HowarthLynch Chartered Tax Advisers specialising in R&D tax

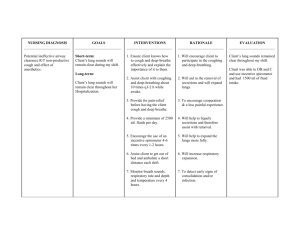

advertisement

HowarthLynch Chartered Tax Advisers specialising in R&D tax credits Your Free Pre-Qualification Checklist The R&D scheme is a tremendously generous tax relief which can secure substantial tax repayments or even payable tax credits for loss making companies which have paid no corporation tax. Therefore it is a great idea to spend two minutes now trying to decide whether your company will be eligible to make a claim. R&D has different meanings for different companies, but HMRC have a very clear definition of what constitutes Research and Development for the purposes of the tax relief. Most R&D claims in the Travel industry revolve around internal software development. For example, developing a complex website, search engine, booking system, security encryption or bespoke operating software systems linkages. It is possible you may have incurred costs that qualify for R&D tax relief. As a rule of thumb, for every £1 spent on internal or external R&D the company is eligible to claim back circa 25p in a tax refund or tax credit. The rules are complex but before we speak to you it is useful to consider both the nature of the development and the relationship and ownership of the software. Please complete the boxes below and we can then discuss your particular set of circumstances in our pre-qualification telephone conversation or email you with our assessment of your claim. Please take 2 minutes to fill out the following 7 questions and send them to our industry expert, Rachael.hart@howarthlynch.co.uk or call 0114 2364457 for your free no obligation phone call. A detailed explanation of some of the rules relating to the travel industry is provided below for information only. 1. Outline the nature of the development work. For example, what is it that is being developed? For example “development of a software platform to provide an infrastructure for tailor made and bespoke holidays.” 2. Have you bought an off-the-shelf package OR have you developed the software from scratch OR is it a mixture of the two? 3. Have you outsourced the development work OR have you employed an in-house development team OR is it a mixture of the two? TEL 0114 2364457 HEAD OFFICE Gardeners Cottage, Beauchief Hall, Beauchief Drive, Sheffield, S8 7BA WEB www.howarthlynch.co.uk HowarthLynch Chartered Tax Advisers specialising in R&D tax credits 4. How long has the development taken and approximately how much has it cost? If you can, provide an approximate start date. 5. How many employees does the Company have (note - you have to include ALL group companies whether overseas or not). 6. What is the company’s year end? (Note – the company has 2 years from the end of its accounting period to claim R&D tax relief). 7. Has the company ever tried to claim R&D tax credits before? 8. Any other comments that you think may be relevant at this stage. We are happy to undertake a free telephone conference call to pre-qualify the company and give a definitive assessment of whether the company is eligible for an R&D tax credit and how much cash you are likely to save or whether the company is under-claiming R&D tax relief. INFORMATION ONLY In practice, there seem to be two main areas that need considering when claiming R&D tax relief in the travel industry. 1. Are you carrying out qualifying R&D? To qualify, a company must meet three important criteria: Firstly, the company must be aiming to, or achieving, an advance in technology. A technological advance may simply be making an appreciable improvement to an existing product or process. For example, an TEL 0114 2364457 HEAD OFFICE Gardeners Cottage, Beauchief Hall, Beauchief Drive, Sheffield, S8 7BA WEB www.howarthlynch.co.uk HowarthLynch Chartered Tax Advisers specialising in R&D tax credits improvement may be realised by developing a piece of software that you cannot buy off-the-shelf or appreciably improving a piece of software that is already available. Secondly, in making the technological advance, a company must also be overcoming technological uncertainties. In other words, the software developer must be faced with a real technical challenge to develop your software rather than following a well-trodden path to get to the end result. Finally, the projects must not be readily deducible by a competent professional. In practice, the easiest way to ensure that this is not the case is the length of time a project takes to complete. As a general rule, qualifying projects last at least three months and cost a lot of money (e.g. tens of thousands). If projects last, say, less than 3 months and cost, say, less than £10,000, it is likely that insufficient uncertainty existed at the start of the project (and the project would therefore be considered as having been readily deducible). 2. If you subcontract the development work, who claims the relief? Typically, within the travel industry, software development is outsourced to a third party. Ideally in order for you to be eligible for the relief, where subcontracted development occurs, the subcontractor would need to be appointed to provide a deliverable and would only be paid once they had achieved that aim. Your company will be able to claim the R&D relief if you are employing a true subcontractor rather than buying a piece of software off-the-shelf and getting it programmed or “tweaked” to suit your purposes. A true subcontractor is usually working to a contract for a “deliverable” on a project whereby the contractor is “at risk” of a claim for damages if he gets it wrong or has to put the work right at his own cost. They generally work to fixed price contracts and the price is usually agreed at the outset for a specific piece of work. The contractor would not usually own the intellectual property resulting from the R&D as you would be contracting them to develop the software for your company only. If this applies, the R&D relief claim is allowable but in most cases is restricted to 65% of the cost. A true subcontractor can be compared to a consultant which would not be a qualifying activity for R&D tax relief purposes. A consultant can be described as someone that does not undertake a specific part of the R&D activities. They are not undertaking subcontracted R&D. A consultant is likely to get paid for time and materials (e.g. on an hourly rate rather than a fixed price). The consultant is also likely to get paid whether the outcome is successful or not. The consultant is likely to be tweaking, fault fixing or supporting the software rather than actually developing it. Within the Travel industry we have identified a number of situations where an ‘off-the-shelf’ software package has been purchased from, say, a software company like Open Destinations and an extra layer of development has been undertaken to tailor the product to the client’s bespoke specifications. In a lot of cases the extra layer of R&D is developed and owned by the original software company (e.g. Open Destinations) that developed the original product. If the source code of the additional layer of development also remains the property of the original software company, then the software company should claim the R&D tax relief. For example, ABC Travel Limited (”ABC”) has bought a travel software package from Software Company (“SC”) Limited for a set fee. ABC then provided SC with a bespoke specification of how the platform should be tailored for their company and pays SC an additional set fee for the end product. SC retains the intellectual property of the software platform in its entirety and can use this knowledge to upgrade and further develop the SC TEL 0114 2364457 HEAD OFFICE Gardeners Cottage, Beauchief Hall, Beauchief Drive, Sheffield, S8 7BA WEB www.howarthlynch.co.uk HowarthLynch Chartered Tax Advisers specialising in R&D tax credits platform. In this scenario SC would be the company that could claim the R&D rather than ABC who are paying for an end product. However, if ABC develops their own software platform by using their own internal staff or third party subcontractor from scratch, or buys the original platform from SC and spends a significant sum of money to appreciably improve the SC platform, then ABC is likely to be eligible for tax relief as long as SC does not own the IP of the extra layer so that they can then role this extra development layer out to all their other customers. I trust this helps set the scene for you. I look forward to speaking to you. Rachael Hart Rachael.hart@howarthlynch.co.uk Mobile number: 07904 686012 Office number: 0114 2364457 TEL 0114 2364457 HEAD OFFICE Gardeners Cottage, Beauchief Hall, Beauchief Drive, Sheffield, S8 7BA WEB www.howarthlynch.co.uk