Chapter 1 – Introduction

advertisement

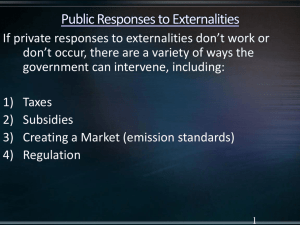

Chapter 1 – Introduction 1) a) Putin’s statement is consistent with an organic conception of government. Individuals and their goals are less important than the state. b) Rehnquist makes a clear statement of the mechanistic view of the state. 4) a) If the size of government is measured by direct expenditures, the mandate does not directly increase it. Cost of compliance, however, may be high and would appear as an increase in a “regulatory budget”. b) It’s hard to say weather this represents an increase or decrease in the size of the government. One possibility is that GDP stayed the same, and government purchases of goods and services fell. Another is that gov. purchases of goods and services grew, but at a slower rate than the GDP. One must consider the coincident federal credit and regulatory activities and state and local budgets. c) The federal budget would decrease if grants-in-aid were reduced. However, if state and local governments offset this by increasing taxes, the size of the gov. sector as a whole would not go down as much as one would have guessed. Chapter 3 – Tools of Normative Analysis 4) a) Social indifference curves are straight lines with slope of -1(i.e. linear functions with a negative slope). As far as a society is concerned, the “util” to Augustus is equivalent to the “util” to Livia. UL UA b) Social indiffernce curves are straight lines with slope of -2. This reflects the fact that society values a “util” to August twice as much as a “util” to Livia. 1 UL UA c) UL a Optimal solution is in favor of Livia UA UL Optimal solution is in favor of Augustus b UA 2 7) In this case, we have 2 consumers, only one commodity, and no production. Let us illustrate it by a diagram. Indifference curve for Consumer I Indifference curve for Consumer II O A B C Consumption of Consumer I O’ Consumption of Consumer II Consumers will make choices at points like A, B, or C on the horizontal axis. One cannot claim that any of these points would reflect a “fair” situation. The resulting situation will not be fair as long as the consumers prefer to share the total amount unevenly. Besides, since there is only one good to consume, the allocation points will unavoidably occur between the points O and O’. 10) a) The statement is uncertain. Remember that the necessary condition for Pareto efficiency is MCa/MCf = MRSafConsumer I = MRSafConsumer II when we have 2 consumers who consume good “a” and good “f”. For that reason, in order to say that the allocation of resources is Pareto efficient we must take into account the production side as well, i.e. the MRTaf = MCa/MCf. b) Yes, this statement is true. [As explained in section a)] c) When we get vaccinated against a disease, we give our immune system the opportunity to develop a defense against that disease. At the same time, third parties can benefit from the defense that we have created by getting vaccinated. So, there is positive externality in that case. d) True. The First Welfare Theorem indicates that a competitive system leads to efficient allocation on the utility possibilities curve, however, there is no reason that it is the point that maximizes social welfare. We may conclude that, even if we have a Pareto efficient allocation of resources, government intervention may be needed to achieve “fairness”, i. e. a socially desirable point. The Second Fundamental Theorem of Welfare indicates accordingly that a society can attain a Pareto efficient allocation of resources by making a suitable assignment of initial endowments and then letting people freely trade with each other. 3 Chapter 4 – Public Goods 1) a) Wilderness area is an impure public good – at some point, consumption becomes nonrival. b) It is a publicly provided private good. c) Medical school education is a private good. d) Public television programs are nonrival in consumption (Public good). e) An internet site is nonrival in consumption (though, it’s excludable). 2) We can assume that Cheetah’s utility does not enter the social welfare function; hence her allocation of labor supply across activities does not matter. a) The public good is patrol; the private one is fruit. b) Recall that efficiency requires MRSTARZAN+MRSJANE=MRT. TARZAN JANE MRS =MRS =2. However, MRT=3. For this reason, summation of the MRSs is greater than the MRT. To achieve an efficient allocation, Cheetah should patrol more. 9) To prevent anyone from consuming the apartment’s temperature is almost impossible. Moreover, once it is provided, the additional cost for the additional consumer is zero. So, we can easily say that, apartment’s temperature is a public good. MBR+MBM=MC (Efficiency condition). We can conclude from the table that, 7+10=17 at 67 oC. 10) MBTHELMA = 12 – Z; MBLOUISE = 8 – 2Z. MBTOTAL = 20 – 3Z. MC = 16. So, for efficiency: MBT = MC. 20 – 3Z = 16. Z = 4/3. $ 20 16 MC=16 12 MBTOTAL 8 4 12 Z 4/3 4 Chapter 5 – Externalities 2) $ $b g MCP c b h MSBP d a MBP P a) b) c) d) Parties per month P* P. See schedule MSBP. P*. Grant a unit subsidy of $b per party. Total subsidy is given by the area abcd. Society comes out ahead by ghc, assuming the subsidy can be raised without any efficiency costs. (Cassanova’s friends gain gcdh; C loses chd but gains abcd, which is a subsidy cost to government.) 3) Coase Theorem: Efficient solution is to put the resources in question into private hands. a) If you know who was cooking, the externality is easy to identify, and depending on how many students are involved, the costs of negotiation should be fairly small. Yes, applicable. b) In this case, the source of the externality is easy to identify, but the costs of negotiation for a large river are substantial. This leads to the conclusion that the Coase theorem is not applicable. c) There are too many farmers and too many city-dwellers for a negotiation. Not applicable. d) Again, too many people are involved for negotiation. Not applicable. 7) a) MC = MB. 13 = 13 at 4 hogs. b) MC + MD = MB. 6 + 7 = 13 at 2 hogs. c) If two firms merge, the externality is internalised- it is taken into account by LP hog farm. Production is stil 2 hogs. 5 $ d) MSC MPC B 13 8 MB A MD 3 2 Q 4 Before they merge, area A shows the lost profits of LP farm. Area B is the social gain of Tipsy. After they merge, profits will increase, because area B will be the gain of the merger. 8) Private Marginal Benefit = 10 – X. Private Marginal Cost = $5. External cost = $2. Without government intervention, PMB = PMC; X = 5 units. Social efficiency implies PMB = Social Marginal Costs = $5 + $2 = $7; X = 3 units. Gain to the society is the area of the triangle whose base is the distance between the efficient and the actual output levels, and whose height is the difference between MSC and MPC. Hence, the efficiency gain is (5-3)(7-5)/2 = 2. A Pigouvian tax adds to the private marginal cost the amount of the external cost at the socially optimal level of production. Here, a tax of $2 per unit will lead to efficient production. This tax would raise $2(3)=$6 in revenue. The diagram below illustrates what happens. $ 10 b e c a d f MSC=5+2 MPC=5 MPB 3 5 10 Q 6 7