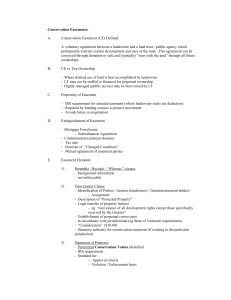

Contracts - Neustadter - 1998 Spr - outline 1

advertisement