Economics 514

advertisement

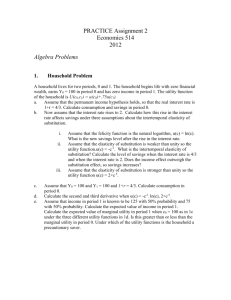

PRACTICE Assignment 2

Economics 514

2007

Algebra Problems

1.

Household Problem

A household lives for two periods, 0 and 1. The household begins life with zero financial

wealth, earns Y0 = 100 in period 0 and has zero income in period 1. The utility function

of the household is U(c0,c1) = u(c0)+.75u(c1).

a.

Assume that the permanent income hypothesis holds, so that the real interest rate is

1+r = 4/3. Calculate consumption and savings in period 0.

The household budget constraint is to set present value of lifetime

consumption equal to present value of lifetime income.

c

c0 1 Y0

1 r

Maximize utility subject to the constraint:

c

max u (c0 ) .75 u (c1 ) c0 1 Y0

1 r

c

c0 1 Y0

1 r

u '(c0 )

.75 u '(c1 )

1 r

u '(c0 ) 1 r .75 u '(c1 )

When 1+r = 4/3, Y0 = 100

1 r 4 3 u '(c0 ) u '(c1 ) c0 c1

c

c0 0 Y c0 4 7 Y0 57.14285714

4/3

S0 Y0 c0 42.85714286

b.

Now assume that the interest rate rises to 2. Calculate how this rise in the interest

rate affects savings under three assumptions about the intertemporal elasticity of

substitution.

We can write the constant intertemporal elasticity of substitution utility

1 1

c 1

1

function as u (c)

.

The

marginal

utility

is

where the

u

'(

c

)

c

1 1

intertermporal elasticity of substitution is ψ.

i.

Assume that the felicity function is the natural logarithm, u(c) = ln(c).

What is the new savings level after the rise in the interest rate.

The marginal utility is u’(c) = c-1. This is the same as the intertemporal elasticity when ψ

= 1. Given the intertemporal equation, u '(c0 ) 1 r .75 u '(c1 ) we would write this

2 .75 1 c1 1.5 c0 . Given the budget constraint, we would

c1

1.5 c0

c0

Y0 c0 4 7 Y0 57.14285714

write

The household was initially a saver.

2

S0 Y0 c0 42.85714286

So a rise in the interest rate increases their possibility of consuming in the future without

cutting back current consumption (i.e. there is a positive income effect). When there is a

unit elasticity of substitution, the substitution effect is just strong enough to outweigh the

income effect, so interest rate has no effect on savings.

as 1

c0

ii.

Assume that the elasticity of substitution is weaker than unity so the

utility function.u(c) = -c-1. What is the intertemporal elasticity of

substitution? Calculate the level of savings when the interest rate is 4/3

and when the interest rate is 2. Does the income effect outweigh the

substitution effect, so savings increases?

When the utility function is u(c) = -c-1 then the marginal utility is u '(c) c 2 which is the

same as the constant intertemporal elasticity of substitution is ψ = .5. Using the

intertemporal first order condition c0 2 2 .75 c12 . Raise both sides of this equation to

the power -.5. c0 2 .75 c1 c1 1.5 c0 . Substituting this into the intertemporal

.5

1.5 c0 2 1.5

2

c0 Y0 c0

Y0 62.02041029

budget constraint.

2

2

2 1.5

S0 Y0 c0 37.97958971

When the elasticity of substitution is less than 1, the substitution effect is not strong

enough to outweigh the income effect. A rise in the interest rate reduces savings.

c0

iii.

Assume that the elasticity of substitution is stronger than unity so the

utility function u(c) = 2×c.5.

When the utlity function is u(c) = 2×c.5then the marginal utility is u '(c) c .5 which is

the same as the constant intertemporal elasticity of substitution is ψ = 2. Using the

intertemporal first order condition c0 .5 2 .75 c1.5 . Raise both sides of this equation to

the power -2 c0 2 .75 c1 c1 1.52 c0 . Substituting this into the intertemporal

2

1.52 c0 2 1.52

2

c0 Y0 c0

Y0 47.05882353

budget constraint.

2

2

2 1.52

S0 Y0 c0 52.94117647

c0

When the elasticity of substitution is greater than 1, the substitution effect is strong

enough to outweigh the income effect. A rise in the interest rate increases savings.

c.

Assume that Y0 = 100 and Y1 = 100 and 1+r = 4/3. Calculate consumption in

period 0.

When 1+r = 4/3, c0 c1 , so if Y0 = Y1, then

c

Y

c0 1 Y0 1 c0 Y0 100 and savings is zero.

1 r

1 r

d. Calculate the second and third derivative when u(c) = -c-1, ln(c), 2×c.5.

When u(c) = -c-1, u’ = c-2 > 0, u’’ = -2∙ c-3 < 0 , u’’’ = 6∙ c-4 > 0. When u(c) = ln(c), u’

= c-1 > 0, u’’ = -1∙ c-2 < 0 , u’’’ = 2∙ c-3 > 0. When u(c) = 2c.5 u’ = c-.5 > 0, u’’ = -.5∙ c-1.5

< 0 , u’’’ = .75∙ c-2.5 > 0

e.

Assume that income in period 1 is known to be 125 with 50% probability and 75

with 50% probability. Calculate the expected value of income in period 1.

Calculate the expected value of marginal utility in period 1 when c0 = 100 as in 1c

under the three different utility functions in 1d. Is this greater than or less than the

marginal utility in period 0. Under which of the utility functions is the household a

precautionary saver.

f. of the utility functions is the household a precautionary saver.

The expected value of income in period 1 is .5*125+.5*75 = 100. If the household

consumes 100 in period 0, they will have no savings and must consume their income

in period 1. Their marginal utility in period 0 is u’(100). Their marginal utility will

be u’(Y1). The expected value of marginal utility will be .5*u’(125) +.5u’(75). See

the following table:

u(c)

u’(100)

5*u’(125) +.5u’(75)

-1

-c

0.0001

0.000121

ln(c)

0.01

0.010667

2c.5

0.1

0.102456

In all cases, expected marginal utility will be higher in period 1 than in period 0, if the

household does not save. To equalize marginal utility, the household must save more

to transfer income to the uncertain period.

2.

Keynesian Consumption Function from Permanent Income

Hypothesis.

A household lives for 20 periods. The real interest rate is 5%. The household’s income

grows by 5% (g = .05) in every period. The household begins with 1000 in financial

wealth.

a.

We do not know the current income level, Y0. Assuming the permanent income

hypothesis holds (i.e (1+r) ×β =1), we can write the current consumption in the

Keynesian form, C0 = A0 + mpc×Y0. Solve for mpc when FW0 is proportional to A0.

The households financial and human wealth is equal to

Y

Y2

YT

W F0 Y0 1

...

2

T

1 r 1 r

1 r

With a constant income growth rate g, we can write Yt = (1+g)t Y0.

(1 g )Y0 (1 g )2 Y2

(1 g )

(1 g )T YT

. Define z

. Then

W F0 Y0

...

2

T

1 r

1 r

1 r

1 r

W F0 Y0 (1 z z 2 ... z T ) . When z = 1 (i.e. g = r), this is equal to

1 zT 1

W F0 (T 1) Y0 1000 21 Y0 . When z < 1, this is equal to W F0

Y0

1 z

C

C2

CT

...

The present value of consumption is C0 1

. Assuming the

2

T

1 r 1 r

1 r

permanent income hypothesis Ct = C0, C0

C0

C0

C0

...

. Define

2

T

1 r 1 r

1 r

1

, then the present value of consumption is C0 ∙ (1 + x + x2 + x3 + ….+ xT) =

1 r

1 xT 1

. If the present value of consumption equals total wealth, then

C0

1 x

1 x

1 x

1 x

1 x 1 z T 1

F0

C0

W

F

Y0 . So if C = A + mpc Y, then A =

T 1

T 1 0

T 1

1 xT 1

1 x

1 x

1 x

1 z

1 x 1 z T 1

and mpc =

. When r = .05, then x = 1

, if T = 20, then

1.05

1 xT 1 1 z

1 x

0.074282007 , so if F0 = 1000, then A = 74.28200678. If r = g, then mpc =

1 xT 1

1 x

(T 1) = 1.559922142.

1 xT 1

x

b.

Solve for autonomous consumption when initial financial wealth is 0.

When financial wealth is zero, so is autonomous consumption.

c.

Solve for mpc when the growth rate of income is zero (g = 0).

When g = 0, then x = z, so mpc = 1.

3.

Growth Model with Endogenous Savings and Investment (a little

harder)

Calculate the general equilibrium between borrowers and savers as well as workers and

employers. Model an economy with an average household that lives forever and an

employer that liver forever.

a.

The household never dies and gets utility from consumption and leisure in each

period. The household has a utility function of the form:

.99 ln C

t

t

t 0

ln(1 Lt ) where the time endowment is 1, so that 1-Lt is the

leisure enjoyed by the household. The household starts out with no financial

wealth and earns income from producing goods each period. The restrictions on

the lifetime consumption stream are that lifetime consumption equals lifetime

t

t

1

1

C

t

Yt . Take the labor decision of the household as

t 0 1 r

t 0 1 r

given and solve for the optimal consumption path to maximize:

t

1 t

1

t

max ln Ct

Yt

Ct . Report the Euler Equation

t 0

t 0 1 r

t 0 1 r

for each period that solves this equation. If the interest rate is given by the

decisions of these savers, report the steady-state real interest rate, r*, that occurs

when Ct = Ct+1.

The first order condition that maximizes the Lagrangian functions are:

t

t 1

1

t 1 1

t (1 r )

t 1 (1 r )

t

,

Ct (1 r )t

Ct 1 (1 r )t 1

Ct

Ct 1

income.

1

(1 r )

Ct

Ct 1

The interest rate that would set consumption today equal to consumption in

1

1

1

the future is (1 r )

r

.99

99

b.

Firms produce goods with a Cobb-Douglas production function Yt Kt 3 Lt 3 and

the firm accumulates capital according to the equation Kt+1 = (1-δ) Kt + It.

1

2

T K 3L 3 w L K

t

t

t t

t 1 (1 ) K t

Maximize the present value of the firm.

by

t

t 0

1 r

choosing a demand for labor and a capital stock, Kt+1, in each period. Given the

real interest rate, r*, calculated in 3a, calculate the optimal capital labor ratio

assuming that the depreciation rate is δ = .1. Also, calculate the labor demand

1

2

curve, calculate labor-productivity at the optimal capital labor ratio. Calculate the

wage rate at this optimal productivity level.

Given that the real price of capital is equal to 1, the rental price of capital

should be equal to r+δ. The first order conditions of the problem of the firm is

MPK t 1

Rt 1

1

1

K L

Pt 1

1

r K

r

L

MPLt wt (1 ) K L w K

c.

L

1

w

(1 )

1

( )

1

1

1

w (1 )

r

Assume that we reach a steady state level of capital, where Kt+1 = Kt , so that

investment is equal to It = δKt. Calculate the long-run ratio of investment to

I

labor, t

using the capital to labor ratio calculated in 3b.

Lt

The steady state investment to labor ratio is

1

1

1

It

K

t

r

Lt

Lt

d.

Assuming that the goods produced by this economy are used for consumption and

investment Qt = Ct + It. Using the labor productivity solved for in 3b and the

investment to labor ratio solved for in 3c, calculate the consumption to labor ratio.

Q

C

I

C

Y

I

Divide both sides of the equation by L to get t t t t t t .

Lt

Lt

Lt

Lt

Lt

Lt

Y

With a Cobb-Douglas production function, the ratio t is proportional to the marginal

Lt

1

w

Y

Y

product of labor MPLt 1 t wt t

r

Lt

Lt 1

1

1

. This

1

1

1

1

Ct

Y

I

t t

r

r

Lt

Lt

Lt

r

implies that

1

1

1

r

e.

In each period, the household earns income from labor income at the real wage

rate w, and profit income from the firms they own, Y0 = wt Lt + Πt.. Solve the perperiod trade-off between consumption and leisure to derive Taking profit income

as given, calculate labor supply by maximizing u(C,L) = ln(Ct) + .5ln(1-Lt)

1

subject to C0 = wt Lt + Πt . Using the consumption to labor ratio solved for in part

3d and the wage solved for in 3b, solve the first order condition for the optimal

labor level.

The household maximizes u(C,L) = ln(Ct) + .5ln(1-Lt) s.t. Ct = wt Lt + Πt or

maximize ln(wt Lt + Πt) + .5ln(1-Lt). The first order condition is

wt

w

wt

L

1

w

.5

t

.5 t

C

C

wt Lt t

1 Lt Ct L t

1 Lt

t

L

Lt

1

1

r

1

1

r

r

r

1

1

1

r

Lt

2

2 L

1 Lt

1 2

f.

Using the optimal labor in 3e, and the consumption to labor from 3d, solve for

long-term consumption level. Solve for the investment level, using the investment

to labor ratio from 3c. Solve for capital and output using the capital to labor ratio

and labor productivity from 3b.

Multiply the ratios by the solution in 3e, we get

r

2

C

1

1 2

1

1

r

1

1

1 2

I

r

1 2

1

1

1 2

K

r

1 2

1

Y

r

1

2

1 2

4.

Corporate Tax Rates and Investment

A firm accumulates capital by buying new investment goods at price Pt.

Kt 1 (1 ) Kt It

where the depreciation rate is 10%, (δ = .10). The firm produces goods with a CobbDouglas production function using capital and labor rented at wage rate Wt.

1

1

Yt Kt 2 Lt 2

Goods are sold at price Pt so the relative price of investment goods is ptI 1 . There is a

constant nominal interest rate 1+i = 1.10. There is a constant inflation rate of 1+π = 1.05,

so the constant real interest rate is 1 r 1.10

. The firm lasts from period 0 to

1.05 1.04762

period T. The nominal present value of the firm is

1

1

T

2

2

PK

t t Lt Wt Lt Pt [ Kt 1 (1 ) Kt ]

V0

(1 i)t

t 0

.

a.

Assume the firm managers choose paths of labor and capital to maximize real

present value of the firm.

W

1

1

Kt 2 Lt 2 t Lt [ Kt 1 (1 ) Kt ]

T

Pt

V0

(1 r )t

t 0

Solve for the profit maximizing capital to labor ratio (which is the same in every

period after period 0). Solve for the profit maximizing real wage rate.

This is a function of (2T+1) {Kt+1},{Lt} and the first order conditions are:

12

b.

c.

Kt 1

1

(1 )

2

K

1

Lt 1

1 t 1 (

)2 11.475

(1 r )

Lt 1

2 [r ]

Now assume that firms have to pay taxes equal to a share of revenue at tax rate, τ =

.25.

TAX t

1

1

1

1

TAX t Pt Kt 2 Lt 2

Kt 2 Lt 2

Pt

Assume that the managers maximize the real after-tax value of the firm.

Wt

1

1

2

2

(1

)

K

L

Lt [ Kt 1 (1 ) Kt ]

t

t

T

Pt

V0

(1 r )t

t 0

Solve for the profit maximizing capital to labor ratio (which is the same in

every period after period 0). Solve for the profit maximizing real wage

rate.

TAX t

1

1

1

1

TAX t Pt Kt 2 Lt 2

Kt 2 Lt 2

Pt

Now assume that the firm is taxed only on revenue net of the cost of capital and

labor.

1 1 W

TAX t

1

1

2

2

TAX t PK

Kt 2 Lt 2 t Lt (r ) Kt

t t Lt Wt Lt (r ) PK

t t

Pt

Pt

Assume that the managers maximize the real after-tax value of the firm.

W

1

1

(1 ) Kt 2 Lt 2 (1 ) t Lt (r ) Kt [ Kt 1 (1 ) Kt ]

T

Pt

V0

(1 r )t

t 0

Solve for the profit maximizing capital to labor ratio (which is the same in

every period after period 0). Solve for the profit maximizing real wage

rate.

12

1

2

K

(1 ) t 1

Lt 1

(1 r )

(1 )

1

1

Kt 1

1

(

) 2 6.454904488

[r ]

Lt 1

2

1

1

K

Wt

(1 ) 12 t 1 83 11.475 2 =0.952743902

Pt

Lt 1

d.

2

Now assume that in calculating the cost of labor, the taxman values the firms capital

stock at the previous periods price level.

1 1 W

TAX t

(r )

1

1

2

2

TAX t PK

Kt 2 Lt 2 t Lt

Kt

t t Lt Wt Lt (r ) Pt 1 Kt

Pt

Pt

1

Assume that the managers maximize the real after-tax value of the firm.

W

1

1

(r )

(1 ) Kt 2 Lt 2 (1 ) t Lt

Kt [ Kt 1 (1 ) Kt ]

T

Pt

1

V0

(1 r )t

t 0

Solve for the profit maximizing capital to labor ratio (which is the same in every

period after period 0). Solve for the profit maximizing real wage rate. Solve for the

profit maximizing capital to labor ratio if the inflation rate were zero (and real

interest rates were unchanged).

12

1

2

K

(1 ) t 1 (r ) (1 )

12

L

K

t

1

1 12 (1 ) t 1 (1 )(r )

(1 r )

Lt 1

K t 1

W

1

(

) 2 11.47538576 t 1.693766938

Lt 1

2 [r ]

Pt