GFOA Budgeting Exam Study Notes

advertisement

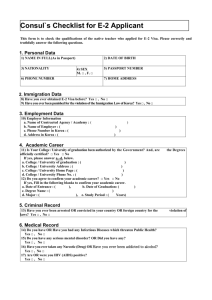

STUDY NOTES FOR GFOA BUDGETING EXAM A. SOURCE: LOCAL GOVERNMENT FINANCE – CONCEPTS & PRACTICES Chapter 4 – Operating Budgets: A budget can be a process, a document, an accounting ledger, a plan, or a system. Local gov’t budgeting process unique – product of geographical, historical, economic, political and social factors peculiar to that jurisdiction. Budgeting is a unified series of steps to line and implement four functions: policy development – as policy instrument, CEO and legislative body need to articulate the goals, objectives and strategies that underline the budget – the flip side of proposing policy changes is accountability financial planning – includes gov’t financial condition; current/past-year trend financial act. by dept or prog; formal revenue est; look to the future to anticipate events/conditions; ensure debt service remains under control (while debt service receives first draw on municipal exp, financial plan set a rational debt service level for multi-year period service/operations planning – blueprint that governs the amount of service provided communications – way for decision makers to communicate changes in priorities, rationale for decisions and changes to vision in the future The final step in securing a framework w/in w/c the needs of policy setting, financial planning, service planning and communications can work is the development of quantitative performance measures. Environment/actors dictate the extent to which the linkage occurs and the form of linkage. Four phases of local budget cycle: planning/preparation – key that encourages integration of policy, financial and operation aspects of budgeting – planning is the process of preparing a set of decisions for action in the future, directed at achieving goals by preferable means integration selling passage execution/feedback As service plans, budget could be organized by programs or discrete services – then officials agree on specific objectives of these programs w/c s/b: results-oriented measurable within a given time related to the overall dept goal Actors in the budget process: a) CEO – generally the main change agent in local decision making b) dept. officials – focus on serving their constituents c) legislative body – ultimate holder of the purse strings d) citizen committees – help focus the decision makers on an issue not on policy agenda before e) media – key ingredient in utilizing budget as communications device f) CBO – CEO’s main tool in coordinating and controlling the conflict inherent in resource allocation process – play important role during the integration stage of the budget process Four types of measures: 1) demand – indicate the scope of the prog or the need for service – do not directly assist in the choice among competing policy or funding priorities but provide backdrop for budgeters to put in perspective the gross budget numbers being requested 2) workload – go one step further than demand measure – indicate amount of work actually performed on a particular activity 3) efficiency – relate the workload measures to resources required and results obtained 4) effectiveness – build on efficiency measurers and tell how well activity meets objective Budgets based on objectives and service plans generally allow the decision makers an opportunity to play “what-if” games. Before the budget can be used as a policy instrument or a political vision, the financial and operation foundation needs to be laid. CEO categorizes the electoral constituency into four groups (for selling/passage): 1) those who will have not place to go no matter what 2) mobile constituents who need to be kept happy 3) potential new constituents who are marginally in the other groups’ camp 4) those who are not and never will be constituents Traditional budget control serves to: 1) prevent budget deficits and embarrassing situations 2) ensure that administrative actions produce desired policy and prog. accomplishments Values of unappropriated surplus: 1. avoid short-term borrowing or going back to taxpayer for additional revenue 2. help balance following year’s budget The budget/process will depend on: environment, issues and actors in the locality. Chapter 5 – Capital Planning and Budgeting CIP – a multi-year plan that forecasts spending for all anticipated capital projects – s/b a logical extension of a jurisdiction’s comprehensive land use plan Capital budget – first year of the CIP – primary difference between cap budget and CIP is that the capital budget is a legal document that authorizes specific projects during the ensuing fiscal period The best capital planning process encompasses the ff: considers all proposed projects simultaneously produces planning doc that considers available financing and feasible timing measure the impact of capital spending on overall financial position relates a community’s perception of itself and its goals to a coherent program The cap budget and cap plan are closely associated w/ long term operating prog and budget since the reason for each cap proj is to facilitate the accomplishments of an operating objective. Infrastructure or capital facilities’ characteristics that justify their inclusion and analysis in a special cap budget: essential public purpose long useful life infrequent and expensive related to other gov’t function local gov’t’s responsibility to provide them Advantages of capital planning and budgeting: as a reporting document as a financial management tool contributes to long-range policy development as a positive credit rating consideration As a general rule, items in a local gov’t’s budget are classified as capital or operating by cost and frequency. Rating categories for projects: urgent projects – meet emergency; required by state of federal law necessary projects – eliminate safety hazards; meet contractual obligations; required renovation/repair desired projects – replace equip; extend/enhance service; match state/federal funds ongoing projects – continue work in progress deferrable projects – nonessential/questionable timing or need Frequently general criteria for evaluating projects: fiscal and budgetary impacts health and safety effects community economic effects extent of facility use environmental, esthetic and social effects disruption and inconvenience caused distributional effects prior commitments and feasibility implications of deferring projects amount of uncertainty and risk effects on interjurisdictions’ relationship advantages accruing from relation to other cap proj Cost benefit analysis: a stream of benefits compared to the project cost NPVb = - I + Bi + …+ Bn (1 + r) (1 + r)n NPVb = net present value of benefits I = investment (capital cost) B = benefits in each future year r = rate of interest (social cost of capital) n = number of years Problems w/ quantitative benefits analysis: difficult to quantify benefits of public spending relating NPV to social cost of capital and rate of discount to employ Financial analysis: economics of proj financing feasibility of the proj impact of cost on the jurisdiction effect of future maintenance and operational expenses on the operating budget Revenue growth depends on several key variables including demographic trends, tax policy and general business cycle. To forecast revenues, need to understand nature of local tax and user charge structure. Major sources of funding: pay as you go – paid from current income grants – from other gov’t debt public/private ventures There are no hard and fast rules for determining a good mix of financing methods – every jurisdiction must develop its own criteria that recognize legal and practical limits of each approach based on cost, location and timing and its fiscal capacity, etc. Urgency and feasibility will likely dictate the initial field of candidates for CIP. Chapter 6 – Property Taxes Property tax – major tax source for state and local gov’t; only tax w/ an unobservable base – valuation is inherently subjective. Valuation approaches: 1. cost approach – current cost of reproducing a property minus dep’n – used frequently in the appraisal of new construction and special purposed properties 2. income approach – potential net earning power will support based on a capatilization of net income – used to value investment properties (commercial/industrial) 3. market data approach – indicated by recent sales of comparable properties in the marketplace One of the primary objectives in property tax administration is the assessment of property in a uniform manner. Consequence of nonuniform is unwarranted shift of burden elsewhere to the benefit of some. Property valuation serves as a basis for: tax levies by overlapping gov’ts determination of net bonded indebtedness determination of authorized levies restricted by statutory tax rate limits apportionment of state assistance to local gov’t A. assessment/sales ratio – the technique most commonly used to measure the degree of assessment in relationship to the market value or sales price of property sold Use of averages: mean – derived by computing the assessment/sales ratio for each parcel sold, adding those ratios and dividing the total by the number of items median – measure of central tendency used to describe a group of individual assessment/ sales ratio – arrange the individual assessment/sales ratio in order of magnitude from highest to lowest then selecting the middle ratio in the series aggregate or weighted average – divide total assessor’s market value of properties sold B. assessment/sales dispersion – degree to which actual assessment ratios are dispersed around the measure of central tendency. Revenue stability – the absolute amount produced by the property tax in any single year is calculated as the product of the property tax rate and the property tax base – the nominal tax rate is determined by legislative process – the tax base or assessed value changes as a result of a change in the level of assessment – given a constant assessment ratio, the base would increase in direct proportion to the growth in market values. Approaches to property tax relief: a) Direct relief ( can be broad or targeted): partial exemption credit refund or rebate freeze use-value assessment classification circuit breaker deferral b) indirect – works outside the property tax system; may or may not affect the total property tax levy Chapter 7 – Nonproperty Taxes MVIL – most widely used although not the most productive in terms of revenue Sales tax – the most impt single local nonproperty tax – followed by income tax A diversified tax base promotes equity b/c it can capture revenues from individuals who can escape some taxes but not others. Also promotes efficiency b/c it reduces distortion of economic decisions resulting from over-reliance on any particular tax. Diversification keeps all tax rates lower than they would otherwise be. Offers local gov’t the same advantages that a diversified portfolio of financial assets offers investors. Drawbacks to diversification: nonproperty taxes often cause greater distortion of economic decisions than the property tax; and, additional local taxes create additional costs of administration and compliance. Rationale for nonproperty tax: impt evaluation criteria is incidence – who actually bears the burden of the tax – incidence merely tells who does pay – it does not tell who should pay. Economists suggest two principles who should pay: 1. benefit principle – a citizen’s share of the tax burden is proportional to the benefit he receives 2. ability to pay principle – widely interpreted to imply a proportional or progressive tax – tax burden rises in proportion to or faster than income as income rises Horizontal inequity (i.e., sales tax) – households w/ the same incomes can pay vastly different percentages depending on how much of their income they spend rather than save and how their spending is allocated between non taxed or taxed purchases Basic characteristics of local personal income tax (most require state authorization): payroll tax – has no exemptions, deductions or filing of tax returns piggyback tax – local income tax linked directly to federal or state tax broad-based tax – graduated income tax w/ locally set exemptions and deductions An income tax is usually more responsive to both inflation and to real economic growth than property tax esp. if it is broad based. However, this tax is difficult to justify based on benefit principle but has stronger case on the ability to pay principle. B. SOURCE: THE OPERATING BUDGET – A GUIDE FOR SMALLER GOVERNMENTS Chapter 1 – Organizing the Budget Function To achieve the best results in the planning and delivery of community services, key programmatic and financial decisions related those services must be made explicitly and under a single umbrella. The process of a local gov’t is the forum to: accumulate financial and performance info about all local services into a common format analyze and debate the merits of each service set priorities w/c services gov’t can or can’t afford make decision on the level and cost of services Legal basis for budgeting: responsibilities of various officials legal actions required to establish official budget details of budget enacments general schedule to be followed changes to enacted budget restrictions of undesignated fund balance to balance budget budget deficits – impact on service levels or capital impv’t Budget preparation manual should contain: legal foundation of budget process organizational responsibilities budget calendar procedures for preparing/implementing budget policies on expenditure categories standard forms structural balance concept – seeks to ensure that stable and reliable delivery of public services is the goal of the budget process: requires two principles – a) budget office responsible for building reserves; b) anticipate cyclical growth 2 broad categories of responsibilities in budget prep, adoption and implementation: executive or administrative legislative or policy making – overall concern w/ budgetary and programmatic policy; prerogative to set our a growth or no growth budget; must be careful not to give up its policy making role entirely to the executive; to fulfill its budgetary role should: become involved in development of policies and guidelines should be sure to receive all the materials it needs to give full and effective consideration of proposals should not concern itself extensively w/ administrative and financial details Budget officer roles: coordination – in this role, BO does not evaluate dept requests or make recommendations or seek to balance proposed exp w/ rev policy guidance – becomes involved in all programmatic and financial issues relating to the budget – guidelines on acceptable levels of service increases/decreases and evaluate requests based on policy; dev. obj; ensure consistency; balance exp w/ rev; recommend budget action to legislative body direct supervision – ensure dept don’t exceed budget limits; review budget transfer requests; performance reports; etc. Advantages of “centralized” budget office: best determine priorities for services budget prep standardized effective control of resources’ in and outflow fiscal problems can be detected sooner It is recommended that all executive budget functions be administered by a single budget officer – works best when budget officer has full responsibility for managing the coordination and administration of the budget process. budget classification structure – forms the framework around w/c budget requests are prepared and presented; structure w/in w/c actual rev and exp are classified and reported – components are: 1. fund – s/b discussed w/ accounting personnel and analysis of the accounting system and legal requirements 2. organizational unit – identify the responsibility – where significant managerial responsibility lies 3. program – include broad categories of services 4. activity – specific function w/in a dept 5. object of expenditure – types of goods and services – enable gov’t to develop more precise estimates – tools for planning and control, not the end product of local services 6. source of revenue – similar function as object of expenditures 7. project A good coding structure permits a locality to: a)classify info and detailed levels and b) easily summarize financial data at all necessary levels above the detailed level – s/b based on most complex case. Coding structure in budgeting s/ be same in accounting. The budget classification structure s/b a part of a locality’s chart of accounts and the coding structures develop should facilitate this linkage. 2 major steps in developing structure: decide what components are needed and how they should be organized develop a coding structure w/c can be used in the existing accounting system Chapter 2 – Initiating the Annual Budget Preparation Cycle 2 principal steps of developing guidelines at beginning of preparation cycle: develop overall fiscal and programmatic policy prepare and disseminate to each dept detailed instructions for preparing requests 2 impt steps in preparing annual operating budget (adequate attention to long term costs and revenue projectives can prevent many of the less severe budgetary consequences of shifts in the economy): analyze revenue prospects determine current service costs Objective of developing policy guidelines: develop a rough framework of the financial constraints that will be faced in the budget year. Chapter 3 – Estimating Available Resources 2 steps in determining reasonable estimate of available resources: determine estimated undesignated fund balance in current fiscal year estimate expected revenue to be collected in budget year – s/b reviewed when requests are formally submitted to legislative body and immediately prior to the final opportunity for change for budget is adopted Integrating grants funds into the overall budget request can be: identified as a completely separate activity w/in the dept’s request – this approach facilitates clearer accountability combined into an activity along w/ other funds – this approach encourages more unified planning and budgeting Thorough analysis s/b made of grant requirements before approving its acceptance – official do address this will better understand long term potential financial risks – possible solution to use grant funds to nonrecurring costs. 2 essential components for each revenue source: revenue base – economic entity to be taxed revenue rate – percent of the value of the base to extracted from the economy 8 steps to revenue forecasting (impt to develop conservative estimates esp. for large revenue sources): set framework to promote realistic estimate select revenues for special analysis define acceptable level of variances collect initial dept estimates or “drivers” identify business changes and indirect impacts document date, assumptions/projection methods apply analytical techniques for projections monitor closely actual revenues versus budget during the year trend analysis – involves using historical (5-6 years) collection pattern of each source to predict revenues for coming year – when identifying trend, best variable measure is change in revenue base, then average change and rate of change over the period Chapter 4 – Planning & Developing Budget Requests Good budgets should be based directly on service needs - (admin officials should think): level of service is needed minimum and maximum level that can be provided how many resources are needed (inputs) to deliver service (outputs) efficient use of resources if service more effectively and/or efficiently provided by private sector Budgetary process as an effective program planning instrument: people who manage local activities s/b involved in the budgeting process conscious effort must be made to determine what residents think about current services budget classification structure should identify service or function performed requests should determine what the service is performance s/b monitored in relation to service levels use benchmarking to identify, understand and adapt good practices and processes legislative and CEO must support the program planning process Roles or the program planning leader: catalyst – stimulate thinking on the part of the operating dept on how they would plan for measures and develop service effectiveness and cost estimates for services to be provided coordinator – pull together all participants to meet deadlines and provide info in a common format critic – evaluate and strengthen the info provided by operating officials department goal – broad statement of that dept’s mission – pinpoints the reason for their existence and establish its direction 3 steps in developing annual objectives and performance measures: develop dept objectives w/c are results-oriented; specific, measurable, attainable w/in a specified time frame and related to dept’s goal develop quantitative measures of performance – include demand (need for service), workload (amount of work), efficiency (relation between cost and results) and effectiveness(how well it meets the objectives) measures develop budget requests based on objectives and performance plans (requires relating resources or costs to outputs or services) – workplan w/c becomes a device to debate service and costs budgeting for contractual services (cost should not exceed community standards): specify task to be done identify outputs if any specify length of time to perform service indicate total cost of service Non departmental expenditures, such as utilties, debt service and salary increases not budgeted in depts based on policies should be prepared by the budget officer. Chapter 5 – Reviewing and Adopting the Budget A central budget review is best performed by the central budget officer and the chief executive. If delegated by the CEO, the CBO is responsible for weeding out unnecessary, ineffective and inefficient activities. Completed budget document should include: message, planning processes, summary of revenues, dept and other expenditures including changes, summary of capital info, dept goals and objectives and performance measures, prior year actual, current estimate and budget year figures for revenue/expenditures and detailed justifications of budget recommendations. steps leading to budget adoption: informal briefings formal presentation of CEO’s recommendations adjustments to CEO’s recommendations adopting appropriation ordinance – s/b in a form that allows best control of funds and enables fiscal policy and legislative intent to be carried out while allowing dept operations adopting applicable taxing ordinances Chapter 6 – Implementing and Monitoring the Budget Developing expenditure plan: CBO prepares baseline plan adjust for major anticipated deviations formal allotment systems – specific portions of the dept’s appropriation are made available, say on a quarterly basis – overly stringent allotment can hamper agency’s flexibility and ability to be efficient position control consists of: – list of jobs for all depts; standard rates of pay, budget for approved positions, hiring for approved positions and modifying positions and pay plans in an orderly manner major issues to determine in reviewing personnel actions: if position is authorized by legislative body if personnel change is justified for dept’s work program and current demands for service fiscal impact 4 themes of budget presentation: as a policy document, as a financial plan, as an operations guide, and as a communications device C. SOURCE: CAPITAL IMPROVEMENT PROGRAMMING – A GUIDE FOR SMALLER GOVERNMENTS Chapter 1 – Overview of Capital Improvement Programming capital asset – new or rehabilitated physical asset that is nonrecurring, has a useful life of more than 3 to 5 years and is expensive to purchase; a capital project is undertaken to acquire a capital asset capital program – identifies each proposed cap proj, the year it will be started or acquired, the amount expected to be expended on the proj each year and the proposed method of financing the expenditure – cap prog not to be confused w/ cap budget w/c represents the first year of the cap prog Purpose of CIP: formal mechanism for decision making – orderly process for planning and budgeting for cap needs link to long-range plan – s/b developed in concert w/ comprehensive land use, strategic plan or other long range plans financial management tool – prioritize current and future needs w/in anticipated financial resources reporting document – describes proposed projects Advantages of CIP: focus on community goals, needs and financial capability - an impt aspect of developing CIP is balancing community needs w/ its ability to pay build public consensus for proj and improves community awareness improve inter-intragov’tl cooperation and communication avoid waste of resources help ensure financial stability Steps in CIP process: 1. establish administrative structure – organizational framework – who’s involved 2. establish policy framework – financial or programmatic 3. formulate evaluation criteria - prioritizing 4. prepare capital needs assessment – existing and future needs 5. determine status of previously approved proj/identify new ones – add’tl funds required 6. assess financial capacity – examine past, present and future revenue trends, expenditures and other variables 7. evaluate funding options – pay as you go or issuing debt – legal authority to do so, political acceptability and administrative complexity 8. compile, evaluate and rank proj requests 9. adopt CIP and capital budget 10. implement and monitor the cap budget and proj – outflows 11. evaluate CIP process – what changes to be made Chapter 2 – The Administrative Structure CIP coordinator – coordination, cooperation, communications are critical: (2 approaches – individual or committee) prepare calendar, form, instructions assist dept in submitting proposals create opportunities for citizens’ involvement coordinate w/ other gov’t units evaluate funding options review and prioritize CIP submission submit proposals to legislature for approval monitor proj implementation cost and useful life – criteria for classification of assets calendar – prepare early in the process to determine who does what and when Citizen ideas can help assure most desirable proj receive the highest priority – gain support for CIP and budget and for funding options esp. when issuing debt. An orderly CIP process depends on the establishment of an administrative structure and procedures to organize CIP activities – identifying a committee, department or individual to lead the process is critical. Means for providing citizens input to the CIP process: public hearing advisory committee planning commission opinion surveys communications to elected officials Chapter 3 – The Policy Framework CIP policies set parameters w/in w/c capital planning and spending decisions are made – building blocks to construct CIP – 2 kinds: programmatic – gov’t strategic goals and community values ( can be formal, or comprehensive plans or informal by setting goals) – tend to be broadly stated financial – communicate to legislative body preference for certain types and amounts of revenues, expenditures and debt (include capital funding, capital reserves, evaluation of asset condition and maintenance needs) Essentials of CIP policy development integrate policies w/ other financial policies involve all interested parties disseminate policies early in the process Chapter 4 – Capital Project Evaluation Criteria CIP evaluation criteria – support the policy goals but provide means to measure the relative value of each proposed project – include: legal mandates fiscal and budget impacts health and safety impacts economic development impacts environmental, aesthetic and social effects project feasibility distributional effects – disruption or inconvenience caused impact of deferral uncertainty of risk interjurisdictional effects relationship to other projects Advantages to developing/using criteria: (by relying on criteria rather than selected judgment, gov’t can reduce charges of favoritism or political influence) types will depend on gov’t specific goals and policies help encourage agreement or priorities provide objective basis for assessing cap projects facilitate comparison among diverse types of projects Principles for developing in evaluation criteria: (sometimes necessary to test outcomes before accepting criteria) clear and understandable guidelines aspects or consequences of a project relevant and accurate information about project result in selecting projects that meet critical needs and rejection of projects than don’t practical in terms of cost, time and available personnel Chapter 5 – Preparing the Capital Needs Assessment Infrastructure decisions must be made w/ regard to existing and new facilities – for existing, need to address appropriate maintenance strategies, renewal versus abandonment and repair versus replacement. Capital inventory – identifies gov’t owned facilities and equipment; age and condition of assets and cost to replace them – used to systematically plan for repair and replacement -–can be used as a communications device to sell CIP Checklist for developing capital inventory: definition or categorization of asset location quantity age – when purchased condition repairs made/when/cost initial purchase price replacement value Assessing future demands: the first step in determining future needs is to review comprehensive land use, transportation or other plans. Another way is to set level of service standards w/c are quantifiable indicators of the amount service that will be provided. GIS – systems that are integrated databases that link geographic info w/ other types of info for planning purposes; e.g., population, employment, land uses and gov’t owned infrastructure – valuable tool for CIP as its mapping capabilities enhance ability to illustrate where proj proposals are located to ensure consistency w/ land use plans or zoning ordinance. Chapter 6 – Identifying Projects for the CIP Project identification usually starts w/ a review of the status of previously approved projects – serves two purposes: a) provide systematic means to monitor and report on progress toward completion; b) aid in updating CIP and new capital budget Project status report: completed; expected to be continued into coming fiscal year; to be deleted Identifying projects – stems from land use, strategic or service plans – capital asset inventories and condition assessments provide basis for proposals Info needed to evaluate new projects: title of asset description and scope justification – addresses policy goals, consistency w/ land use, service or other plans, criteria that are relevant schedule of major milestones – helps gov’t for construction activities – relationship to annual budget w/c is basis to pay vendors – keep project on track estimated cost – baseline estimate; contingency; escalation – consider project characteristics such as site, scope and market or labor condition impact on revenues – e.g., negative (if project takes property of tax rolls); positive if project provides new or additional user fees project cash flows formula for escalation: = C x (1+r)n = C (Cost); r (escalation rate); n(time in years from date of estimate) alternative analysis – process of comparing different approaches to providing a service – key objective is to provide decision makers w/ impt info need to evaluate each alternative – planning tool to consider to determine best way of providing particular service – used to assess the costs and benefits associated w/ constructing and operating a facility in house vs. private sector contract – addresses the ff: descriptions of options considered effect of each option analysis of full cost of each option identification of uncertainty associated w/ various cost estimates consideration of funding alternatives life cycle cost – all costs associated w/ cap proj over life of the asset including engineering and design, construction, installation, day to day operations, maintenance and rehabilitation objective of a value engineering assessment – identify any parts of the project that add cost to the project but do not add any functional value Chapter 7 – Evaluating the Ability to Fund Capital Projects financial plan – essential component of preparing CIP financial capacity analysis – evaluate jurisdiction’s financial condition (revenue, expenditure trends, debt levels, current operation position) and assess likelihood that historical trends will continue Measures of financial condition (assessment encompasses 5-10 years review of past trends) – objective is to determine what factors have been impt in shaping these trends: trends in revenue – changes in assessed valuation, tax base, collection rates, employment, retail sales and business activity; changes in socioeconomic and demographics; use of one-time revenue raising mechanisms trends in expenditures – normal recurring or operating; pay-as-you-go capital expenditures and long term debt – determinants include number of employees; changes in cost structure of public service either due to internal productivity or labor agreements; state or federal mandates; increases maintenance costs due to failure to adequately maintain aging infrastructure debt position unfunded liabilities operating position – surplus/deficit; fund balance; liquidity measures key variables (including national, state or local development): CPI interest rates unemployment rates local business location decisions characteristics of community population ratios used by rating agencies or credit analysts to determine debt levels: debt per full or equalized assessed value of property debt per capita debt as percentage of personal income overlapping or underlying debt from all jurisdictions supported by same tax base debt as % of operating revenues or expenditures other relevant financial indicators to decide CIP expenditures for particular year: level of unfunded liabilities (pension or retire health coverage) level of undesignated reserves liquidity to withstand a short-term financial cash flow (high quick asset ratio: cash and short term investments/current liabilities) sensitivity analysis – how variations in forecasting revenues/expenditures affect forecasted results and the likelihood scenarios (optimistic or pessimistic) will occur Chapter 8 – Evaluating Funding Options As a rule no capital funding decision should proceed w/o developing an understanding of the long term financial consequences. potential resources: grants; revolving loans; current receipts/fund balance from prior year; private contributions; impact fees; service contracts; public-private partnerships; leasing guiding principles in selecting funding sources: equity – who will pay effectiveness – will money be there when needed efficiency – relative cost of financing method – staff resources/monetary when assessing capital financing mechanisms consider: legally available? politically acceptable? administratively feasible? advantages of pay as you go financing: savings in interest and other issuance costs preservation of financial flexibility protection of borrowing capacity enhanced perception of credit quality disadvantages: insufficient funding for capital needs discourages intergenerational equity “lumpy” capital expenditures (unevenness in capital expenditures) debt and other financing include: GO bonds – secured by unlimited tax pledge; lower interest rates revenue bonds – usually enterprises; specific revenue source special assessment bonds – particular geographic area tax increment – projects w/in an area (check if permitted by law and legal requirements are met lease purchase – agreement w/ vendor or financial institution to lease asset over period and may have option at end to purchase assets – may be obtained w/o voter approval COPs – lessor will identify group of investors who are willing to provide funding for asses in return for share of the lease payments made by gov’t – carry lower credit rating than GO bonds, ergo, higher interest rates grants – advantage don’t need to be paid back impact fees and exactions – contributed by developers revolving loan bond banks public private partnerships private contributions Chapter 9 – Evaluating and Programming Capital Projects Ultimately, the job of the CIP coordinator is to decided on the best mix of projects and funding sources for the planning period. tasks: reviewing project applications – compile, assign project reference, completeness and accuracy prioritizing – based on relative need and cost selecting and scheduling and assigning funding source (most essential, feasibility) objectives of financing programming: identify most appropriate sources of funding (what alternatives are available? eligible for grants? project can be phased?) balance objective of meeting capital needs w/ maintaining tax rates/user fees at acceptable levels maintain debt service at affordable level to preserve budgetary flexibility and credit quality maximize the use of intergovernmental aid The use of capital evaluation criteria can be a useful tool in making difficult choices. Regardless of the form used, it is essential that the overall program reflect the gov’t priorities established through its goals and policies. Chapter 10 – Adoption of the Capital Program and Budget CIP coordinator: prepare CIP document submit prelim CIP to legislative body engage formal public hearings revise CIP if necessary and submit final CIP and budget Components of CIP document: narrative statement of issues – framework for selecting CIP, definitions of key terms and CIP process, financial trends, etc overview of projects and funding summary list of projects project detail other info – such as planned bond issues, o/s debt service; impact of planned debt In formally adopting the multi year CIP, legislative body commits to a tentative scheduling of capital projects over the planning period. Chapter 11 – Monitoring the Capital Budget & Program Responsibilities of project manager: develop project schedule develop/contribute RFP to solicit bids, including technical specs ensure prelim work for construction is completed coordinate w/ other depts/agencies involved in carrying out project coordinate/monitor in-house labor and contractors CIP coordinator – should stay informed of changing conditions that affect magnitude and composition of CIP - communicate key info on the progress of capital project to legislative bodies – status report to include: problems encountered in progress reports/financing projects delays in implementing projects/causes status of funds available other developments affecting CIP implementation Issuers permitted to retain arbitrage earnings if any of the ff. conditions apply (gov’t that fail to meet even of the spending milestones no longer qualify for the exception for that bond issue) expend all proceeds of tax-exempt w/in six months expend all proceeds over 18 month as follows: 6 mo 15%; 12 mo 60%; 18 months 100% expend at least 75% of proceeds as follows: 6 mo 10%; 12 mo 45%; 18 mo 75%; 24 mo 100% Chapter 12 – Evaluating the CIP Process Components of the evaluation (CIP coordinator to take lead): organizational/process issues – sufficient time? right individuals/depts involved? size for decision-makers right? citizens given opportunity to input? evaluation criteria relevant? forms and documents – effectiveness of forms/docs used financial issues/assumptions – assumptions valid? planned sources materialize? accuracy of info on project costs D. SOURCE: RECOMMENDED BUDGET PRACTICES – A FRAMEWORK FOR STATE AND LOCAL GOVERNMENT BUDGETING National Advisory Council on State & Local Budgeting recommended practices: advocate a goal-driven approach to budgeting that spans the planning, development, adoption and execution phases of the budget policies promote linkage of the budget process w/ other activities of the gov’t – scope/dimension: political, managerial, planning, communications and financial should have long range perspective and not simply an exercise in balancing revenues and expenditures one year at a time. enhance quality of decision making by encouraging practices that illuminate key issues and choices facing a community The quality of decision resulting from the budget process and the level of their acceptance depend on the characteristics of the budget process that is used. Framework and compendium of good budget practices intend to serve as tools to improve budget process the benefits of w/c include: educate gov’t and budget participants about potential of budget systems help gov’t assess adequacy of their system provide guidance to gov’t who want to improve their process promote education, training and further experimentation Good budgeting – process that has political, managerial, planning, communications and financial dimensions – consists of activities that encompass the development, implementation and evaluation of a plan for the provision of services and capital assets Characteristics of good budget process: incorporate long term perspective establish linkages to broach organizational goals focus budget decisions on results and outcomes involve and promote effective communications w/ stakeholders provide incentives to gov’t management and employees mission of the budget process: help decision makers make informed choices about the provision of services and capital assets and to promote stakeholder participation in the process budget practice – a procedure that assists in accomplishing a principle and element of the budget process – do not identify specific time frame budget tools and techniques – specific methods of accomplishing a practice – identify specific time frame If there is unresolvable conflict between recommended practices and statute, statutory requirements should take precedence. 4 principles of budget process: 1. establish broad goals to guide gov’t decision making 2. develop approaches to achieve goals 3. develop budget consistent w/ approaches to achieve goals 4. evaluate performance and make adjustments 12 elements of the budget process: in relationship to principle 1 1. assess community needs, priorities, challenges and opportunities – assess stakeholder satisfaction w/ programs and services and progress towards achieving goals; frequency and extensiveness of the evaluation s/b consistent w/ how frequently the info changes and the relative importance of the info being gathered – consider local, national and global factors in evaluating community condition including economic, financial, demographics, legal, social, cultural, physical, intergovernmental and technological issues/trends/factors 2. identify opportunities and challenges for gov’t services, capital assets and management – evaluate programs’ purpose, beneficiaries; impact of deferred maintenance; examine strengths and weaknesses of organizational structure; interdepartmental communications; policies and procedures 3. develop and disseminate broad goals – express goals in written forms followed by action plans – s/b proactive rather than reactive – conduct public forums in relationship to principle 2 4. adopt financial policies – guide creation, maintenance and use of resources for financial stability – distinguish legally required reserves from discretionary reserves – how fees and charges are set – debt issuance and management – use of one-time or unpredictable revenues s/b explicitly defined – commitment to balanced budget – strive to use diversified revenues to extent possible – financial action during emergency or catastrophic events 5. develop programmatic, operating, and capital policies and plans – policies and plans that guide design of specific programs and services – which groups or population to be served – plans for capital acquisition, maintenance and replacement/retirement 6. develop programs and services that are consistent w/ policies and plans – evaluate delivery mechanism (what’s the best approach) – consider cost of service; service quality and control; management issues; financial issues; impact on stakeholders including employees; statutory or regulatory issues – identify functions, programs and/or activities of the organization to identify tasks/roles – develop and utilize performance measures (inputs, outputs, efficiency and effectiveness) w/c are relevant to goals – use benchmarks or standards of performance to help make improvements 7. develop management strategies – to facilitate attainment of program and financial goals – focus both on (emphasizing rewards to produce better results) rather than on penalties – mechanism to ensure compliance w/ adopted budget – choose the type (e.g., line item or program, etc.) the manner and time period of the budget in relationship to principle 3 8. develop a process for preparing and adopting a budget – budget calendar, guidelines for preparing budget (consider role of stakeholders) – incorporate financial policies – responsibilities for overall coordination (not necessarily imply overall decision making authority) – making choices to adopt a budget - 9. develop and evaluate financial options – assess long term implications of current and proposed policies, programs and assumptions – financial plan is not a forecast of what is certain to happen but rather a device to highlight significant issues or problems that must be addressed if goals are to be achieved – revenue projections; analyses of major revenues (in-depth understanding); effect of changes to revenue rates and bases; tax and fee exemptions impact; consensus on revenue forecast; document revenue sources in a Revenue Manual – expenditure projections – evaluate revenue and expenditure options (determine if they maintain, erode or improve government’s financial condition); flexibility - CIP 10. make choices necessary to adopt a budget – recommended budget should address stakeholder issues – include all programs and funds – comply w/ statutory requirements – balance of resources and assigned uses – key programmatic and financial policies, plans and goals w/c influence the recommended budget are included in the document – highlight key issues to provide disclosure and analysis to determine that well-considered budgetary decisions are made – provide financial overview (short term and long term plan), operations guide; explanation on basis of accounting, budget summary (non-technical as much as possible and easy to read) in relationship to principle 4 11. monitor, measure and evaluate performance – prepare regular reports – monitor and evaluate stakeholder satisfaction w/ programs and services and make adjustments including financial performance relative to the budget – evaluate financial condition (distinguished from budget performance w/c identifies explicit short term indicators, primarily revenue and expenditure status for the budget period) w/c considers broad array of factors that may have long term implications on the govt’s financial health – external factors w/c govt cannot control such as national or regional economy, demographics, statutory changes – CIP status 12. make adjustments as needed – for unforeseen events that require budget changes – including changes to policies, plans, programs and management strategies (based n assessment of performance) – changes to goals if no longer appropriate – desirable to minimize number of adjustments to long term goals to maintain credibility E. SOURCE – BUDGETING – A GUIDE FOR LOCAL GOVERNMENTS – ICMA Chapter 2 – Designing the Budget Process budget process – frames decisions and organizes decision making so that budgeteers can make timely choices w/ sufficient info – defines and monitors budgetary balance and influences the scope of govt services and the distribution of the tax burden – deal w/: timing decisions – budget calendar, manual training participants – including citizens and the press framing decisions – ask budget participants the right questions; executive to consider budget format and presentation of options that may affect decision; executive or mayor should ensure decisions are policy issues rather than managerial concerns factors CEO needs to consider legal and historical constraints form of govt degree of centralization level of citizen participation 4 stages of budget cycle (and end products): 1. preparing budget requests (proposed budget) 2. legislative approval – sets legal spending (appropriations) 3. budget implementation (encumbrance and disbursement of funds) 4. summary of reporting on actual budget transactions (audited financial report) openness of budget deliberation – key factor in the level and quality of participation (by interested parties) – depends on forum used and the design used constraints on the design of the budget process state laws local charters form of government – while this influences the location of budgetary power, it does not lock it in broad policy issues whether CEO designs from scratch or alters existing budget process (and basic values that budget process addresses): 1. relationship between executive and governing body – (roles of executive and legislative branches reflect the larger issues of accountability, managerial effectiveness, democratic participation and representativeness) 2. level of centralization – avoid extremes and s/b appropriate to the problems currently facing the govt – overcentralization carries number of risk including micromanaging, employees evading controls – (reflects the need to balance fiscal control w/ managerial expertise and initiative) 3. role of citizens and interested groups – (reflects the trade off between being vulnerable to demands and judiciously responsive to public interest) one advantage of outcome-oriented budgeting – maintains sufficient level of managerial autonomy while increasing level of accountability – however, if jurisdiction is under fiscal stress and wants to encourage efficiency, it may be wise to substitute incentives for rigid rules. In an extremely complicated situation involving many interests, putting forward one alternative may the best solution – number of alternative w/c may favor some interests over others may be simply overwhelming. budget policy statements – it is much easier to formulate a policy and come to agreement when a local govt is not facing a financial emergency – having a policy in place will not always prevent unwise decisions but it may eliminate particularly poor options or make them look less attractive b/c consequences would have already been discussed and prudent financial practice will have become more institutionalized in the decision making framework budget policies include: operating budget – scope, balance, maintenance of reserves, roles of various actors revenues – stability of tax rates, use of one-time revenues, review of service charges budget implementation – balancing flexibility w/ need for accountability debt – limits (% of operating revenues or amount of o/s debt) In creating budget reserves, govt must resolve two policy issues: 1) size of the reserve; 2) conditions that must be met before reserves can be tapped types of budget reserves: cash flow – inflow of revenues never precisely coincide w/ outflow of payments revenue stabilization unforeseen contingencies – protect govt from issuing short term debt equipment replacement – able to replace when obsolete building repairs or other improvements debt service Summary: in designing budget process, local govt officials are constrained by laws, charters, precedent but there is considerable latitude w/in these constraints to shape a process that matches the management style of the CEO and fits the political conditions of the community. In addition to helping resolve specific problems, the design of the budget process can influence the level of governmental accountability and the level of citizen control over govt and taxation. Chapter 3 - Budget Preparation & Adoption Complex process that requires communication and cooperation among diff. parties including CEO, budget office, dept heads, governing body and the public. Role of budget office varies depending on location, e.g., housed under the CEO or finance department (advantage being budget director’s role broader – provide advice and info to CEO – buffer budget office from political and policy concerns of CEO enabling budget office to play more technical role and to have less direct involvement in public policy) target based budgeting – budget office assigns maximum funding levels to each dept; enables budget office to limit total budget requests to expected revenue levels modern budget office – assumes more supportive role – tasks remain the same: estimate revenues, assemble budget requests into proposal, ensure total request do not exceed estimated revenues - assumes number of roles including: educate participants, adjudicates among participants, manage computing facilities, represent the values of accuracy and fiscal conservatism and provide public accountability (most important role) 4 techniques of projecting revenues (in practice, budget offices combine several methodology depending on the revenue source): 1. informed judgment – professional guess – comes w/ experience and careful observation 2. deterministic techniques – formula based (e.g., assessed value x taxable rate) 3. time series techniques – based on trends from prior years’ data – for revenues not particularly elastic w/ respect to economic growth, trend analysis provides useful and accurate estimate – not advisable to use for high volatile revenues 4. econometric models – causal modeling or statistical modeling – using from simple correlations to most complex input-output matrixes (e.g., rise in building permits or decline in unemployment rate correlates or predicts sales or income tax yields) – close correlation predict how revenues will behave in the coming year problems w/ routine underestimates of revenues create general mistrust of the budget office may cause unnecessary reductions in dept staffing or delay capital purchase may create pool of unallocated revenue that can be spend at the discretion of CEO or legislative body (may hold down budgeted expenditures without limiting actual expenditures) advantages of long term projections: early, small corrective action can avert a relatively large problem several years down the road can give sufficient lead time for implementing tax increase or averting ill-timed revenue reduction giver jurisdiction flexibility to reduce staff through hiring freezes and attrition rather than disrupted and expensive reductions in force disadvantages: everything being equal, the longer the period covered by the projection, the lower its accuracy credibility – depends on variety of underlying assumptions of w/c must be clearly identified, valid and defensible common elements in a budget manual: budget prep calendar list/samples of forms list of definitions instructions for filling out each form assumptions – e.g., inflation rates chart of accounts forms for enumerating objectives/performance measures (for those govt that use program or performance budget) explanation on what is to be excluded from the target budget (for target-based budget) under target based budgeting – depts give budget office 2 lists: one of continuing programs funded w/in the target and a second prioritized requests that can’t be funded w/in the target formats for executive budget hearings dept heads meet one on one w/ budget director or CEO executive may form committee to review requests – advantage is that it gives dept heads an opportunity to see requests from other units in the context of overall revenue limits 2 types of legislative budget hearings executive w/ technical support from dept heads present proposals to council (presentation to the council s/b made by the manager) formal public hearing Legislative work sessions to analyze budget proposals are esp. impt. in communities that do not have an executive budget and executive budget hearings. Budget work sessions tend to run more smoothly when there is a professional manager to recommend what s/b in the budget and ensure that council do not have to resolve technical issues themselves and call attention to legal and policy constraints at the beginning of the budget process. Legislative examination of the budget is more effective if it is not concurrent w/ a public hearing. Formally amending the budget during the year has the advantage of bringing requested changes back to the council for discussion and public airing. However, making too many budget amendments conveys the impression that the CEO and the governing body have done a poor job of estimating revenues and planning expenditures. Summary: Although the precise roles and responsibilities of the budget office may vary somewhat, depending on its location w/in the org. structure and size and form of govt, the budget office generally takes revenue projections, assists in the development of budget guidelines, collects and reviews dept. requests and participates in the executive budget hearings. A successful budget process depends in part on the participants’ fulfilling their roles: CEO and CBO must present a balanced budget proposal and educate the governing body about legal and financial constraints; elected officials and the public must present their opinion to staff; and staff must incorporate these policy statements that respond to the preferences of the council and the community. Chapter 5 – The Budget as a Management Tool Local govt often use budgets to improve management: budgets help official identify impending problems, improve productivity, maintain service quality and achieve performance targets. Increasingly, budgets are used not only to improve internal management but also to increase accountability to citizens and elected officials who represent them. Although line item budgets are simple in comparison to program or performance budgets, they still have a number of potential uses as management tools if managers know w/c line items to watch and how to use the information. By examining trends, managers can track exp. patterns and ratios and obtain warning of emerging problems. Unless the budget is organized by program and provides info on the output quantity and quality for each program, questions about productivity cannot be addressed thru the budget. A performance budget provides info on how well public sector activities are carried out – would address cost per unit and would ask whether services are being provided at an agreed upon level of quality and whether programs are achieving their goals. Performance measurers are more meaningful and useful when combined w/ a program format. advantages of program/performance budgets: ability to monitor and improve productivity link performance to budget allocations improve accountability productivity – ratio of input to output – often geared to make employees work harder, longer, smarter and can be used to protect quality SOURCE – HANDBOOK OF GOVERNMENT BUDGETING (This book deals with budget at the federal level) F. Chapter 1 – Features of the Budgetary Process four stages of budgetary process 1. executive preparation – begin w/ setting presidential priorities – then OMB; Council of Economic Advisers, Treasury Dept – various agencies involved 2. legislative review – to Congress who considers president’s proposals – congress focus on protecting the power of the purse (given by Article 1 of the Constitution) – begin w/ receiving president’s budget in early Feb. and concludes w/ passage of concurrent resolution in mid April (required by Congressional Budget Act of 1974) – resolution is congressional rule that does not go to the president for approval – becomes Congress’ spending plan – need to be approved in a separate appropriations bill – esol sets targets for social security revenues and outlays – House initiates appropriations bill – also initiates tax bill – House Ways & Means Committee and Senate Finance Committee have jurisdiction over the tax laws the normal budgetary process runs from the president’s budget to the Budget Resolution to the appropriations bills to the new fiscal year - final step in the legislative process occurs when president signs the appropriations bill into law – president may veto a bill and Congress may override veto w/ 2/3 majority 3. execution – management process – agencies obligate funds to accomplish program goals – two execution techniques: those concerned w/ financial controls and those concerned with administrative controls – goals s/b be to preserve legislative intent observing financial limitations and maintaining flexibility at all levels of administration 4. audit deferrals – temporary withholdings, take effect immediately unless overturned by an act of Congress – control pace of spending and must be obligated at the end of the fiscal year – conversely, rescissions permanently cancel budget authority Annual budget process compared to biennial: annual lead to review and enactment of a budget each year; biennial lead to new budget every two years and have a definite on and off cycle – some adopt two one-year budgets, others adopt a single budget for the two years – some believe biennial b/c they believe budget prep costs and budget exp are lower and more opportunity exists for long term planning – proponents to biennial believe it would decrease tremendous annual effort to developing and implementing the annual budget both I the executive and legislative branches of gov’t agency budget process usually combine centralized and decentralized elements: decentralize spreads the organization’s goals and objectives (makes for a more complicated and lengthy process) top down process – usually dominate jurisdictions under fiscal stress baseline forecast useful for several reasons: warn of future problems for individual tax and spending programs provide starting point for formulating and evaluating president’s budget used as a policy neutral benchmark against alternative proposals differences in budget process – federal/state: budget prep may be similar but pattern not universal – the ones that resemble federal: governors prepare unified budget as legislative agenda and deny legislature access to original agency requests By: Agnes T. Walker Financial Services Director City of Redondo Beach (Now Revenue Officer for the City of Long Beach)