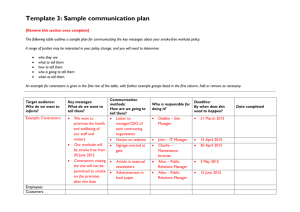

1 This is heading One

advertisement