Past Agendas - LifeCycle Returns, Inc.

advertisement

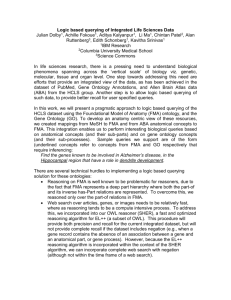

-----Original Message----From: Rawley Thomas [mailto:Rawley@LCRT.com] Sent: Friday, July 20, 2007 12:15 PM To: Tony Rossitto (antonino.s.rossitto@bankofamerica.com); Aaron VanGetson; aaron.meder@ubs.com; Abol Jalilvand (ajalilv@luc.edu); Adam Cohen; Adam Gehr (agehr@depaul.edu); Alex Rabinovich (alex.rabinovich@morningstar.com); Andy Mose; Amit Dugar; Amit Dugar (amit_dugar@yahoo.com); Andrew McElheran (andrew.mcelheran@hewitt.com); Ashok Abbott; Bart Madden (bartmadden@yahoo.com); Bill Anstine (AnstineW@yahoo.com); Bill Hass (WJHass@aol.com); Bob Atra (atraro@lewisu.edu); Brett Rentmeester; Carson Boneck (cboneck@qsg.com); Chris Goebel (chris.goebel@hewitt.com); David Hightower (hightower@futures-research.com); David Trainer (David.Trainer@NewConstructs.com); Debbie Nochlin (dnochlin@imca.org); Dennis Aust (Dennis.Aust@chartermast.com); Doug Allen (dougallen1@sbcglobal.net); Douglas Hoerr; Ellen Riccardi; Frank Leibor (fleiber@leiberassociates.com); Greg Jania (gjj@wpglobalpartners.com); Ishak Mohammed; Jack Rader; Jack Tilton (jrtilton@comcast.net); jacqueline@drexel.edu; Javier Estrada (jestrada@iese.edu); Jeff Nevins (Nevins@fana.com); Jenny Wong (Jenny.Wong@rrd.com); Jill Epstein; Jim Grant (jim@jlgresearch.com); Joe Simpson; John Ptak; jpayne@txstate.edu; Keith Black (kblack@stuart.iit.edu); kenia.iskantina@abnamro.com; Lee Hayes (hayeslt@comcast.net); Marc Tourville; Mark Hooker (mark_hooker@ssga.com); Mark Ubelhart; Melanie Angers (MAngers@gsb.uchicago.edu); Mike Lindh (michael.lindh@RandT.com); Mike Wolcott (mwolcott@yahoo.com); Nadia Van Dalen (nadia.vandalen@morningstar.com); Nick Padgett (nick.padgett@emiquon.com); Paul Kaplan (paul.kaplan@morningstar.com); Peter Beno (pbeno@highbrookpartners.com); Peter Carl (pcarl@gsbalum.uchicago.edu); Ralph Goldsticker (ralphg@mcm.com); Rebecca Fender (rebecca.fender@cfainstitute.org); Ricardo Bekin (rbekin@ativoresearch.com); RobertAtra@cs.com; Ron Holland (Ron.Holland@morganstanley.com); Ronald Ewing; Russell E. Long (russell_long@standardandpoors.com); Sachin Dole (sdole@saventech.com); Salman Hamidani (salman.hamidani@ubs.com); Samir Raza (samir.raza@hewitt.com); Sergei Khamdiev (skhamdiev@hotmail.com); Shantal Alonso; Sheng Guo (shengguo@uchicago.edu); Shepherd Pryor (ShepPryor4@aol.com); Steven Youngren; Susan Mangiero (smm@bvallc.com); Ted Steven (ted.steven@mts.net); Terry Odean; Theodore K. Wood; Tim Bixler (tim.bixler@creditsuisse.com); Tom Larsen (TLarsen@hlmnet.com) Cc: Charles Beauchamp Subject: Practitioner Demand Driven Academic Research Initiative (PDDARI) Practitioner Demand Driven Academic Research Initiative (PDDARI) Hi All, The next meeting of FMA PDDARI as supported by the CFA Society of Chicago occurs at: Tuesday July 24th at 12:45 CDT (1:45 EDT, 10:45 PDT) – Right after the Education Group whose meeting begins at 12 Noon. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CDT, following the Education Group meeting which begins at 12 Noon. August 28, 2007 September 25, 2007 October 23, 2007 – NO Meeting ! (Rawley at FMA Annual Meeting & “vacation”) November 27, 2007 December 25, 2007 – NO Meeting ! (Christmas) If you would like a box lunch for the Task Force meeting and have NOT signed up for the Education Group, please e-mail Shantal Alonso directly at salonso@cfachicago.org . The Society web site link for current drafts of research initiatives, meeting agendas, and Conflicts of Interest Discussion is FMA PDDARI as supported by the CFA Society of Chicago. Agenda 1. FMA (Rawley) – Next Practitioner Research Committee Conference Call on 2. 3. 4. 5. Monday September 17, 2007 a. Teaching persons listing topics for research on how best to use the FMA website to identify potential researchers if they are interested in conducting a search to draw out demand b. Developing guidelines for listing funded research and paid consulting do we even need guidelines or will the market take care of things as long we provide adequate disclosure? c. How should we promote the initiative to members before, during and after the Annual Meeting? d. FMA Annual Meeting Thursday October 18th 9:45 AM Orlando - Special Panel on how professional associations work with the academic community – Paul Kaplan is representing the CFA Society, Steve Davidson is representing the Securities Industry and Financial Markets Association (SIFMA) and Kevin Roth is representing the Association of Financial Professional (AFP). Rawley is moderating and describing PDDARI. Fundamental Indexation. – No responses yet from any recipient of invitation to participate. Katy Sherrerd of Research Affiliates; Cliff Asness (cliff.asness@aqr.com); David Burkart (david.burkart@barclaysglobal.com); Bruce Bond (BBond@PowerShares.com); John Southard (jsouthard@powershares.com); Jeremy Siegel (Sieglel@Wharton.UPenn.edu); Jeremy Swartz (JSwartz@WisdomTree.com) Rob Arnott; Jason Hsu; Jack Wildermuth (wildermuth@rallc.com). Any ideas for encouraging responses? Charles F. Beauchamp effects of fund reported residual values on the performance measurements of private equity and the predictability of final fund performance using reported residual values. Any interest? – Joe Simpson, Randy Schostag Benchmarking – Joe Simpson status report Bob Atra – Research Status Report a. Three Phase Dividend Discount Model (ROPE – Return on Payout / Equity model) – regression toward the mean substantially increases accuracy of model and explains its use in the practitioner community relative to the traditional one phase Gordon DDM – Plans for next steps b. Applying the Kelly Formula of edge / odds information advantage to portfolio weighting on actual and back test portfolios – Contrast to cap 6. 7. 8. 9. 10. 11. 12. weighting, equal weighting, and fundamental weighting – anyone interested in working with Bob and me? Edge relates to under (over) intrinsic valuation. Vision Statement (Rawley) – Jack Rader suggested renaming it to “Shared Philosophy” and provided some suggested edits – on Rawley’s desk for next draft Cross Sectional Risk Measurement (Rawley) a. Complete new better draft started by Paul Kaplan to avoid confusion with time series; on Rawley’s desk for next draft b. Complete 7 year data received from Ironwood for Stable Paretian and other distributional analyses c. Paul volunteered Morningstar data on 3,600 funds under certain conditions to Ashok Abbott for analysis; project started Hewitt Associates – Mark Ubelhart and Samir Raza – Anything new to report? Asset Allocation – Peter Carl, Aaron Meder, Ralph Goldsticker – anything new to report? Aaron VanGetson – Demand Driven Disclosure (I-3-D). Other agenda items Next Meeting Date Time (4th Tuesday of Each Month) Tuesday August 28th at 12:45 CDT (1:45 EDT, 10:45 PDT) Thanks. Rawley Thomas (The “T” in HOLT) VP of Practitioner Services of the Financial Management Association (FMA) Chairman of the FMA Practitioner Research Committee Chairman of the FMA PDDARI Meeting Supported by the CFA Society of Chicago Principal of the Minnesota Business Valuation Group President and Co-Founder of LifeCycle Returns, Inc. (LCRT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com June 22, 2007 Practitioner Demand Driven Academic Research Initiative (PDDARI) Hi All, The next meeting of the Society’s PDDARI Task Force occurs at: Tuesday June 26th at 12:45 CDT (1:45 EDT, 10:45 PDT) – Right after the Education Group whose meeting begins at 12 Noon. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CDT, following the Education Group meeting which begins at 12 Noon. If you would like a box lunch for the Task Force meeting and have NOT signed up for the Education Group, please e-mail Shantal Alonso directly at salonso@cfachicago.org . The Society web site link for current drafts of research initiatives, meeting agendas, and Conflicts of Interest Discussion is FMA PDDARI as supported by the CFA Society of Chicago. The FMA web site has gone live with a Blast Announcement to its 3,000 members. That web site is: http://www.fma.org/PDDARI/PDDARI.htm Please check it out. Agenda 1. For 25 minutes, Bart Madden will present his work on disclosure of 2. 3. managements’ model linking their firm’s performance to stock price. See attached article from the Journal of Applied Corporate Finance. Does the group prefer highlighted agendas or non-highlighted ones? Financial Management Association (FMA) (Rawley) a. Went live with E-Mail Blast Announcement to its 3,000 members. b. Ashok Abbott of West Virginia University has agreed to oversee graduate students to work on: i. Time Series Risk Ranking ii. Cross Sectional risk measurement iii. Valuation of private and illiquid equity within portfolios iv. Valuation of possibly mis-priced bonds within portfolios c. Paul Kaplan and I had a conference call Friday June 8th with Ron Surz on benchmarking. Ron agreed to work with Joe Simpson on a request for research. d. Jessica Conser of Colorado State University (CSU) wishes to collaborate with another Professor at CSU on initiative #16: “Are Earnings Estimates already Embedded in Stock Prices. Specifically, following the work of Robert Schiller, Vernon Smith, and other behavior finance people on market over reaction, the PDDARI “Thought Partners” wish to decompose the effects of earnings, sentiment or noise, EPS surprises, and DCF intrinsic values on stock price level and change. Suggests need for research specification on the FMA web site to assure academics’ understanding of “Thought Partner” needs. e. Suman Banerjee of Tulane e-mailed us an excellent article on “Fat Tails and Slumping Shoulders: Kurtosis and the Market Microstructure of Daily Stock Returns.” Paul Kaplan and I are responding to encourage his efforts. f. Javier Estrada, program chair for the FMA European Conference just 4. 5. 6. 7. 8. 9. 10. 11. ended, is researching the geometric mean criteria of portfolio construction. Fundamental Indexation. Paul, Mike, Lee and I finished the draft on Alternative Weighting Strategies. I e-mailed an invitation to Katy Sherrerd of Research Affiliates; Cliff Asness (cliff.asness@aqr.com); David Burkart (david.burkart@barclaysglobal.com); Bruce Bond (BBond@PowerShares.com); John Southard (jsouthard@powershares.com); Jeremy Siegel (Sieglel@Wharton.UPenn.edu); Jeremy Swartz (JSwartz@WisdomTree.com) Rob Arnott; Jason Hsu; Jack Wildermuth (wildermuth@rallc.com) to participate in further drafting. No responses yet. S&P – I met with Cliff Griep on Friday, June 8. Cliff is the Chief Risk Officer and Executive Managing Director for Standard & Poor’s. I sent Cliff a followup e-mail, which said in part: “I will call Steve Davidson to plant the seed of using SIFMA as a possible coordinating vehicle for implementing PDDARI with S&P, Moody’s, Fitch, and Duff and Phelps on academic research of common interest. I will also continue to encourage dialogue within the FMA PDDARI as supported by the CFA Society of Chicago to flush out the initiative of analyzing both debt and equity with the same framework and metrics. Perhaps some collaboration with S&P on this critical topic for the profession will evolve. A conceptually sound, empirically validated Framework on capital structure and dividend policy would help corporate management focus on the right objectives to improve capital market efficiency.” Hewitt Associates – Mark Ubelhart and Samir Raza – Anything new to report? Vision Statement – Lee Hayes’ vision statement draft is on the web site. I proposed some additions in an e-mail to Javier Estrada. Paul has agreed to make the next draft to integrate the two drafts within a historical context based on Peter Bernstein’s Capital Ideas Evolving. Aaron VanGetson – Demand Driven Disclosure (I-3-D). Other agenda items I will be in Orlando Tuesday, October 23rd on vacation after the Orlando FMA Annual Meeting. Is someone else willing to lead the PDDARI meeting that day, do you want me to try to phone in, or should we cancel the meeting for that October month only? Next Meeting Date Time (4th Tuesday of Each Month) Tuesday July 24th at 12:45 CDT (1:45 EDT, 10:45 PDT) Thanks. Rawley Thomas (The “T” in HOLT) VP of Practitioner Services of the Financial Management Association (FMA) Chairman of the FMA Practitioner Research Committee Chairman of the FMA PDDARI Meeting Supported by the CFA Society of Chicago Principal of the Minnesota Business Valuation Group President and Co-Founder of LifeCycle Returns, Inc. (LCRT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com From: Rawley Thomas [mailto:Rawley@LCRT.com] Sent: Thursday, May 17, 2007 2:15 PM To: Warren Isabelle; Aaron VanGetson; aaron.meder@ubs.com; Abol Jalilvand; Adam Cohen; Adam K Gehr; ALEX RABINOVICH; Andy Mose; Amit Dugar; Amit Dugar; Ashok Abbott; Bart Madden; Bill Hass; Bob Atra; Brett Rentmeester; Carson Boneck; Chris Goebel; David Hightower; David Sekera; Debbie Nochlin; Doug Allen; Douglas Hoerr; Ellen Riccardi; Frank Leibor; Greg Jania; Ishak Mohammed; Jack Rader; jacqueline@drexel.edu; Javier Estrada; Jeff Nevins; Jill Epstein; jim@jlgresearch.com; Joe Simpson; John Ptak; jpayne@txstate.edu; Keith Black; kenia.iskantina@abnamro.com; Lee Hayes; Marc Tourville; Mark Hooker; Mark Ubelhart; Melanie Angers; Mike Lindh; Mike Wolcott; NADIA VANDALEN; Nick Padgett; PAUL KAPLAN; Peter Beno; Peter Carl; Ralph Goldsticker; Rebecca Fender; Ricardo Bekin; Ron Holland; Ronald Ewing; Russell E. Long; Sachin Dole; Salman Hamidani; Samir Raza; Sergei Khamdiev; Shantal Alonso; Shepherd Pryor; Steven Youngren; Susan Mangiero; Ted Steven; Terry Odean; Theodore K. Wood; Tom Larsen; Tony Rossitto Subject: Agenda for Next FMA PDDARI Meeting Supported by the CFA Society of Chicago May 22, 2007 at 12:45 CDT Practitioner Demand Driven Academic Research Initiative (PDDARI) Hi All, The next FMA PDDARI Meeting Supported by the CFA Society of Chicago occurs at: Tuesday May 22nd at 12:45 CDT (1:45 EDT, 10:45 PDT) – The Education Group canceled its meeting this month. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CDT, following the Education Group meeting which begins at 12 Noon. If you would like a box lunch for the meeting, please e-mail Shantal Alonso directly at salonso@cfachicago.org . The web site for the FMA PDDARI meeting supported by the CFA Society of Chicago is FMA PDDARI . Please check it out for current drafts of Research Initiatives, Agendas, Conflicts of Interests Policies, and draft Vision Statement. Agenda 1. Financial Management Association (Rawley) a. The FMA Practitioner Research Committee approved the FMA PDDARI Web Site, which will go live any day now with a blast announcement to the FMA’s approximately 3,000 members. Check it out at http://www.fma.org/PDDARI/PDDARI.htm b. Special panel for the FMA October Annual Meeting approved for Academic / Practitioner experiences including PDDARI. Rawley to moderate Steve Davidson VP Capital Markets Research for the Society of Securities Industry and Financial Markets Association(S I F M A), Kevin Roth, Director of Research for the Association of Financial Professionals (AFP), and our own Paul Kaplan of Morningstar. c. Position paper on narrow exception for non-disclosure of proprietary algorithms e-mailed to Betty Simpkins for consideration of the editors of the Journal of Applied Finance (JAF). 2. Aaron VanGetson – Investor Demand Driven Disclosure (I-3-D) status report a. Bart Madden has agreed to present his work on disclosure of managements’ model linking their firm’s performance to stock price for 25 minutes during our next meeting on June 26 th. See attached article from the Journal of Applied Corporate Finance. b. E-mail sent to Jonathan Boersema of the CFA Institute to try to connect to the Institute’s Global Performance Indicators initiative. c. Concept of using the proxy process and CFA Society Global Performance Indicators (GPIs) as free market encouragement of better disclosure. See web site with information on the process and rules associated with shareholder proposals: http://www.shareholderproposals.com/. 3. E-Mail drafted to invite Research Associates and other firms interested in fundamental indexation to participate in the creation of the Request for FMA Research. May be released next week with current draft of request for research on “Alternative Weighting Strategies.” 4. Hewitt Associates status report by Samir Raza or Mark Ubelhart on migration of pivotal employees, liability asset matching, economic capitalization of expenses, and economic accounting of executive stock options 5. Lee Hayes – draft available on web site on PDDARI Vision. 6. Bob Atra – Dividend discount models research extended to 3-phase (ROPE) and possibly Merrill Lynch; trying to link price level tracking error to literature. Planned focus on measurement of models: robustness, accuracy, unbiased, and predictive capability. 7. Valuation of Distressed Firms (David Sekera and Rawley Thomas) – contacted Russ Long of S&P (serves on FMA Board) to explore using the same framework and metrics for valuation analysis of both debt and equity; availability of market values of debt instruments 8. Cross Sectional Analysis of Return, Risk and Attribution- drafting by Lee Hayes, Paul Kaplan, and Rawley 9. Global Asset Allocation – Peter Carl and Chris Goebel may join Ralph Goldsticker on this Initiative. Consider linking fundamental DCF intrinsic value and supply / demand commodity price level equilibrium analysis with sentiment to predict change in correlations between stocks and commodities from negative or low to significantly positive. Issue of silos of price change research and price level research. 10. Open Source “R” Statistic Library – Peter Carl – relevance to risk measurement because automated calculations for volume applications have not been available for the Stable Paretian distribution and other key statistical needs. 11. Independent Valuations of Securities owned by Mutual Funds Where Thin or No Markets Exist – Debt, Public Equity, Private Equity – University of West Virginia (Ashok Abbott) willing to coordinate effort and share results with the CFA Society and FMA. After request for research drafted by U of West Virginia and Minnesota Business Valuation Group (MBVG) produced, invite National Association of Certified Valuation Analysts (NACVA), American Society of Appraisers (ASA), Institute of Business Appraisers (IBA), and AICPA to participate. Objective is to explore less labor intensive, more automated approaches which produce more defensible valuations at practical cost, so mutual funds investors are not disadvantaged by the daily net asset price mechanism. Is anyone in the CFA Society of Chicago interested in collaborating on the effort? 12. Other Agenda Items 13. Next Meeting Date Time (4th Tuesday of Each Month) Tuesday June 26th at 12:45 CDT (1:45 EDT, 10:45 PDT) Thank you. Rawley Thomas VP of Practitioner Services of the Financial Management Association (FMA) Chairman of the FMA Practitioner Research Committee Chairman of the FMA PDDARI Meeting Supported by the CFA Society of Chicago President and Co-Founder of LifeCycle Returns (The “T” in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com April 20, 2007 Practitioner Demand Driven Academic Research Initiative (PDDARI) Hi All, The next meeting of the Society’s PDDARI Task Force occurs at: Tuesday April 24th at 12:45 CDT (1:45 EDT, 10:45 PDT) – Right after the Education Group whose meeting begins at 12 Noon. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CDT, following the Education Group meeting which begins at 12 Noon. If you would like a box lunch for the Task Force meeting and have NOT signed up for the Education Group, please e-mail Shantal Alonso directly at salonso@cfachicago.org . We now have a web site link for current drafts of research initiatives, meeting agendas, and Conflicts of Interest Discussion. PDDARI Task Force Agenda 1. Financial Management Association (FMA) (Rawley) a. The current list of topics will go live on the FMA web site in the next few weeks to elicit academic responses to our requests for research. Risk Ranking is the #1 topic. b. At the FMA Mid-Year meeting, the Board approved the appointment of Betty Simpkins as head editor for the Journal of Applied Finance (JAF). Since JAF is a natural outlet for much of the planned CFA Society PDDARI Task Force research, I suggested that we review the current requirement that all proprietary algorithms be placed in the public domain as a prerequisite for academic publication. The attached position paper lays out the issues. Traditional top academic research journals have required that all research have the capability of being replicated by other academics to prevent fraud.[1] This requirement is fine for academics working with public sources like Compustat. However, for comparative testing of the results of proprietary algorithms, requiring algorithm replication obviously directly conflicts with the valuable intellectual property rights of the owners. Besides JAF, other options for academic publication may include The Financial Analyst Journal (FAJ), Journal of Portfolio Management (JPM) and Journal of Applied Corporate Finance (JACF), which we think do not require full replication, but which also do not have the same high stature of JAF for academic recognition, advancement, and tenure. Betty and Jack Rader (FMA Executive Director) will review my attached document and submit it to the other editors for their review. The editors have traditionally retained the power to make the decision to reject papers which cannot be replicated. If the editors believe that this absolute policy should be reconsidered in response to PDDARI with carefully considered carve out exceptions, they may likely seek FMA Board approval for this strategic policy change. Would the proposed carve out narrow exceptions work for the Task Force? 2. Hewitt Associates introduction to Mark Ubelhart (present) and Samir Raza (not present) a. Mark is Principal, Practice Leader for Value Based Management and Architect of Human Capital Foresight for Hewitt Associates. Samir leads the shareholder value initiative as a member of the corporate finance group team at Hewitt Associates. He is also managing research aspects of the Human Capital Foresight™ project, leveraging over a decade of management consulting experience with clients in North America, Europe, and Asia, and research experience in academic institutions. Currently, Mark, Samir, and Hewitt seek to join the PDDARI Task Force within the CFA Society of Chicago to develop products for the investment community that allow projecting industry stock price inflection points based on sound, independent academic research. Hewitt’s unique database, based on 22 3. 4. 5. 6. 7. 8. million US employees from Hewitt’s HR outsourcing, benefit and actuarial services, is updated monthly. Empirical evidence with CSFB HOLT’s research suggests the flow of pivotal employees leads to significant changes in CFROI® and stock prices thus potentially providing an information advantage to portfolio managers. Hewitt may also be interested in employing its actuarial pension fund data to aid in the conceptual development of matching asset products to liability cash flows. Hewitt helps design compensation structures to encourage organizational change consistent with shareholder value creation linked to sound human resource principles. b. Mark Ubelhart – report on Industries for which Hewitt as data. How would this be consolidated for use by investment professionals? c. Asset Pricing Models; Risk management methodologies; Integration of Liability Management and Asset Management (Aaron Meder – UBS) d. What is the proper economic accounting and empirical valuation for executive stock options from publicly available data? (Lee Hayes) Aaron VanGetson – report on form agreement to cover academic’s access to PDDARI Task Force members willing to provide data and other assistance. Discussion of Investor Demand Driven Disclosure (IDDD). Lee Hayes – report on Fundamental Indexation. Discussion of Paradigm Shifting Vision for PDDARI. Bob Atra – report on growth rates used in empirically validation of DCF models; Mental Model Assumptions Underlying Portfolio Strategies on the relationships of Noise, Transactions Costs, and Information Advantage. [2] David Sekera - At his former position at a hedge fund, David was a research analyst and provided buy / sell and long / short opinions for the entire capital structure from debt to equity based on his fundamental analysis and economic business valuation opinion. David and I discussed the challenging decision related to buying the debt or buying the equity of a firm in financial distress. Attached is an LCRT graphical analysis of the most risky Cauchy distribution of under (over) valuation of firms in high financial distress, where the distribution tails are so fat that the mean fails to exist. We seek more accurate intrinsic valuation models and analytical methodologies to separate firms into the debt pile or the equity pile or both and why.[3] Global Asset Allocation – Bob Atra, Ralph Goldsticker, Rawley Thomas. I (Rawley) have not had the time to review the data on multiple countries back to the 19th century provided by Bob Atra, or the time to perform a Stable Paretian and Stable Paretian Cupola Analysis of the indices time series to illustrate what Academics might do. Relevant network connections to other professional associations (Rawley) a. SIFMA – Securities Industry and Financial Markets Association – Steve Davidson VP and Director of Research engaged. Meeting with B of A, Goldman, JP Morgan, and CitiGroup Directors of Research to determine their interest. b. AFP – Association of Financial Professionals – declined suggested request for empirically testing mental stock price formation models of its members as being too “academic.” Seeking other professional associations with potential interest, including National Investor Relations Institute (NIRI) and National Association of Certified Valuation Consultants (NACVA). Possibly also SURFA (see below). AFP may be interested in pension funding and disclosure issues. c. SURFA – Society of Utility Rate Making Financial Analysts – placed request for research with FMA on whether Congressional allowance of acquisitions and the associated purchase premiums in the utility industry affect the cost of capital or the market expected cash flows. Interested in advanced DCF. d. Strategic Risk Council of the Conference Board of Canada Toronto Annual Meeting – Enterprise Risk Management (ERM) might be more properly termed Enterprise Uncertainty Management (EUM) due to the focus on uncertain immeasurable events[4] as opposed to measurable distributions of risky events. However, they are also interested in better methods for measuring risky events and mitigating their loss. How do academics propose that both corporations and portfolio managers address both uncertain and risky events for practical decisions? 9. Economic Drivers of Intrinsic Valuation – For people willing to stay later beyond the normal ending time, LCRT seeks help in its continuing research. After incorporating the effects on DCF automated intrinsic valuation of cash economic returns, sustainable growth rates, size, and leverage, what additional economic drivers should be empirically tested for relevant impacts on intrinsic valuations: a. Fixed costs of trading per share appears significant (thanks to Mike Lindh for suggesting this economic effect) b. Dividend policy is also significant, with its significance increasing after the decrease in the dividend tax rate to 15% - seems to be measuring both investor tax premiums and risk preferences for dividends now over capital gains later (unless the cash can be employed at high returns as quantified in the sustainable growth rate). c. Share repurchase, while significant, is less important than dividends (thanks to Amit Dugar for suggesting this test). d. % excess cash to assets seems relevant to smaller firms with options to reinvest that cash at high excess returns, but not to larger firms e. How best to measure the effect of abnormal accruals on intrinsic valuation (see Howard Schilit, Scott Richardson, etc.) f. What other Economic Drivers of DCF Intrinsic Valuation should be tested? Do multi-factor models suggest underlying Economic Drivers which deserve empirical testing? 10. Other agenda items 11. Next Meeting Date Time (4th Tuesday of Each Month) Tuesday May 22nd at 12:45 CDT (1:45 EDT, 10:45 PDT) Rawley Thomas VP of Practitioner Services of the Financial Management Association (FMA) Chairman of the FMA Practitioner Research Committee Chairman of the CFA Society of Chicago PDDARI Task Force http://www.PDDARI Task Force President and Co-Founder of LifeCycle Returns (The “T” in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com Several instances of well publicized scientific fraud in proper empirical analysis have been published. Consequently, editors naturally wish to minimize the risk that they publish research which subsequently proves to be fraudulently produced. [2] Bob says: “Here is a graph of my thinking on the types of portfolio strategies that would be most beneficial under certain assumptions about markets. It is a back of the envelope thinking which might help the PDDARI Task Force synthesize some of our suggested research and spur our thinking about these issues. Feel free to comment or “move around” the strategies. I have not read the entire Poundstone book, so I am guessing where the Kelly Criterion would fall. Of course where any strategy would fall could be up for a healthy debate. This survey may prove useful as well for someone doing more of a survey type of article. My thinking was that indexing is associated with market efficiency, yet few believe the market is efficient in all aspects. The three items identified -- noise, information, transactions costs -- can all be viewed as different flavors of market inefficiency. Different types of indexing may be superior given different sources of inefficiency. I threw in the other two just for discussion. Thanks, Bob [1] For example, Compustat and other data base vendors, which are traditionally available to Academics, capture book values of debt, but not market values. Would market values of debt make a significant difference to matching intrinsic valuations, especially with firms in financial distress? If desired, Rawley will check with Russ Long on availability of S&P Bond pricing data to compliment traditional sources. What are the best methods for estimating the market valuation of privately held debt (insurance and bank) where no or few transaction prices exist? [4] Paul Kaplan’s “Mexican Peso Revaluation Problem.” [3] March 23, 2007 Practitioner Demand Driven Academic Research Initiative (PDDARI) Hi All, The next meeting of the Society’s PDDARI Task Force occurs at: Tuesday March 27th at 12:45 CDT (1:45 EDT, 10:45 PDT) – Right after the Education Group whose meeting begins at 12 Noon. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CDT, following the Education Group meeting which begins at 12 Noon. If you would like a box lunch, please e-mail Lori Tews at ltews@cfachicago.org . We now have a web site link for current drafts of research initiatives, meeting agendas, and Conflicts of Interest Discussion. PDDARI Task Force Agenda 1. Status Reports a. Financial Management Association (FMA) (Rawley) b. i. Mid-Year Board Meeting occurred in San Diego during the Southwest Finance Association Annual Conference ii. Board most impressed with the engagement of senior leaders within the Practitioner Community, the length, and the scope of Research Initiatives iii. Linking PDDARI to student chapters, education, and doctoral students iv. Jack Rader, Executive Director, requested preliminary draft of Current List of Initiatives (attached for discussion) for placing on FMA web site to elicit FMA member participation; plan to go live in the next few weeks v. Announced PDDARI during several sessions, the cocktail hour and the luncheon. Substantial enthusiasm existed between 1-2 dozen academics with whom I spoke. Academics want to work with Practitioners. Hewitt Associates – Introduction to Samir Raza (present) and Mark Ubelhart (not present) i. Mark is Principal, Practice Leader for Value Based Management and Architect of Human Capital Foresight for Hewitt Associates. Samir leads the shareholder value initiative as a member of the corporate finance group team at Hewitt Associates. He is also managing research aspects of the Human Capital Foresight™ project, leveraging over a decade of management consulting experience with clients in North America, Europe, and Asia, and research experience in academic institutions. Currently, Mark, Samir, and Hewitt seek to join the PDDARI Task Force within the CFA Society of Chicago to develop products for the investment community that allow projecting industry stock price inflection points based on sound, independent academic research. Hewitt’s unique database, based on 22 million US employees from Hewitt’s HR outsourcing, benefit and actuarial services, is updated monthly. Empirical evidence with CSFB HOLT’s research suggests the flow of pivotal employees leads to significant changes in CFROI® and stock prices thus potentially providing an information advantage to portfolio managers. Hewitt may also be interested in employing its actuarial pension fund data to aid in the conceptual development of matching asset products to liability cash flows. Hewitt helps design compensation structures to encourage organizational change consistent with shareholder value creation linked to sound human resource principles. (Back ground information to be e-mailed subsequent to this e-mail) ii. Asset Pricing Models; Risk management methodologies; Integration of Liability Management and Asset Management (Aaron Meder – UBS) iii. What is the proper economic accounting and empirical valuation for executive stock options from publicly available data? (Lee Hayes) c. Bob Atra – Growth Rates used in valuation models – several 2. 3. 4. programmed – currently running production to test the accuracy of dividend discount model intrinsic valuations to stock prices produced by each growth rate, equity risk premium, and CAPM beta permutations. Little research published in academic community. d. Mike Lindh – Fundamental Indexation – Separate Research Initiative Planned. e. Paul Kaplan (not present) – attending the “Q” Group; Risk Ranking in Non-mean Variance World submitted to FMA. f. Ralph Goldsticker – Global Asset Allocation – country index data sent to Rawley. Bob Atra also provided data back to 1900. Rawley plans to perform a Stable Paretian Analysis of the data with long short weightings to illustrate the type of analysis we would like Academics to research. Other Professional Associations (Rawley) c. Discussions begun with Kevin Roth, Director of Research for the Association of Financial Professionals (AFP – Treasury Professionals). Supplied three dozen topics of interest to members. Discussing possibility of academic empirical testing of advanced valuation models, which may prove relevant to Society’s members for fundamental analysis in active portfolios. Next Meeting - Tuesday April 24th at 12:45 CDT (1:45 EDT, 10:45 PDT) Other Business Rawley Thomas President and Co-Founder LifeCycle Returns, Inc. (LCRT) (The "T" in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com February 22, 2007 Hi All, The next meeting of the Society’s PDDARI Task Force occurs at: Tuesday February 27rd at 12:45 CST (1:45 EST, 10:45 PST) – Right after the Education Group whose meeting begins at 12 Noon. The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265778-9101; Conference call to end by 2 PM; Meeting may continue. For future planning, these meetings occur the fourth Tuesday each month at 12:45 CST, following the Education Group meeting which begins at 12 Noon. Agenda – New Information Highlighted in Yellow 1) Status Reports – Abstract added to Initiatives; a) Paul Kaplan report on risk initiative – Risk Adjusted Ranking in a Non Mean- Variance World and Cross Sectional Risk / Return Measurement of Portfolio Results over an Internal of Time in a Non Mean-Variance World just about ready to be submitted to the Financial Management Association (FMA) b) Morningstar will evaluate research proposals and may provide data on stocks, mutual funds, closed-end funds, ETFs, hedge funds, and broad market indexes. Academic proposals that are deemed by Morningstar to have particular value for practitioners may qualify for waived or reduced-fee research charges. c) Ironwood has proposed an agreement of hold harmless and nondisclosure for academics to execute in order to obtain data; Exploring feasibility of combining separate monthly files with CUSIP numbers into one file with all months and years and Total Shareholder Return by month; will seek review of proposed agreement by Society Task Force and FMA Practitioner Research Committee when it’s finished d) Discussion e) Rawley Thomas and Ralph Goldsticker – Investment Strategies Across Global Asset Classes; David Hightower willing to contribute commodity data; Timbervest may contribute data; Ralph Goldsticker willing to contribute country index data for long short portfolios; Ralph and Rawley discussed illustrating Cupola Stable Risk Reduction analysis with 70 permutations of four long and four short countries; discussion f) Mike Lindh report on Fundamental Indexation i) Mike Lindh, Paul Kaplan, and Lee Hayes met for lunch; decided to ii) iii) iv) v) split out Fundamental Indexation into separate request for research – who will write the first draft? Rawley Thomas suggests that we still need an Initiative which combines the results of Indexation, Fundamental Indexation, Multi-Factor, and DCF (Rawley Thomas) – Consider adding as a weighting possibility in addition to cap and size weights the Kelly Formula based on Shannon’s information theory to apportion the fund according to superior estimates of the probabilities relative to the implied market expectations – edge/odds[1] Lee Hayes – Consider new Initiative on Global Portfolio Construction, place issue on next survey, and / or produce conference on the subject Discussion g) Amit Dugar and Ralph Goldsticker report on multi-factor models; Paul Kaplan suggested factor attribution analysis to cross sectional risk / return measurement of portfolio results; discussion h) Rawley Thomas report on DCF (1) (1)Bob Atra – beginning research on best estimates for growth to use in DCF valuation models using LCRT Research Platform (2) (2)Beginning to explore feasibility of overlaying Company (3) Guidance and Consensus estimates over DCF Intrinsic Valuations derived solely from historical data with no analyst intervention to measure analysts’ estimates effect on model accuracy and predictive capability; Per Tom Copeland, this research methodology effectively separates the effect of historical data from the effect of analysts’ estimates. Discussion i) Lee Hayes Liaison with Society Technology Group – Updating Task Force Initiatives i) Permission for LCRT to create stand-alone web pages for updating PDDARI initiatives; link from CFA Society of Chicago web site; No commercial links from web site; approval from Society Technology group required. 2) Institutions willing to contribute data; Data Working Group – volunteers, recruiting additional volunteers, data format, automation of analytical capability ; (1) E-mailed Adam Cohen of Zacks a draft request for obtaining permission from brokerage firms to include Barron’s performance data 3) Discussion of next Initiatives; Additions; Volunteers to draft (Time permitting) (1) Linking detailed data by individual investor and fund manager (2) to price formation process – arose at last meeting Matching assets to liabilities of pension funds unresolved issue (like risk measurement) – e-mails sent to Aaron Meder at UBS and Mark Ubelhart at Hewitt – Lee Hayes – discussing this within private wealth management – how to set the goals and strategies to meet those goals, including behavioral finance 4) Does anyone work on derivatives and have an interest in eliminating the systematic bias called the “volatility smile” in option pricing? 5) Rawley Thomas - Status of FMA Practitioner Research Committee a) Committee Formed i) Amy Edwards – SEC – added marketing flair to E-mail Blast to FMA ii) members on PDDARI John Finnerty – Professor at Fordham University; written articles on executive stock options; expert witness in valuation cases – suggested that thought partners offer no exclusives on academic research, but grant multiple academics access to the data and thought b) partner expertise in order to produce healthy competition and avoid thought partner disappointment if one academic loses interest iii) Jack Rader – Executive Director of the FMA (ex-officio, non-voting) iv) Mike Riley, former CFO of UAL and Postal Service; Professor at U of Maryland v) David Walker – Professor at Georgetown University; former Trustee for the Financial Management Association vi) Ralph Walkling – President of FMA; Professor at Drexel University (exofficio, non-voting) Process under review i) Role of Committee may change – Committee may facilitate establishing relationship between practitioner thought partners and academics, instead of formally approving practitioner requests for proposal submitted and academic proposals submitted. Consequently, the Practitioner Thought Partners may choose the academic proposal(s) they like with any help from the Committee which they seek. This is more of a free market system. However, the Committee is most willing to act as a filter so the best academic proposals are forwarded to practitioner thought partners for their review. ii) How best to engage top academics in the effort – is publishing sufficient to compete against consulting income? One important principle – avoid being too directive on the research design and measurement methodologies – see revisions to requests for research proposals. iii) Some top scholarly journals require complete replication of data and algorithms, which directly conflicts with practitioner intellectual property rights; other outlets and alternatives to full replication under exploration. For some publications, making the data available, but not the algorithms, may be sufficient. iv) Practitioner Requests for Research and Academic Research Proposals likely to become 3-tiered for time efficient communications and academic self selection into the process (1) Title of Initiative (2) One Page description (3) Multi-Page detail for completeness to satisfy practitioner needs and to develop mutual respect between the academic and practitioner communities v) Other professional associations contacted – some of these, like risk, affect the investment community (1) Society of Utility Regulatory Financial Analysts (SURFA) – President Pauline Ahern Supportive, FMA member Ted Wood of Southwest Gas producing initial list of topics – owner of the process (2) Conference Board of Canada – attending brain storming session with Strategic Risk Council on Enterprise Risk Management (ERM) on April 5th, including some academics; Karen Schoening-Thiessen, Conference Board Senior Research Associate, owns the process (3) Investment Management Consultants Association – contacts made; process and Society proposals on risk sent; waiting for more discussion with Debbie Nochlin, Managing Editor of The Journal of Investment Consulting (4) Received Tom Copeland’s suggested topics on corporate needs; passed (5) (6) those along to Mike Riley I sense Professional Associations are often interested in large research initiatives addressing difficult practitioner decisions, NOT Tiny Topics I plan to establish an advisory panel consisting of representatives of the practitioner professional organizations interested in PDDARI to facilitate two way flow of information and provide a mechanism for continuing communication. The advisory panel may enable us to combine proposals where possible to avoid duplication. Will need a representative from the CFA Society of Chicago in addition to Rawley Rawley Thomas President and Co-Founder LifeCycle Returns, Inc. (LCRT) (The "T" in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com [1] Of current relevance to our risk topics and portfolio construction, Bill Miller says in the just published CFA Institute Global Perspectives on Investment Management: Leaning from the Leaders, “Money Management involves knowing how much you commit to a position. Will it be 1 percent, 5 percent, 10 percent? I recommend the book Fortune’s Formula: The Untold Story of Scientific Betting System that Beat the Casinos and Wall Street (by William Poundstone). It is a far better way of thinking about asset allocation than mean-variance analysis.” See in particular pages 70 and 72 of Fortune’s Formula. Poundstone also suggests that the Kelly System avoids the economist’s necessity of specifying investor utility functions; see pages 223-224. January 22, 2007 Hi All, The next meeting of the Society’s PDDARI Task Force occurs at: Tuesday January 23rd at 12:45 CST (1:45 EST, 10:45 PST) The meeting will be held at the CFA Society of Chicago’s offices - 134 N. La Salle Drive, Suite 1740. Attending by phone. The dial in is 866-325-4310, and the password is 265-778-9101 For future planning, these meetings occur the fourth Tuesday each month, following the Education Group meeting which begins at 12 Noon. Agenda 1. Status Reports – Abstract added to Initiatives; Please read other red-lined changes; obtaining permission for data from institutions taken off critical path (Paul Kaplan’s suggestion) a. Paul Kaplan report on risk initiative – Risk Adjusted Ranking in a Non Mean-Variance World and Cross Sectional Risk / Return Measurement of Portfolio Results over an Internal of Time in a Non Mean-Variance World; discussion b. Rawley Thomas and Ralph Goldsticker - Investment Strategies Across Global Asset Classes; David Hightower willing to contribute commodity data; Ralph Goldsticker willing to contribute country index data for long short portfolios; Ralph and Rawley discussed illustrating Cupola Stable Risk Reduction analysis with 70 permutations of four long and four short countries; discussion c. Mike Lindh report on Fundamental Indexation; discussion d. Amit Dugar and Ralph Goldsticker report on multi-factor models; Paul Kaplan suggested factor attribution analysis to cross sectional risk / return measurement of portfolio results; discussion e. Rawley Thomas report on DCF; Invited competitors to join the Research Initiative Process – CSFB HOLT, AFG, Ativo, Stern Stewart, Valu-Trac, Morgan Stanley (no responses yet) f. Lee Hayes Liaison with Society Technology Group – Updating Task Force Initiatives g. Mike Lindh and Rawley Thomas CFA Society of Nebraska and other Midwest Societies h. Institutions willing to contribute data; Data Working Group – volunteers, recruiting additional volunteers, data format, automation of analytical capability ; asked Adam Cohen of Zacks about the possibility of obtaining permission from brokerage firms to include Barron’s performance data i. Discussion of next Initiatives; Additions; Volunteers to draft (Time permitting) j. Does anyone work on derivatives and have an interest in eliminating the systematic bias called the “volatility smile” in option pricing? 2. Rawley Thomas - Status of FMA Practitioner Research Committee a. Committee Formed i. Amy Edwards – SEC ii. John Finnerty – Professor at Fordham University; written articles on executive stock options; expert witness in valuation cases iii. Jack Rader – Executive Director of the FMA (ex-officio, non-voting) iv. Mike Riley, former CFO of UAL and Postal Service; Professor at U of Maryland v. David Walker – Professor at Georgetown University; former Trustee for the Financial Management Association vi. Ralph Walkling – President of FMA; Professor at Drexel University (exb. c. officio, non-voting) Process under review i. Role of Committee may change – Committee may facilitate establishing relationship between practitioner thought partners and academics, instead of formally approving practitioner requests for proposal submitted and academic proposals submitted. Consequently, the Practitioner Thought Partners may choose the academic proposal(s) they like with any help from the Committee which they seek. This is more of a free market system. However, the Committee is most willing to act as a filter so the best academic proposals are forwarded to practitioner thought partners for their review. ii. How best to engage top academics in the effort – is publishing sufficient to compete against consulting income? One important principle – avoid being too directive on the research design and measurement methodologies – see revisions to requests for proposals. iii. Some top scholarly journals require complete replication of data and algorithms, which directly conflicts with practitioner intellectual property rights; other outlets and alternatives to full replication under exploration. For some publications, making the data, but not the algorithms, may be sufficient. Other professional associations contacted – some of these, like risk, affect the investment community i. Society of Utility Regulatory Financial Analysts (SURFA) – President Pauline Ahern Supportive, FMA member Ted Wood of Southwest Gas producing initial list of topics – owner of the process ii. Conference Board of Canada – attending brain storming session with Strategic Risk Council on Enterprise Risk Management (ERM) on April 5th, including some academics; Karen Schoening-Thiessen, Conference Board Senior Research Associate, owns the process iii. Investment Management Consultants Association – contacts made; process and Society proposals on risk sent; waiting for more discussion with Debbie Nochlin, Managing Editor of The Journal of Investment Consulting iv. Received Tom Copeland’s suggested topics on corporate needs; passed those along to Mike Riley v. I sense Professional Associations are often interested in large research initiatives addressing difficult practitioner decisions, NOT Tiny Topics Rawley Thomas President and Co-Founder LifeCycle Returns, Inc. (LCRT) (The "T" in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com P.S. Of current relevance to our risk topics and portfolio construction, Bill Miller says in the just published CFA Institute Global Perspectives on Investment Management: Leaning from the Leaders, “Money Management involves knowing how much you commit to a position. Will it be 1 percent, 5 percent, 10 percent? I recommend the book Fortune’s Formula: The Untold Story of Scientific Betting System that Beat the Casinos and Wall Street (by William Poundstone). It is a far better way of thinking about asset allocation than mean-variance analysis.” From: Rawley Thomas [mailto:Rawley@LCRT.com] Sent: Sunday, November 26, 2006 5:32 PM To: Warren Isabelle; Adam Cohen; Amit Dugar; Amit Dugar; Bob Atra; Greg Jania; Jack Rader; Jeff Nevins; Jill Epstein; jim@jlgresearch.com; Joe Simpson; Lee Hayes; Mark Hooker; Mike Lindh; Mike Wolcott; Nadia Van Dalen; Paul Kaplan; Goldsticker Ralph; Ronald Ewing; Russell E. Long; Shantal Alonso; Tony Rossitto Subject: FW: CFA Education Advisory Group and Research Group Meeting CHANGED to Monday, December 4 Hi All, 1. The CFA Research Group meeting has been postponed to Monday, December 4 at 12:30 to 1:30 Central Time (10:30 West Coast Time; 1:30 East Coast Time) The Education Group meets from 12 Noon to 12:30. 2. The meeting will occur at the CFA Society of Chicago Offices 134 N. LaSalle Dr. Suite 1740 Chicago, IL 60602. 3. To join by phone, please dial 1-866-325-4310 Pass code #: 265-778-9101 4. Agenda a. Discussion of full disclosure, cleansing, and multiple thought partners where the APPEARANCE or reality of any conflict of interest exists. (Background discussion: www.lcrt.com/Updates/ConflictsOfInterest.doc) i. Require full disclosure early on. ii. Cleanse Research Initiatives of commercial interests as much as practically possible, but do not forgo thought partner new concepts, relevant research, useful illustrations, or important experience. iii. Where the APPEARANCE or reality of any conflict of interest exists, involve multiple thought partners with conflicting interests to select and define the Research Initiatives. b. c. d. e. f. g. h. i. Rawley Thomas - Status of FMA Practitioner Research Committee – Committee formed; to meet in December; questions? Paul Kaplan report on risk initiative – Risk Adjusted Ranking in a Non Mean-Variance World and Cross Sectional Risk / Return Measurement of Portfolio Results over an Internal of Time in a Non Mean-Variance World; discussion Rawley Thomas - New Initiative on Investment Strategies Across Global Asset Classes (I took the liberty of asking Ralph Goldsticker of Mellon Bank and Tony Rossitto of Bank of America to consider becoming thought partners on this Initiative); discussion Mike Lindh report on Fundamental Indexation; discussion Amit Dugar and Ralph Goldsticker report on multi-factor models; discussion Rawley Thomas report on DCF; Invited competitors to join the Research Initiative Process – CSFB HOLT, AFG, Ativo, Stern Stewart, Valu-Trac, Morgan Stanley (no response yet); discussion Institutions willing to contribute data; Data Working Group – volunteers, recruiting additional volunteers, data format, automation of analytical capability Discussion of next Initiatives; Additions; Volunteers to draft (Time permitting) I look forward to seeing or hearing you all there. Rawley Thomas President and Co-Founder LifeCycle Returns, Inc. (LCRT) (The "T" in HOLT) 7N238 Barb Hill Drive Saint Charles, IL 60175-6804 630-377-0761 630-377-2191 FAX 708-404-0761 Mobile Rawley@LCRT.com http://www.LCRT.com