528-SP11-Wells-20110120-094902

advertisement

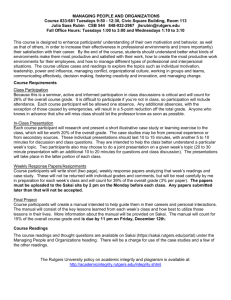

RUTGERS, THE STATE UNIVERSITY OF NEW JERSEY The Bloustein School of Planning and Public Policy Urban Planning and Policy Development Program 970:528 Housing Markets & Finance (3.0) Spring 2011 Dr. Jan S. Wells jwells@mtahq.org 212-878-7079 Monday 6:10 - 8:40 pm Room 113 In 2010, the overall U.S. economy appears to have stabilized (although, like a recovering patient, there is always the danger of relapse). Housing, however, remains a moving target. While some local markets seem to have gained some breath, the foreclosure debacle seems to never end. Construction financing, too, has proven to be elusive. However, affordable housing and green building now offer builders some opportunities due to available subsidy programs. And, buyers with stable income and good credit can secure housing at greatly reduced prices at incredibly low interest rates. Still, there are those foreclosures......... This spring we will spend the first half of the course on the basics of real estate/housing finance: demographics of housing demand and supply; time value of money; home buying and the concepts of mortgages; operating properties and the historic process of residential development finance; preparing cash flow pro-formas; and tax implications. The second half of the course will cover "what happened". We'll go into the murky worlds of subprime mortgages, Wall Street's smoke and mirrors (derivatives, anyone?), the collapse of the secondary market icons -- Fannie Mae and Freddie Mac, MERS, and the banks who aided and abetted the madness. We'll spend some time looking at the foreclosure mess and the impact of foreclosures on local housing markets and communities. We will use two texts: Wiedemer, Goeters, and Graham. 2011. Real Estate Investment, 7th Edition Immergluck, Dan. 2009. Foreclosed. Cornell University Press. We will also have numerous articles for reading and speakers from different realms who will give us their take on who, what ,when and why. The goal is to impart to the student an appreciation and understanding of the financial components involved in homeownership and housing development, and to understand the stresses that are impacting the housing economy today. Course requirements include small written assignments, problem homework and class participation (40%), Mid-term (30%) and Final (30%). All readings and assignments will be placed on Sakai or downloaded from the internet. Knowledge of spreadsheet software such as Excel is necessary. Students are expected to adhere to the Rutgers policy on academic integrity. See http://academicintegrity.rutgers.edu/integrity.shtml Preliminary Syllabus Class 1 – January 24 Introduction Social aspects of housing Demand Supply Market outcomes Measures of imbalance in a market: vacancy rate, crowding, and % of income on housing expenses Housing Demography: life cycle and housing choices See Assignment #1 on Sakai Class 2 – January 31 Basics of real estate Assignment #2 on Sakai Class 3 – February 7 The home buying process Review of Assignments #1, 2 Qualifying for a mortgage Tax benefits of a home mortgage Issues in affordability, the role of the state Assignment #3 on Sakai Class 4 – February 14 Cash flow analysis, operating property Review of Assignment #3 Cash flow analysis of an operating property Cash flow pro-formas Capitalized value After tax cash flow Assignment #4 on Sakai 2 Class 5 – February 21 Profitability analysis and Construction financing Review of Assignment #4 Profitability: Rate of Return, IRR and MIRR Development Process and financing Assignment #5 on Sakai Class 6 – February 28 Review of Assignment #5 Analysis of for-sale developments Role of Appraisals Assignment #6 on Sakai Review for Mid-term on Sakai Class 7 – March 7 Speaker Review of Assignment #6 Review for Mid-Term SPRING BREAK! Class 8 – March 21 Mid-term exam Secondary Mortgage Market Assignment #7 on Sakai Class 9 – March 28 Collapse of the mortgage markets - domestic level Assignment #8 on Sakai 3 Class 10 – April 4 Collapse of the mortgage markets - global level Review Mid-term Exam Assignment #9 on Sakai Class 11 – April 11 Review Assignment #8 Foreclosure debacle Assignment #10 on Sakai Class 12 – April 18 Speaker Review for Final Exam on Sakai Class 13 – April 25 Speaker Class 14 – May 2 Review Assignment #10 and Final Exam Review MAY 9 FINAL EXAM 4