OPERATIONAL REGULATIONS

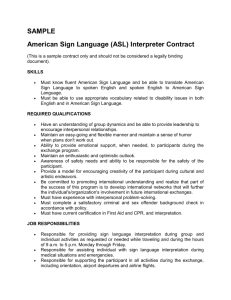

advertisement