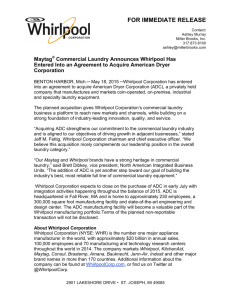

Whirlpool can change Maytag retirees' benefits

advertisement