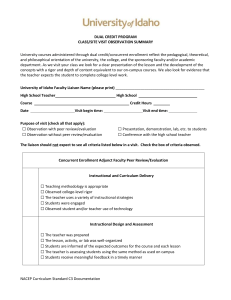

Location - Idaho Society of CPAs

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

Location: James McClure Federal Building

1 st Floor Conference Room

550 W Fort Street

Boise, ID 83724

Chairperson: Richard W Jackson, CPA/PFS (ISCPA)

Facilitator: Deborah Chrisman (Northwest Area Manager

Stakeholder Liaison Field, SBSE)

Attendees: Robert Aldridge (Idaho State Bar Assoc)

Jerry Croce (CFP, EA)

Claudia Johnson (Idaho State Tax Commission)

John McGown (Idaho State Bar Assoc)

LaFonda Merrick (IAPA)

E. Shawn Novak (Boise State University)

Patty Verdun (Tax Executives Institute)

Gonzella Jones (SBSE Stakeholder Liaison)

Ryan Kinikin (TAC)

Norma Marroquin (Advisory Insolvency)

Terry McCarthy (LMSB)

Hester Pulling (SBSE Collection)

Shannon Runer for Merry Trudeau (TAS)

Donna Weddle (W&I SPEC)

Brian Wozniak (SBSE Stakeholder Liaison)

Organizations: Idaho Society of CPAs, Idaho Association of Public Accountants, Idaho Bar

Association (Tax Division), Internal Revenue Service, Idaho State Tax

Commission

Next Meeting: May 4, 2006

Opening Remarks by new Meeting Facilitator, Deb Chrisman (Northwest Area Manager Stakeholder

Liaison). Gonzella Jones was the primary Stakeholder Liaison contact point; however she has accepted a new position and Brian Wozniak is the contact point. Their contact information is as follows:

Deb Chrisman

NW Area Manager

Seattle, WA 98174

206-220-5659

Brian Wozniak

Stakeholder Liaison

Stakeholder Liaison 1220 SW Third Ave

915 Second Avenue . Portland, OR 97204

Tel: 503-326-3343

Fax 503-326-5957

1

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

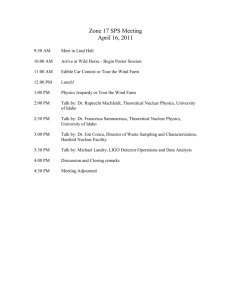

News items covered by Gonzella Jones (SL) and Brian Wozniak (SL) in the last segment of the meeting have been summarized here for the convenience of the member organizations’ newsletter staffs. Please note that an internet “Hot Links Page” has also been attached to this document,

Idaho Practitioner Liaison Committee Chart of Resources - Nov,2005

Abusive

Transaction

Settlement

Initiative http://www.irs.gov/newsroom/article/0,,id=150072,00.html

Bankruptcy

US District and Bankruptcy Court For The District of Idaho

10/14/2005 Memorandum to Members of the Bar.

New Bankruptcy Law Changes Debtors’ Responsibilities http://www.irs.gov/newsroom/article/0,,id=150241,00.html

e-File

The main focus of these documents is e-file & epay as well as items of particular interest to the practitioner and small business communities .

Issue

Management

Resolution

System at work

Idaho Taxpayer

Assistance Center locations

Private Debt

Collection

Recent Court

Case

Sample of Issues resolved through issue management resolution system. http://www.irs.gov/localcontacts/article/0,,id=98272,00.html

COURT BARS "IN-KIND WAGE PAYMENT" TAX SCHEME

Promoters Allegedly Targeted Western Dairy Farms http://www.usdoj.gov/opa/pr/2005/October/05_tax_565.html

2

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

Stakeholder

Partners’

Headliners Index

Here is an IRS web site listing of titles and links to “Headliners” issued for 2005 and earlier http://www.irs.gov/businesses/small/article/0,,id=102669,00.html

"IN-KIND

WAGE

PAYMENT"

TAX SCHEME

.New Bankruptcy Procedures/Law

Brain Wozniak and Norma Marroquin provided a brief update of the new bankruptcy law requirements.

Debtor responsibilities under new bankruptcy law changes o Tax Return Filing Compliance o Credit counseling o Financial education o News release link http://www.irs.gov/newsroom/article/0,,id=150241,00.html

As of June 13, 2005

US Bankruptcy Court memorandum dated Oct. 14, 2005 provided by Norma Marroquin,

Insolvency Advisor, provided link with helpful information regarding the Reform Act on US

District and Bankruptcy Court website. http://www.id.uscourts.gov/BK_Reform/BKReformAct2005.htm

As of June 13, 2005, the centralized site in Philadelphia handles Idaho Chapter 7 No Asset cases and Chapter 13 post confirmation. Contact number for the centralized site is 1-800-913-

9358 and FAX number is 215-516-2015, assistors are available during working hours in your area. o Two mailing addresses for cases assigned to Philadelphia

Chapters 7,9,12 and 13. - send all payments to the Centralized Insolvency

Operation (CIO). The proper mailing address for these checks is Insolvency

Remittance, Post Office Box 21125, Philadelphia, PA 19114.

Correspondence for case listed above should be sent to PO Box 21126,

Philadelphia, PA 19114

Payments for Chapter 11 cases should be sent to the local Field Insolvency office assigned to the cases.

All committee members as part of the discussion expressed concern Bankruptcy requirement for financial education is in item of concern. Believe Idaho lacks resources for the education of the

3

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005 debtor. It was acknowledge that it was too early to discuss the new law applications and the issue will need to have on agenda for May 4th meeting.

Taxpayer Assistance Center (TAC)

Ryan Kinikin briefed committee regarding:

TAC funded through the 2006 Fiscal Year

There will be no hiring for TAC nor will any replacements for any employees who leave.

During the 2006 filing season can expect the level of services and assistors will also providing the assistance with casualty loss questions.

Assistors are currently receive annual training

A question was raised regarding location of the Taxpayer Assistance Centers.

See resource chart for link to local offices.

Richard Jackson complimented the Idaho TACs for their consistent excellent service to practitioners and taxpayers.

Gonzella Jones briefed committee on the following:

Abusive Transaction Settlement Initiative –

The initiative is a broad-based, limited-in-time opportunity for taxpayers to come forward and settle an array of transactions the IRS considers abusive. Taxpayers who undertook these deals will have until

January 23, 2006 to submit their settlement papers to the IRS. News release is in resource chart above.

Committee discussion questioned the settlement opportunity is being publicized by the IRS. Two major issues identified.

1.

Not everyone has access to electronic information and because of the short deadline of

January 23, 2006 the Service needs to be sure the information is full publicized.

Communication with tax practitioners are generally not until after Jan. 23 date.

2.

The date of Jan. 23, 2006 does not allow taxpayers time to get information from their tax practitioner and the date should be close to or after April 15 th to ensure the information has been made available to clients.

Issue Management Resolution System (IMRS)

Issue Management Resolution System was designed to capture, develop, resolve and respond to significant national and local stakeholder issues in a timely manner. IMRS objectives are to: o create a channel for stakeholders to identify national or local issues, o ensure issues are resolved in a timely manner, o leverage stakeholder organizations to share changes relating to IRS policies, practices and procedures, o and identify trends with reporting, filing and paying requirements o examples of issues that have been resolved are in the resource chart above.

COURT BARS "IN-KIND WAGE PAYMENT" TAX SCHEME

Promoters Allegedly Targeted Western Dairy Farms - The court's order bars the defendants from promoting their in-kind payment program and bars the corporate defendants from engaging in any payroll, employee-leasing or labor management services.

4

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

Discussion – What is the effect on the employees of these farms? How should their returns be filed?

Next meeting scheduled for May 4, 2006 at 9:00 am.

Wrap Up:

Chair requested more committee members attend meetings.

Also requested someone from Internal Revenue Service Tax Exempt Organization attend to discuss increased focus on private foundations

Practitioner Questions/Issues for Elevation Identified at this Meeting:

Question was also raised during the May 2005 liaison meeting. Bob Finlan secured following answer from the Office of Professional Responsibility.

Question: One of the issues that came up was whether there would ever be definitions to define

"tax avoidance" versus "tax evasion." The audience was concerned about this because of their worry about giving advice to their clients regarding participation in certain opportunities that would come up. Their concern about advice was from the standpoint of potential ethics conflicts resulting from being advisers and not knowing enough about how to direct them on these opportunities that might be tax-planning instruments or might be tax avoidance schemes.

The chair of the meeting had previously called the tax specialist about what kind of advice might be given for clients who were wondering whether they should get into charitable trusts, etc. The chair had encountered an ethics / Circular 230 presentation by attending a Vegas seminar on High Income Individuals.

Currently, the term "avoidance or evasion of any tax" in our regulations simply means that there is a purpose of reducing tax, one that may be completely legal. We cannot speak to whether the terms are being addressed in other areas of the code or regulations. If a practitioner does not know enough about a tax planning instrument to know whether it is an abusive scheme then the representative should not advise a client to undertake the transaction. Charitable trusts are not abusive per se, but again, the practitioner needs to assure himself that it involves a legal reduction of tax under the particular facts and circumstances of his/her client.

What is the current staffing for the each enforcement function Collection, Criminal Investigation and

Examination? And what are each functions hiring plans?

Function Current Staff Hiring Plans

SB/SE Exam – 20 Field Revenue Agents

3 Field Revenue Agent Managers

3 Revenue Agent hires in

Jan 2006 with on board date of 1/22/2006

6 TCOs

1 TCO Manger

5

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

Collection Idaho Falls: 1 RO (Assigned to Specialty abusive schemes group)

Twin Falls: 6 RO's (cover all of SE Idaho)

Boise: 11 RO's (2 new hires)

3 Group Managers

1 OIC Specialist

4 Bankruptcy Specialists

Coeur d'Alene: 5 RO's (2 new hires)

No additional hires planned for FY 2006

Is it possible to have a name and number of one person from each function (primarily enforcement -

Collection, Exam, & CI) as a point of contact for the practitioner community?

Function

SB/SE Exam

Contact Person

John Dorais

Phone Number

208-378-2820 ext. 304

Appeals

Government Liaison & until Jan. 2006 Disclosure

Officer

Collection

Les L. Lucas

Deborah Diamond

503-326-5522

206- 220-4376

Deborah Diamond 206-220-5672 toll free phone numbers for key Collection services:

Stakeholder Liaison

Wage and Investment Field

Assistance

Lien Desk (800) 913-6050

8:00am – 5:00pm

Fax (859) 669-5152

All requests must include the name and phone number of the requestor, the date the account was satisfied, the method of payment, the Serial Lien Identification (SLID) number of the lien to be released and the taxpayer’s name .

Centralized OIC 1-866-790-7117

Automated Collection

System

Brian Wozniak

Todd L. Harber

Number on Notice

503-326-3343

Idaho message number

208-387-2829 ext. 400

(208) 387-2829 Ext 301

6

Minutes – Idaho Tax Practitioner Liaison Committee Meeting

Thursday – November 2, 2005

What are the tax consequences for the employees of Western Dairy Farms? (Income tax and Social

Security) What is the correct way to file the individual returns?

Notice 989, Commonly Asked Questions When IRS Determines Your Work Status is “Employee”, provides guidance how to correctly file the individual returns for these employees. Notice is in the resource chart. Notice 989 is generally sent with an SS-8 employee determination; the basic information answers the questions and ignore references to the determination letter.

Non Filer – When letters are sent with each year’s return outlining that there are both balance due returns and refund returns, is it possible to coordinate the processing of delinquent returns so refunds would not be issued until all returns are processed? Suggestion to be forwarded

E-Services – A CD on how to use e-services would be a great addition to IRS products and services.

Suggestion to be forwarded

OIC – Would like to see a calculator worksheet means test on irs.gov to assist in the calculation of

Reasonable Collection Potential (RCP) completion of an offer. Suggestion to be forwarded

Minister Market Segment Specialization Program (MSSP) – With new emphasis on tax exempt organizations would like to know if the ministry audit guide still on irs.gov? Concern was expressed that some information contained in the market segment was incorrect. The Minister MSSP has been taken off due to various accounting and law changes. Our plans are to have a combined Service

Industry ATG developed which would include a section on Ministry. The timing of this change is dependent on time, manpower and budget.

Several Social Security Issues were raised. Next meeting Social Security Public Affairs Specialist,

Corliss Neuber, has been invited and will be joining us.

7