General Property II Outline

advertisement

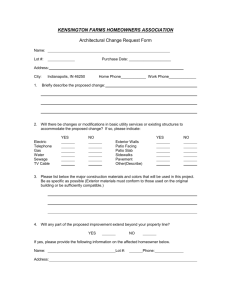

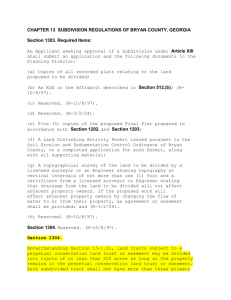

Easements An easement is a privilege to use the land of another. An affirmative easement is one entitling its owner to do a physical act on the land. A negative easement allows the owner to restrict others from doing certain deeds on the servient estate. Definitions: 1) Dominant estate-Property getting the benefit of the easement 2) Servient Estate-Property burdened by the easement Licenses-Permission to enter another’s land -Revocable -Can be explicit or implicit -Not transferable -No Statute of Frauds issues Profit a prende-Right to enter another persons land without liability for trespass, and remove minerals, wild animals, and fish for profit. A person with a profits interest has an easement to venture onto the property as necessary to enjoy the profits interest. I. Implied Easements A. Easements Implied from prior use i) Necessary elements a) The unity of ownership is severed (i.e. there was a common owner and then the land was divided.) b) The use was in place before the parcel was severed c) The use must have been visible or apparent at the time of the severance(Roads and sewers) d) The easement is reasonably necessary for the enjoyment of the dominant estate (necessity) B. Easement Implied by Necessity i) Necessary elements a) A common owner severed the property (unity of ownership) b) No prior use requirement-I.E. not requirement that the use was in place at the time of the creation of the easement. c) There was a necessity for egress and ingress existed at the time of the severance (There was a need for the easement at the time of the severance.) d) The easement is strictly necessary for egress from and ingress to a landlocked parcel. C. Easement by Prescription-Adverse Use i) Necessary Elements a) Same as adverse possession -Actual use -Open and notorious -Hostile use -Continuous and uninterrupted use -Exclusive use (in a minority of states) -For the prescribed statutory period D. Easements by Estoppel i) Definition-Created where A allows B to use A’s land (by license) under circumstances where A should reasonably foresee that B would rely on that license for a period of time. ii) Permission PLUS investment (reliance) iii) Failure on the part of the A to stop the use (Like adverse possession) iv) Counter-argument-Most courts will not grant this easement if the claimant should have verified his rights before investing in the property. v) Examples: Purchasers from a developer who buy after seeing a plat will succeed if the plat showed roads in the subdivision in getting the right to use those roads. vi) Some courts don’t recognize this because of SOF issues. They grant an irrevocable license which does not need a writing. vii) Some courts use the part performance theory viii) One or two states don’t allow any of these theories. II. Requirements for Running with the Land A. Burdens running with the land i) Must be described in detail in the deed (or some other form) ii) Intent by the grantor that the easement should run with the land iii) Notice -Actual-Explicit knowledge -Inquiry-Based on the physical condition of the land (I.E. a roadway across your land) -Constructive-Recorded in the deed or title B. Benefits running with the land i) Intent-Did the grantor intend for the benefit to run? ii) Notice of some kind iii) Easement in writing Express Easements An express easement must be in writing to satisfy the statute of frauds. When a grantor conveys property to someone else and maintains an easement for himself, this is called an easement by reservation A. Appurtenants- Benefits the possessor of the land (Most common)(Dominant estate. The land that is burdened is called the serviant estate) i) Subdividable (Presumed, unless the intent of the grantor was that it not be) ii) Must look to the language of the deed to determine the limits of the easement. iii) The determinative test is whether the benefit is intimately tied to a particular piece of land (the dominant tenement) iv) Fully transferable and the burdens and benefits run with the land. B. In Gross- An easement in gross is sometimes called a "personal" easement. It is not tied to any particular piece of land. i) There is no dominant estate; the burden is imposed on the servient estate with a benefit that runs to a person or entity rather than with the land. ii) It does not "run with the land" and cannot be transferred or inherited. (Not assignable), unless it is a commercial easement(presumed transferable) iii) Pipeline easements and other public utility easements are easements in gross. iv) Exclusive and Non-exclusive easements: a) Exclusive easements in gross are those where the easement holder has the sole authority to authorize others to use the easement. The person has the right to permit many others to use the easement as long as the burden on the servient estate does not amount to a surcharge or misuse of the easement. b) Non-exclusive-One in which the easement holder can not prevent the servient estate from granting the right to use the easement to other persons. Can’t be subdivided or apportioned any rights to the easement. Termination of Easements 1) By an agreement in writing 2) By their own terms-“This easement will only last 10 years” 3) By merger (When the dominant estate and the servient estate are owned by the same person) 4) By abandonment-Intent to abandon must be shown by explicit statement. Words alone are not sufficient 5) Adverse possession- Stopping the person from using the easement 6) Courts may sometimes terminate by “frustration of purpose” (I.E. the easement is no longer needed) 7) Some states require a re-titling of the easement every 50 years or so Transfer of Easements When the title of a servient estate is transferred, the burden of the easement remains with the land. When there is a benefit on the land, it depends on whether the easement was an appurtment or in gross. An appurtment normally passes with the transfer of the dominant estate. Also if the dominant estate is such that each of the smaller lots can benefit from the easement, then each will generally be permitted to do so. -Easements in gross under common law are not transferable. Modern view holds that easements in gross used for commercial purposes are transferable. Restrictive Covenants To enforce the burden to run with the land 1) In writing 2) Clearly intended to run with the land-Benefit/Burdens 3) Notice -Actual -Inquiry -Constructive 4) Touch and Concern the land (Reasonableness of the covenant) Does the covenant restrict the quality and mode of enjoyment of the land? (I.E. Residential Limits, Homeowners Assoc. Fees, Reasonable restrictive covenants)-The third restatement eliminates the touch and concern requirement. 5) Privity- (Economic Damages only) Horizontal-Mutual promises between the two parties and there was a transaction of the land at the same time as the promise. (Instantaneous) Examples-Sales, Leases (Mutual), Grant of an easement (Mutual) a. Running of burdens: i. For burden to run to an assignee, the covenant must be formed at the time of the horizontal privity. b. Benefit – Privity is not required in most jurisdictions for running of benefit. Vertical-Privity between an original party to covenant and a subsequent assignee. Does not have to be direct.(I.E. The previous owner was not an original but was assigned the land by an original party) Public Policy Rationale: reason for privity requirement was to keep land free of burdens undiscoverable by purchaser inspecting the land. Since a benefit increases marketability there is no requirement of privity. i) Strict Vertical privity (The seller did not retain any interest in the property-I.E. full sale) Relaxed Vertical privity (Seller retains some interest in the land) (Most states allow this) (I.E. Whitensville) -Leases and subleases ii) a. b. Burden: privity requires that assignee succeed to the identical estate owned by promisor. 1. Estate must be of same duration(i.e. if you had a fee simple and you gave someone a life estate, there would be no vertical privity.) Covenants run with estates in land - only will run with identical estate 2. minority rule - no privity required to enforce a burden (3rd Restatement) Benefits: Traditional rule holds that a benefit can be enforced by anyone who has taken possession of the promisee’s property with the promisee’s permission. B has promised A that B and his assigns will never use Blackacre in a certain way (e.g. for retail purposes) and that if they do they will pay damages. The issues are whether B’s assignee, D is burdened by this promise (i.e. can be liable for damages) and whether C (A’s assignee) can benefit Damages for a Breach of Covenant-If all 5 burdens are satisfied, then you can get injunctive relief and economic damages. If only the first four elements are satisfied, then you can only get injunctive relief) Policy against enforcing a benefit in gross -A benefit in gross: some one who no longer owns a property is attempting to control the land (Not enforceable) (I.E. Developers after they have fully developed the land) -Exception: Homeowner’s association To enforce the benefit to run with the land -Intent to run -Touch and concern (Presumption that if intent to run with the land is satisfied, then touch and concern is satisfied) -If the benefit touches and concerns the promisee’s land, the benefit will run though the burden does not. That is, the benefit can run even if the burden is in gross, i.e. personal to the promisor. Covenants against Competition Reasonable covenants against competition may be considered to run with the land when they a serve a purpose of facilitating orderly and harmonious development for commercial use. (Whitinsville Plaza) Changes in the area A restrictive covenant will not be enforced where a fundamental change has occurred in the intended character of the neighborhood that renders the benefits underlying imposition of the restrictions incapable of enjoyment. The entire neighborhood does not need to be changed in order to determine if the covenant is still needed. Equitable Servitudes 1. 2. 3. 4. 5. Definition: Requirements a. Touch and Concern: both real covenants and eq. servitudes must touch and concern the land b. Notice: Neither is enforceable against a bona fide purchaser without notice c. Creation-Need not be in writing. d. Enforcement by or against assignees (requirements) Intent a. no technical words (i.e. “assigns” - see covenants running at law) are required b. look to purpose of covenant and surrounding circumstances Privity of Estate - generally not required a. tracing title - some states require person seeking to enforce to trace title to original promisee (i.e. must be able to trace to original subdivision purchaser) (minority view) b. Third Party Beneficiary - majority of states allow 3P beneficiary to enforce covenant in law or equity if contracting parties so intend. c. Distinguish - easements - easements cannot be reserved in favor of 3rd parties Touch and Concern Requirement-The big idea, is that the covenant must have something to do with the way land is used or enjoyed, it must connect to land use. If it is a promise that is integrated with your property rights and flows to successsor owners of the property, even tough they themselves did not make the promise, the touch & concern element ensures that the promise will stick only if it is connected to the property itself (and is not in the nature of a personal K). Most covenants do touch & concern the land, for example: a covenant banning commericial uses satisfies the rule because it governs how the land is used by WHOEVER IS THE OWNER. It connects to the property, not the individual owner. Affirmative covenants (like the obligation to pay association fees) have historicaly been more controversial, but now are uniformly held to touch & concern the land. Why? even though it is a promise to pay money that feels more like a personal K, the fee connects to the property and enhances it value and quality. a. b. c. generally: touch and concern is a general notion - affecting physical use or enjoyment or economic value may qualify. Negative Covenants - touch and concern by restricting what owner of burdened land can do; also enhance the value of benefited land. i. Covenants not to compete ii. but note: in some jurisdictions this do not touch and concern. rationale: disfavored covenants because they are anti-competitive Affirmative Covenants-Modern view - permit affirmative covenants to run both in law and equity; usually held to touch and concern 1. exception: an affirmative covenant that imposes a substantial burden on property which receives no benefit from it and has no clear expiration date may be found not to touch and concern 2. Covenant to pay for water has no means of expiration; thus doesn't touch and concern even though there is intent and privity; so it does not run. 3. Perpetuity Problem a. b. c. covenants w/out time limitations are problematic i) probably will not touch and concern for affirmative covenants ii) may need statutory support for negative covenants (i.e. historical preservation) touch and concern used as a catch-all for policy concerns - doesn't just deal w/ physical nature Want to avoid undue restrains on alienation that last forever i) need to have some mechanism to get rid of covenants if conditions change ii) note: because changed conditions is an equitable doctrine this is especially important for real covenants / enforcement at law 6. Notice-Must be actual, constructive or inquiry notice Implied Negative Reciprocal Servitudes Implying covenants on land that are not specifically stated Rules: a) Must prove a common plan(look at the pattern of the developer when they start selling the plots) and a common grantor(the landowner group) i. What constitutes a common plan? Must find a suitable number of lots in a subdivision are subjected to a common covenant. A variation in the terms or incidence of the covenants may indicate that the common owner did not intend a common scheme. ii. When does a common scheme begin? Lots may be sold before a common plan is developed. Lots sold before the common plan are not subject to the covenant. iii. Geographic Boundaries of a common plan-Look to the circumstances and facts of what the developer intended. b) Look for promises common on a number of a tract of lands. (Numerous tracts of lands with the same promises attached to them), look how the property is platted(mapped) out, look how the development is advertised and what the other residents were told. This is after the land has already been platted. c) One part of the development (with similar structure and platting) can have restrictions on it and another doesn’t have to. Example: The McLeans owned property in which they wished to build a gas station. The parcel that they owned had no restrictions on it, but the majority of parcels around them had restrictions limiting the use to residential purposes. There was a common grantor. 53 of 91 lots had restrictions. The court held that the McLeans were on constructive notice as of the restrictions on the neighboring parcels and inquiry notice as to determine whether the restrictive covenants on the neighboring parcels could interpreted as a plan to restrict the entire neighborhood to residential uses. Since the majority of the neighborhood was residential, the court inferred that the intent of original owner was to create a common plan. The California court has found that a covenant must be recorded in a deed at the time of purchase to apply. Ambiguity When there is any ambiguity or substantial doubt in the meaning, restrictive covenants will be read narrowly in favor of the free use of property. Restraints on Alienation Definition: A limit on the free sale or transfer of property. Generally seen as unenforceable, but in modern times, there are situations where it can be enforced. (Life estates, land use restrictions, fee simple defeasible) -Balance the consequences of the restraint versus the benefits that the restraint will allow. Take land off the market, making it unusable for the best use; unmortgageable; unimprovable; concentrates wealth; prevents creditors from reaching it -In condo association situations, the power to withhold consent on the free sales of a condo to a fair purchaser is a restraint on alienation. The association could get around this if it found a purchaser on its own for a fair market value. -The test for the right of first refusal is one of reasonableness is whether the refusal is rationally related to the protection, preservation, or proper operation of the property and the purposes of the association’s governing documents. Secondly, the power must be exercised in a fair and nondiscriminatory manner. To withhold sale for race, sex, or other discriminatory reasons is a restraint on alienation. Altering leases to restrain alienation The owners of the condos purchased their homes with the knowledge that their leases were amendable with the additional restriction. Additionally, the restriction does not violate any public policy. The owners of condos are on constructive notice that their ownership rights are not unlimited and are subject to special limitations that would not be applicable to other ownership situations. (Woodside Village) Developer Controlled Property Provisions allowing amendments to restrictive covenants are subject to the reasonable test. -Elements that the court should consider in balancing its reasonableness test 1. The character of the interest to be protected 2. The relative adequacy to the plaintiff of injunction in comparison with other remedies 3. The delay if any in bringing suit 4. The misconduct of the plaintiff if any 5. The interest of third persons 6. The practicability of granting and enforcing the order or judgment 7. The relative hardship likely to result to the defendant if an injunction is granted and to the plaintiff if an injunction is granted and to the plaintiff if it is denied. -Uniform rule of balancing is based on presumption that the developer is doing something underhanded. -The purchasers of the land have reliance that everyone is required to follow the same plan. -Also of consideration is the amount of money invested in the land, based on that reliance. Counter-Argument The developer may argue that since he has the most votes in the association, based on his land ownership, that he should be given the chance to exercise his franchise. Plus, the original deed stated that the board had the ability to alter the composition of the development. That constituted constructive notice to the other land owners. Plus, there might be a public policy argument stating that the ability to subdivide increases the value of it. Public Policy -It is impossible for the condo to list every specific condition banned. When a condo constitution specifically allows the Board to ban certain things and conditions to create a uniform exterior, unless there is some compelling reason, condo boards are given deference in their decisions. (O’Buck) -The appellate court found that the right to assemble was traditionally limited to political and social reasons and that the potential for possible conflict with the other religious groups who desired to use the auditorium. Such a restriction meets the standard for reasonableness required. (Neuman) Under the reasonableness test, the covenant does not meet the reasonable length requirement (since it was a 40 year lease) and since the covenant restricts the use of land specifically situation for use as a supermarket, the covenant is too contrary to the public good. (Davidson) Ways to terminate Equitable Servitudes and Covenants 1) By the terms of the covenant (Specified # of years pass or a specified condition occurs) 2) Merger 3) Release-Written release by the benefitted property holder 4) Acquiescence-Pattern of violations leading almost to abandonment 5) Abandonment-High number of landowners in a common scheme violate the covenant to such an extent that there is a significant change to the neighborhood 6) Changed conditions-Covenants can be terminated if the conditions in the neighborhood have so changed that the covenant no longer serves its intended purpose 7) Relative hardship-If the harm to the burdened property is disproportionally great compared to the benefit to the neighboring properties, courts will not enforce a covenant. Real Estate Disclosure of defects Old Rule: Caveat Emptor-Puts the burden on the buyer because since they are spending the money, they should take a full inspection of the property they are buying. On the opposite side, the buyer is operating from a weakened bargaining position and is vulnerable to manipulation by a seller. New Rule-Obligation to disclose facts that 1) materially affect the value of the house and the buyer would want to know about and are not readily observable. Title Covenants -Waiver of disclosure: Must be a very specific disclosure. General merger clauses don’t count, unless they have a very specific “as is” clause. This is very controversial and is not followed by all jurisdictions. -Implied warranty of habitability-The developer has a superior knowledge and is assumed to have provided a product (new residential house) that is fully habitable. That implied warranty may or may not be waived. This is limited to only the home’s builder, not a reseller. -Marketable title-The seller has the obligation to provide a fully marketable title. Free from reasonable doubt, but not every doubt. It will likely be free from title defects and encumbrances and other person’s interests in that property. There must be disclosure of any easements or liens or mortgages. If there is a problem that is not disclosed, the buyer can get out of the sale and possibly get damages. Generally, a title is unmarketable if there is a legitimate risk that the buyer would be subject to legal actions (adverse possession, creditor’s rights) if the purchase goes through. A purchaser is not required to buy a lawsuit, so to speak. Buyer’s remedies for breach of the purchase and sale agreement -Specific performance forcing the sale of the house. -Damages-the differences between the market value at the time of breach and the contract price. -Rescission -Vendee’s Lien-There is a debt owed by the seller to the buyer. Seller’s Remedies -Specific performance-Damages-Rescission and forfeiture of down payment -Vendor’s lienEquitable Conversion The person who is the buyer has equitable ownership during the executor person and the liability is on them at that point. In some states, the insurance on the house is given to the equitable owner, but not in all states. Therefore the seller gets the purchase price, plus the insurance money. Formalities The deed must 1) identify the parties 2) describe the property being conveyed 3) state the grantor’s signature 4) contain the grantor’s signature. There must be actual intended delivery and not just physical delivery. Recording is not required but its stupid not to do it. Present Covenants a. Warranty of title- Present Covenants from the grantor to the grantee, starting at the date of the sale. b. Covenant of seisen-I promise I own the property I’m selling and have the type of estate I say I do(fee simple) c. Covenant of the right to convey the land. Full alienation d. Covenant against encumbrances-Promise that there are no mortgages, liens, easements. Things that would decrease the property value. Future covenants-starts at discovery of the defect or breach I. Covenant of warranty a. General warranty deed-seller will protect against all defects in the title. b. Special warranty deed-I promise to warranty against defects the seller’s has caused c. Quitclaim deed-Representation by the seller that he releases my claims to this asset, if I have any. II. Covenant of quiet enjoyment-No one will disturb your title III. Covenant for further assurances-I promise to be affirmatively bound to fix any future problems. Types of recording acts -The first person who records good title to the property is the true owner of the property unless the 2nd owner is a bona fide purchaser (someone who bought the property for fair value, based on a statutory provision. Some states require the 2nd buyer be unaware of the title problems. And some states combine the two) I. Race statute (only 2 states)-The person who records first will prevail. Knowledge is irrelevant. II. Notice statute (half the states)-Requires the person who was a bonafide purchaser not know that anyone else had claim to the land. Actual notice, inquiry notice, constructive notice will suffice. III. Race-notice. Must win the race and have no notice of the other conveyance. Notice to subsequent claimants In virtually all jurisdictions, the subsequent purchaser will lose if he was on notice of the earlier conveyance A. Actual Notice: If the subsequent purchaser is shown to have had actual notice of the existence of the prior unrecorded interest, he will not gain the protection of the recording act in a notice or notice-race jurisdiction. B. Record Notice: The subsequent grantee is deemed to have record notice if the prior interest is adequately recorded. However, the mere fact that a deed is recorded somewhere in the public records does not mean that the recording is adequate-the document must be recorded in such a way that a reasonable searcher would find it. Imputed knowledge-If proper recording of the earlier document took place, subsequent purchasers are on “record notice” even if they never actually see the document that has been filed. That is, the court imputes to the subsequent purchaser the knowledge which he would have had obtained had be conducted a diligent title search. C. Inquiry Notice: Even if a purchaser has neither record nor actual notice of a prior unrecorded conveyance, he may be found to have been on “inquiry notice” of it. Inquiry notice exists where a purchaser is in possession of facts which would lead a reasonable person in his position to make an investigation, which would in turn advise him of the existence of the prior unrecorded right. Such a person is on inquiry notice even if he does not in fact make the investigation. (But the purchaser is responsible only for those facts which the investigation would have disclosed) Possession-Thus if the parcel is possessed by a person who is not the record owner, this will place a subsequent purchaser on inquiry notice. That is, the purchaser must: 1)view the property to see whether it is in the possession of someone other than the record owner; and 2) if there is such a possessor, he must inquire as to the source of the possessor’s right in the property. Fraud A forged deed is always void. A fraudulent deed is voidable, if there is no BFP yet. Financing People who buy property and borrow money have statutory rights. 1) Borrower must sign a promissory note, usually with collateral (a mortgage) 2) If the borrower defaults, the lender has the right to the sell the house Low bid problem- Must have public notice of the public auction. Usually there is a small # of bidders which keeps the price down. Statutory right of redemption-Post foreclosure Equity of redemption-Pre foreclosure. If the sale price of the house is below the value owed on the debt, the borrower still owes the remaining debt. In some states, this is not the case. There is such a thing as an antideficiency statute that says the sale of the house satisfies the debt, but in that case, the bank gets an excellent price on the sale of the house. Sometimes, the buyer borrows from the seller. The seller acts as a lendor. INSTALLMENT LAND CONTRACT a. No bank will lend you money. You make a deal with the seller- Seller Sally will finance for you. Here is what you sign up for: b. Title: she’ll keep title. c. repairs: borrower lives there, pay taxes, repairs etc- in every way as if you own it d. forfeiture: you lose your interest and sally keeps property if default. e. Liquidated damages: what happens to the money you paid? Usually the K provides that the person owed the debt (the lender Sally) will just keep whatever you have paid up to the time of default.(this contract term is called a liquidated damages clause) This may or may not be enforceable, depending on what state you are in and depending on whether the K term for damages is considered a legitimate liquidated damages clause or is instead excessive and is considered a "penalty" to the defaulting borrower. Current Status of Law (p. 809-812) a. some states ignore the liquidated damages clause and simply treat the installment land contract as if it were a traditional mortgage. Sebastian p. 808 takes this approach it is described in note #1. The borrower will have all the protections the law provides for a mortgagor. he may try and avoid foreclosure by using the right to equity of redemption. If the foreclosure occurs, the money paid to the lender pre-foreclosure will be treated like mortagage payments that reduce the debt, and the proceeds from the sherrifs sale will pay off the balance of the debt owed, and any excess proceeds will be retained by the borrower. b. some states will choose whether or not to 1) treat the debt as a traditional mortgage or 2) enforce the K as an installment land K, depending on a list of factors. this approach is described in note 2, p 810. c. ome states retain traditional installment land K doctrine. The Stonebreaker case p 806, and note 3 p. 810 describe this approach. If this approach is taken: 1) the borrower will be evicted. 2) the borrower may or may not get back some of the money they have paid to the lender. In other words, the liquidated damages clause may or may not be enforceable. It depends on whether it is viewed as a penalty, in which case it will NOT be enforced or whether it is S indeed a legitimate liqudated damages clause.To determine this the court will look at what the actual damages amount to. Damages include the amount of rent that the possessor (the borrower) would owe if they had been a tenant ("lost rent" is counted as a damage since the title holder (sally the lender) lost the right of possession on account of the K. Add to that any attorney's fees, costs necessary to repair the property and any costs for having to find a new buyer. Once all the damages are added up, you compare the actual damages to how much the borrower has paid the lender and see if the amount paid to date to the lender is "grossly disproportional to actual damages". If it is NOT grossly disproportional, then the lender can retain all amounts paid. If it is grossly disproportional, then it is a "penalty" and the lender cannot retain the full amount paid. The lender must refund to the borrower, the difference between actual damages and the amount paid to the lender.