ACC 135 EI9 - Great Basin College

advertisement

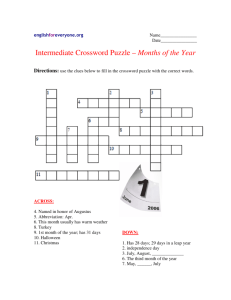

Spring 2008 COURSE SYLLABUS Great Basin College ACC 135B EI9 Independent Study BOOKKEEPING I Instructor: Mrs. Bea Wallace, MBA, CPA Office: GTA 103 Office Phone: (775) 753-2334 (voice mail) Office Hours: 10:00-11:00 MWF; 10:30-11:30 TTh; & by appointment Time: To be arranged E-mail: Through WebCampus OR BeatriceW@gwmail.gbcnv.edu COURSE MATERIALS 1) Textbook: College Accounting, by Price/Haddock/Brock, 11e, McGraw-Hill Irwin, 2007 (Required) 2) Study Guide and Working Papers, Chapters 1-13, by Price/Haddock/Brock, 11e. (Optional)) 3) A hand calculator for working problems (helpful for exams). (Strongly recommended) 4) Student resources available at publisher’s website: www.mhhe.com/price11e. COURSE CATALOG DESCRIPTION An introduction to the basic procedures of accounting for the financial activity of a business enterprise. Debits and credits, the accounting cycle, journals, ledgers, bank reconciliations, payroll, and the preparation of simple financial statements. COURSE PURPOSE & GOALS The major purpose of Bookkeeping I is to provide the student with the ability to record simple financial transactions and maintain a set of books for a small business. The extensive use of a set of working papers assures that the student obtains adequate practice in performing the various functions of the bookkeeper. COURSE PREREQUISITES There are no prerequisites for the course, but it is understood that the student has basic skills such as analytical reading and simple mathematical ability. COURSE OBJECTIVES/EXPECTED LEARNER OUTCOMES MEASUREMENT Upon completion of the course the student will be able to: 1. Identify & describe users of financial info, accounting career Crossword; Exam 1 opportunities, types of business entities, process to develop GAAP. 2. Use the accounting equation to record transactions in tabular & T Homework problems 2-2A,2-4A, account formats; prepare financial statements 3-1A, 3-4A; crossword; Exam 1 3. Record transactions in a general journal & post journal entries to Homework problem 4-2A; general ledger accounts; correct journal & ledger errors. crossword; Exam 2 4. Prepare a trial balance, a worksheet, financial statements; Homework problem 5-4A; journalize & post adjusting entries. crossword; Exam 2 5. Complete the accounting cycle; journalize & post closing entries; Homework problem 6-2A; prepare a postclosing trial balance; interpret financial statements. crossword; Exam 2 6. Record transactions in sales & purchases journals; post to Homework problems 7-4A, 8-4A; customer & creditor subsidiary ledger accounts; prepare schedules of crossword; Exam 3 accounts receivable & accounts payable. 7. Record transactions in cash receipts & cash payments journals; Homework problems 9-4A, 9-5A; post to appropriate accounts; prepare a bank reconciliation; account crossword; Exam 3 for a petty cash fund; identify internal control procedures for cash. 8. Properly account for payroll transactions; prepare various records Homework problems 10-4A, 11-1A, & payroll reports for a business. 11-2A; crossword; Final Exam 9. Complete adjustments for inventory, accrued & prepaid expenses, Homework problem 12-3A; accrued & deferred income; prepare a 10-column worksheet. crossword; Final Exam 10. Prepare classified financial statements; journalize & post Homework problem 13-2A; adjusting, closing, & reversing entries; prepare a postclosing trial crossword; Final Exam balance In addition, this course is part of the Associate of Applied Science degree in which students’ overall progress is measured at the program level upon entrance into the program and upon graduation. METHODS OF INSTRUCTION This course is provided in an independent study format. You are expected to read each chapter, complete the chapter homework assigned (submit on WebCampus), complete the crosswords before each exam, and take the four exams as scheduled (in the testing center). Course orientation will be given on Feb. 25 at 1:00 in GTA 103. Meetings thereafter will take place on a weekly or monthly schedule or as needed. Instructor and student will agree on the frequency/necessity to meet to cover course material, questions, problems, or any issues. It is anticipated that meetings will occur at least monthly. HOMEWORK AND EXAMS Homework must be turned in on time to receive full credit. Homework assignments may be discussed with others, but the final product submitted should be the student’s individual work. Copying the homework assignment of another is cheating. Using notes, textbooks, relaying or accepting information during exams is cheating. Cheating is a serious matter and will not be tolerated. As outlined in the GBC catalog and student handbook, penalties for cheating range from an F for the assignment or for the course to reprimand, probation, or expulsion from the college. Dates Feb 25-28 ACC 135B Spring 2008 TENTATIVE COURSE SCHEDULE Topics Homework Apr 21 Apr 22-26 Apr 27-May 1 May 2-6 May 7-11 Course Orientation Chapter 1: Accounting: The Language of Business Chapter 2: Analyzing Business Transactions Chapter 3: Analyzing Business Transactions Using T Accts **EXAM 1 (Chapters 1-3)** Chapter 4: The General Journal and the General Ledger Chapter 5: Adjustments and the Worksheet Chapter 6: Closing Entries & the Postclosing Trial Balance **EXAM 2 (Chapters 4-6)** Chapter 7: Accounting for Sales & Accounts Receivable Chapter 8: Accounting for Purchases & Accounts Payable Chapter 9: Cash Receipts, Cash Payments, & Banking Procedures **EXAM 3 (Chapters 7-9)** Chapter 10: Payroll Computations, Records & Payment Chapter 11: Payroll Taxes, Deposits, & Reports Chapter 12: Accruals, Deferrals, & Worksheets Chapter 13: Financial Statements & Closing Procedures May 12 FINAL EXAM (Chapters 10-13) Feb 29-Mar 5 Mar 6-11 Mar 12 Mar 13-16 Mar 17-22 Mar 23-30 Mar 31 Apr 1-7 Apr 8-13 Apr 14-20 Due Dates Points Prob 2-2A, 4A Prob 3-1A, 4A Crossword Mar 6 Mar 11 Mar 12 10 10 Prob 4-2A Prob 5-4A Prob 6-2A Crossword Mar 17 Mar 23 Mar 30 Mar 31 10 10 5 Prob 7-4A Prob 8-4A Prob 9-4A, 5A Crossword Apr 8 Apr 14 Apr 21 Apr 20 5 10 15 Prob10-4A Prob 11-1A,2A Prob 12-3A Prob 13-2A Crossword Apr 27 May 2 May 7 May 11 May 12 5 10 10 10 Although no major changes in the content of this syllabus are anticipated, instructor reserves the right to change certain aspects of the course syllabus, such as assignments, due dates, grading procedures, or materials to accommodate student/instructor needs. However, no changes will be made without informing the student in a timely and clear manner. Course Requirements: 3 Exams (100 pts each) Homework assignments Crossword Puzzles Final Exam Total points 300 100 50 100 550 Letter Grade Equivalents: A 95-100%; A- 90-94% B+ 87-89%; B 83-86%; B- 80-82% C+ 77-79%; C 73-76%; C- 70-72% D+ 67-69%; D 63-66%; D- 60-62% F <60% Students who successfully complete this course meet with the instructor as required and complete all homework assignments and exams in a timely manner. Remember that the more effort you put into this class, the more you will get out of the class in terms of knowledge as well as a course grade.