C. Fund Manager

advertisement

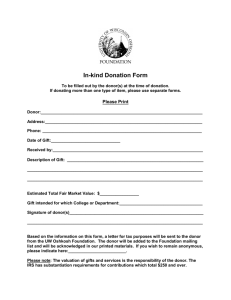

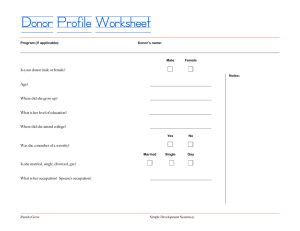

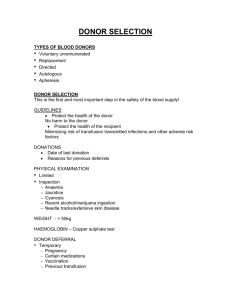

POLICIES AND PROCEEDURES CHANTICLEER CHARITABLE FUND THESE POLICIES AND PROCEDURES are adopted by the Board of Directors of the Chanticleer Foundation, Inc. a South Carolina non-profit corporation on April 15, 2010. I. GENERAL The Chanticleer Charitable Fund (“CCF”) is a Donor-Advised Fund (“DAF”) program offered by Chanticleer Foundation, Inc., a South Carolina non-profit corporation organized on October 26, 2009. (the “Foundation”). The Foundation has filed an application to be a public charity described in §§501(c)(3), 509(a)(1) and 170 (b)(1)(A)(vi) of the Internal Revenue Code of 1986, as amended (the “Code”). CCF offers donors the opportunity to make immediately deductible charitable contributions while retaining some influence over the charitable purposes for which those contributions are ultimately used. The Foundation becomes the exclusive legal owner of the funds and assets in CCF. Accordingly, this policy and proceedure refers to contributions by donors for the purpose of establishing or adding to DonorAdvised Funds within CCF as contributions made “to the Foundation,” and addresses other matters to ensure the continued viability of CCF. II. DEFINITIONS A. Donor-Advised Fund 1. IRC 4966(d)(2) defines a "donor-advised fund" as (1) a fund or account owned and controlled by a sponsoring organization, (2) which is separately identified by reference to contributions of the donor or donors, and (3) where the donor (or a person appointed or designated by the donor) has or reasonably expects to have advisory privileges over the distribution or investments of the assets. All three prongs of the definition must be met in order for a fund or account to be treated as a donor-advised fund. Exception: Funds or accounts that make distributions only to a single identified organization or government entity are not DAFs. IRC 4966(d)(2)(B)(i). Chanticleer Foundation, Inc. - Policies and Proceedures - Page 1 of 32 Exception: Funds or accounts for which a donor provides advice regarding grants to individuals for travel, study, or other similar purposes are not DAFs, provided: a. The donor's, or the donor advisor's, advisory privileges are performed in his capacity as a member of a committee, all the members of which are appointed by the sponsoring organization; b. No combination of donors or donor advisors (or related persons) directly or indirectly control the committee; and c. All grants are awarded on an objective and nondiscriminatory basis pursuant to a procedure approved in advance by the board of directors of the sponsoring organization that meets the requirements of IRC 4945(g)(1), (2) or (3). IRC 4966(d)(2)(B)(ii). B. Sponsoring Organization IRC 4966(d)(1) defines a "sponsoring organization" as an organization that (1) is described in IRC 170(c) (other than a governmental entity described in section 170(c)(1), and without regard to any requirement that the organization be organized in the United States), e.g., a charitable organization, including domestic fraternal organizations, war veterans organizations, and cemetery companies; (2) is not a private foundation (as defined in IRC 509(a)); and (3) maintains one or more donor-advised funds. The Sponsoring Organization for the Foundation is the Chanicleer Foundaation, Inc., a South Carolina non-profit corporation. C. Fund Manager IRC 4966(d)(3) defines a "fund manager" with respect to a sponsoring organization as an officer, director, or trustee of such sponsoring organization (or an individual having powers or responsibilities similar to those of officers, directors, or trustees of the sponsoring organization). The initial Fund Manager is Michael Pruitt. D. Donor A Donor is identified as follows and has the following rights: Makes the initial contribution to the DAF; Is identified as the Donor on the DAF application; Can recommend the initial investment advisor; and Can be or appoint the initial Grant Advisor. For most Donors, the two most important benefits are being eligible to claim an income tax deduction for gifts to the Fund and serving as the Fund’s Grant Advisor. E. Grant Advisor The Donor appoints the initial Grant Advisor and the Grant Advisor has the following rights with respect to the Fund: Can make grant recommendations for all or part of the Fund; Can make grant recommendations both during lifetime and through written instrument at death; Chanticleer Foundation, Inc. - Policies and Proceedures - Page 2 of 32 Can make grant recommendations subject to any restrictions on grant recommending authority imposed by the Foundation’s policies, the Fund Agreement or the person who appointed the Grant Advisor; Can name successor Grant Advisors while living or through written instrument at death; and Receives quarterly reports from the Foundation, which cover the contribution, grant and investment activity of the Fund. F. Successor Grant Advisor Successor Grant Advisors have no rights until they succeed the person who appointed them. Upon the resignation or death of a current Grant Advisor, the Successor Grant Advisor acquires all of the rights of the Grant Advisor who appointed them. G. Disqualified Persons 1. "Disqualified persons" include the following with respect to a donor-advised fund: A donor or any person appointed or designated by a donor (donor advisor) who has, or reasonably expects to have, advisory privileges with respect to the distribution or investment of amounts held in a donor-advised fund by reason of the donor’s status as a donor. IRC §4958(f)(7)(A) (cross-referencing IRC 4966(d)(2)(A)(iii)); A member of the family of an individual described above. IRC §4958(f)(7)(B); A 35% controlled entity. IRC § 4958(f)(7)(C) (cross-referencing §4958(f)(3)). 2. "Disqualified persons" include the following with respect to a sponsoring organization: An "investment advisor," which is any person (other than an employee of the sponsoring organization) compensated by the sponsoring organization for managing the investment of, or providing investment advice with respect to, assets maintained in donor-advised funds. IRC 4958(f)(8)(B); A member of the family of an individual described above. IRC §4958(f)(8)(A)(ii); A 35% controlled entity. IRC § 4958(f) §4958(f)(8)(A)(iii). H. Published Guidance Notice 2006-109, 2006-51 I.R.B. 1121, provides interim guidance regarding certain requirements enacted as part of the Pension Protection Act of 2006 (PPA) that affect donor-advised funds. Notice 2006109 excludes certain employer-sponsored disaster relief funds from the definition of donor-advised fund, and clarifies how the Internal Revenue Service will apply the new IRC 4966 excise taxes with respect to payments made pursuant to education grants awarded prior to the date of enactment of the PPA. Published guidance shall include any future publications relating to DAF’s III. GENERAL POLICIES AND PROCEDURES A. Establishing a Chanticleer Foundation Donor-Advised Fund To establish a Chanticleer Foundation Donor-Advised Fund, the Donor must complete a DonorAdvised Fund Application (Attachment 3). On the Application, the donor(s) will be asked to name their fund. Typically, donors choose a name in honor of themselves, their family, a relative, a friend or a cause that is important to them. If the Application is accepted by the Foundation, the Donor will be required to execute a fund agreement (Attachment 4). The donor’s financial advisor, if approved by the Foundation, may open a brokerage or mutual fund account for the Donor-Advised Fund and work with the Foundation to arrange to have donations of Chanticleer Foundation, Inc. - Policies and Proceedures - Page 3 of 32 cash and/or securities transferred into the account. The Donor or the Donor’s financial advisor must contact the Foundation for information needed to complete investment account applications. Once the Foundation approves the donation, the donor (or his or her investment advisor, if desired) will receive further communications and instructions from the Foundation. Contributions not approved by the Foundation will be returned to the donor. B. Donors and Contributions 1. General Donors to the Foundation have the opportunity at any time to make nonbinding, advisory grant recommendations to the Foundation regarding the charities they would like to benefit from their contributions. The Foundation retains the exclusive discretion as to whether, and to whom, to make a grant in accordance with applicable IRS regulations. Assets held in the various DonorAdvised Funds within CCF are invested and professionally managed, offering the potential for contributions to grow and ultimately result in larger charitable gifts. A donor may recommend the initial investment advisor for the Donor-Advised Fund. These recommendations are advisory only and are subject to review and approval by the Foundations pursuant to the Foundation’s established investment policy. CCF offers numerous advantages to the donor, including: The donor may claim an immediate tax deduction for contributions made to and accepted by the Foundation; The donor may contribute appreciated assets, thereby avoiding capital gains; The donor can make grant recommendations to support public charities based on the value of the Donor-Advised Fund; The donor may recommend grants to multiple charities; The donor may request anonymity in connection with recommended charitable grants from a Donor-Advised Fund; No tax reporting is required by the donor; Donated assets may appreciate in value after their transfer to the Foundation; The donor may recommend an investment advisor to manage the assets in a DonorAdvised Fund; and CCGF represents a cost-effective alternative to creating a private foundation. The Foundation monitors the ongoing operations of the CCF program and will investigate any apparent improper usage of a fund (e.g., usage for any purpose inconsistent with the purposes and programs described in §§170(c)(2)(B) and 501(c)(3) of the Code). 2. Eligible Donors The Foundation accepts charitable contributions from individuals, companies, trusts, estates and other entities. Contributions other than cash or publicly-traded securities require review and approval by the Foundation’s Officers. 3. Primary Grant Advisor If there are multiple Grant Advisors to a Fund, one person must be designated as the Primary Grant Advisor. Only the Primary Grant Advisor will receive reports from the Foundation. All Grant Advisors have the right to appoint a successor to assume his or her rights Chanticleer Foundation, Inc. - Policies and Proceedures - Page 4 of 32 as a Grant Advisor upon his or her resignation or death. The initial Grant Advisor may select any person, including a spouse, child, another descendant, heir or representative to appoint as their successor Grant Advisor. Upon the Grant Advisor’s resignation or death, the rights and duties associated with the Grant Advisor of the Fund including the right to make grant recommendations and receive quarterly statements will transfer to the successor Grant Advisor. In the case of resignation, the original Grant Advisor must send to the Foundation a signed letter of resignation. If a successor has already been named, that person will be the successor Grant Advisor. If no successor has been named prior to sending a letter of resignation or the Grant Advisor wishes to change the named successor, an Account Information Change Form naming the successor must accompany the letter. If the Grant Advisor dies, the successor must provide the Foundation with written notification and sufficient proof of the death of the Grant Advisor, whereupon the successor will assume the role of Grant Advisor. If the successor is a minor, the Foundation reserves the right to require that grant recommendations be made by the minor’s legal guardian. A successor may also appoint his or her own successor. Rather than choosing a person to succeed a Grant Advisor at death, a Grant Advisor may recommend (subject to review and approval by the Foundation) that one or more qualified charitable organizations receive annual grants from the remaining assets in the Donor-Advised Fund account upon the Foundation’s notification of the Grant Advisor’s death. Such grants will continue so long as there are assets in the Fund. Each grant will be accompanied by a letter that references the Grant Advisor and the Fund name. If no successor Grant Advisor or charitable organization is designated by the last surviving Grant Advisor, then, upon notification to the Foundation of the death or resignation of that Grant Advisor, the Foundation will make annual grants to one or more qualified charitable organizations from the remaining assets in the Donor-Advised Fund account upon the Foundation’s notification of the Grant Advisor’s death. Distributions are granted at the sole discretion of the Foundation in accordance with applicable regulations and the Foundation’s policies and procedures. 4. Initial Donor Contributions All initial donor contributions to a Fund must be accompanied by a completed DonorAdvised Fund Agreement. The initial contribution to a Fund must have a minimum fair market value of $10,000. Unless otherwise indicated, the first donor listed in the application will receive written confirmation of the contribution and is deemed to be the Primary Grant Advisor. After acceptance by the Foundation, the Foundation may liquidate and reinvest any or all contributions. The Foundation will return any contributions not accepted by the Foundation. 5. Types of Contributions Charitable contributions may be in the form of cash, mutual fund shares, publicly-traded stocks or bonds. Real estate, closely-held stock and other hard-to-value assets may also be contributed to the Foundation after review and approval by the Foundation’s Officers. For information on contributions of hard-to-value assets, the prospective Donor must contact the Foundation. 6. Additional Contributions Additional contributions to the Foundation of $500.00 or more may be made at any time by any person and must be accompanied by a completed Additional Contribution Form. Most contributions are made directly into a brokerage account established in the name of the Chanticleer Foundation, Inc. - Policies and Proceedures - Page 5 of 32 Foundation, and are accounted for within CCF by using the Fund’s segregated account. After acceptance by the Foundation, the Foundation may liquidate and reinvest any or all additional contributions. As with an initial contribution to the Foundation, the donor receives written acknowledgement of each additional contribution. Contributions that are not accepted will be returned. 7. Minumun Amount Required to Maintain DAF The Fund Balance must be at least $5,000.00 to maintain the DAF. If the Fund drops below $5,000.00, the Foundation has the option of distributing the balance of the Fund pursuant to the charitable purposes of the Foundation. 8. Testamentary Gifts and Gifts from Trusts Donors may name their Donor-Advised Fund as the beneficiary of a bequest of cash, securities, mutual funds or IRA assets. Additionally, Donors may name their Donor-Advised Fund as the beneficiary of a charitable remainder trust, charitable lead trust or life insurance policy. A successor Grant Advisor must be chosen for all testamentary and trust gifts. If no Grant Advisor is designated for a Fund, the Foundation will make annual grants to charities from the Fund equal to 5% of the Fund’s annual value. Donors are advised to contact their tax and legal advisor before establishing any testamentary gift. 9. Contributions are Irrevocable Once the Foundation accepts a contribution, the gift is irrevocable and may not be refunded. All accepted gifts become the exclusive legal property of the Foundation. 10. Types of Assets used to Fund DAF The following are exampled of assets that can be used to fund DAF’s: 11. Cash Stocks Mutual Funds Real Estat Closely-held Businesses IRA’s Bequests Trust Interests Life Insurance Process for Investing Contributed Assets a. Investment Recommendations: The Foundation will consider investment recommendations made by the donor and the donor’s investment advisor if such advisor is approved by the Foundation. Each Fund must have an investment advisor managing the Fund’s investments. Each such investment advisor must be a licensed professional investment advisor who provides investment advice as a profession. If the Donor does not make investment recommendations or does not recommend an approved investment advisor to manage the assets, the Foundation will appoint an investment advisor to invest the funds in accordance with the Foundation’s Investment Policy. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 6 of 32 b. Cash: The net proceeds of cash contributed to the Foundation will be invested in accordance with the Foundation’s Investment Policy. c. Securities: Securities, including mutual funds, accepted by the Foundation may either be held or sold in accordance with the Foundation’s Investment Policy. The net proceeds of contributed securities that are sold by the Foundation will be invested in suitable investments in accordance with the Foundation’s Investment Policy. d. Real Estate and other hard-to-value assets: All hard-to-value assets accepted by the Foundation may either be held or sold in order to comply with the Foundation’s Investment Policy. Donors and their investment advisors can recommend specialists to assist with the sale as appropriate. The net proceeds of the sale of hard-tovalue assets sold by the Foundation will be invested in suitable investments in accordance with the Foundation’s Investment Policy. C. Tax Considerations 1. Charitable Deduction (Consult Your Tax Advisor) Itemized tax deductions for a charitable contribution to a charitable organization may be taken on the date that the contribution is made to the Foundation. Donors are encouraged to consult with their legal or tax advisors to review their personal situation; however, contributions of the following assets are usually treated as noted below. Deductibility will depend in part upon the type of asset contributed to the Foundation. a. Cash: Amount of cash contribution accepted by the Foundation. b. Publicly-Traded Securities: If held for more than one year, the average of the high and low prices reported on the date the contribution is made to the Foundation. For open end mutual fund shares held for more than one year, the net asset value on the date the contribution is completed. For securities or mutual funds held for one year or less, the deduction is the lesser of the cost basis or fair market value. c. Real Estate: If held for more than one year, the fair market value on the date the contribution is made to the Foundation. For real estate held less than one year, the deduction is based on the lesser of the cost basis or fair market value. Gifts of real estate require review by the Foundation prior to contribution. The Internal Revenue Service requires a qualified appraisal for any contributed asset for which you will claim a deduction of more than $10,000. For gifts over $500,000, the qualified appraisal must be included with the donor’s tax return. d. Closely-Held Stock and other securities: For securities that cannot be freely-traded on an exchange on the contribution date and have been held for more than one year, the donor may deduct the fair market value on the date the contribution is made to the Foundation. The value is determined by a qualified appraisal. For securities held for one year or less, the deduction is for the lesser of the cost basis or fair market value. The Internal Revenue Service requires a qualified appraisal for any contributed asset for which you will claim a deduction of more than $10,000. For gifts over $500,000, the qualified appraisal must be included with the donor’s tax return. 2. Other Deduction Limitations Chanticleer Foundation, Inc. - Policies and Proceedures - Page 7 of 32 Individual donors are eligible for an itemized deduction for cash contributions to the Foundation in an amount up to 50% of the donor’s adjusted gross income (AGI) in the tax year in which the contribution is made. Deductions for contributions of appreciated assets held for more than one year are limited to 30% of AGI. Any excess amount may be carried forward and deducted by the donor during the five-year period after the year of contribution. A donor’s ability to benefit from a deduction may be subject to certain IRS limitations. Donors are advised to seek legal or tax advice to determine your ability to benefit from your contribution. 3. Estate Planning Contributions to the Foundation and any earnings related to contributions are not part of the donor’s taxable estate and are not subject to probate. Amounts contributed to the Fund should not be included in Donors taxable estate. 4. Tax Treatment of Investment Income Investment income earned by a Fund is income of the Foundation. Because the Donor-Advised Fund’s assets belong to the Foundation and not to the donor, this income is neither taxed to the donor nor is the donor eligible to claim an additional charitable deduction for that income. Such income is reflected in the segregated account balance of the individual Donor-Advised Fund. 5. Gramts to Charitable Organizations When the Foundation makes grants to charities, it distributes funds from CCF which are owned by the Foundation and held in its individual Donor-Advised Funds. Donors may not claim additional charitable deductions when grants are made. D. Investments Once a Donor-Advised Fund has been created upon a donor’s contribution to the Foundation, the donor may recommend an investment advisor to oversee the assets in the Fund. However, final and exclusive authority to select and retain the investment manager and to make investment decisions rests with the Foundation. All investment managers retained by the Foundation must sign the Foundation’s Investment Policy Statement and abide by the Foundation’s policies. If a donor does not recommend a qualified investment manager, the Foundation will appoint one. E. Grant Making 1. General Historically, charitable grants have often been made in response to requests from friends or associates, or out of an awareness of a pressing social issue or organizational need. Today, donors are voicing an increasing desire to be proactive in directing their philanthropic choices. This sentiment has increased the popularity of Donor-Advised Funds, which provide a good “fit” with the entrepreneurial spirit that many donors have displayed in accumulating personal wealth. The Foundation, through the CCF program, offers valuable information and tools to assist you in making informed philanthropic decisions. You will be able to recommend gifts to your favorite charities, your alma mater, local libraries and to many other qualified charitable organizations. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 8 of 32 2. Grant Recommendations Donors and any Grant Advisors authorized by the donors, have the ability, by way of a Grant Recommendation Form, to recommend qualified charitable organizations to receive grants from the Foundation. Grant Recommendations are advisory only and are subject to review and approval by the Foundation, which retains exclusive legal control and discretion over all grants made from one of its Funds; however, the Foundation will generally honor a Grant Advisor’s recommendation. All grants are subject to the Foundation’s policies and procedures. If the Foundation does not adopt a donor’s recommendation, or if a recommended organization no longer qualifies at the time the grant is to be made through CCF, the Foundation will make reasonable efforts to notify the donor and obtain a recommendation for a grant to an alternative charitable organization. If the Foundation approves the grant recommendation, the Foundation will issue a check to the recommended organization. A letter accompanying the grant will acknowledge the Fund and the Grant Advisor’s involvement unless the Grant Advisor wishes to remain anonymous. Grant recommendations will be processed as soon as possible, but generally not later than two weeks after receipt by the Foundation. 3. Multiple Recommendations Grant recommendations will be processed in the order in which they are received. In the event that multiple authorized individuals make simultaneous grant recommendations that exceed the amount remaining in the fund, the Foundation or its representative will attempt to contact the Grant Advisors to inform them of the overlapping requests and offer them the opportunity to agree on a recommendation. If the Grant Advisors are not available or an agreement cannot be reached, the Foundation will evaluate the grant recommendations and award funds as it feels appropriate. 4. Naming Grant Advisors Once the Donor has appointed the initial Grant Advisor, the Grant Advisor may name a successor Grant Advisor for the Fund. Any such appointment must be submitted in writing to the Foundation. 5. Grant Recipients Grants may be made to charities located anywhere in the United States that are recognized by the IRS as publicly-supported charities. Grants may not be made to private nonoperating foundations, to foreign organizations, to individuals or to a disqualified supporting organization. Additionally, grants may not be used to pay for membership fees, dues, tuition, benefit tickets or goods bought at auctions, nor may they be used to fulfill a pre-existing binding pledge to a charitable organization. The Foundation will not make any grants that violate Foundation Policies or that are in conflict of its charitable purposes or State or Federal statutes or regulations governing the DAF. 6. Minumum Amount for Grants The minimum grant amount is $500.00 per grant. If the amount of a grant recommendation exceeds the balance of a Donor-Advised Fund’s account, the Foundation will Chanticleer Foundation, Inc. - Policies and Proceedures - Page 9 of 32 make such grant (if approved) in an amount not to exceed the level of funds available in the Donor-Advised Fund’s account after current expenses, if any, have been paid. 7. Minimum Grant Activity The minimum grant distribution is 5% of the DAF balance as of January 1 of each year. The Foundation reserves the right to change this policy at any time to conform to Internal Revenue Service regulations or other regulations, if applicable. The Administrator shall determine the amount in each donor’s account as of January 1 of each year and shall communicate to each donor before March 1 of each year the required contribution amount for the year. The donor shall have until October 15 of each year to make recommendations to the Administrator as to charitable distributions. If no recommendations are made from the donor, the Administrator shall select a distribution of the minimum amount required to be made before the end of the year. 8. Inactive Account If the Donor, Grant Advisor and investment manager fail to take any activity in a particular DAF for a period of more than three years, the DAF will be declared inactive and the Foundation may place the DAF in an unrestricted account for general charitable purposes. F. Record Keeping and Reporting The Foundation’s policy is to provide written confirmation of contributions to every donor of a Donor-Advised Fund within a reasonable amount of time after each contribution. Contribution confirmations serve as receipts and should be kept with the donor’s tax records for IRS reporting. Consultation with the donor’s tax advisor should take place prior to claiming any deduction in connection with a contribution. IRS Form 8283 must be completed by the donor and filed with federal income tax returns for gifts of property valued at $500 or more. If the donor contributed and unmarketable asset to the Foundation, the Foundation will complete the “Donee Acknowledgment” section of an IRS Form 8283 submitted to the Foundation. Quarterly statements will be sent to the current Grant Advisor reflecting all contributions received, grants made and current investment holdings for the current year. Each report will document activity for the calendar year through the end of the quarter. Reports will show: 1. Current quarter figures, including: Beginning and ending asset values; Total contributions received during the year; and Total grants paid to charities during the year. 2. Details of contributions received from the donor during the current year, including: The amount of each contribution; The date on which the Foundation received each contribution; and The type of asset contributed. 3. Details of grants paid during the current year, including: The name of the recipient charity; The amount paid to each charity; and The date on which each grant was paid. G. Service Provider Chanticleer Foundation, Inc. - Policies and Proceedures - Page 10 of 32 The Foundation has retained Chanticleer Advisors, LLC to act as Administrator of the DAF’s and to perform certain accounting and administrative functions for the Foundation. H. Fees and Charges Each DAF will be assessed a proportional contribution to the operational needs of the Foundation’s office and programs in accordance with the most current rate structure which shall not exceed usual and customary rates. The Foundation has retained Chanticleer Advisors, LLC to provide administrative serviced for the Foundation. The current rate is and annual rate of 1% of the assets in each DAF assessed quarterly. As such, curently, each Donor-Advised Fund is subject to annual administration fees of 1% that are assessed quarterly (0.25% each quarter). The assets in each Donor-Advised Fund are typically in marketable securities and may also be charged a fee for investment. The Foundation reserves the right to charge additional fees for extraordinary or special services. A non-exclusive example of an extraordinary service is if the Fund (with prior Foundation approval) engages in fundraising activity or produces an event such as a golf tournament. No Fund, donor or Grant Advisor is permitted to solicit contributions without specific prior written authorization from the President of the Foundation. IV. POLICIES AND PROCEDURES KEYED TO THE DONOR-ADVISED FUNDS GUIDE SHEET A. PART I 1. The Foundation is an organization described in IRC 170(c)(2)(B) [a charitable organization] and the Foundation is not a governmental organization or a private foundation. 2. The Foundation maintains one or more accounts or funds that are both (1) separately identified by reference to the contribution of a donor, and (2) owned and controlled by the Foundation. 3. The donor, or a person appointed or designated by the donor, shall have, or shall reasonably expect to have, advisory privileges over the distribution or investments of the account or fund established with the donor’s contribution. 4a. The Foundation is not excepted from classification as a sponsoring organization because its accounts or funds consist of amounts that may only be distributed to a single identified organization or governmental entity as described in IRC 4966(d)(2)(B)(i). 4b. The Foundation is not excepted from classification as a sponsoring organization because its accounts or funds consist of amounts that may only be distributed as educational grants to individuals as described in IRC 4966(d)(2)(B)(ii). 4c. The Foundation is not excepted from classification as a sponsoring organization because its accounts or funds consist of amounts that may only be distributed as educational grants to individuals that are not excepted by IRC 4966(d)(2)(B)(ii) but made pursuant to a grant commitment entered into on or before August 17, 2006, as described in Notice 2006-109. 4d. The Foundation is not excepted from classification as a sponsoring organization because its accounts or funds consist of amounts that may only be distributed as employersponsored disaster relief funds as described in Notice 2006-109? B. PART II Chanticleer Foundation, Inc. - Policies and Proceedures - Page 11 of 32 1. The Foundation provides a copy of the fund agreement or contract that outlines the terms and conditions for participation by a contributor to a donor-advised fund. The approved fund agreement is attached as Attachment 4 and is subject to modification based upon changes in the law or upon advice of professional advisors. 2. The Foundation provides promotional or informational material that explains how the donor-advised fund operates. The promotional or informational material is attached as Attachment 5 and is subject to modification based upon changes in the law or upon advice of professional advisors. 3. The Foundation has an Internet site, and although the information is not yet posted on the site, the information will be posted after the IRS issues its determination letter and the Internet site information regarding the operation of donor-advised funds shall be consistent consistent with the written information provided as part of the IRC 501(c)(3) application process. 4. The Foundation specifically informs donors that they may not impose restrictions or conditions on the assets in their account. 5. Each donor shall receive a separate statement reporting account information about the donor’s account, including balances, investments, and distributions? 6a. The donor is permitted by the Foundation to provide recommendations as to charitable distributions made from the donor’s account. 6b. The Foundation shall review all donor recommendations for distributions. 6c. The Foundation has a criteria to help ensure that distributions will accomplish charitable purposes. The criteria (stated in Section V.E. of the Policies and Procedures) is as follows: 1. It is the primary goal of the Foundation that no distribution will in any way affect the Foundations status as and IRC 501(c)(3) exempt charitable organization or the status of the charitable contribution made by any donor to the CCF. As such The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that the recommendation is to an individual or entity to be used exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals. 2. The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that no part of the recommendation is to an individual or entity whose net earnings of which inures to the benefit of any private shareholder or individual. 3. The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that no substantial part of the activities of the recommendation is to an individual or entity of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in IRC 501(h)) and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 12 of 32 4. The Administrator shall report its findings to the Board for final approval If the Administrator or the Board is unsure as to whether the distribution will accomplish charitable purposes, the Administrator or the Board shall refer the matter to legal counsel for final opinion. 6d. The Foundation shall have final decision making authority on how distributions from a donor’s account are made. 6e. The procedures and criteria it will use to ensure that the assets in the DAF account are used to accomplish charitable purposes are set forth in Section 6.c. above and in Section V.E. of the Policies and Procedures. 7a. The donor shall not have the ability to select investment options from a list of pre-approved options. Investment options shall be a matter between the donor and the investment advisor on the donor’s DAF 7b. The Foundation shall not provide the donors with a list of pre-approved investment options. 7c. In that the Foundation will not providing investment options the Foundation will have no need to explain how the assets in the funds will be used to accomplish charitable purposes in light of the investment options. 8a. account. The donor shall have the ability to recommend investment options for the donor’s 8b. The foundation shall explain to the donor how it evaluates whether to approve or deny an investment option selected by a donor as follows (stated in Section V.F. of the Policies and Procedures): 1. the investment manager on the donors account shall inform the Administrator of the investment options selected by the investment manager and donor; 2. Administrator shall ensure that the option is not violative of any statutes, rules and regulation governing the DAF; 3. The Administrator will ensure that the investment option complies with the Investment Policy for the Chanticleer Foundation, Inc.; 4. The Administrator shall report its findings to the Board for final approval If the Administrator or the Board is unsure as to whether the investment options are proper, the Administrator or the Board shall refer the matter to legal counsel for final opinion. 8c. The Foundation has the final decision-making authority on how investments from a donor’s account are made. 9. account. The donor shall have the ability to select successor advisors for the donor’s 10a. There are provisions in the fund agreement for investments and distributions if a donor’s account is inactive (see Section VII.E.8 of the Fund Agreement). Chanticleer Foundation, Inc. - Policies and Proceedures - Page 13 of 32 10b. The Foundation has explained how often the donor is required to provide advisory recommendations, and what happens if the donor does not offer any advisory recommendations (see Section VII.E.7 and VII.E.8 of the Fund Agreement). 11a. The Foundation does not require a minimum yearly distribution across all DAFs. 11b. The Foundation does require a minimum yearly distribution from each DAF. 11c. The Foundation does described its minimum yearly distribution from each DAF as being 5% of the value of the account as of January 1, of the distribution year. 11d. The Foundation explains its mechanism to ensure that a minimum annual distribution from a donor’s account is made as follows (See Section II.E.& of the Policies and Procedures): 1. The Administrator shall determine the amount in each donor’s account as of January 1 of each year and shall communicate to each donor before March 1 of each year the required contribution amount for the year. 2. The donor shall have until October 15 of each year to make recommendations to the Administrator as to charitable distributions. If no recommendations are made from the donor, the Administrator shall select a distribution of the minimum amount required to be made before the end of the year. 11e. The Foundation required yearly minumum distributions so as such will fulfill its tax exempt purpose including making distributions. C. PART III 1a. The Foundation does not yet have an agreement or arrangement with any investment or financial company to invest its assets. 1b. Although there is no agreement yet in effect, the Foundation has identified Chanticleer Holdings, LLC as a potential approved investment or financial company. 1c. The Foundation has described its policies and procedures to ensure that it will not permit excessive brokerage fees, such as the buying and selling of securities on a frequent basis in order to earn brokerage commissions at the expense of serving charitable purposes. The Investment Policy is attached as Attachment 6. 1d. The Foundation and Chanticleer Holdings, LLC does have a common Board member, namely Michael Pruitt. 1e. The Foundation and Chanticller Holdings, LLC will not share office space, common phone numbers, promotional literature, or common Internet addresses. 1f. Not applicable. 1g. Although the Foundation is not required to use the investment advisor recommended by the donor, the Foundation will consider the investment advisor recommended by the donor so long as the investment advisor agrees to the policies and proceedures of the Foundation. If the donor does not recommend a financial advisor, or if the financial advisor does not agree to comply with the policies and proceedures of the Foundation, the Foundation will Chanticleer Foundation, Inc. - Policies and Proceedures - Page 14 of 32 select the investment advisor. The Foundation will use a competitive bidding process for selecting approved investment advisors and the Board will audit the investment advisors on a yearly basis to ensure that private interests are not being served more than incidentally. 2. Not applicable. 3. The Foundation may make distributions from its donor-advised funds to any natural person (i.e., a live person rather than a corporation, trust, partnership, or other artificial legal entity). 4a. With respect to distributions from its donor-advised funds, donors will not be allowed to recommend grants to individuals for travel, study, or other similar purposes. 4b. Not applicable. 5a. With respect to distributions from its donor-advised funds, will donors will not be allowed to recommend grants for employer-sponsored disaster relief funds. 5b. Not applicable. 6. The Foundation may make distributions from its donor-advised funds to any other person (i.e., corporation, trust, estate, partnership, or association). 7. With respect to distributions from its donor-advised funds to other organizations, the Foundation will make distributions to IRC 170(b)(1)(A) organizations. 8a. With respect to distributions from its donor-advised funds to other organizations, the Foundation may make distributions to supporting organizations defined in IRC 509(a)(3) so long as they are not disqualifying organizations (see Attachment 1 for guidance). 8b. The Foundation will only make distributions to supporting organizations defined in IRC 509(a)(3) that are Type I, Type II, or functionally integrated Type III supporting organizations and where the donor who has advisory rights does not directly or indirectly control the recipient supported organization. 9. With respect to distributions from its donor-advised funds to other organizations, will the organization may make distributions to the sponsoring organization of such donoradvised fund, or to another donor-advised fund? 10. With respect to distributions from its donor-advised funds to other organizations, will the Foundation will not make distributions from its donor-advised funds solely to a single identified organization or governmental entity, 11a. Apart from distributions specified by questions 7 through 10, the Foundation may make distributions to other organizations 11b. Any distribution to other organizations will distribution be for a purpose specified in IRC 170(c)(2)(B) (i.e., a charitable purpose). 11c. With respect to other organizations, if the Foundation decides to make grants to restricted organizations, the Foundation will exercise expenditure responsibility as described in IRC 4945(h) with respect to such distributions (see Attachment 2 for guidance). Chanticleer Foundation, Inc. - Policies and Proceedures - Page 15 of 32 12. The Foundation has attached a copy of policies and procedures that it has adopted to ensure that it will not permit the distribution of funds from its donor-advised funds to be used to directly or indirectly provide more than an incidental benefit to any donor, donor advisor, or related person. The policy is set forth in Section V.G. of this Policy and Procedure. 13. The Foundation has attached a copy of policies and procedures that it has adopted to prohibit distributions from donor-advised funds in the form of grants, loans, compensation, or other similar payments, including expense reimbursements, to the donor, donor advisor, a member of the donor or donor advisor’s family, or a 35% controlled entity of the aforementioned. The policy is set forth in Section V.G. of this Policy and Procedure. 14. The Foundation has attached a copy of policies and procedures that it has adopted to prohibit excess benefit transactions from donor-advised funds to donors or donor advisors (or related persons) and from sponsoring organizations to investment advisors (or related persons). The policy is set forth in Section V.H. of this Policy and Procedure. SPECIFIC POLICIES AND PROCEDURES V. A. Avoidance of Excise and other Taxes on Distributions The Foundation will monitor distributions the ensure that they are not taxable or the excise taxes are not assessed. The following guidelines shall be followed. 1. IRC 4966 a. IRC 4966 imposes a 20% excise tax on taxable distributions made by a sponsoring organization. In addition, a 5% excise tax applies to a fund manager who makes a taxable distribution knowing that it is a taxable distribution. b. Taxable distributions include any distribution by a sponsoring organization from a donoradvised fund account if the distribution is (1) to any natural person (i.e., individual), or (2) to any other person (i.e., estate, partnership, association, company, or corporation) if the distribution is not for a charitable purpose, or if the sponsoring organization does not exercise expenditure responsibility in accordance with IRC 4945(h). Exception: Distributions to IRC 170(b)(1)(A) organizations (other than to disqualifying supporting organizations) are not taxable distributions. • Disqualifying supporting organizations are Type III non-functionally integrated supporting organizations and Type I, Type II, and functionally integrated Type III supporting organizations where the donor or donor advisors directly or indirectly control the supported organization. In addition, the Secretary may determine by regulations that a distribution to such organization otherwise is inappropriate. (Distributions to these entities do not meet the exception and are likely taxable distributions.) • Type I, Type II, and functionally integrated Type III supporting organizations are not disqualifying supporting organizations, provided the donor or any person designated by the donor for the purpose of providing advice to the donor-advised fund does not directly or indirectly control the supported organization. (Under these circumstances, distributions to these entities would meet the exception and generally not be taxable distributions.) Chanticleer Foundation, Inc. - Policies and Proceedures - Page 16 of 32 Exception: Distributions from a donor-advised fund to the sponsoring organization of such donoradvised fund, or to any other donor-advised fund, are not taxable distributions. 2. IRC 4967 a. IRC 4967 applies a 125% excise tax on a donor, donor advisor, or related person who gives advice to have a sponsoring organization make a distribution from a donor-advised fund, which results in such person receiving, directly or indirectly, a more than incidental benefit as a result of such distribution. The tax does not apply if a tax has already been imposed with respect to such distribution under IRC 4958. In addition, a 10% excise tax applies to a fund manager who makes a taxable distribution knowing that it is a taxable distribution. b. A benefit is more than incidental if, as a result of a distribution from a DAF, such person receives a benefit that would have reduced or eliminated a charitable contribution deduction if the benefit was received as part of the transaction. See Staff of the Joint Committee on Taxation, Technical Explanation of H.R. 4, The "Pension Protection Act of 2006" as Passed by the House on July 28, 2006, and as Considered by the Senate on August 3, 2006 (JCX-3806) at 350. 3. IRC 4943(e) IRC 4943(e) applies the taxes on excess business holdings applicable to private foundations to donor-advised funds. The tax is equal to 10% of the value of the excess business holdings. If the excess business holdings are not disposed of within a specified time period, an additional tax of 200% of the excess holdings is imposed. The rule applies to taxable years beginning after August 17, 2006. B. Avoidance of Excess Benefit Transaction 1. IRC 4958 a. Under the provision, any grant, loan, compensation, or other similar payment from a donoradvised fund to a person that with respect to such fund is a donor, donor advisor, or a person related to a donor or donor advisor is automatically treated as an excess benefit transaction under section 4958, with the entire amount paid to any such person treated as the amount of the excess benefit. IRC 4958(c)(2). b. "Other similar payments" include payments in the nature of a grant, loan, or payment of compensation, such as an expense reimbursement. See Staff of the Joint Committee on Taxation, Technical Explanation of H.R. 4, The "Pension Protection Act of 2006" as Passed by the House on July 28, 2006, and as Considered by the Senate on August 3, 2006 (JCX-3806) at 347. c. Other similar payments do not include, for example, payments pursuant to bona fide sales or leases of property. Id. However, these transactions are still subject to the general rules of section 4958: As donors and donor advisors are disqualified persons with respect to DAFs, they may be subject to IRC 4958 taxes if they engage in " excess benefit transactions," as defined in §4958(c)(1). See IRC 4958(f)(1)(E). As investment advisors are disqualified persons with respect to sponsoring organizations, they may be subject to §4958 taxes if they engage in "excess benefit transactions," as defined in section 4958(c)(1). See IRC 4958(f)(1)(F). Chanticleer Foundation, Inc. - Policies and Proceedures - Page 17 of 32 C. Disclosure Pursuant to IRC 508(f) IRC 508(f) requires that a sponsoring organization notify the Secretary that it maintains or intends to maintain donor-advised funds, including the manner in which it plans to operate such funds. Rules implementing disclosure of this information have not yet been issued but will be complied with by the Foundation when issued. D. Exemption Issues The Foundation will ensure that the DAF’s do not take any action that would result in a loss of the exemption under IRC 501(c)(3). The Following guidelines will be considered. 1. Although donors or their advisors may provide advice or recommendations with regard to fund distributions and investments, to be consistent with exemption under IRC 501(c)(3), the charities maintaining the funds must have the ultimate authority over how the assets in the funds are invested and distributed. If a donor or his advisor continues to exercise control over amounts contributed, it might be found that sponsoring charities do not have legal ownership and control of the assets following the contribution. (In the case of a community foundation, the contribution may be treated as being subject to a material restriction or condition by the donor). See Staff of the Joint Committee on Taxation, Technical Explanation of H.R. 4, The "Pension Protection Act of 2006" as Passed by the House on July 28, 2006, and as Considered by the Senate on August 3, 2006 (JCX-38-06) at 340. 2. The IRS has been concerned that some donors or related parties are exerting excess control or receiving undue benefits from a donor-advised fund. For example, some donors to donor-advised funds participate in schemes that allow them to regain the assets they contribute to their donor-advised funds. Assets in a donor-advised fund have been used to — partially pay for a grant to a public charity and partially pay for goods and services provided to the donor by the grant recipient; provide "educational" loans to members of the donor’s family; pay for donor travel expenses that are not substantially related to a charitable purpose. For exemption purposes, the concern is whether the sponsoring organization has sufficient procedures and governance to ensure that the assets in its donor-advised funds accomplish charitable purposes, are used exclusively for charitable purposes, and not for an impermissible private benefit. For example: Does the sponsoring organization allow donors to place limitations on the amounts that may be distributed from funds? These types of limitations may indicate that the assets in the account are not being used primarily to accomplish charitable purposes. Does the sponsoring organization permit investments in closely held corporations, limited partnerships, or limited liability corporations? These types of investments could be an indicator that the sponsoring organization is serving the private interests of its donors. Does the sponsoring organization allow the assets in its donor-advised funds to be used for fundraising events, for travel, or for other types of administrative items? This could mean that the assets in the donor-advised funds are being used to subsidize the donor’s lifestyle rather than being used primarily to accomplish charitable purposes. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 18 of 32 3. If donors have placed a material restriction on amounts transferred to a donor-advised fund, the sponsoring organization may be receiving donors’ assets in trust rather than as the owner. Amounts received in trust would not qualify as public support for purposes of qualifying as a publicly supported organization under IRC 509(a)(1)/170(b)(1)(A)(vi) or IRC 509(a)(2). 4. The Internal Revenue Service has been interested in whether donor-advised funds should be required to distribute for charitable purposes a specified amount in order to ensure that the sponsoring organization with respect to the fund is operating consistent with the purposes or functions constituting the basis for its exemption. See Notice 2007-21, 2007-9 I.R.B. 611, Study on Donor-Advised Funds and Supporting Organizations. 5. The IRS has also been interested in whether a donor-advised fund engages knowledgeable individuals to review donor distribution and investment recommendations. E. Criteria to help ensure that distributions will accomplish charitable purposes. The criteria is as follows: 1. It is the primary goal of the Foundation that no distribution will in any way affect the Foundations status as and IRC 501(c)(3) exempt charitable organization or the status of the charitable contribution made by any donor to the CCF. As such The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that the recommendation is to an individual or entity to be used exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals. 2. The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that no part of the recommendation is to an individual or entity whose net earnings of which inures to the benefit of any private shareholder or individual. 3. The Administrator, currently Chaticleer Advisors, LLC, will review each donor recommendation to ensure that no substantial part of the activities of the recommendation is to an individual or entity of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in IRC 501(h)) and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office. 4. The Administrator shall report its findings to the Board for final approval If the Administrator or the Board is unsure as to whether the distribution will accomplish charitable purposes, the Administrator or the Board shall refer the matter to legal counsel for final opinion. F. Approval of Investment Options The foundation shall explain to the donor how it evaluates whether to approve or deny an investment option selected by a donor as follows: 1. the investment manager on the donors account shall inform the Administrator of the investment options selected by the investment manager and donor; 2. Administrator shall ensure that the option is not violative of any statutes, rules and regulation governing the DAF; Chanticleer Foundation, Inc. - Policies and Proceedures - Page 19 of 32 3. The Administrator will ensure that the investment option complies with the Investment Policy for the Chanticleer Foundation, Inc.; 4. The Administrator shall report its findings to the Board for final approval If the Administrator or the Board is unsure as to whether the investment options are proper, the Administrator or the Board shall refer the matter to legal counsel for final opinion. G. Policy and Procedure to Ensure that it will not Permit the Distribution of Funds From its Donor-Advised Funds to be Used to Directly or Indirectly Provide More Than an Incidental Benefit to Any Donor, Donor Advisor, or Related Person. IRC 4967 applies a 125% excise tax on a donor, donor advisor, or related person who gives advice to have a sponsoring organization make a distribution from a donor-advised fund, which results in such person receiving, directly or indirectly, a more than incidental benefit as a result of such distribution. A benefit is more than incidental if, as a result of a distribution from a DAF, such person receives a benefit that would have reduced or eliminated a charitable contribution deduction if the benefit was received as part of the transaction. See Staff of the Joint Committee on Taxation, Technical Explanation of H.R. 4, The "Pension Protection Act of 2006" as Passed by the House on July 28, 2006, and as Considered by the Senate on August 3, 2006 (JCX-38-06) at 350. The following procedure will be employed to ensure that the funds to be used do not directly or indirectly provide more than an incidental benefit to any donor, donor advisor, or related person: 1. The Administrator will identify all "Disqualified persons" with respect to a donor-advised fund as follows: A donor or any person appointed or designated by a donor (donor advisor) who has, or reasonably expects to have, advisory privileges with respect to the distribution or investment of amounts held in a donor-advised fund by reason of the donor’s status as a donor. IRC §4958(f)(7)(A) (cross-referencing IRC 4966(d)(2)(A)(iii)); A member of the family of an individual described above. IRC §4958(f)(7)(B); A 35% controlled entity. IRC § 4958(f)(7)(C) (cross-referencing §4958(f)(3)). 2. Unless the Administrator is familiar with the organization that the grant is being made and that such organization does not provide more that an incidential benefit to any donor, donor advisor or related person, the Administrator will require and affidavit from the organization that the funds do not benefit any donor, donor advisor or related person or that it is a A 35% controlled entity. IRC § 4958(f)(7)(C) (cross-referencing §4958(f)(3)). H. The Policy and Procedures to Prohibit Excess Benefit Transactions from Donor-advised Funds to Donors or Donor advisors (or related persons) and from Sponsoring Organizations to Investment Advisors (or related persons). Under the provisions of IRC 4958, any grant, loan, compensation, or other similar payment from a donor-advised fund to a person that with respect to such fund is a donor, donor advisor, or a person related to a donor or donor advisor is automatically treated as an excess benefit transaction under section 4958, with the entire amount paid to any such person treated as the amount of the excess benefit. IRC 4958(c)(2). "Other similar payments" include payments in the nature of a grant, loan, or payment of compensation, such as an expense reimbursement. See Staff of the Joint Committee on Taxation, Technical Explanation of H.R. 4, The "Pension Protection Act of 2006" as Passed by the House on July 28, 2006, and as Considered by the Senate on August 3, 2006 (JCX-38-06) at 347. Other similar payments do not include, for example, payments pursuant to bona fide sales or leases of property. Id. However, these transactions are still subject to the general rules of section 4958: Chanticleer Foundation, Inc. - Policies and Proceedures - Page 20 of 32 As donors and donor advisors are disqualified persons with respect to DAFs, they may be subject to IRC 4958 taxes if they engage in " excess benefit transactions," as defined in §4958(c)(1). See IRC 4958(f)(1)(E). As investment advisors are disqualified persons with respect to sponsoring organizations, they may be subject to §4958 taxes if they engage in "excess benefit transactions," as defined in section 4958(c)(1). See IRC 4958(f)(1)(F). The Administrator will ensure that for each DAF, does not engage in any excess-benefit transactions in that the Foundation will not permit any grant, loan, compensation, or other similar payment from a donor-advised fund to a person that with respect to such fund is a donor, donor advisor, or a person related to a donor or donor advisor. THESE POLICIES AND PROCEDURES were approved and adopted by the Chanticleer Foundation Inc. on the 15th day of April 2010. Chanticleer Foundation, Inc. Secretary Chanticleer Foundation, Inc. - Policies and Proceedures - Page 21 of 32 Attachment 1 Section 509(a)(3) Supporting Organizations Supporting organizations are charities that carry out their exempt purposes by supporting other exempt organizations, usually other public charities. The classification is important because it is one means by which a charity can avoid classification as a private foundation, a status that is subject to a much more restrictive regulatory regime. The key feature of a supporting organization is a strong relationship with an organization it supports. The strong relationship enables the supported organization to oversee the operations of the supporting organization. Therefore, the supporting organization is classified as a public charity, even though it may be funded by a small number of persons in a manner similar to a private foundation. Examples: University endowment funds and organizations that provide essential services for hospital systems. Like all charitable organizations, a supporting organization must be organized and operated exclusively for purposes described in section 501(c)(3). A supporting organization must also be organized and operated exclusively to support specified supported organizations. Moreover, a supporting organization must have one of three relationships with the supported organizations, all of which are intended to ensure that the supporting organization is responsive to the needs or demands of the supported organization and intimately involved in its operations and that the public charity is motivated to be attentive to the operations of the supporting organization. Type I supporting organizations are operated, supervised, or controlled by the supported organization. Type II supporting organizations are supervised or controlled in connection with the supported organization. Type III supporting organizations are operated in connection with the supported organization. Because Type III relationships are less formal than a Type I or Type II relationship, Type III organizations must meet a responsiveness test and an integral part test. These tests are designed to ensure that the supporting organization is responsive to needs of a public charity and that the public charity oversees the operations of the supporting organization. Finally, the supporting organization must not be controlled directly or indirectly by disqualified persons. Some promoters have encouraged individuals to establish and operate supporting organizations described in section 509(a)(3) for their own benefit. A common theme of such abusive transactions is a charitable donation of an amount to the supporting organization, and a return of the donated amounts to the donor, often in the form of a loan. To disguise the abuse, the transaction may be routed through more intermediary organizations controlled by the promoter. Because of these abuses, Congress imposes additional restrictions on certain supporting organizations. Organizations that operate for the personal benefit of their founders are not operated exclusively for purposes described in section 501(c)(3). Where part of an organization’s net earnings inures to the benefit of private persons or where more than an insubstantial part of its activities benefits private interests, the organization will fail to qualify. In addition, excise taxes may be imposed on its disqualified persons and organization managers. Even where the organization does not operate for the personal benefit of its founder, it may not qualify for section 509(a)(3) classification because- It is controlled by disqualified persons. It is not be sufficiently responsive to the needs or demands of a supported public charity. It does not maintain a significant involvement in the affairs of a specified publicly supported charity. A specified public charity might not be motivated to be attentive to its operations. Loss of section 509(a)(3) classification means that the organization would be classified as a private foundation, subject to private foundation excise taxes . Chanticleer Foundation, Inc. - Policies and Proceedures - Page 22 of 32 Chanticleer Foundation, Inc. - Policies and Proceedures - Page 23 of 32 Attachment 2 Expenditure Responsibility A foundation may make grants to restricted organizations if it exercises expenditure responsibility, i.e., if it follows the procedures prescribed in tax regulations relating to grants to organizations. I.R.C. § 4945(h). The procedures are as delineated in the following paragraphs: a. Pre-grant Inquiry: Prior to making a grant to a restricted organization, the foundation must investigate the grantee organization to reasonably assure itself that the grantee will use any funds distributed to it by the foundation for the purposes specified by the foundation. Treas. Reg. § 53.4945-5(b)(2). Any pre grant inquiry should address the identity, prior history and experience (if any) of the grantee organization and its managers, and it should also take into account any other information which the foundation can reasonably rely upon concerning the management, activities and practices of the grantee organization. According to the regulations “the scope of the inquiry might be expected to vary from case to case depending on the size, the purpose of the grant, the period over which it is to be paid, and the prior experience which the grantor has had with respect to the capacity of the grantee to use the grant for proper purposes.” Treas. Reg. § 53.4945-5(b)(2)(i). b. Terms of Grants: Any grant to a restricted organization must be made pursuant to a “written commitment signed by an appropriate officer, director or trustee of the grantee organization.” Treas. Reg. § 53.4945-5(b)(3). The grantee must agree to the following: to repay any unexpended portion of the grant; to submit full and complete annual reports in the manner on which any grant has been expended; to maintain records of expenditures of the grants; to allow the foundation to inspect such records; to refrain from using any funds to carry on propaganda or otherwise influence legislation; to refrain from influencing a public election or carry on a voter registration drive; to refrain from expending any granted funds in a way that does not comply with rules relating to taxable expenditures; and to refrain from using the grant for any noncharitable purpose. The written agreement must also clearly state the charitable purpose of the grant. c. Reports from Grantees: Pursuant to the written agreement, the grantee organization must make an annual report to the foundation. Treas. Reg. § 53.4945-5(c). The report must address the use of the funds, compliance with the terms of the grant and the progress made by the grantee toward achieving the purposes for which the grant was made. The report must be made within “a reasonable period” after the close of the grantee’s accounting year. The foundation need not conduct any independent audit of expenditures. The foundation may require the grantee to segregate the grant funds from the grantee’s other funds. Where the grantee provides adequate records and other sufficient evidence of the use of the grant, the foundation may rely on such records. d. IRS Reporting Requirements: If during a taxable year a foundation exercises expenditure responsibility over any grant, it must provide a report to the IRS attached to its annual tax return, Form 990-PF. Treas. Reg. § 53.4945-5(d). The report to the IRS must contain the following elements: the name and address of the grantee, the date and amount of the grant, the purpose of the grant, the amounts expended by the grantee, whether the grantee has diverted any portion of the funds from the purpose of the grant, the dates of any reports received from the grantee and the date and results of any verification of the grantee’s reports. e. Recordkeeping Requirements: In addition to the yearly reporting requirement, the foundation must make available to the IRS upon request the following documentation: a copy of the agreement between the foundation and the grantee organization, a copy of the grantee Chanticleer Foundation, Inc. - Policies and Proceedures - Page 24 of 32 organization’s yearly expenditure report, and a copy of any results of any investigation conducted by the foundation. Treas. Reg. § 53.4945-5(d)(3). f. Diversions of Funds by the Grantee: If the grantee diverts any funds over which the foundation exercises expenditure responsibility, the amount diverted is a taxable expenditure, unless the foundation takes appropriate action. Treas. Reg. § 53.4945-5(e). The foundation must take reasonable and appropriate steps to either recover the diverted funds or ensure that such funds are restored to their original purpose. The foundation must also withhold any further payments to the grantee until it has received assurances that the grantee will not divert any future grants, and has required the grantee to take “extraordinary precautions” to prevent future diversions from occurring. g. Grantee Failure to Make Reports: If the grantee organization fails to report the details of the expenditure of any funds granted to it by the foundation, the grant will be treated as a taxable expenditure unless the grantor has adhered to all requirements listed above, reasonably attempted to obtain the required reports, and withhold any future payments until such report is provided. Treas. Reg. § 53.4945-5(e)(2). In summary, a grant to a restricted organization by a foundation will be treated as a taxable expenditure if the granting foundation does not make a pre-grant inquiry, does not make the grant in conformance with the above requirements, or fails to report to the IRS. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 25 of 32 Attachment 3 Donor Advised Fund Application DONOR ADVISED FUND APPLICATION The Chanticleer Charitable Fund (“CCF”) is a Donor-Advised Fund (“DAF”) program offered by Chanticleer Foundation, Inc., a South Carolina non-profit corporation organized on October 26, 2009. (the “Foundation”). The Foundation has filed an application to be a public charity described in §§501(c)(3), 509(a)(1) and 170 (b)(1)(A)(vi) of the Internal Revenue Code of 1986, as amended (the “Code”). CCF offers donors the opportunity to make immediately deductible charitable contributions while retaining some influence over the charitable purposes for which those contributions are ultimately used. A. DONOR-ADVISED FUND INFORMATION Your fund can be named after you or your family, or it can reflect an area of interest to you (e.g. John Donor Family Fund, or the Donor Fund for the Arts). Unless you choose to remain anonymous, the name of your fund will be used in correspondence to the charitable organizations that receive grants from the fund. The words "trust", "foundation", or "endowment" cannot be used in your fund name. B. DONOR INFORMATION Donor of Record: Street Address: Mailing Address: Telephone Number: Cell Phone: Facsimile Number: e-mail: Date of Birth: Social Security #: Reports will be mailed to the Donor of Record only. Chanticleer Foundation, Inc. - Policies and Proceedures - Page 26 of 32 Additional donors: Donor: Street Address: Mailing Address: Telephone Number: Cell Phone: Facsimile Number: e-mail: Date of Birth: Social Security #: Donor: Street Address: Mailing Address: Telephone Number: Cell Phone: Facsimile Number: e-mail: Date of Birth: C. Social Security #: PROPOSED CONTRIBUTION TYPE (Check Type or Types): Cash Description: Stocks Description: Mutual Funds Description: Real Estate Description: Closely-held Businesses Description: IRA’s Description: Bequests Description: Trust Interests Description: Life Insurance Description: Other Description: Chanticleer Foundation, Inc. - Policies and Proceedures - Page 27 of 32 D. PROPOSED INVESTMENT MANAGER You may recommend an investment manager for your fund; however, final selection will be made by Renaissance Charitable Foundation Inc. All managers retained by the Foundation must adhere to the Foundation's investment policies. If you do not recommend a manager, the Foundation will appoint one for your fund. Name: Street Address: Mailing Address: Telephone Number: Cell Phone: Facsimile Number: e-mail: E. PROPOSED ADVISORY GRANT RECOMMENDATIONS You may make advisory grant recommendations from fund; however, such recommendation is advisory only and Chanticleer Foundation Inc. has the right to make final determinations as to grants. Advisory Grant Recommendation: Advisory Grant Recommendation: Advisory Grant Recommendation: F. PROPOSED SUCCESSOR INFORMATION The donor's successors shall have the right to make grant recommendations. Donors have two (2) alternative successor options: To name an individual to succeed the donor as the advisor of the donor-advised fund; or To recommend that, upon the death of the fund's last surviving advisor (including all named successors), the fund supports one (1) or more charitable organizations described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended (the "Code"), and that are not private foundations within the meaning of Code Section 509(a). (Please list additional charitable organizations and the percent they are to receive.) Successors may be appointed or changed at any time by submitting an Account Information Change form. As Donor of Record, I hereby name the following person as my successor: Successor: Street Address: Mailing Address: Telephone Number: Cell Phone: Chanticleer Foundation, Inc. - Policies and Proceedures - Page 28 of 32 Facsimile Number: Date of Birth: e-mail: Social Security #: If the Application is approved, a Fund Agreement will be forwarded to you for your signature and more information will be provided to allow you to fund your DAF. Donor of Record Signature: Date: Please forward the completed Application to the following: Chanticleer Foundation, Inc. 11220 Elm Lane, Suite 203 Charlotte, NC 28277 Facsimile Number: (704) 366-2463 Chanticleer Foundation, Inc. - Policies and Proceedures - Page 29 of 32 Attachment 4 Donor Advised Fund Agreement Chanticleer Foundation, Inc. - Policies and Proceedures - Page 30 of 32 Attachment 5 Information Chanticleer Foundation, Inc. - Policies and Proceedures - Page 31 of 32 Attachment 6 Investment Policy Chanticleer Foundation, Inc. - Policies and Proceedures - Page 32 of 32