfortably afford to spend on a house. There are budgeting software programs available that take in information and work out a budget for individuals. You can utilize this software to calculate the amount that a buyer can afford. (On the next page put slides Practices – Purch – Sale – Page 009 & 009A) (On the next page put an ending slide) 9