Accounting Cycle Adjustments Tutorial

advertisement

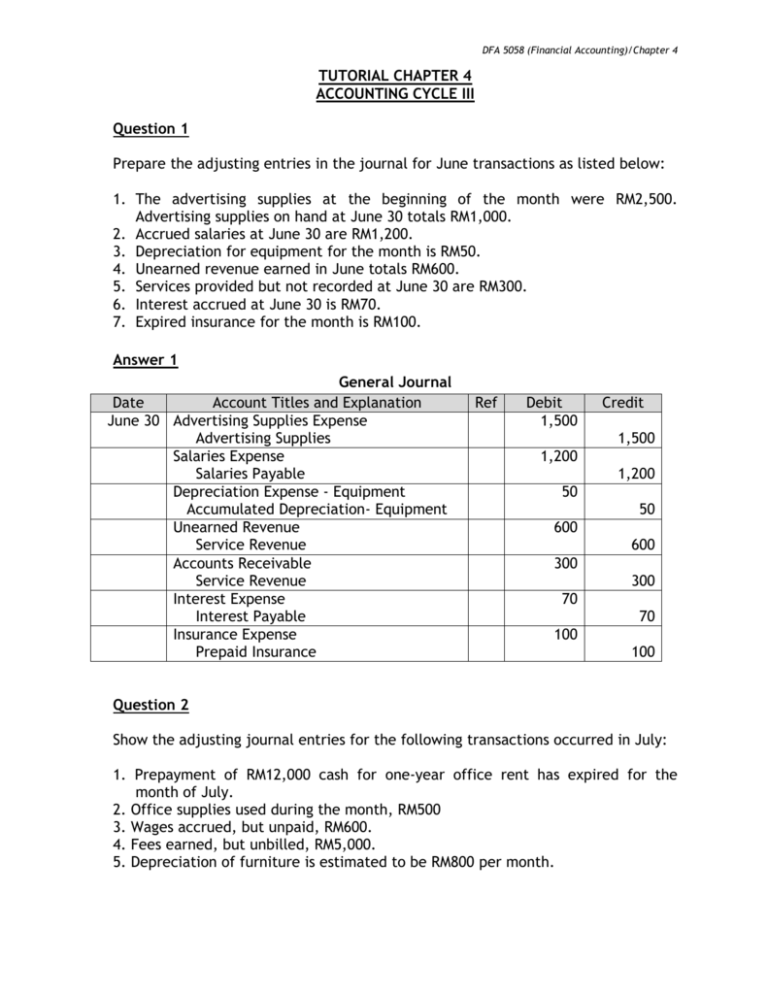

DFA 5058 (Financial Accounting)/Chapter 4 TUTORIAL CHAPTER 4 ACCOUNTING CYCLE III Question 1 Prepare the adjusting entries in the journal for June transactions as listed below: 1. The advertising supplies at the beginning of the month were RM2,500. Advertising supplies on hand at June 30 totals RM1,000. 2. Accrued salaries at June 30 are RM1,200. 3. Depreciation for equipment for the month is RM50. 4. Unearned revenue earned in June totals RM600. 5. Services provided but not recorded at June 30 are RM300. 6. Interest accrued at June 30 is RM70. 7. Expired insurance for the month is RM100. Answer 1 General Journal Date Account Titles and Explanation June 30 Advertising Supplies Expense Advertising Supplies Salaries Expense Salaries Payable Depreciation Expense - Equipment Accumulated Depreciation- Equipment Unearned Revenue Service Revenue Accounts Receivable Service Revenue Interest Expense Interest Payable Insurance Expense Prepaid Insurance Ref Debit 1,500 Credit 1,500 1,200 1,200 50 50 600 600 300 300 70 70 100 100 Question 2 Show the adjusting journal entries for the following transactions occurred in July: 1. Prepayment of RM12,000 cash for one-year office rent has expired for the month of July. 2. Office supplies used during the month, RM500 3. Wages accrued, but unpaid, RM600. 4. Fees earned, but unbilled, RM5,000. 5. Depreciation of furniture is estimated to be RM800 per month. DFA 5058 (Financial Accounting)/Chapter 4 Answer 2 General Journal Date Account Titles and Explanation Jul 31 Rent Expense (12,000/12) Prepaid Rent Supplies Expense Supplies Wages Expense Wages Payable Accounts Receivable Fees Revenue Depreciation Expense - Furniture Accumulated Depreciation – Furniture Ref Debit 1,000 Credit 1,000 500 500 600 600 5,000 5,000 800 800 Question 3 The schedule presents the trial balance for Team Cafe at the end of the fiscal year. The following information is available to assist in the preparation of adjusting entries: Team Cafe Trial Balance December 31, 2010 Cash Account receivable Supplies Prepaid rent Prepaid Insurance Equipment Accumulated depreciation- equipment Account payable Unearned internet fees Common stock Retained earnings Dividends Internet fees Wage expenses Rent expenses Utility expenses Total Debit (RM) 1,300 700 200 400 600 9,100 Credit (RM) 400 500 900 1,500 1,000 8,000 22,700 3,500 2,000 1,200 RM 27,000 RM 27,000 The following information is available to assist in the preparation of adjusting entries: a. An inventory of supplies reveals RM100 still on hand. b. Prepaid insurance consists of a two-year policy purchased on July 1, 2010. c. Depreciation on equipment is estimated to be RM 500. d. Accrued wages are RM100 on December 31. DFA 5058 (Financial Accounting)/Chapter 4 e. Accrued utility expenses RM 300. f. One-third of the unearned internet fees have been earned by December 31. g. Management estimates income taxes for the year to be RM 2,500. Instructions a) Prepare the adjusting entries. b) Prepare the adjusted trial balance. Answer 3 Team Cafe General Journal Date Account Titles and Explanation Ref Dec 31 Supplies Expense Supplies Insurance Expense Prepaid Insurance Depreciation Expense – Equipment Accumulated Depreciation – Equipment Wages Expense Wages Payable Utilities Expense Utilities Payable Unearned Internet Fee Internet Fee Revenue Income Taxes Expense Income Taxes Payable Debit 100 Credit 100 150 150 500 500 100 100 300 300 300 300 2,500 2,500 Team Cafe Trial balance December 31,2010 Cash Account receivable Supplies Prepaid insurance Prepaid rent Equipment Accumulated. Depreciation - Equipment Account Payable Income taxes payable Unearned internet fees Wages payable Utility payable Common stock Retained earnings Dividends Internet fees revenue DEBIT (RM) 1,300 700 100 450 400 9,100 CREDIT (RM) 900 500 2,500 600 100 300 1,500 1,000 8,000 23,000 DFA 5058 (Financial Accounting)/Chapter 4 Wages expense Income taxes expense Rent expense Utility expense Depreciation expense Insurance expense Supplies expense 3,600 2,500 2,000 1,500 500 150 100 RM 30,400 RM 30,400 Question 4 Lina Rig started her own consulting firm, Excellent Consulting, on May 1, 2011. The trial balance at May 31 is as follows. Excellent Consulting Trial Balance 31 May 2011 Debit (RM) 7,700 4,000 1,500 2,400 12,000 Cash Accounts Receivable Supplies Prepaid Insurance Office Furniture Accounts Payable Unearned Service Revenue Lina, Capital Service Revenue Salaries Expense Rent Expense Credit (RM) 3,500 3,000 19,100 6,000 3,000 1,000 RM 31,600 RM 31,600 Other data 1. RM500 of supplies have been used during the month. 2. Travel expense incurred but not paid on May 31, 2010, RM200. 3. The insurance policy is for 2 years. 4. RM1,000 of the balance in the unearned service revenue account remains unearned at the end of the month. 5. Accrued salary expenses at 31 May, RM500. 6. The office furniture is being depreciated at RM200 per month for 60 months. 7. Invoices representing RM1,000 of services performed during the month have not been recorded as of May 31. Instructions a) Prepare the adjusting entries for the month of May. b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. c) Prepare an adjusted trial balance at 31 May 2011. Answer 4 Excellent Consulting DFA 5058 (Financial Accounting)/Chapter 4 General Journal Date Account Titles and Explanation May 31 Supplies Expense Supplies Travel Expense Travel Payable Insurance Expense (2,400/24) Prepaid Insurance Unearned Service Revenue (3,000 – 1,000) Service Revenue Salaries Expense Salaries Payable Depreciation Expense – Office Furniture Acc. Depreciation – Office Furniture Accounts Receivable Service Revenue (b) May 31 Balance b/f Jun 1 Balance b/f May 31 Balance b/f Service Revenue Jun 1 Balance b/f May 31 Balance b/f Jun 1 Balance b/f May 31 Balance b/f Jun 1 Balance b/f May 31 Balance b/f Ref Debit 500 500 200 200 100 100 2,000 2,000 500 500 200 200 1,000 Cash 7,700 May 31 Balance c/f 7,700 7,700 Accounts Receivable 4,000 May 31 Balance c/f 1,000 5,000 5,000 Supplies 1,500 May 31 Supplies Expense Balance c/f 1,500 1,000 Prepaid Insurance 2,400 May 31 Insurance Expense Balance c/f 2,400 2,300 Office Furniture 12,000 May 31 Balance c/f Credit 1,000 7,700 7,700 5,000 5,000 500 1,000 1,500 100 2,300 2,400 12,000 DFA 5058 (Financial Accounting)/Chapter 4 Jun 1 Balance b/f 12,000 12,000 Accumulated Depreciation – Office Furniture May 31 Balance c/f 200 May 31 Dep. Exp – Off Furniture 200 Jun 1 Balance b/f Accounts Payable May 31 Balance c/f 3,500 May 31 Balance b/f 3,500 Jun 1 Balance b/f May 31 Service Revenue Balance c/f May 31 Balance c/f May 31 Balance c/f May 31 Balance c/f May 31 Balance c/f May 31 Balance b/f Unearned Service Revenue 2,000 May 31 Balance b/f 1,000 3,000 Jun 1 Balance b/f 12,000 200 200 200 3,500 3,500 3,500 3,000 3,000 1,000 Salaries Payable 500 May 31 Salaries Expense 500 Jun 1 Balance b/f 500 500 500 Travel Payable 200 May 31 Travel Expense 200 Jun 1 Balance b/f 200 200 200 Lina, Capital 19,100 May 31 Balance b/f 19,100 Jun 1 Balance b/f 19,100 19,100 19,100 Service Revenue 9,000 May 31 Balance b/f Unearned Revenue Accounts Receivable 9,000 Jun 1 Balance b/f 6,000 2,000 1,000 9,000 9,000 Salaries Expense 3,000 May 31 Balance c/f 3,500 DFA 5058 (Financial Accounting)/Chapter 4 Salaries Payable Jun 1 Balance b/f May 31 Balance b/f Jun 1 Balance b/f 500 3,500 3,600 3,500 Rent Expense 1,000 May 31 Balance c/f 1,000 1,000 1,000 1,000 Supplies Expense 500 May 31 Balance c/f 500 500 500 500 Travel Expense 200 May 31 Balance c/f 200 200 200 200 Depreciation Expense – Office Furniture May 31 Acc Depn –Off Furniture 200 May 31 Balance c/f 200 Jun 1 Balance b/f 200 200 200 Insurance Expense 100 May 31 Balance c/f 100 100 100 100 May 31 Supplies Jun 1 Balance b/f May 31 Travel Payable Jun 1 Balance b/f May 31 Prepaid Insurance Jun 1 Balance b/f (c) Excellent Consulting Adjusted Trial Balance 31 May 2011 Cash Accounts Receivable Supplies Prepaid Insurance Office Furniture Accumulated Depreciation – Office Furniture Accounts Payable Unearned Service Revenue Travel Payable Salaries Payable L.Rig, Capital Debit (RM) 7,700 5,000 1,000 2,300 12,000 Credit (RM) 200 3,500 1,000 200 500 19,100 DFA 5058 (Financial Accounting)/Chapter 4 Service Revenue Salaries Expense Rent Expense Supplies Expense Depreciation Expense – Office Furniture Travel Expense Insurance Expense 9,000 3,500 1,000 500 200 200 100 RM 33,500 RM 33,500 Question 5 Chiko Laundry‘s trial balance before adjustment on 30 June 2010 is as follows. Chiko Laundry Trial Balance 30 June 2010 Debit Credit RM RM Account Receivable 8,000 Cash 7,500 Supplies 9,000 Equipment 26,000 Accumulated Depreciation – Equipment 7,800 Prepaid Insurance 3,000 Account Payable 11,500 Unearned laundry revenue 8,000 Capital 10,000 Drawing 1,500 Laundry Revenue 31,200 Salary Expenses 2,000 Utility Expenses 2,500 Rent Expenses 5,500 Interest Expenses 1,700 Maintenance Expenses 800 RM 68,500 RM 68,500 Additional transactions : 1. RM1,000 of supplies has been used during the period. 2. Depreciation of equipment for period is RM700. 3. Salaries of RM2,000 are accrued at 31 June 2010. 4. Unearned laundry revenue of RM2,000 has been earned. 5. Prepaid insurance expired for the month is RM250. 6. Utilities expenses of RM300 are accrued at 30 June 2010. Instructions (a) Journalize the adjusting entries. (b) Prepare an adjusted trial balance for Chiko Laundry Service. (c) Prepare the income statement for Chiko laundry Service. Answer 5 (a) Chiko Laundry General Journal DFA 5058 (Financial Accounting)/Chapter 4 Date Account Titles and Explanation June 30 Supplies Expense Supplies Depreciation Expense – Equipment Acc. Depreciation – Equipment Salaries Expense Salaries Payable Unearned laundry Revenue Service Revenue Insurance Expense Prepaid Insurance Utilities Expenses Utilities Payable Ref Debit 1,000 Credit 1,000 700 700 2,000 2,000 2,000 2,000 250 250 300 300 (b) Chiko Laundry Trial Balance 30 June 2010 Cash Account Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation – Equipment Account Payable Unearned laundry revenue Salary Payable Utilities Payable Capital Drawing Laundry Revenue Rent Expenses Salary Expenses Utility Expenses Interest Expenses Supplies Expenses Maintenance Expenses Depreciation Expenses -Equipment Insurance Expenses (c) Chiko Laundry Income Statement Debit RM 7,500 8,000 9,000 2,750 26,000 Credit RM 8,500 11,500 6,000 2,000 300 10,000 1,500 33,200 5,500 4,000 2,800 1,700 1,000 800 700 250 RM 71,500 RM 71,500 DFA 5058 (Financial Accounting)/Chapter 4 For the month ended 30 June 2010 RM Revenue Laundry Revenue Expenses Rent Expense Salary Expense Utility Expense Interest Expense Supplies Expense Maintenance Expense Depreciation Expense -Equipment Insurance Expense Total Expenses Net Income RM 33,200 5,500 4,000 2,800 1,700 1,000 800 700 250 (16,750) RM 16,450 Question 6 Chenta Resort opened for business on 1 September 2010. Its trial balance before adjustment on September 30 is as follows:Chenta Resort Trial Balance 30 September 2010 Cash Supplies Prepaid Insurance Account Receivable Land Buildings Furniture Accounts Payable Unearned Rent Revenue Mortgage Payable Amani, Capital Amani, Drawing Rent Revenue Repair Expense Salaries Expense Utilities Expense Debit (RM) 15,600 3,300 6,000 4,000 25,000 125,000 26,000 Credit (RM) 6,500 7,400 80,000 100,000 5,000 80,000 3,600 51,000 9,400 RM 273,900 RM 273,900 Other data 1. Insurance expires at the rate of RM400 per month. 2. A count on September 30 shows RM600 of supplies still on hand. 3. Monthly depreciation is RM500 on buildings and RM200 on furniture. 4. Unearned rent revenue of RM4,200 was earned prior to September 30 5. Salaries of RM400 were unpaid at September 30. DFA 5058 (Financial Accounting)/Chapter 4 6. Rentals of RM1,000 were due from tenants at September 30. Instructions (a) Journalize the adjusting entries on September 30. explanation. (b) Prepare an adjusted trial balance on September 30. You may omit the Answer 6 Chenta Resort General Journal Date Account Titles and Explanation Sept 30 Insurance Expense Prepaid Insurance Supplies Expense (3,300 – 600) Supplies Depreciation Expense – Buildings Depreciation Expense – Furniture Acc. Depn.– Buildings Acc. Depn. – Furniture Unearned Rent Revenue Rent Revenue Salaries Expense Salaries Payable Accounts Receivable Rent Revenue Ref Debit 400 Credit 400 2,700 2,700 500 200 500 200 4,200 4,200 400 400 1,000 1,000 Chenta Resort Adjusted Trial Balance 31 August 2010 Cash Account Receivable Supplies Prepaid Insurance Land Buildings Less: Accumulated Depreciation – Buildings Furniture Less: Accumulated Depreciation – Furniture Accounts Payable Unearned Rent Revenue Salaries Payable Mortgage Payable Amani, Capital Amani, Drawing Rent Revenue Salaries Expense Utilities Expense Debit (RM) 15,600 5,000 600 5,600 25,000 125,000 Credit (RM) 500 26,000 200 6,500 3,200 400 80,000 100,000 5,000 85,200 51,400 9,400 DFA 5058 (Financial Accounting)/Chapter 4 Repair Expense Supplies Expense Depreciation Expense – Buildings Insurance Expense Depreciation Expense – Furniture 3,600 2,700 500 400 200 RM 276,000 RM 276,000