20060215_Post Interim FY06 Sing Roadshow_Note_Daiwa Victor

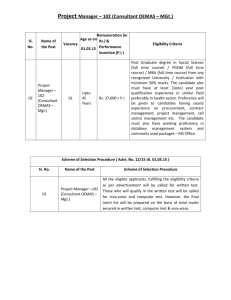

advertisement

** Skyworth Digital (751 HK; NR; HK$1.11): Roadshow update; accelerating digitisation remains a KEY THEME; cash/share of HK$0.45 provides good support to share price We brought Skyworth’s mgt (CEO Mr Zhang Xuebin; CFO Mr Frederick Leung) to a 2-day roadshow in Singapore. Key take-aways: Growth drivers, according to mgt, include: 1) domestic market: thanks to accelerating TV digitisation; 2) overseas market: to focus on a few key strategic OEM/ODM customers; 3) set-top boxes (again thanks to accelerating digitization); 4) handsets (market size bigger than TV; mgt emphasised the business will be done in a very cautious way) Domestic market: Skyworth maintained its no. 1 market share in terms of revenue in 100 major cities in China. According to GfK Skyworth’s market share was 11.82% as of Oct 2005. In unit volume terms market share stood at 14.83% after Changhong. In terms of high end LCD market share Skyworth stood at no. 2 with 11.3% market share in Oct after Hisense Admittedly the China TV market has been steady-mgt estimates the overall market to grow by 5% on a yearly basis. The competition is very keen and its difficult to further gain market share from key competitors. The TV market in China is pretty consolidated with top 5 TV makers accounting for c80% of total sales. Mgt admits that Skyworth’s growth in volume terms could be limited; but is confident to report good sales value growth thanks to shift to high end products (HDTVS, LCD and Plasma TVs accounted for 50% of total China TV sales in 1H06). LCD TVs command a higher GP margin at 18% vs CRT TV’s 13%. TV digitisation remains a major theme in China. China is scheduled to cut off analogue TV broadcasting signal by 2010. TV digitisation is steaming along as we are heading towards 2008 Olympic (games to be digital-broadcasted). TV digitisation also benefits Skyworth’s set-top box sales. Currently there are about 100m cable subscribers in China and in some cities (eg some parts of Shenzhen and Qingdao people cannot watch TVs without a set top box). According to mgt, Skyworth is no. 2 in set box sales in China (no. 1 is Coship, or Tongzhou in Chinese). Mgt targets to sell 1m set top boxes in FY06 (340K sold in 1H06. Overseas market: admittedly margins are lower as most of the sales are on OEM basis. Mgt indicates that Skyworth will focus on a few strategic OEM/ODM customers (with no names revealed) which could provide the company with big volume despite lower GP margins. On net margin level margins are comparable as Skyworth is not involved in any marketing or selling and distribution activities. Own branded sales are tiny (2% of overseas sales). Handsets: Skyworth’s sales (own branded Skyworth handsets) have been launched in December 2005. Sales are tiny at the moment. Mgt emphasised that the business will be done on very conservative basis-deposits or full amounts are to be received before production/delivery. Skyworth will not push its inventory to the channel. Mgt indicates that Lenovo’s business model (to focus on in-house R&D) is a good example to follow. In sum, handsets business will remain small in medium term. Skyworth is exercising bigger control on its sales to large chain stores (GOME, Suning, China Paradise etc) on the back of high operating expenses involved. TV sales to large chain stores accounted for 30% of total TV sales in China. My personal view: Stock has been sold off aggressively after resumption of trading (following a 14-month suspension). Many shareholders I believe have sold off their holdings if they want to; otherwise will be holding on to the shares. I believe the share price should be well consolidated at current level (ie big selling pressure should be over). During the roadshow many investors remain +VE on the accelerating digitization trend as well as the fast growing set top box sales. I think the stock should be worth a revisit at current levels: 1) share price already trading at below book value of HK$ 1.3; 2) cash per share of HK$0.45 to provide good support; 3) accelerating TV digitisation theme to bode well; 4) improving corporate governance; 5) ex-chairman Stephen Wong’s case to be decided on 8th Feb; hence uncertainties to be removed.