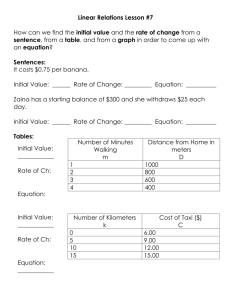

ps#7 answers

advertisement

Econ 301 – F07 PROBLEM SET 7 – Due Wednesday Dec 5 by noon at Jiyoun's Uris Hall office Wissink 1. You are given the following information about a monopolist who makes gizmos: the monopolist’s production function x=L1/2 where L is measured in hours; the firm must get a permit to operate and the cost of the permit is $16; the current market wage rate is $1/hour; and market demand is XD = 120 – 2P. a. What are the values for the simple monopoly equilibrium; that is what are xSM, PSM, profitSM , Net Social SurplusSM, Consumers’ SurplusSM, Producer’s SurplusSM and dead-weight-lossSM? b. Graph this solution. [ANSWER] tc(x) = x2+16 atc(x) = x+16/x mc(x) = 2x Demand curve : XD = 120 – 2P P=60-1/2x tr(x) = (60-1/2x)x = 60x-1/2x2 mr(x) = 60 – x Maximize profit : set mr(xSM)=mc(xSM) 60-xSM = 2xSM xSM = 20 PSM = 60-1/2xSM = 50 profitSM = 50*20 – (20*20+16) = 584 $ 90 80 70 B 60 C A Psm 50 40 D 30 20 10 0 -10 0 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 64 68 72 76 80 84 -20 xmes -30 x NSSSM = area OBCD = 60*24*1/2-20=700 CSSM = area PSMBC = (60-50)*20*1/2=100 PSSM = area OPSMCD = 700-100=600 DWLSM = areaDCA = (50-40)*(24-20)*1/2=20 atc mc demand mr c. Is the monopolist productively efficient? Defend. [ANSWER] No! xSM is not at the minimum of the lratc curve. However, if you want to argue that the rising part of the lratc makes no sense since the firm would replicate beyond xMES then I would accept “yes” as an answer, provided you provided that proviso! d. Is the monopolist allocatively efficient? Defend. [ANSWER] No! x* = 24 maximizes Net Social Surplus. 2. In a diagram using typical cost curves and a linear market demand curve, show how a PRICE CEILING can be successfully used to get a simple monopolist to put more on the market and sell it at a lower price. [ANSWER] $ A mc B PSM C PC E NEWmr F G Dmkt D qSM qC q mr C Suppose P is a price ceiling that the government slaps on the market. A simple monopolist’s new marginal revenue curve is the red line, PCCFD. The monopolist produces qC with the lower price, PC, the price ceiling. Also, consumer surplus increases from PSMAB to PCAC and the dead-weight-loss decreases from GBE to FCE. Note that the efficient price ceiling would be at the price indicated by point E. 3. In a diagram using typical cost curves and a linear market demand curve, show how a PER UNIT TAX ON THE MONOPOLIST’S OUTPUT will alter the profit maximizing quantity and price for simple monopolist. Show how the economic price incidence of the per unit tax is shared (or not) between the buyers and the monopolist. [ANSWER] 2 NEWmc $ C t mc B P SM P E G mkt D t q SM q q mr After a per unit tax, t, is levied on the monopolist’s output, atc, avc, and mc shift up – and mc shifts up by exactly t(the per unit tax). A per unit tax will cause a monopolist to reduce the profit maximizing quantity from qSM to qt and raise price from PSM to Pt for simple monopolist. The profit for the firm decreases since it was maximized before, so by revealed profit analysis, profit must be less at this combination…note the monopolist could have selected this quantity before but did not. The tax is shared since Pt-PSM is less than t. 4. Prove that a monopolist will never choose to operate in the inelastic portion of his demand curve if he is a simple profit maximizing monopolist. [ANSWER] Suppose I claim X* profit maximizes and X* is in the inelastic portion of demand. Now increases P. Then X decreases (due to law of demand): TR increases since D 1 ; TC decreases since cost are an increasing function of output and output(X) decreases; π increases. (π =TR-TC) Therefore, X* could not have maximized profit. QED. 5. In a diagram using typical cost curves and a linear market demand curve, demonstrate that a simple monopolist who is profit maximizing and at the same time earning zero economic profit must be producing less output than is productively efficient. [ANSWER] $ lratc lrmc PMC d xMC mr x 3 Get the profit maximizing output, xMC, by setting mr=mc. But when a simple monopolist (or a monopolistically competitive firm in long run equilibrium) has zero profit, then the lratc must be TANGENT to the downward sloping demand curve, which implies that the minimum of the lratc curve is to the right of, that is larger than, xMC. 6. Assume that the taxi industry in Ithaca satisfies the following set of assumptions: The industry is perfectly competitive. The industry is presently in long-run equilibrium. The industry is an external constant-cost industry. Each taxi driver has a set of "typically" shaped cost curves. In particular this means that short-run supply curve for the individual taxi driver and the industry is typically shaped (due possibly to "dilly-dallying" on the part of taxi drivers). All taxi drivers are the identical with respect to their cost structures. Demand for taxi rides is typically shaped. a. Graph the present long-run equilibrium situation for both a typical taxi driver and the entire taxi industry. [ANSWER] Profit>0 Price S2 S1 D D $ srmc lratc sratc P2 P* D D Q2 Q* Taxi Market Quantity q* q2 Quantity Typical Firm Suppose now that the mayor decides to license taxi drivers and issues a limited number of licenses, less than the number of taxis currently in operation. The licenses are freely given to existing taxi drivers on a random basis. For example they put names into a hat and draw out the lucky drivers to decide who will, and who will not, be given a license. Assume that you must have a license to operate a taxi and the government does not collect a fee for the license. HINT: THE TOTAL NUMBER OF “TAXI-FIRMS” WILL NOW BE LESS. b. Explain and indicate on the graphs for the previous part what will happen to price, quantity, and profit in the short-run and long-run once the licenses have been issued. Be sure to discuss and graphically point out both the effect on the individual taxi driver and the entire taxi market. [ANSWER] see the graphs above. Suppose the number of licenses is N2 which is less than N1, the original number of taxi drivers in the entire market. In the short-run, there are now only N2 taxis. The short run market supply curve shifts to the left from S1 to S2. Price increases from P* to P2. Each tax driver provides rides q2 which is more than q*. Then, each taxi driver has positive profit with price, P2, and new quantity, q2. In the long-run, firms can not enter and profit for the lucky taxi drivers who got a license persists and is positive. We are unable to get back to a long run equilibrium. 4 c. If any taxi driver with a license can sell the license to an ex-taxi driver who did not get a license, what will be the maximum amount the ex-taxi driver will be willing to pay for the license? (I’m not looking for an exact number.) [ANSWER] The maximum amount would be the profit that the taxi driver earns who was lucky and got a license for free. d. What would happen to Ithaca's taxi market if someone purchased all the taxi licenses at once? Would it make sense for someone purchasing all the licenses at once to be willing to pay more than the total number of licenses times your answer to part (c) of this question? Explain. [ANSWER] Yes, since now the taxi monopolist can control and restrict output to drive up (no pun intended) the market price and increase total profit. So, if you could buy all the licenses at once and thereby be a monopolist, then you would have more profit – making you willing to pay more for the entire set of licenses than the sum of all the profit when the drivers act as perfect competitors. But you’d have to buy them all at once, or you would find yourself involved with a hold up game at the very end for the last few people who you try to buy licenses from. 7. Critically evaluate the following statements and explain in what way they are true, false, or uncertain. a. Monopolists are never ever allocatively efficient. [ANSWER] False. For successful 1st degree price discrimination or for the case of a monopolist confronted with an efficient price ceiling imposed by government set where demand and mc intersect you get allocative efficiency. b. Monopolists are never ever productively efficient. [ANSWER] False. They just might be. But don’t necessarily have to be. c. Since monopolists produce less than what would be produced under competitive conditions, monopolists create shortages. [ANSWER] False. At the price set by the monopolist, all demand is met. It is true that XM is less than X*. But there is no shortage of X at price PM. d. Monopolists will never earn zero economic profit since entry does not force profits down to zero as in perfect competition. [ANSWER] False. Remember zero economics profit means there is positive ACCOUNTING profit and all the opportunity costs of the monopolist are being covered. Having a monopoly DOES NOT GUARANTEE long run positive economic profit. e. Monopoly is a bad thing for consumers and a good thing for producers. Therefore, on balance, we can't be sure that monopoly is responsible for any loss in economic efficiency. [ANSWER] False, with simple monopoly there IS a loss of efficiency relative to perfect competition, that is to say the maximization of net social surplus. It is only in the case of successful perfect price discrimination or efficient price ceilings that you get efficiency with monopoly. 8. Horizon Mobile Inc. is a monopolist in the local cell phone market in Oulu Finland. There are two buyers of cell phone minutes in this town: Ville and Mikko. Suppose Ville’s and Mikko’s demands are as follows: Ville: qV = 40 - 2P Mikko: qM = 20 - P q = minutes used, P = price per minute. Mikko and Ville already own their own cell phones and are just buying minutes on the system. Suppose Horizon's marginal costs for minutes are constant and equal to $2 regardless of who it sells minutes to and regardless of how many minutes it sells. Horizon has no fixed costs. 5 a. Suppose Horizon can’t tell the difference between Mikko and Ville, so it has to operate as a simple monopolist. Determine the simple monopoly profit maximizing solution. That is, how many minutes - in total - are sold and at what price? How many minutes does Ville buy? How many minutes does Mikko buy? What is Horizon’s profit? [ANSWER] Suppose Q is the market quantity demanded. Q = qV+qM = 60 - 3P PD = 20-1/3Q mr = 20 – 2/3Q Set mr = mc for a simple monopoly. 20-2/3Q = 2 QSM = 27 PSM = 20-1/3QSM = 11 qV,SM = 40-2*11 = 18 qM,SM = 20-11 = 9 πSM = 11*27-2*27 = 243 b. Calculate Ville’s own price elasticity of demand and Mikko’s own price elasticity of demand at their respective simple monopoly solutions. [ANSWER] D Ville’s own price elasticity of demand: qV , P 2 *11 / 18 11 / 9 D Mikko’s own price elasticity of demand: qM , P 1 *11 / 9 11 / 9 c. Suppose Horizon figures out a way to tell Ville and Mikko apart and can now split the market and engage in third degree price discrimination. Would it pay to engage in third degree price discrimination? (THINK!) If so, what price will Horizon charge Ville and Mikko per minute now? How many minutes in total will Horizon sell? How many minutes does Ville buy? How many minutes does Mikko buy? What are Horizon’s profits now? [ANSWER] Since they have identical own price elasticities of demand at the simple monopoly solution, there is no advantage to engaging in 3rd degree price discrimination. Solution would be exactly the same. But if you do not trust me, then note. For Ville, set mr(qV)=mc(qV) 20 - qV = 2 qV = 18; PV = 11 For Mikko, set mr(qM)=mc(qM) 20- 2qM = 2 qM = 9; PM = 11 πSM = 11*18+11*9-11*2=243 d. Suppose Horizon decides to (and can) engage in perfect or first-degree price discrimination. Horizon decides to implement this through a perfect two two-part-tariff pricing scheme. What entry fee and price per minute will Horizon charge Ville? What entry fee and price per minute will Horizon charge Mikko? (Please use area “calculations” here - not discrete sums.) What is Horizon’s profit now? [ANSWER] P = 2, Mikko buys 18 and Ville buys 36. Entry Fee (EF) for each will be equal to their consumer’s surplus at this solution. qV = 36, EFV = 1/2*36*18 = 324, qM = 18, EFM = 1/2*18*18 = 162, π = 324 + 162 + 2(54) – 2(54) = 243 e. Suppose Horizon realizes it really can’t tell Ville and Mikko apart. Will the perfect two two-parttariff scheme you just outlined still work? Why not? [ANSWER] No, Ville will pretend to be Mikko. f. Desperately trying to hang onto more profit than less, suppose Horizon contemplates using a single two-part-tariff pricing scheme knowing Ville and Mikko look exactly alike and can’t be told apart. Suppose Horizon continues to charge $2 per minute. Given this $2 per minute price, what entry fee 6 would maximize Horizon’s profit? Is a single two-part-tariff better than behaving as a simple monopolist here? Why or why not. [ANSWER] Since Ville and Mikko can not be differentiated, Horizon will charge only one entry fee for both Mikko and Ville. If EF = 324, then only Ville buys in and profit is 324. To get both Horizon must lower the entry fee to EF = 162 and then they will get both Ville and Mikko and profit will be 324. Either is fine and both are better then behaving as a simple monopolist since then profit is 243. Thus, a single two-part-tariff is better. 7