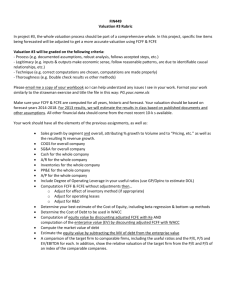

FIN449 Valuation #3 – M&A In July 2012, LaCrosse Footwear, Inc

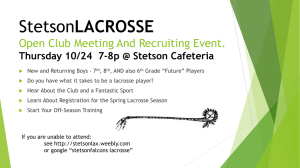

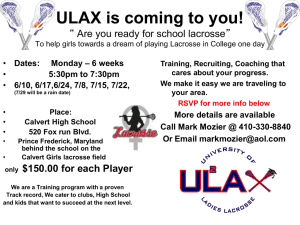

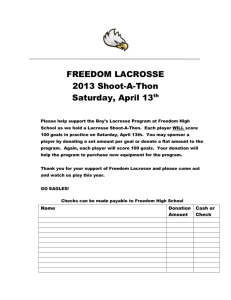

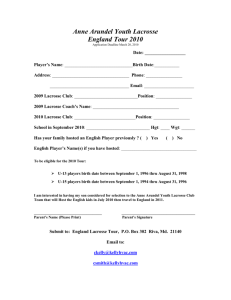

advertisement

FIN449 Valuation #3 – M&A In July 2012, LaCrosse Footwear, Inc., (BOOT) announced it was being acquired for $20 per share. Their stock had an adjusted close of $10.98 prior to this news. http://www.bizjournals.com/portland/blog/threads_and_laces/2012/07/already-big-in-japan-lacrosse-sale.html http://www.oregonlive.com/playbooks-profits/index.ssf/2012/07/lacrosse_footwear_deal_hinged.html http://finance.yahoo.com/news/law-firm-levi-korsinsky-llp-154400052.html There are other sources of information about this action. You will need to research the issue thoroughly. Turn In: All pages should be neatly formatted & easily readable. - 1 page detailing the computation of the historic unadjusted FCFF and FCFE for the past three years. - 1 page detailing the historic FCFF & FCFE adjusted & recast to accommodate leases and other issues covered in class. - 1 page determining LaCrosse’s Ke, Kd and WACC, including the components of each. This must include beta based on regression and a “bottom-up” computation. Make sure to list the comparable firms used for the bottom-up beta and explain why each is appropriate. - Analysis of the price offered showing the growth, cash flow and other assumptions the buyer is likely using to value the firm at the offered price. Use a forecast of FCFF and of FCFE to arrive at the price offered for LaCrosse. - 1 page discussing the LaCrosse’s situation. Address the following points: Who is the buyer, and what is their history & expertise? Is LaCrosse involved in a hostile takeover? What is the buyer’s motive? What expectations does the buyer have (based on your analysis above)? What aspects of their fiscal management make LaCrosse desirable for a takeover bid? What issues or problems does the buyer face from this offer? Do you believe the price offered is too high, too low or about right? Explain your answer. Make sure to cite any references used in this discussion. Additional information: Your basic approach should be to take the amount offered and determine what it is based on. For example, if the equity is being purchased for $100/share and there are 200,000 shares, the total price is $20,000,000. We know that P0 = CF1/(r-g), so the next step is to assume what the discount rate and growth might be. If r=15% and g=5%, then CF1 = $2,000,000. Assume this is FCFE. Compare the assumed FCFE to what is likely based on current performance, then determine what needs to change: Growth, risk, profitability, assets, liabilities, etc. to make the computation work. Tie this to the practical things the buyer will need to do and predict what actions they will take.