Lecture 5

advertisement

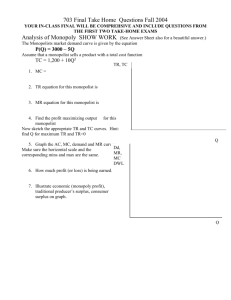

Updated: 02.04.2007 MICRO ECONOMICS (ECON 601) Lecture 5 Topics to be covered: a- Barriers to entry b- Technical Barriers c- Legal Barriers d- Creation Barriers to entry e- Profit Maximization and Output Choice f- Monopoly Profits g- Monopoly and Resource Allocation h- Price Discrimination i- Discriminating Monopolist j- Across Different Markets k- Deadweight Loss in two markets l- Single Price Policy (Monopolist) m- Discrimination through Price Schedules n- Two Part Tariffs o- The Optimal Tariff p- Regulation of Monopolies r- Two-Tier Pricing Systems s- Rate of Return Regulation Models of Monopoly Chapter 13, Nicholson A monopoly is a single supplier to a market. The monopoly faces the market demand curve for its output. Its output decision will determine the good’s price. It may choose either market price or quantity, but not both. Monopoly exists because other firms find it either unprofitable or impossible to sell in the market. Barriers to Entry There can be either technical barriers or legal barriers to entry. Technical Barriers – Production may exhibit decreasing marginal costs and average costs over a wide of output levels. P MC AC Pm MR Q AR Monopoly price may still be below the average costs of an entry firm. – – Local monopolies due to high transportation costs Ownership of particular natural resources might allow a firm to be a monopoly Legal Barriers – Main cause of monopoly are legal restrictions – Patents – Market Franchises – public utilities, post office, water, gas, electricity, telephone 1 – Traditional argument is that these sectors are natural monopolies, hence, should be a regulated monopoly. In the recent years technology has moved so that most of these sectors are no longer natural monopolies. Creation of Barriers to Entry– Firms may try get monopoly position by: – Development of unique technologies – Buy up competitors so that one firm controls much of market (eg. De Beers in the diamond market) – Make rent seeking expenditures to obtain a monopoly position Profit Maximization and Output Choice For profit maximization necessary to equate MR to MC. If in order to sell more a monopolist must reduce its price, therefore, MR < P. D MC AC P* F E A AC=C* G MR D MR O Q* at Q* we find the monopolist has MR = MC. The market price for Q* units is P*. Monopoly Profits are, P*EAC* = (OP*EQ* – OFGQ*) = (Total revenue – Total costs) From chapter 13, we found that, 2 Total revenue = P * q where prices is a function of q i.e. P(q) MR = d(Pq)/dq = d(P(q)q)/dq = P + q (dP/dq) q dp = P (1+1/εqp) MR = P 1 p dq In equilibrium for a monopolist MC = MR MC = P (1+1/εqp) MC/P= (1+1/εqp) – MC/P = – 1 – (1/εqp) (P-MC)/P= – (1/εqp) – (1/εqp) is equal to the proportional gap between the price of output and the MC of producing an additional unit. XPx is the own-price elasticity of demand for X in the market. Observations 1. 1 From, MR = P 1 XPx We see that monopolist will always operate where XPx < –1 (so that MR is positive). With xPx > –1 (demand curve inelastic) then MR is negative, so Monopolists will not operate there. 2. From, (P-MC)/P=–(1/εXPx), we find that the monopolist mark up over marginal cost values inversely with the elasticity of demand. If XPx = –2, then MC= P (1+1/εXPx), 2P – 2MC = P, P = 2MC 4P – 4MC = P, P = 4/3MC If XPx = –4, then MC= P (1+1/εXPx),, 3. So long as the demand curver is downward sloping i.e. XPx < 0, increases in MC will cause monopolist to reduce output and thereby raise prices. 3 Monopoly Profits Monopoly Profits exist if P* > AC If no entry monopoly profits can exist in long run, hence, called monopoly rents. The difference between P and AC depends on nature of fixed costs as well as marginal costs. MC C* MC P* AC C * AC P D D MR MR O O Q* Monopoly making profits Q* Monopoly *making losses Monopoly does not have a supply curve. It has just one price, quantity combination when MR=MC. Example: Demand: Q=2000-20P or P= 2000 Q 20 20 P=100-Q/20 TC=0.05Q2+10000 TR=PQ=100QMR=100- Q2 20 MC=0.1Q MC=0.1 (500) = 50 Q 10 MC=0.01Q MR=MC 100 0.1Q 0.1Q 0.2Q 100 Q 500, P * 75 TC 0.05(500) 2 10,000 22,500 22,500 AC 45 500 * ( P AC )(Q ) (75 45)(500) 15,000 Q P 75 20( ) 3 P Q 500 P MC 1 1 3 ( P MC ) P QP 3 2 QP 4 Monopoly and Resource Allocation Harberger estimates DW loss at 0.1 of GDP B Pm Transfer from consumers to firm Deadweight loss E Pc A Competitive equilibrium is (Pc, Qc) Monopoly equilibrium is (Pm, Qm) MC Goes Value of transferred inputs O Qm to produce other goods and service Qc MR D Note: To measure welfare changes accurately we should be using a compensated demand curve. Remember, TXPx = SXPx – SxXI Competitive output would have been where P = MC or (Pc, Qc) monopoly prices is Pm and output Qm where MR = MC. Loss to consumer, Pm B E Pc = Monopoly profits to firm Pm B A Pc + Deadweight loss of BAE QmAEQc represents value of resources transferred out of the industry, if it were previously a competitive industry and will be used by other industries. Suppose at point B, XPx = –2 Therefore firm, (P-MC)/P= 1/2 Pm = 2MC or 2 Pc If linear demand curves, Qm = ½ Qc DWLoss = 0.5 of Monopoly Profits DWLoss = 1/3 of Loss of consumer surplus DWLoss = 1/2 of Value of resources transferred out of sector. 5 Monopoly and Product Quality: Depending on the nature of consumer demand and the firm’s cost a monopolist may produce a quality of a product that is different from what would exist in a competitive market. Suppose consumer’s willingness to pay for quality (X) is given by the inverse demand function P(Q, X). ∂P/∂Q < 0 ∂P/∂X > 0 The benefits of increasing quality come about due to the fact that the price one can charge for an item can be increased if its quality is increased. Costs of producing Q and X are given by C(Q, X) The monopolist will choose Q and X in order to maximize profits . Where is, = P (Q, X) Q – C (Q, X) (1) (2) ∂∏/∂Q = P (Q, X) + Q ∂P/∂Q – CQ = 0 ∂∏/∂X = Q∂P/∂X – CX = 0 MR = MC where MR= P (Q, X) + Q ∂P/∂Q and MC= CQ. MR from increasing quality = Marginal cost of creating quality From (1), From (2), Under competitive conditions the product quality will be the one that maximizes net social welfare (sum of consumer and producer surplus) Q* (3) SW = P(Q, X )dQ C (Q, X ) 0 where Q* is level of output where P = MC. Differentiation of (3) with respect to X yields first order condition for a maximum, i.e. where increased benefit from increased quality less the marginal cost. Q* (4) ∂Sw/∂X = P X (Q, X )dQ C X = 0 0 (2) (Monopolistic situation) looks at incremental or marginal value of quality assuming Q is at its profit-maximizing level Q*, while equations (4) (Competitive situation) looks at the marginal value of quality averaged across all output levels, Q* AV = (Px(Q,X)dQ)/Q is the average valuation (AV) of product quality. 0 6 Hence, Q. AV = Cx is the quality rule adopted to maximize net welfare under perfect competition. Each firm will equate its marginal cost of producing quality to the average benefit across the entire market. Even if a monopolist and a perfectly competitive industry choose the same output level, they might opt for different quality levels since each is concerned with a different margin in its decision making. Price Discrimination A monopoly engages in price discrimination if it is able to sell otherwise identical units of output at different prices. Arbitrage between buyers of the good will destroy the ability of a monopolist to discriminate between buyers of her output. First Degree Perfect Price Discrimination Suppose a monopolist charges each consumer the maximum amount they would be willing to pay for each unit. Here we mean the monopolist is able to change different prices for each unit it sells. D P1 P2 P3 P4 MC E MC D Q* Total Revenue Q MC 0.1Q If (Q * 666) 20 P MC 66.6 P 100 R Q Q 0 P(Q)dQ 100Q 2 40 666 0 55,511 7 Total Cost C 0.05Q 2 10,000 32,178 and Profit R C 55,511 32,178 23,333 Monopolist will proceed to sell units up to the point when the price charged the last buyer is just equal to marginal cost. For perfect discrimination to be possible buyers who place a lower willingness to pay for the item must not be allowed to resell the item to those who have a higher willingness to pay. If a monopolist can operate in a perfectly discriminating manner it will be able to extract all the consumer surplus from the buyers and will produce to the point where the prices for the last item sold P* = MC. There is no dead-weight loss (economic loss) in this situation. Perfect price discrimination requires the monopolist to know the demand function for every potential buyer. A more likely situation is for the monopolist to segment different markets, usually markets that are geographically separated. Discriminating Monopolist Across Different Markets: In this situation knowledge of the price elasticities in the different markets is enough to set different prices to maximize overall profits. Profits are maximized if it sets Marginal Revenue equal in each market and also sets MR to its Marginal Cost of production in the supply of both markets by one plant. As, MR1 = P1 (1 + 1/є1xp) 1 1 P1 2 P2 1 1 1 and, MR2 = P2 (1 + 1/є2xp) Therefore, profits are maximized when, P1 (1 + 1/є1xp) = P2 (1 +1/є2xp) = MC Prices will be higher in those markets where demand is less elastic. If, 1XP = –2 then P1 will be 2 times MC If, 2XP = –3 then P2 will be 1.5 times MC 8 MC P1 P2 D MR1+MR2 Q1 MR1 D1 Market 1 Q2 MR2 D2 Market 2 Monopolist A multiple price monopolist will charge a higher price in market 1 when the demand is less elastic. The deadweight loss created by a multiple price monopolist will be less than in the case of a single price monopolist only if the total market output is greater. Example: Two markets (1), Q1 = 24 – P1 and Q2 = 24 – 2P2, (2) MC = 6 P1=24-Q1 P2=12-Q2/2 TR1 = P1Q1 = 24Q1 – Q21 TR2 = P2Q2 = 12Q2 – ½ Q22 MR1 = 24 – 2Q1 MR2 = 12 – Q2 MR1 = 24 – 2Q1 = MC = MR2 = 12 – Q2 If, MC = 6, then Q1 = 9 and Q2 = 6. The prices in the market will therefore be: In Market 1: P1 = 15, in Market 2: P2 = 9. Profits for monopolist: = (P1 – 6) Q1 + (P2 – 6) Q2 = (15 – 6) (9) + (9 – 6) (6) = 81 + 18 = 99 Deadweight loss in two markets At a competitive price of 6 = MC, from demand functions we have Q1 would be 18 and Q2 would be 12. 9 Deadweight loss from discriminating monopolist: DW1 = 0.5 (P1 – MC) (18 – Q1) = 0.5 (15 – 6) (18 – 9) = 40.5 DW2 = 0.5 (P2 – MC) (12 – Q2) = 0.5 (9 – 6) (12 – 6) = 9 Total dead weight = 49.5 Single Price Policy (Monopolist) Demand Q = Q1 + Q2 = 48 – 3P P = 16 – (1/3)Q TR = P. Q = 16Q – (1/3)Q2 6 = 16 – 2/3Qm MR = 16 – (2/3)Q MC = 6 Qm = 15 If Q = 15 => P = 11, Competitive quantity = 30 DW = .5 (P1 – MC) (30 – Qm) = .5 (11 – 6) (30 – 15) = 37.5 About 25 percent smaller DW than if price discrimination. Profits = (P – MC) (Q) = (11 – 6) (15) = 75. Second Degree Price Discrimination through Price Schedules Pricing schedule is designed to give consumers an incentive to separate themselves depending on how much they wish to buy. Such schemes include quantity discounts, cover charges, tie-in sales. – Will be adopted by a monopoly if they yield greater profits than a single price schedule. – Again they require different people to be paying different prices they will only work if there are no arbitrage possibilities. 10 Two Part Tariffs Common in pricing of water utilities or amusement parks. Demanders must pay a fixed fee for the right to consume a good and a uniform price for each unit consumed. Total cost = T (Q) = A + PQ A = fixed fee, P is marginal price, Average price = P = T/Q = A/Q + P Suppose we have our two separated markets: Can not allow these who pay an average price to resell the item to these ho pay higher than average price. Market 1 Demand = Q1 = 24 – P1 Market 2 Demand = Q2 = 24 – 2P2 If pricing at MC = 6, then in market 1 we would sell 18 units and 12 units in market 2. Consumer surplus in market 2 will be, S2 = ½ (Pmax – MC) (Q2) Pmax = 12, i.e. Price where Q2 = 0 S2 = ½ (12 – 6) (12) = 36 Suppose monopolist charges this amount 36 as an entrance fee. Consumer 2 will just be indifferent, but consumer 1 will be better off. Total profits = 2 (36) = 72 Which is less profits than if the monopolist operated as a single monopolist of 75 or as a price discriminating monopolist with profits of 99. There are no deadweight loss associated with this pricing scheme as the competitive level of output will be produced and consumed. 11 The Optimal Tariff A E B P F P G MCA C MCB The problem is to maximize 2 PEF MC A PBC MC B PFG Profits are collected as a fixed lump sum fee plus the profits on each unit sold. – Assuming that the lump-sum fee is set equal to total consumer surplus in market 2, total profits are: = 2S2 + (P – AC) Q = 2 Q2 (½ (12 – Pc)) + (P – 6) Q = Q2 (12 – P) + (P – 6) Q Substitute for Q2 = 24 – 2P and Q = 48 – 3P = (24 – 2P) (12 – P) + (P – 6) (48 – 3P) Simplifying we have, = 18P – P2 ∂/∂P = 18 – 2P = 0 P = 18/2 = 9 S2 = ½ (12 – 9) Q2 = ½ (12 – 9) (24 – 2 (9)) = ½ (3) (6) = 9 Q = 48 – 3P = 48 – 3 (9) = 21 Total profits = 2S2 + (P – MC) Q = 2 (9) + (9 – 6) 21 = 18 + 63 = 81 The optimal tariff does not require a formal market segregation. 12 Regulation of Monopolies Regulation of Natural Monopolies: Utilities, Railroads, Communications. Very important subject: More economic consultants work on regulatory issues than on any other subject. To minimize deadweight loss it is necessary that P = MC However, if P = MC the monopolist would operate at a loss. D PA A C B G AC MC PR MR D QA QR In the absence of regulation the monopolist would produce at outputs QA and receive a price of PA for its product. At this point profits would be equal to P AABC. A regulatory agency would set prices at PR. At this price QR is demanded. However at this price, while PR = MC, the average costs are G. Hence, the regulated monopolist would have losses of PRGFE. Either the monopolist will have to be subsidized or it will go out of business. Two–Tier Pricing Systems Monopolist is permitted to charge some users a high price while maintaining a low price for marginal users. 13 D P1 B A F E P2 C AC MC D Q1 Q2 Some users will pay P1, at this price Q1 is demanded. Others who will not pay P1 are offered a price of P2. Demand at P2 is Q2 – Q1. Total output of Q2 is produced at an average cost of A. Profits on high priced sales are P1DBA balance the losses incurred on low priced sales BFEC. In principle the “marginal” user pays marginal cost while the “inframarginal” user pays the higher price. Many utilities charge commercial users a higher price than residential consumers. Rate of Return Regulation Allow the monopoly to charge a price above marginal cost that is sufficient to earn a “fair” rate of return on investment. If the “fair” rate of return is above the competitive return then there will be incentives to overinvest (Averch-Johnson) effect. Suppose regulated utility has a production function of the form, Q = f(K, L) Firms actual rate of return S = [P[ f(K,L)]-WL]/K Where P is the price of firm’s output which depends on Q and W is the wage rate for labor input. 14 If S is constrained by regulation to be equal to S , then the firm’s problem is to maximize profits = Pf (K, L) – wL – K subject to the regulatory constraint, L = Pf (K, L) – wL – K + [wL + S K – Pf (KL)] If = 0 regulation is ineffective and the monopoly behave likes any profit maximizing firm. If = 1 then equation (1) becomes L = ( S – ) K and if S > then the firm should hire an infinite amount of capital. A result which is not relevant. Hence, must be 0 < < 1 First order conditions: (1) ∂L/∂L = PfL– w + [w – PfL] = 0 (2) ∂L/∂K = PfK – + [ S – PfK] = 0 (3) ∂L/∂λ = wL + S K – Pf (KL) = 0 From (1), PfL– w + [w – PfL] = 0 PfL (1 – ) + (–1 + ) w = 0 PfL (1 – ) = (1 – ) w PfL = w for profit maximization From (2), PfK – + [ S – PfK] = 0 PfK (1 – ) = – S PfK = ( - S )/(1-) = = v S S = 1 1 1 (1 ) ( S ) = – ( S –)/(1- ) 1 1 15 Since, S > and < 1. This implies PfK < Hence, firm will employ more capital and achieve a lower marginal productivity of capital then under unregulated conditions. – Overcapitalization Monopoly profits and innovation – Joseph Schumpeter Monopoly profits might be spent of on R and D to maintain its monopoly position. eg. Microsoft? 16 Question 13.9 Can a monopolist be subsidized in order to behave like a perfect competitor ? Will a lumpsum subsidy work? Pm MC Pc K rate of subsidy MR* = (Pc – K) MC* O Qm Qc MR Qm = Monopoly output level D Qc = Competitive output level here P = MC Monopolist equals MR = MC If Subsidy, the marginal cost seen by monopolist is MC* = (MC – K) MR = MC* = (MC – K) = Pc – K If upward sloping MC curve D Pm MC Pc E K G (Pc–K) O MC* A Qm Qc MR 17 Additional Applications: Economic Benefits vs. Financial Benefits of State-Enterprise to expand supply in monopolized industry. Suppose we build a factory to increase supply to a sector that was previously monopolized. Assume this new firm has same constant marginal cost (MC) as monopolist. Initially the monopoly produced Q0 and changed a price of P0m. The new firm’s objective is to expand the supply of the good in the market. However, it prices its output at the same price as is charged (after project) by monopolist. The new firm produces a quantity Q1D – Q1S and sells at the new market price of P1M. How does the economic value of this factory’s output compare with its financial value? From the monopolist’s perspective the demand it faces has decreased at every price by (QD1 – QS1), it will operate as a monopolist in a smaller market. P P0m B F P1m H Ps =C G A MR1 O E MC J Dm0 MR0 Q1s Q0 Q1d Dm1 Qc Financial value of output of “new” firm = Q1SFEQ1D Economic value of output of new firm = WsPs + WdPd Q1SGAQ0 + Q0BEQ1D Economic value < Financial value Profits of Monopolist before, P0MBAC 18 Q Profits of Monopolist after, P1MFGC Profits of new firm, GFEJ Gain of consumer’s surplus, P0MBEP1M Loss in profits by monopolist: (1) to consumer surplus = P0mBHP1m, plus (2) transfer of profit to new firm of GFHA. Increase in economic value of output to consumers of Q0BEQ1d of which AHEJ is value of additional consumption in excess of the marginal costs of production (profits to new firm) and BEH is the reduction in the economic cost of monopolist that is now transferred as a benefit to consumers. The End 19