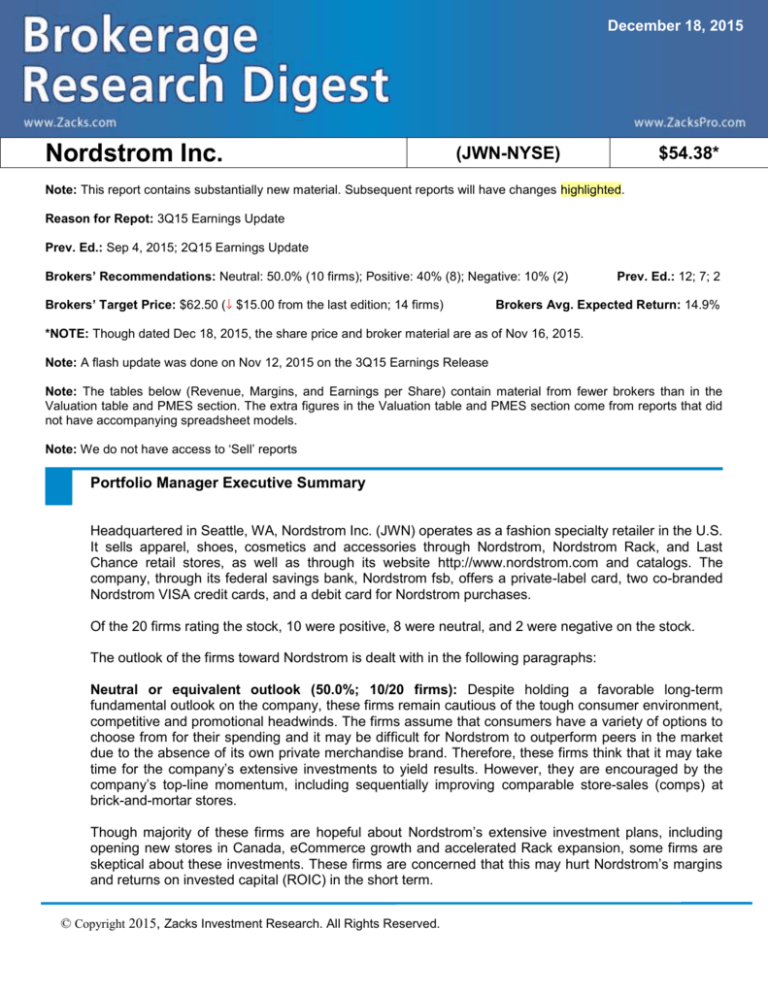

December 18, 2015

Nordstrom Inc.

(JWN-NYSE)

$54.38*

Note: This report contains substantially new material. Subsequent reports will have changes highlighted.

Reason for Repot: 3Q15 Earnings Update

Prev. Ed.: Sep 4, 2015; 2Q15 Earnings Update

Brokers’ Recommendations: Neutral: 50.0% (10 firms); Positive: 40% (8); Negative: 10% (2)

Brokers’ Target Price: $62.50 ( $15.00 from the last edition; 14 firms)

Prev. Ed.: 12; 7; 2

Brokers Avg. Expected Return: 14.9%

*NOTE: Though dated Dec 18, 2015, the share price and broker material are as of Nov 16, 2015.

Note: A flash update was done on Nov 12, 2015 on the 3Q15 Earnings Release

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in the

Valuation table and PMES section. The extra figures in the Valuation table and PMES section come from reports that did

not have accompanying spreadsheet models.

Note: We do not have access to ‘Sell’ reports

Portfolio Manager Executive Summary

Headquartered in Seattle, WA, Nordstrom Inc. (JWN) operates as a fashion specialty retailer in the U.S.

It sells apparel, shoes, cosmetics and accessories through Nordstrom, Nordstrom Rack, and Last

Chance retail stores, as well as through its website http://www.nordstrom.com and catalogs. The

company, through its federal savings bank, Nordstrom fsb, offers a private-label card, two co-branded

Nordstrom VISA credit cards, and a debit card for Nordstrom purchases.

Of the 20 firms rating the stock, 10 were positive, 8 were neutral, and 2 were negative on the stock.

The outlook of the firms toward Nordstrom is dealt with in the following paragraphs:

Neutral or equivalent outlook (50.0%; 10/20 firms): Despite holding a favorable long-term

fundamental outlook on the company, these firms remain cautious of the tough consumer environment,

competitive and promotional headwinds. The firms assume that consumers have a variety of options to

choose from for their spending and it may be difficult for Nordstrom to outperform peers in the market

due to the absence of its own private merchandise brand. Therefore, these firms think that it may take

time for the company’s extensive investments to yield results. However, they are encouraged by the

company’s top-line momentum, including sequentially improving comparable store-sales (comps) at

brick-and-mortar stores.

Though majority of these firms are hopeful about Nordstrom’s extensive investment plans, including

opening new stores in Canada, eCommerce growth and accelerated Rack expansion, some firms are

skeptical about these investments. These firms are concerned that this may hurt Nordstrom’s margins

and returns on invested capital (ROIC) in the short term.

© Copyright 2015, Zacks Investment Research. All Rights Reserved.

While the firms are encouraged about the holiday season sales, some of these anticipate softness in

the company’s apparel sales to continue in 2016, which along with the impact from Nordstrom’s Credit

Card portfolio sale, will likely weigh on its overall performance.

Positive or equivalent outlook (40.0%; 8/20 firms): These firms believe that Nordstrom offers various

assortments with an unmatched level of customer service in the department store industry, that will help

the company maintain its high sales growth rate. The firms also point out that Nordstrom has a flexible

operating expense model (i.e. commissioned sales force) than its peers, that enables it to lower selling,

general and administrative (SG&A) expenses as sales decline.

The firms further state that Nordstrom's focus on price integrity and superior customer service will boost

growth, resulting in market leadership, strong brand recognition and relevance, and a healthy

eCommerce retail environment. The company will thus benefit from improved consumer sentiment and

increased demand.

Further, the bullish firms appreciate the company’s long-term vision to provide customers with a

differentiated, seamless multichannel experience. In this regard, Nordstrom remains focused on

developing the multichannel network; improving its merchandise offerings; developing IT infrastructure

to enhance customer’s web and mobile experience; renovating stores with a modern look; developing

fulfillment centers to enable speedy delivery to online customers; implementing an enterprise-wide

inventory management system as well as enhancing relationships with existing and new customers.

Most of the firms believe that these initiatives will go a long way to open up multiple growth avenues for

the company.

The firms also remain impressed by Nordstrom’s strong balance sheet and ample free cash flow

generation, which provide sufficient cash for future investments.

December 18, 2015

Overview

The firms identified the following issues as critical to the evaluation of the investment merits of

Nordstrom:

Key Positive Arguments

Nordstrom’s continued focus on differentiating its

assortments provides it with a competitive edge.

The company has high visibility into its future

opportunities, including the opening of new stores in

FY15 and beyond.

Nordstrom is committed toward improving its

customer service.

Improved performance of the women’s apparel

section, revamping of the Savvy department,

introduction of some exclusive brands and

enhancement of the Fashion Rewards program are

likely to boost sales volume.

Zacks Investment Research

Page 2

Key Negative Arguments

Merchandising errors and execution risks are

always associated with the implementation and

utilization of new systems.

Any potential weakness in the high-end consumer

market and the lack of square footage growth

could have a negative impact on the company’s

earnings.

Changing fashion trends and markdown risk

remain threats to the company.

Nordstrom operates in a highly competitive

backdrop, where the target customers have a

multitude of retail options.

www.zackspro.com

Based in Seattle, WA, Nordstrom Inc. (JWN) is one of the nation's leading fashion specialty retailers.

Founded in 1901 as a shoe store in Seattle, Nordstrom operated 323 stores across 38 states of the

U.S. and Canada as of Dec 1, 2015. The company has two segments: Retail and Credit. The Retail

segment offers a selection of branded and private-label merchandise. The segment includes Nordstrom

branded full-line stores and website, off-price Nordstrom Rack stores, and other retail channels

including HauteLook and Jeffrey boutiques. The Credit segment operates Nordstrom private label and

co-branded VISA credit cards. The company’s fiscal year ends in January.

December 18, 2015

Long-Term Growth

Nordstrom’s strong line-up of globally recognized brands acts as a competitive advantage for the

company, bolstering its well-established position in the market. The company offers a broad array of

over 500 brands, targeted toward the whole family, through a strong nationwide network.

The firms maintain that Nordstrom has developed a differentiated business model known for its

emphasis on customer service and its large footwear department. It focuses on providing a quality

customer experience via personalized service, a compelling merchandise offering and a pleasant

shopping environment. Nordstrom also appeals to its consumers by offering a broader, more inclusive

selection of quality merchandise, which further distinguishes it from other mall-based department store

retailers.

Additionally, Nordstrom’s business is in line with the evolving retail industry that focuses on offering

maximum choices to customers to enhance their shopping experience. The company also makes

regular amendments to its clearance strategy to better manage its inventories, keep up with customer

demands and provide them with a better shopping experience. In addition, the price integrity initiatives

undertaken by the company are likely to help build healthy relations with customers, thereby enhancing

customer loyalty.

Furthermore, the firms have appraised the company’s acquisition of Trunk Club, a provider of

personalized clothing services for men, as this will help Nordstrom in capturing market share in the

rapidly growing men’s clothing business. The firms believe that the acquisition strategically fits

Nordstrom’s business model, as it will allow the company to better serve its male customers and

facilitate the expansion of its online clothing services for men, its initial investment in which dates back

to 2012 when it acquired Bonobos.

The firms are of the opinion that Nordstrom is poised to augment its sales, given its eCommerce

enhancement endeavors, the successful expansion of Rack Stores, growth in Canada and multichannel investments. Moreover, the firms think that Nordstrom’s focus on building customer loyalty and

its initiatives to create a customer-friendly shopping environment will drive sales in the future.

Additionally, the firms commend the company’s efforts to attract technology-friendly consumers by

enhancing its mobile commerce sites, social networking, and in-store capabilities.

Moreover, the company’s latest capital expenditure plan reveals its stringent focus on improving its

market share by increasing investment in stores. Going forward, the company plans to continue making

significant investments to support growth in Canada and Manhattan as well as its eCommerce business

and Rack Stores. With these initiatives underway, the company is well on track to achieve its target of

operating 300 Rack stores by 2020.

Zacks Investment Research

Page 3

www.zackspro.com

Additionally, the company looks forward to further leveraging its strategic capacities by undertaking

enhancements in supply chain, technology, merchandise and marketing. These in turn will drive

fundamental growth.

December 18, 2015

Target Price/Valuation

Rating Distribution

Positive

Neutral

Negative

Average Target Price

Digest High

Digest Low

No. of Firms with Target Price/Total

50.0%

40.0%

10.0%

$62.50

$80.00

$45.00

14/20

Risks to the target price include deterioration in the consumer-spending environment, slowdown in

comps growth, and fashion-related risks in a seasonal, cyclical and trend-focused sector.

Recent Events

On Nov 12, 2015, Nordstrom reported dismal 3Q15 results. Nordstrom’s quarterly adjusted earnings of

$0.57 per share came in way below the Zacks Consensus Estimate of $0.71 and plunged 21.9% from

the prior-year quarter figure of $0.73. Nordstrom’s total revenue rose 6% to $3,328 million, but missed

the Zacks Consensus Estimate of $3,371 million.

On Nov 5, 2015, Nordstrom announced plans to shift its Howe Bout Arden Rack store to a remodeled

place in the Sacramento, CA center. Spanning over roughly 35,000 square feet, the relocated store is

slated to open doors in fall 2016.

On Oct 23, 2015, Nordstrom opened its first full-line store in Wisconsin. The new three-level store is

housed at the Mayfair in Wauwatosa and spans over 140,000 square feet.

On Oct 13, 2015, Nordstrom announced plans to employ roughly 11,800 seasonal workers to handle

the crazy holiday rush. The improved staffing was expected to facilitate better customer service during

the busy time of the holidays.

On Oct 9, 2015, Nordstrom announced the opening of its relocated store at Del Amo Fashion Center.

This store was previously situated at South Bay Galleria.

On Oct 2, 2015, Nordstrom opened its second full-line store in the Twin Cities, that is, the MinneapolisSaint Paul metropolitan area in Minnesota. Located at Ridgedale Center in Minnetonka, the store

features the company’s latest interior and exterior design concepts, while accommodating a full-service

restaurant and bar, and improved beauty experience.

Zacks Investment Research

Page 4

www.zackspro.com

On Oct 1, 2015, Nordstrom announced a special dividend and increased its share repurchase

authorization. These moves followed the sale of its credit card portfolio to The Toronto-Dominion Bank

(TD Bank). (Further details discussed in the relevant section).

Revenue

Provided below is a summary of revenue as compiled by Zacks Research Digest:

Revenue($M)

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

Digest High

$3,140.0

$3,701.0

$3,328.0

$4,398.0

$13,507.0

$14,642.0

$15,850.0

Digest Low

$3,140.0

$3,701.0

$3,328.0

$4,236.0

$13,506.0

$14,480.0

$15,272.0

Digest Average

$3,140.0

$3,701.0

$3,328.0

$4,300.7

$13,506.1

$14,544.7

$15,523.3

Y-o-Y Growth

8.9%

9.1%

6.0%

6.4%

7.7%

7.7%

6.7%

Q-o-Q Growth

-7.4%

15.1%

-10.1%

29.2%

The Zacks Digest average total revenue increased 6% year over year (y/y) to $3,328 million in 3Q15,

backed by an increase in Retail sales, partly offset by a decline in Credit Card sales.

Segment Details

Retail

Net sales at the company’s Retail division increased 6.5% to $3,239 million, while its Credit Card

revenues slumped 11% to $89 million.

Net sales at the company’s full-line stores slipped 1.9%, while sales at Rack stores were up 8.4%.

Coming to the company’s online business, Nordstrom.com sales for the quarter jumped 11% and

Nordstromrack.com/HauteLook net sales soared 39%, maintaining the trend of beating expectations.

Additionally, off-price business net sales ascended 12% y/y.

Total company comps inched up 0.9% in the quarter. Further, the company registered a 0.3% rise in

comps at Nordstrom full-line stores (which consist of full-line stores and the Nordstrom.com

businesses), while comps at Nordstrom Rack reflected a 2.2% decline.

Apart from this, sales continued to receive significant contribution from the Nordstrom’s Rewards loyalty

program, which accounted for about 38% of sales during 3Q15.

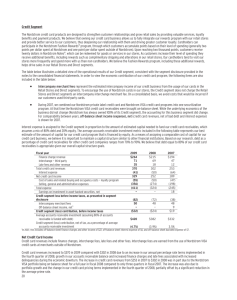

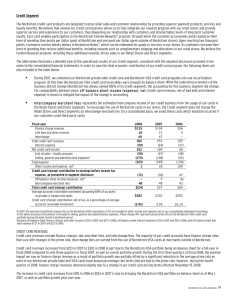

Credit Card

Credit card revenues were down 11% to $89 million.

On Oct 1, 2015, Nordstrom closed the sale of its credit card portfolio to The Toronto-Dominion Bank

(TD Bank) for $2.2 billion. Also, per a long-term agreement between the two companies, TD Bank

became the exclusive U.S. issuer of Nordstrom-brand Visa and private-label credit cards.

Zacks Investment Research

Page 5

www.zackspro.com

Nonetheless, Nordstrom will continue to receive a significant portion of revenues from the credit card

accounts. Further, the company will retain its right to perform account-servicing functions, as well as

fund and manage its loyalty program, debit cards and employee accounts. The deal is expected to

improve Nordstrom’s capital efficiency in addition to enhancing customer experience.

Provided below is a summary of segment revenues as compiled by Zacks Research Digest:

Revenue ($M)

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

Net Sales

Credit Card

Revenue

Total Revenue

$3,040.0

$3,598.0

$3,239.0

$4,230.0

$13,111.0

$14,182.0↓

$15,234.0↓

$100.0

$103.0

$89.0

$70.3

$395.1

$362.3↓

$289.7↓

$3,140.0

$3,701.0

$3,328.0

$4,300.7

$13,506.1

$14,544.7↓

$15,523.3↓

Guidance

Nordstrom remains focused on the execution of its customer strategy via various growth initiatives, in

order to enrich customer experience and boost results.

However, taking into account the disappointing 3Q15 results and the expected impact from the credit

card portfolio sale, the company lowered its guidance for FY15.

The company now expects net sales to increase nearly 7.5–8.0% in the fiscal compared with 8.5–9.5%

growth projected earlier. Comps are estimated to rise about 2.5–3.0% against 3.5–4.5% improvement

expected previously.

Please refer to the separately published spreadsheet of Nordstrom for additional details & updated forecast.

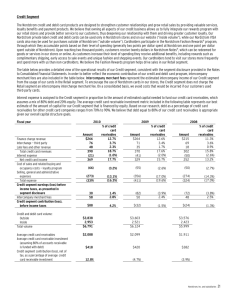

Margins

Provided below is the summary of margins as compiled by Zacks Research Digest:

Margin

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

Gross Margin

34.4%

34.3%

33.0%

35.8%

34.8%

34.5%↓

35.1%↑

Operating Margin

8.3%

9.4%

5.1%

9.5%

9.8%

8.2%↓

7.9%↓

Pre-Tax Margin

7.3%

8.7%

4.2%

8.8%

8.8%

7.4%↓

7.0%↓

Net Margin

4.5%

4.9%

3.3%

5.3%

The Zacks Digest average gross profit increased 1.7% y/y to $1,097 million in 3Q15, while the gross

margin contracted 140 basis points (bps) to 33%, mainly due to greater markdowns, higher occupancy

expenses and unfavorable mix at Nordstrom Rack.

SG&A expenses, as a percentage of sales, escalated 80 bps to 30%, primarily due to expenses related

to the Trunk Club acquisition and the Canadian venture, along with higher fulfillment expenses

associated with the expansion of online footprint.

Consequently, the Zacks Digest average operating income plunged 35.6% to $168.7 million, with the

operating income margin contracting 320 bps to 5.1%.

Zacks Investment Research

Page 6

www.zackspro.com

Guidance

For FY15, gross margin is anticipated to decline in a range of 50–60 bps, compared with the previous

guidance of a -5 to +5 bps range. SG&A expenses, as a percentage of sales, are expected to grow 70–

75 bps, compared with the previous forecast of a 65–75 bps increase.

Please refer to the separately published spreadsheet of Nordstrom for additional details & updated forecast.

Earnings per Share

Provided below is a summary of EPS as compiled by Zacks Research Digest:

EPS

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

Digest High

$0.73

$0.93

$0.57

$1.33

$3.72

$3.45↓

$3.80↓

Digest Low

$0.73

$0.93

$0.55

$1.33

$3.71

$3.45↓

$3.80↓

Digest Average

$0.73

$0.93

$0.57

$1.33

$3.72

$3.45↓

$3.80↓

Y-o-Y Growth

5.3%

-2.1%

-22.2%

1.0%

0.2%

-7.3%

10.4%

Q-o-Q Growth

-23.2%

41.6%

-39.0%

134.3%

The Zacks Digest average earnings per share in 3Q15 were $0.57, down 22.2% y/y and 39%

sequentially. Results were impacted by soft sales trends across all networks and merchandise

categories. Firms believe that this was partly attributable to unfavorable weather and a shift in

consumer patterns.

Including $0.15 of transaction costs associated with the credit card portfolio sale to TD Bank,

Nordstrom’s earnings per share came in at $0.42.

Guidance

The company envisions earnings per share for FY15 in the range of $3.32–$3.42, compared with the

previous guidance of $3.85–$3.95. Excluding the impact of the credit transaction and other one-time

items, earnings per share are expected in the band of $3.40–$3.50, down from $3.70–$3.80 projected

earlier.

Please refer to the separately published spreadsheet of Nordstrom for additional details & updated forecast.

December 18, 2015

Research Analyst

Vrishali Bagree

Copy Editor

Content Ed.

Oindrila Ghoshal Dutta

Rajani Lohia

Zacks Investment Research

Page 7

www.zackspro.com

Lead Analyst

Rajani Lohia

QCA

No. of brokers reported/Total

brokers

Reason for Update

Sumit Singh

Zacks Investment Research

20/20

Earnings

Page 8

www.zackspro.com