Financial Planning and Analyses

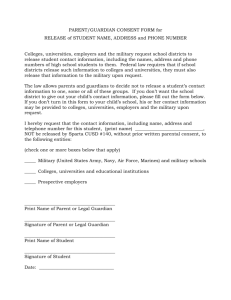

advertisement