Trusts and Wills Outline (Sliskovich)

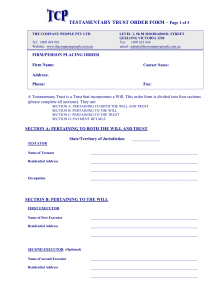

advertisement