2.-Tax-Collectors-Manual-Table-of-Contents

advertisement

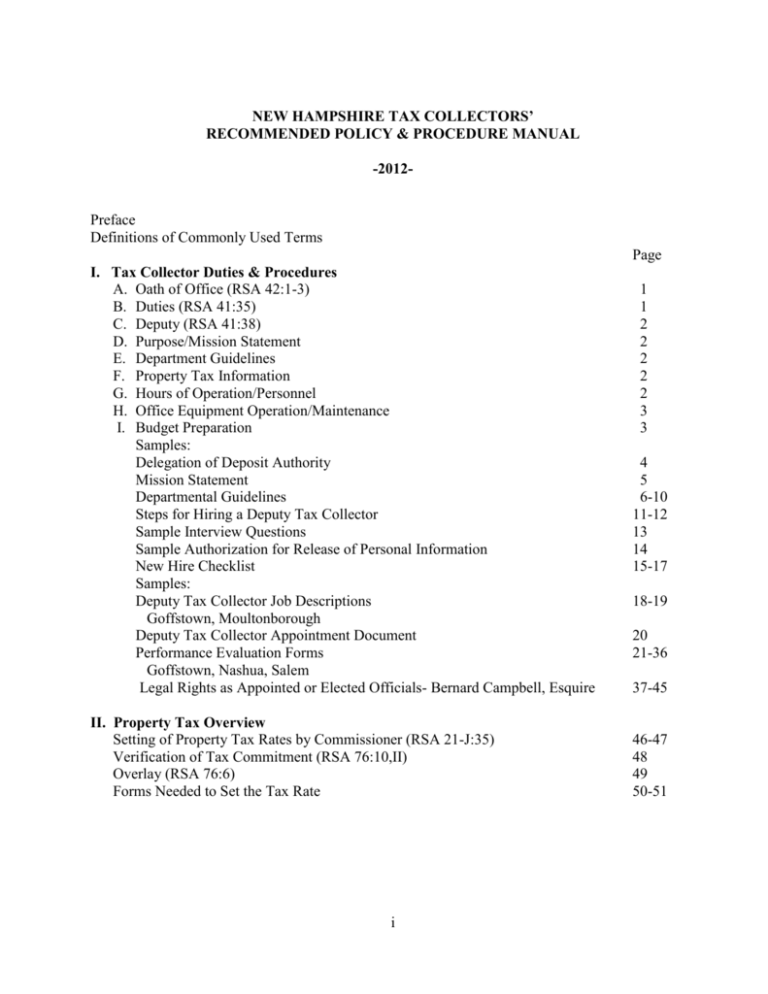

NEW HAMPSHIRE TAX COLLECTORS’ RECOMMENDED POLICY & PROCEDURE MANUAL -2012- Preface Definitions of Commonly Used Terms Page I. Tax Collector Duties & Procedures A. Oath of Office (RSA 42:1-3) B. Duties (RSA 41:35) C. Deputy (RSA 41:38) D. Purpose/Mission Statement E. Department Guidelines F. Property Tax Information G. Hours of Operation/Personnel H. Office Equipment Operation/Maintenance I. Budget Preparation Samples: Delegation of Deposit Authority Mission Statement Departmental Guidelines Steps for Hiring a Deputy Tax Collector Sample Interview Questions Sample Authorization for Release of Personal Information New Hire Checklist Samples: Deputy Tax Collector Job Descriptions Goffstown, Moultonborough Deputy Tax Collector Appointment Document Performance Evaluation Forms Goffstown, Nashua, Salem Legal Rights as Appointed or Elected Officials- Bernard Campbell, Esquire II. Property Tax Overview Setting of Property Tax Rates by Commissioner (RSA 21-J:35) Verification of Tax Commitment (RSA 76:10,II) Overlay (RSA 76:6) Forms Needed to Set the Tax Rate i 1 1 2 2 2 2 2 3 3 4 5 6-10 11-12 13 14 15-17 18-19 20 21-36 37-45 46-47 48 49 50-51 Page III. Billing Process A. Selectmen’s List & Warrant (RSA 76:10) B. Succession in Office (Recommittal Warrant – RSA 41:36) C. Correction of Omissions/Improper Assessments (Supplemental Warrant – RSA 76:14) Sample Recommittal Warrant Billing Process Outline Electronic Tax Billing (HB 1224 – RSA 76:11) Uniform Electronic Transactions Act (RSA 294-E) & Electronic Signatures Electronic Billing – Implementation Recommendations Sample Approval to Send Tax Bills by Electronic Means Information to Appear on Property Tax Bills (RSA 76:11-a) Sample Property Tax Warrant & Warrant with Interest Waiver Supplemental Property Tax Billing (RSA 76:14) Sample Supplemental Warrant IV. Other Taxes Yield Taxes (RSA 79) Sample Yield Tax Warrant Current Use Tax (Land Use Change Tax- RSA 79-A) Changes to Current Use Assessment- Bernard Campbell, Esquire Land Use Change Tax Warrant (A-5W Form) Land Use Change Tax (A-5 Form) Excavation Tax (RSA 72-B) Sample Excavation Tax Warrant Jeopardy Assessments Tax Poem V. Processing Payments Application of Tax Payments Sample Taxpayer Payment Application Form Goffstown Types of Payments: Checks (RSA 80-52-b) Electronic Payments (RSA 80:52-c) Partial Payments in Redemption (RSA 80:71) Interest (RSA 76:13) Handling Bounced Checks- Bernard Campbell, Esquire Returned Checks (RSA 80:56)- Refer to MS-61 Section in this manual Sample Returned Check Policy & Letter Moultonborough Prepayment of Taxes (RSA 80:52-a) and Sample Policy Overpayments (RSA 80:57) vs Prepayments (RSA 80:52-a) ii 52 52 52 53 54 55-57 58-59 60 61-62 63 64-65 66 67 68 69 70 71-72 73-74 75-77 78 79 80-81 82 83 84 85 86-88 89-90 91 92-93 Abatements (RSA 76:16) vs Abatement Refunds (RSA 76:17-d) Sample Abatement Form- Merrimack Reporting Tax Abatement Interest to the IRS Judy Silva, Esquire & Barbara Reid, LGC Staff Daily & Monthly Balancing Procedures A Bit of Humor VI. The Lien/Deed Process Basic Steps of the Property Tax Lien Process Performing the Tax Lien Process Schedule of Fees and Costs Samples: Doolan Language Requirement on Notice of Tax Delinquencies and Unredeemed Taxes Sample Notice of Tax Delinquencies and Unredeemed Taxes Doolan Language Requirement on Impending Lien Notice Sample Impending Lien Notice Affidavit of Execution of Lien Lien Mortgagee Notification Letter from Municipality to Mortgagee Who Changed Name/Address Lien Redemption Report Collection By Suit (RSA 80:50) Performing the Tax Deed Process Samples: Impending Deed Notice Notice to Lienholder of Impending Deed Return of Service Letter Deed Mortgagee Identification Search Criteria List of Title Search Companies UCC Search Information Checklist for Tax Deeding Steps to Keep You Out of Trouble When Tax Deeding a Property List of Information for Tax Deeding File Payment Agreements Payment Plans for Delinquent Taxpayers Paul Sanderson, Esquire, LGC Staff Attorney Payments in Lieu of Deeding Bernard Campbell, Esquire iii 94 95 96-97 98-99 100 101 102-103 104-105 106 107 108 109 110-111 112 113 114 115 116 117 118 119 120 121 122 123-124 125 126-127 128-129 130 131-135 136-138 Samples: Payment Agreements- Farmington, Charlestown, Littleton Forbearance Agreements Deed Waiver- Farmington Re-Purchase Letter From Municipality to Property Owner (once deed issued) Tax Deeded Property: How You Dispose of It- Bernard Campbell, Esquire Sample Repurchase Tax Deeded Property Excel Spreadsheets Madison Moultonborough Federal Tax Liens- Bernard Campbell, Esquire Frequently Asked Questions Regarding Liens & Deeds VII. VIII. 160 161 Reserved 162-164 The MS-61 Form Blank MS-61 Form MS-61 Summary Outline Helpful Hints for MS-61 Reconciliation MS-61 Handbook 165-167 168 169 170-217 Security Workplace Security Personal Safety Cash Security Record Security How to Segregate Financial Duties in a Small Municipal Office Barbara Reid, LGC Staff Cash Controls & Procedures Sample Cash Receipts Policies Amherst, Dover, Nashua Record Retention Record Retention List Sample Fraud Policies Dover, Goffstown, Salem IX. Public Officials’ Ethics & Right to Know Law (RSA 91) Entire Chapter written by- C. Christine Fillmore, Esquire- LGC Staff Attorney X. 139-143 144-149 150 151 152-159 Bankruptcy Information Terminology Sample Forms Blank Bankruptcy Proof of Claim Form Bankruptcy Primer for Municipal Tax Officials- Bernard Campbell, Esquire iv 218-220 221-222 223-224 225-238 239-241 242 243-254 255-270 271-274 275-276 277-279 280-303 XI. Miscellaneous Information Documents Required for an Audit Tax Deferrals for Elderly & Disabled (RSA 72:38-a) Elderly Tax Deferrals- Bernard Campbell, Esquire What is a Credit Bureau? Servicemembers Civil Relief Act (f/k/a Soldiers & Sailors Civil Relief Act) Property Foreclosure Issues- Bernard Campbell, Esquire XII. Resource Section Website Addresses & Helpful Hints Tools to Search via the Internet Frequently Asked Questions “You Know You Have Been A Tax Collector Too Long When . . .” v 304 305 306-311 312 313-314 315-316 317 318 319-321 322