BACTNG1 Syllabus

advertisement

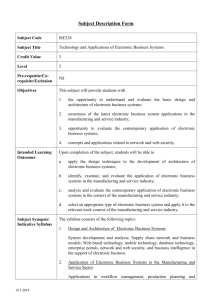

SCHOOL OF BUSINESS ADMINISTRATION AND ACCOUNTANCY General Luna Road, Baguio City UB VISION In pursuit of perfection, the University of Baguio is committed to provide balanced quality education by nurturing academic excellence, relevant social skills and ethical values in a fun-learning environment. UB MISSION The University of Baguio educates individuals to be empowered professionals in a global community. INSTITUTIONAL OBJECTIVES The University of Baguio aims to produce a graduate who: 1. exemplifies a higher standard of learning; 2. manifests the mastery of relevant skills; 3. upholds a conduct that is rightful and just; 4. undertakes scientific and significant researches; 5. advocates sustainable programs for the community and the environment; and 6. leads and demonstrates exemplary performance in the field of specialization. Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Page 1 of 17 Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 SCHOOL OF BUSINESS ADMINISTRATION AND ACCOUNTANCY General Luna Road, Baguio City SCHOOLMISSION The University of Baguio educates individuals to be empowered professionals in a global community. The School of Business Administration and Accountancy edifies competitive and morally upright individuals. SCHOOL OBJECTIVES The School of Business Administration and Accountancy aims to produce a graduate who: 1. cultivates the knowledge that is imperative for success in globalized setting; 2. displays expertise appropriate to the profession; 3. typifies professional integrity with humility; 4. undertakes researches to promote systematic bases for business decisions; 5. utilizes macro-environmental acumen for economic growth and development; and 6. exhibits commendable accomplishments in business and accountancy. PROGRAM OBJECTIVES: The Bachelor of Science in Accountancy Program aims to produce a graduate who: P1. applies accounting knowledge to meet the demands of the business community; P2. demonstrates high proficiency in the practice of the profession; P3. conforms with the highest degree of ethical standards; P4. employs researches to elevate professional knowledge and skills in sound business decisions; P5. satisfies the demands of a dynamic industry for a better community; P6. Typifies excellences in the practice of the accounting profession. The Bachelor of Science in Business Administration and program aims to produce a graduate who: 1. fosters the highest level of competence in the chosen career; 2. performs the requisite skills in the various business disciplines; 3. makes morally upright choices I dealing with ethical dilemmas; 4. undertakes significant researches employed in crafting of relevant business decisions; 5. takes personal initiative and responsibility through participation in community –related activities and; 6. contributes to successful business ventures by creditable work performance. Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 2 of 17 CORE VALUES: 1. Professional Ethics 2. Integrity 3. Objectivity and Independence 4. Professional Competence and Due Care 5. Confidentiality 6. Professional Behavior 7. Fairness 8. Transparency 9. Accountability 10. Hard Work 11. Honesty 12. Patience 13. Diligence 14. Innovativeness 15. Risk-taking 1. Program Learning Outcomes (PLO) vis a vis Program Objectives PROGRAM OBJECTIVES P3 P4 P5 Program Learning Outcomes P1 O1. O2. O3. O4. O5. O6. O7. O8. Students graduate to become professionals imbued with high moral/ ethical standards. Graduates are highly competitive with their acquired knowledge, skills and values in the practice of their profession. Graduates are confident of their academic and industry preparations and the entry competencies learned to tackle the rigors of the business world. Students can carry out researches that can be utilized in the community and in the business profession. Students recognize their responsibility and accountability as professionals and as workers in the community. Students become aware of and strive for their physical, mental and spiritual well-being. Students are prepared to meet the needs and demands of global employment without losing the Filipino spirit. Students become aware of their responsibility to the environment and participate actively in environmental programs. Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 P2 P6 Page 3 of 17 2. Course Objectives vis-a-vis Program Learning Outcomes Course Objectives PROGRAM OUTCOMES O3 O4 O5 O6 O1 O2 COGNITIVE DOMAIN C1. Discuss the key concepts of the course. √ √ √ C2. Explain the importance of accounting in different business organizations. √ √ √ C3. Enumerate and explain the different steps in the accounting cycle. √ √ C4. Relate the preparation and importance of financial statements in the analysis of business operations √ C5.develop a system for higher learning designed specifically in preparation for the CPA Licensure Examinations. AFFECTIVE DOMAIN C6. Appreciate the value of accounting to his future profession. O7 O8 √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ PSYCHOMOTOR DOMAIN C9. Prepare accounting documents and reports in good form. √ √ √ √ √ √ √ √ C10. Solve for unknowns in accounting problems/exercises. C11. Apply the accounting cycle in solving accounting problems. √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ √ C.12 Perform simple evaluation of service and merchandising businesses as to effectiveness of their operations. √ √ √ √ √ √ √ √ C7. Appreciate the need for the fair and reliable reporting of assets, liabilities, owner’s equity, revenue and expenses as they affect the economic decision of statement users C8. Imbibe desirable attitudes and values in the fulfillment of course requirements. Course Description: This course provides an introduction to accounting, within the context of business and business decisions. Students explore the role of accounting information in the decision-making process and learn how to use various types of accounting information found in financial statements and annual reports. This course starts with a discussion of accounting thought and the theoretical background of accounting and the accounting profession. The next topic is the accounting cycle for service and merchandising concerns – recording, handling, and summarizing accounting data, including the preparation and presentation of financial statements for merchandizing and service companies. Emphasis is placed on understanding the reasons underlying basic accounting concepts and providing students with an adequate background on the recording, classification, and summarization functions of accounting to enable them to appreciate the varied uses of accounting data. Also discussed are special journals, the voucher system, and simple bank reconciliation. Pre-requisite/s ENGLIS2, MATHEM1, PHILOS1 Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 4 of 17 I. DETAILED COURSE OUTLINE: Session Learning Objectives/Goals (SLO/G) To orient the student. Content Topic Course Syllabus VMO Seat Plan Leveling of Expectations 1. INTRODUCTION 1.1 1.2 At the end of the session the student is expected to identify and discern theoretical background of accounting such as the definition, the history, fields, phases, basic concepts the accountancy profession, the types of business as to nature, the forms of business organization, as well as the different users of financial information and their information needs. Course Number: BACTNG1; 6 units Development of Accounting Accountancy in the Philippines 1.2.1 Globalization 1.2.2 Policy Developments (www.accounting.rutgers.edu/raw) 1.2.3 Technological Developments 1.2.4 Accountancy Act of 2004 1.2.5 Scope of Practice 1.2.5.1 Public Accountancy 1.2.5.2 Commerce and Industry 1.2.5.3 Education/Academe 1.2.5.4 Government 1.2.6 The Professional Regulatory Board of Accountancy 1.2.7 Qualifications of members of the Professional Regulatory Board 1.2.8 The Certified Public Accountant Examination 1.2.8.1 Qualifications of Applicants 1.2.8.2 Scope 1.2.8.3 Rating in the Licensure Examination 1.2.8.4 Report of Ratings 1.2.8.5 Failure of Candidates to take Refresher Course 1.2.9 Code of Ethics for Philippine CPAs 1.2.9.1 Distinguishing Course Description: INTRODUCTORY ACCOUNTING Outcomes Based Methodologies/ Strategies & Approaches Learning Outcomes Lecture/Discussio n Be oriented of the VMO, Requirements and Grading system Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to define and learn accounting, its four phases, fields and history. The student should be able to differentiate the different types of business as to nature as well as the forms of business organization. They should also be able to differentiate the different users of financial information and their information needs. Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Time Allotme nt 1 hr 4 hrs Values Evaluative Measures Accountability Recitation Professional competence Assignments, Research, Case Analysis, Quiz, Seatworks Page 5 of 17 Characteristics of a Profession 1.2.9.2 Basic Requirements to meet the Objectives on the Accountancy Profession 1.2.9.2.1 Credibility 1.2.9.2.2 Professionalism 1.2.9.2.3 Quality of Services 1.2.9.2.4 Confidence 1.2.9.3 Fundamental Principles/Prerequisites to Achieve the Objectives of the Accountancy Profession 1.2.9.3.1 Objectivity 1.2.9.3.2 Professional Competence and Due Care 1.2.9.3.3 Confidentiality 1.2.9.3.4 Professional Behavior 1.2.9.3.5 Technical Standards 1.2.10 The Accounting Profession 1.2.11 Professional Organization-PICPA 1.2.11.1 Objectives 1.2.12 Core Competencies for Accountants 1.2.12.1 General knowledge 1.2.12.2 Organizational and Business Knowledge 1.2.12.3 Information Technology Knowledge 1.2.12.4 Accounting Knowledge 1.2.12.5 Skills 1.2.12.6 Values 1.2.13 Business Ethics 1.2.14 International Accounting Standards 1.3 Specialized Accounting Services 1.3.1 Auditing Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 6 of 17 1.3.2 Cost Accounting 1.3.3 Financial Accounting 1.3.4 Internal Auditing 1.3.5 Government Accounting 1.3.6 Tax Accounting 1.3.7 Management Consulting 1.3.8 International Accounting 1.4 Forms of Business Organization 1.4.1 Sole Proprietorship 1.4.2 Partnership 1.4.3 Corporation 1.4.4 Cooperative 1.5 Activities Performed by Business Organizations 1.5.1 Service concern 1.5.2 Merchandizing 1.5.3 Manufacturing 1.5.4 Agriculture 1.6 Definition of Accounting 1.6.1 Phases of Accounting 1.6.1.1 Recording 1.6.1.2 Classifying 1.6.1.3 Summarizing 1.6.1.4 Interpreting 1.7 1.8 1.9 Course Number: BACTNG1; 6 units Bookkeeping and Accounting Fundamental Concepts 1.8.1 Entity Concept 1.8.2 Periodicity Concept 1.8.3 Stable Monetary Unit Concept Users and their Information Needs 1.9.1 Investors/ Owner 1.9.2 Employers / Labor Union 1.9.3 Lenders 1.9.4 Suppliers and other trade creditors 1.9.5 Customers 1.9.6 Government and their Agencies 1.9.7 Public Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 7 of 17 2. THE ACCOUNTING EQUATION AND THE DOUBLE ENTRY SYSTEM Accounting Information System 2.1 At the end of the session the student should be able to identify and differentiate the accounting elements and to correctly analyze business transactions of a service business of a sole proprietorship form of business organization. Elements of Financial Statements 2.1.1 Real Accounts 2.1.2 Nominal Accounts The Account 2.2.1 Account – Definition 2.2.2 Typical Account titles Used The Accounting Equation The Double Entry System-Debits and Credits The Rules of Debit and Credit Accounting Events and Transactions Effects of Transactions Typical Account Titles Used Analyzing Business Transactions 2.9.1 Use of Financial Transaction Worksheet 2.9.2 Use of T-Account 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to correctly classify the different accounting elements and to properly identify and analyze business transactions of a services business. 6 hrs Objectivity Board work, Assignments, Quiz, Seat work, Case analysis 2 hrs Accountability Quiz, Assignments 3. ACCOUNTING FOR A SERVICE BUSINESS 3.1 At the end of the session, the student should be able to create reports based on steps in the accounting cycle. Course Number: BACTNG1; 6 units Introduction of the Accounting Cycle 3.1.1 Identifying transactions to be recorded 3.1.2 Journalizing of transactions in the general journal 3.1.3 Posting of journal entries in the general ledger/T-Accounts 3.1.4 Trial Balance preparation 3.1.5 Journalizing adjusting entries 3.1.6 Worksheet preparation 3.1.7 Financial statements preparation (Web site: com.profile/income/sales) 3.1.8 Closing entries 3.1.9 Preparation of the Post Closing Trial Balance 3.1.10 Preparation of the Reversing Entries Course Description: INTRODUCTORY ACCOUNTING Lecturediscussion, Recitations Effectivity: 1st Semester, SY 2013-2014 The student should be able to learn the different steps in the accounting cycle. Date Revised: May 29, 2013 Page 8 of 17 3.2 Transaction Analysis 3.2.1 At the end of the session, the student should be able to properly and accurately analyze and journalize business transactions of a service business. The student should be able to create accurate journal entries. 3.2.2 3.2.3 3.2.4 3.3 3.4 Course Number: BACTNG1; 6 units Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to properly and accurately analyze and journalize business transactions of a service business. Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to properly and accurately post in the ledger/TAccounts the journal entries of business transactions of a service business. Journalizing Transactions 3.3.1 Journalizing-definition 3.3.2 The Journal 3.3.3 Contents of the General Journal 3.3.4 Types of Journal Entries 3.3.4.1 Simple Entry 3.3.4.2 Compound Entry 6 hrs Accountability Board work, Assignments, Quiz, Seat work Accountability Board work, Assignments, Quiz, Seat work Posting 3.4.1 3.4.2 3.4.3 At the end of the session, the student should be able to create postings in the ledger/T-Accounts for the journal entries of business transactions of a service business. Identifying the transactions from the source documents Indicate the accounts—either assets, liabilities, equity, income or expense affected by the transaction Ascertain whether the account is increased or decreased by the transaction Using the rules of debit and credit 3.4.4 3.4.5 3.4.6 3.4.7 3.4.8 Posting-definition The Ledger-definition Types of Ledger 3.4.3.1 General Ledger 3.4.3.2 Subsidiary Ledger Type of Accounts in the General Ledger 3.4.4.1 Permanent Accounts 3.4.4.2 Temporary Accounts Procedures in posting journal entries to ledger Chart of Accounts Normal Balance of an Account Ledger Accounts After Posting 3.4.8.1 Footing 3.4.8.2 Account Balance Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 3 hrs Page 9 of 17 3.5 At the end of the session, the student should be able accurately create the trial balance of a service business. Trial Balance 3.5.1 Definition 3.5.2 Procedures in Preparing the Trial Balance 3.5.2 Locating Errors Case Analysis: 1) High Standards for Journalizing (Source: Fundamentals of Accounting Course1, 7th edition, page 65) The Curious Accountant Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to properly and accurately prepare the trial balance of a service business. Lecturediscussion, Board exercises, Recitations, Group Activity The student should be able to properly and accurately prepare the 6column worksheet and unadjusted financial statements of a service business. 3 hrs Accountability Board work, Assignments, Quiz, Seat work Accountability Board work, Assignments, Quiz, Seat work Accountability Board work, Assignments, Quiz, Seat work (Source: Fundamental Financial Accounting Concepts, 4th edition, page 149) 3.6 Preparing the Worksheet At the end of the session, the student should be able to create properly the 6column worksheet and unadjusted financial statements of a service business. 3.6.1 6-column worksheet 3.7 Preparation of Financial Statements 3.7.1 Statement of Recognized Income and Expenses 3.7.2 Statements of Changes in Owner’s Equity 3.7.3 Statement of Financial Position FIRST GRADING EXAMINATION Common Exam Part II At the end of the session, the student should be able assess and properly create accurate adjusting entries. Course Number: BACTNG1; 6 units 3 hrs 2 hrs 3.10 Adjusting the Accounts 3.10.1 Periodicity Concept 3.10.2 Revenue Recognition Principle 3.10.3 Expense Recognition Principle 3.10.4 The Need for Adjustments 3.10.5 Deferrals and Accruals 3.10.5.1 Deferrals 3.10.5.1.1 Prepaid Expense 3.10.5.1.2 Precollected Income 3.10.5.3 Depreciation 3.10.5.2 Accruals 3.10.5.2.1 Accrued Course Description: INTRODUCTORY ACCOUNTING 6 hrs Lecturediscussion, Board exercises, Recitations, problem solving, Group Activity Effectivity: 1st Semester, SY 2013-2014 The student should be able to properly and accurately prepare the necessary adjusting entries. Date Revised: May 29, 2013 12 hrs Page 10 of 17 Expense 3.10.5.2.2 Accrued Income 3.10.5.2.3 Provision for Bad Debts 3.10.6 Effects of Omitting Adjustments At the end of the session, the student should be able to create and analyze the 10-clomn worksheet. At the end of the session, the student should be able to create accurate financial statements, to assess closing entries, and create a postclosing trial balance and the reversing entries of a service business. At the end of the session, the student should be able to create financial statements based on GAAP. At the end of the session, the student should be able to identify and assess the framework for the preparation of financial statements. Course Number: BACTNG1; 6 units 3.11 Worksheet with Adjusting Entries 3.11.1 10-column worksheet 3.12 Preparation of Financial Statements 3.13 Closing Entries 3.14 Post-Closing Trial Balance 3.15 Reversing Entries 4.0 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES 4.1 Definition 4.2 Criteria for General Acceptance of an Accounting Principle 4.3 Generally Accepted Accounting Principles 5.0 FRAMEWORK FOR THE PREPARATION AND PRESENTATION OF FINANCIAL STATEMENTS 5.1 Underlying Assumptions 5.1.1 Accrual Basis 5.1.2 Going Concern 5.2 Qualitative Characteristics of Financial Statements 1.2.1 Threshold Quality – materiality 1.2.2 Relating to Content 1.2.3 Relating to Presentation Course Description: INTRODUCTORY ACCOUNTING Lecturediscussion, Board exercises, Recitations, problem solving The student should be able to properly and accurately prepare the 10clomn worksheet. Lecturediscussion, Board exercises, Recitations, problem solving The student should be able to properly and accurately prepare the financial statements, to prepare the closing entries, post-closing trial balance and the reversing entries of a service business. Lecturediscussion, Recitations Lecturediscussion, Recitations, Group activity Effectivity: 1st Semester, SY 2013-2014 Accountability Board work, Assignments, Quiz, Seat work 9 hrs Accountability Board work, Assignments, Quiz, Seat work The student should be able to properly apply GAAP in the preparation of financial statements. 1 hr Objectivity Assignments, Quiz The student should be able to properly follow and apply the framework for the preparation of financial statements. 2 hrs Objectivity Assignments, Quiz, Case analysis Date Revised: May 29, 2013 6 hrs Page 11 of 17 5.3 Constraints on Relevant and Reliable Information At the end of the session, the student should be able to compare service business from merchandising business and to assess the documents being used in a merchandising business. At the end of the session, the student should be able to contrast and create reports on the two inventory system. To contrast the different terms of trading transactions. Course Number: BACTNG1; 6 units Case Analysis: The Job Interview (Source: Fundamentals of Accounting Course1, 7th Edition, page 5) Ethical Dilemma: Ethics and Professional Conduct in Business (Source: Accounting Chapters 1-11, Activity 1-1, page 43) MIDTERM EXAMINATION Common Exam Part II 6.0 ACCOUNTING FOR A MERCHANDISING BUSINESS 6.1 Comparison of Income Statements Between Service and Merchandising 6.2 Operating Cycle of a Merchandising Business 6.3 Source Documents 6.3.1 Sales Invoice 6.3.2 Bill of Lading 6.3.3 Statement of Account 6.3.4 Official Receipt 6.3.5 Deposit Slips 6.3.6 Check 6.3.7 Purchase Requisitions 6.3.8 Purchase order 6.3.9 Receiving Report 6.3.10 Credit Memorandum 6.4 Inventory System 6.5 6.4.4 Periodic Inventory System 6.4.5 Perpetual Inventory System Terms of Transactions 6.5.4 Trade Discounts 6.5.5 Cash Discounts 6.5.5.1.1 Purchase Discount 6.5.5.1.2 Sales Discount 6.5.6 Credit Term Course Description: INTRODUCTORY ACCOUNTING 3 hrs 2 hrs Lecturediscussion, Recitations The student should be able to compare service business from merchandising business and to learn the documents being used in a merchandising business. Lecturediscussion, Board exercises, Recitations, problem solving The student should be able to differentiate the two inventory system as well as the different terms of trading transactions. Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 3 hrs 3 hrs Objectivity Assignments, Quiz, Seat work Accountability Board work, Assignments, Quiz, Seat work Page 12 of 17 6.5.7 At the end of the session, the student should be able to assess and identify the owner of goods in transit based on term of the sale/purchase and to be able to justify the person who is liable to pay the freight cost and who actually paid it. Discount Period 6.6 Transportation Cost Lecturediscussion, Board exercises, Recitations, problem solving, Group Activity The student should be able to determine the owner of goods in transit based on term of the sale/purchase and to determine the person who is liable to pay the freight cost and who actually paid it. At the end of the session, the student should be able to properly and accurately create journal entries of business transactions of a merchandising business. The student should be able to compute correctly the net sales, gross profit, cost of sales and the profit or loss for the given period. 6.7 Accounting Procedures for Purchase/Merchandising Transactions 6.7.1 Net Sales 6.7.1.1 Gross Sales 6.7.1.2 Sales Returns and Allowances 6.7.1.3 Sales Discounts 6.7.2 Cost of Goods Sold 6.7.2.1 Merchandise Inventory, Beginning 6.7.2.2 Purchases 6.7.2.3 Purchase Returns and Allowances 6.7.2.4 Purchase Discounts 6.7.2.5 Freight In 6.7.2.6 Goods Available for Sale 6.7.2.7 Merchandise Inventory, End 6.7.3 Gross Profit 6.7.4 Expenses 6.7.5 Net Income / Net Loss 6.7.6 Other Income 6.7.7 Finance Cost 6.7.8 Need for Physical count 6.7.9 Merchandise Inventory Valuation Lecturediscussion, Board exercises, Recitations, problem solving, Group Activity She student should be able to properly and accurately analyze and journalize business transactions of a merchandising business. He/She should be able to compute correctly the net sales, gross profit, cost of sales and the profit or loss for the given period. At the end of the session, the student should be able to properly and 6.8 Worksheet 6.8.1 10-column worksheet 6.9 Adjusting Entries 6.10 Financial Statements Lecturediscussion, Board exercises, Recitations, The student should be able to properly and accurately prepare the Course Number: BACTNG1; 6 units 6.6.1 Transportation In/Freight In 6.6.2 Transportation Out/Freight Out 6.6.3 FOB Shipping Point 6.6.4 FOB Destination 6.6.5 Freight Prepaid 6.6.6 Freight Collect 6.6.7 Determination of Ownership of Merchandise Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 2 hrs 9 hrs 8 hrs Transparency & Accountability Quiz, Assignments, Board work, seatwork, Recitation Accountability Quiz, Assignments, Board work, seatwork, Recitation Accountability Quiz, Assignments, Board work, seatwork, Page 13 of 17 accurately create the adjusting entries, the 10-column worksheet, and the financial statements of a merchandising business. The student should also be able to create the closing entries, the postclosing trial balance and the reversing entries of a merchandising business. 6.11 Closing Entries 6.12 Post-Closing Trial Balance Case Analysis: Purchase Discounts and Accounts Payable problem solving, Group Activity (Source: Accounting Chapters1-11, 21th edition, page280, Activity 6-2) Ethical Dilemma: Among Friends 1) What is a Little Deceit (Source: Fundamental Financial Accounting Concepts, 4th edition, page 144) 2) Wait Until I Get Mine (Source: Fundamental Financial Accounting Concepts, 4th edition, page 260) adjusting entries, the 10-column worksheet, and the financial statements of a merchandising business. He/She should also be able to prepare the closing entries, the post-closing trial balance and the reversing entries of a merchandising business. Recitation, Case analysis 7.0 SPECIAL JOURNALS At the end of the session, the student should be able to construct special journals in recording business transactions especially those of a merchandising business. 7.1 Control Accounts and Subsidiary Ledgers 1.2 Special Journals (www.greatplains.com/accounting/produ ctinfo.asp) 7.2.1 Advantages of Using Special Journals 7.2.2 Types of Special Journals 7.2.2.1 Sales Journals 7.2.2.2 Cash Receipts Journal 7.2.2.3 Purchases Journal 7.2.2.4 Cash Disbursements Journal Lecturediscussion, Board exercises, Recitations, problem solving, Group Activity 7.3 General Journal The student should be able to use properly the special journals in recording business transactions especially those of a merchandising business. 3 hrs Accountability 7.4 Proving the Ledgers 7.5 Flexibility of Special-Purpose Journals Group Activity: Manual vs Computerized Accounting System Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 14 of 17 Quiz, Assignments, Board work, seatwork, Recitation. Case analysis (Source: Accounting Chapter1-11, Edition 21, Activity 5-3, page 227) Ethical Dilemma: Ethics and Professional Conduct in Business (Source: Accounting Chapter1-11, Edition 21, Activity 4-1 page 178) 8.0 VOUCHER SYSTEM 8.1 Voucher At the end of the session, the student should be able to create reports based on the basic concepts of the voucher system. 8.2 Voucher Register 8.3 Unpaid Voucher Files 8.4 Check Voucher Files Lecturediscussion, Recitations The student should be able to learn the basic concepts of the voucher system. Lecturediscussion, Recitations The student should be able to learn the nature, valuation and classification of cash. 2 hrs Transparency & Accountability Quiz, Assignments, Seatwork, Recitation. Accountability Quiz, Assignments, Seatwork, Recitation. 8.5 Paid Voucher Files 8.6 Special Problems in a Voucher System 9.0 CASH 9.1 Nature, Valuation and Classification 9.2 Internal Control Over Cash At the end of the session, the student should be able to assess and create reports on transactions involving cash. 9.3 Petty Cash Fund (Imprest Method) 9.4 Checking Account/Current Account 9.5 Preparing the Bank Reconciliation Statement (Adjusted Balance Method) FINAL EXAMINATION Common Exam Part II Total Hours 2 hrs 3 hrs 2 hrs 108 TOTAL: 108 HRS Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 15 of 17 II. GRADING SYSTEM: For Professional Board Examination Subjects: the cut-off score is 70%. The highest possible grade is ninety-nine (99); the lowest passing grade is seventy-five (75); and the lowest failing grade is sixty-five (65). Grade requirement for Accountancy Students: At least 85 First grading Class standing = 70 % ; Exam = 30 % Midterms Class standing = 60 % ; Exam = 40 % ( Tentative Midterm Grade x 2 + First Grading ) / 3 = Midterm Grade Finals Class standing = 50 % ; Exam = 50 % ( Tentative Final Grade x 2 + Midterm Grade ) / 3 = Final grade TEXTBOOK: Ballada, Win Lu and Ballada, Susan (2013). Basic Accounting. Manila: Dom Dane Publishers and Made Easy Bookstore. REFERENCES: A dictionary of accounting Oxford: Oxford University Press, c2010. Cabrera, Ma. Elenita Balatbat. (2009). Fundamentals of accounting. Manila: GI. Doupnik, Thimothy. (2012). International accounting. 3rd ed. New York: Mc Graw Hill. Edmonds, Olds,et.al. (2010) Fundamental Financial and Managerial Accounting Concepts 2007 Edition. McGraw Hill Companies, Inc. Edmonds, MacNair M., et.al. (2011) Fundamental Financial Accounting Concepts 4th Edition, New York. Jagels, Martin G., et.al. (2010) Hospitality Management Accounting, 9th Edition. John Wiley & Sons, Inc. Guenther, David (2010) Financial Reporting and Analysis. Boston: McGraw Hill Companies, Inc. Lopez, Rafael M. Jr. (2012) Fundamentals of Accounting 2012 Millennium Edition. MS Lopez Printing & Publishing. Mowen, Maryanne M. (2011). Introduction to accounting. Auatralia: Cengage. Reeve, James M. (2012). Principles of accounting 24th ed. Australia: Cengage. Valencia, Edwin (2013) Basic Accounting, Baguio City: Valencia Educational Supply. Valix, Conrado T. (c2013). Financial accounting. 2010 rev. ed. Manila: GIC. Valix, Conrado T. (c2013). Theory of accounts. 2010 rev. ed. Manila: GIC. Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 16 of 17 Warren, Reeve et.al. (2011) Accounting 21st Edition. Thomson Asian Publishing. Weygandt, Kieso, et.al., (2011) Hospitality Financial of Accounting, John Wiley & Sons, Inc. www.careers-in-accounting.com www.accounting.rutgers.edu.raw com.profile/income/sales www.greatplains.com/accounting/productinfo.asp Prepared by: ACC/TAX/BL GROUP Noted by: MS. ALLYN C. GARIBAY Assigned Librarian MR. RHAD VIC F. ESTOQUE, MBA, CPA Program Chair, Accountancy MS. RUBY R. BUCCAT Program Chair, Business Administration Approved by: DR. KAREEN B. LEON, CPA Dean UB SBAA Course Number: BACTNG1; 6 units Course Description: INTRODUCTORY ACCOUNTING Effectivity: 1st Semester, SY 2013-2014 Date Revised: May 29, 2013 Page 17 of 17