- UVic LSS

I. Damages .......................................................................................................................... 7

Basic Process for Assessing Damages: ..................................................................................... 7

Expectation Damages ................................................................................................................ 7

General Principles & Lost Profits ......................................................................................................... 7

Theory and Background (from Fuller & Perdue) ............................................................................. 7

Claiming Lost Profits ....................................................................................................................... 8

Canlin Ltd v. Thiokol Fibres Canada [1983, ONCA] ............................................................. 8

Problems of Determining the Value of a Bargain: Avoiding Double Recovery .............................. 8

R. G. McLean Ltd. v. Canadian Vickers Ltd. [1971, ONCA] ................................................ 8

M.G. Baer, “The Assessment of Damages for Breach of Contract – Loss and Profit” ............... 9

Doctrine of Election ......................................................................................................................... 9

Profit or Capital ........................................................................................................................... 9

Overlap of Expenditures and Lost Profits ..................................................................................10

Problems of Proof .......................................................................................................................10

Ticketnet Corp v. Air Canada [1998, ONCA] – Laskin JA ...................................................10

Damages for Breach of K w/ Alternative Modes of Performance .......................................................12

Hamilton v. Open Window Bakery [2004, SCC] ..................................................................12

Durham Tees Valley Airport Ltd. v. bmibaby Ltd. [2010, Eng. CA] ....................................13

Ditmars v. Ross Drug Co. [1971, NBQB] .............................................................................13

Lewis v. Lehigh Northwest Cement Ltd. [2009, BCCA] ......................................................14

Cost of Performance or Lost Market Value .........................................................................................14

Posner – Economic Analysis of Law ..............................................................................................14

Efficiency ...................................................................................................................................14

Economic Analysis and Damages ..............................................................................................14

Lost Value vs. Cost of Performance ................................................................................................15

The Old Approach: Wigsell v. School for the Indigent Blind, as cited in Radford v.

DeFroberville, and McGregor on Damages ................................................................................15

Megarry V-C in Tito v. Waddell, Four Propositions on Cost of Performance Awards: .............15

Radford v. DeFroberville [1977] ...........................................................................................16

Cotter .....................................................................................................................................17

Sunshine Exploration Ltd. v. Dolly Varden Mines Ltd. [1970, SCC] ...................................17

Groves v. John Wunder Co. [1939, Minn. SC] ......................................................................17

Peevyhouse v. Garland Coal Mining Co. [1963, Oklahoma SC] ...........................................18

Ruxley Electronics and Construction Ltd. v. Forsyth [1996, HL] .........................................18

Wilson v. Sooter [1988, BCCA] ............................................................................................19

Miles v. Marshall [1975, ON] ................................................................................................19

Summary of Factors re Cost of Performance v. Lost Market Value...........................................20

Starting Points........................................................................................................................20

Factors ...................................................................................................................................20

Non-Pecuniary (Aggravated) Damages for Breach of K .....................................................................20

Basics ..............................................................................................................................................20

Addis v. Gramophone [1909, HL] .........................................................................................20

Vorvis v. ICBC [1989, SCC] .................................................................................................20

Policy Concerns ..............................................................................................................................20

Exceptions to the General Rule: Situations in Which Courts WILL Award Non-Pecuniary

Damages ..........................................................................................................................................21

1. Where Breach of K Causes Significant Physical Inconvenience ............................................21

Hobbs v. Southeastern Railway [1875] .................................................................................21

Warton [BCCA] .....................................................................................................................21

2. Psychological Deliverables ....................................................................................................21

Jarvis v. Swan Tours [1972, Eng. CA] ..................................................................................21

Farley v. Skinner [2002, HL] .................................................................................................21

Fidler v. Sun Life [2006, SCC] ..............................................................................................22

Aggravated Damages .................................................................................................................22

1

Turczinski v. Dupont Heating and Air Conditioning [2004, ONCA] ....................................23

Wallace v. United Grain Growers [1997, SCC] ....................................................................23

Honda v. Keays [2010, SCC] ................................................................................................24

Reliance Damages ................................................................................................................... 24

General .................................................................................................................................................24

Reliance damages ARE available: ..................................................................................................24

Reliance damages ARE NOT available: .........................................................................................24

Where Expected Profits are Not Determinable: ..............................................................................25

Misc Rules on Reliance Damages ...................................................................................................25

Reliance Damages for Negligent Misrepresentation ............................................................................25

Negligent Misrepresentation Damages: Requirements (Hedley Byrne Principle) ..........................26

Application ......................................................................................................................................26

Beaver Lumber v. McLenaghan ............................................................................................26

VK Mason v. Bank of Nova Scotia [SCC] ............................................................................26

Rainbow Caterers v. CNR .....................................................................................................27

Negligence and Reliance in Professional Services ..............................................................................28

Posesorski ..............................................................................................................................28

Messineo v. Beale [1978, ONCA] .........................................................................................28

Kienzle v. Stringer .................................................................................................................29

Restitutionary Remedies ......................................................................................................... 29

Basics ...................................................................................................................................................29

Remedial Advantages: .........................................................................................................................29

Established Categories of Restitution Remedy: ...................................................................................30

Requirements for Restitution to be Granted .........................................................................................32

Restitution in Contract .........................................................................................................................32

Quantum

Various Approaches ........................................................................................................33

Punitive Damages .................................................................................................................... 34

Distinguishing Between Some Common Types of Damages ..............................................................34

When are Punitive Damages Available? ..............................................................................................35

Concerns..........................................................................................................................................35

The UK Position ..............................................................................................................................35

Broome v. Cassell [1972, HL] ...............................................................................................35

Canadian Jurisprudence...................................................................................................................36

US Jurisprudence ............................................................................................................................37

II. Limiting Factors.......................................................................................................... 38

Intro to Limiting Factors: ...................................................................................................... 38

Remoteness .............................................................................................................................. 38

Hadley v. Baxendale ..............................................................................................................38

Parsons (Livestock) Ltd. v. Uttle Ingham [1978, QBCA] .....................................................39

Kienzle v. Stringer [1981, ONCA] ........................................................................................40

Matheson v. Canada [2000, NSCA] ......................................................................................40

Summary of Remoteness .....................................................................................................................41

Mitigation ................................................................................................................................. 41

Basics ...................................................................................................................................................41

Cockburn v. Trusts Guarantee Co. .........................................................................................42

Apeco v. Windmill ................................................................................................................42

Erie County Natural Gas v. Carroll [HL]...............................................................................42

Jamal v. Moola Dawood Sons & Co. [1916, PC (Burma)] ....................................................43

Campbell Mostyn v. Barnett Trading ....................................................................................43

Time of Assessment ................................................................................................................. 44

Asamera Oil Corp. v. Sea Oil and General Corp. [1979, SCC] .............................................44

2

Dodd Properties v. Canterbury City Council [Eng. CA] .......................................................45

Perry v. Sidney Philips [1982, Eng. CA] ...............................................................................45

Damages in Lieu of Specific Performance ............................................................................ 46

Wroth v. Tyler [1974, Eng.] ..................................................................................................46

Semelhago v. Paramadevan [1996, SCC] ..............................................................................46

Specific Performance in Real Estate Ks ................................................................................ 47

Background ..........................................................................................................................................47

Domowicz v. Orsa Investments Ltd. [1993, ON Gen. Div.] ..................................................47

McNabb v. Smith [1982, BCCA] ..........................................................................................48

Semelhago v. Paramadevan [1996, SCC] (continued) ...........................................................48

John E. Dodge Holdings Ltd. v. 805062 Ontario Ltd. [2001, ONSC] ...................................48

Earthworks 2000 Design Group Inc. v. Spectacular Investments (Canada) [2005, BCSC] ..49

Raymond v. Raymond Estate [2011, SKCA] ........................................................................49

Measurement Issues: Reinstatement or Diminution ............................................................ 49

Damage to Chattels ..............................................................................................................................49

Dewees v. Morrow [1932, BCCA] ........................................................................................49

Darbishire v. Warran [1963, Eng. CA] ..................................................................................49

O’Grady v. Westminster Scaffolding Ltd. [1962, QB] ..........................................................50

Factors to Consider Re Reinstatement for Damage to Chattels: .....................................................50

Damage to Real Property .....................................................................................................................50

Taylor v. Hepworths Ltd. .......................................................................................................50

Jens v. Mannix & Co. [1978, BCSC] ....................................................................................51

Kates v. Hall [1991, BCCA] ..................................................................................................51

Betterment ............................................................................................................................................52

James St. Hardware v. Spizziri [1987, ONCA] .....................................................................52

Safe Steps ..............................................................................................................................52

Fontaine v. Roofmart Western Ltd. [2005, MBQB] ..............................................................52

III. Remedies for Personal Injury ................................................................................... 53

Context: The Role of Tort in Dealing with Disability .......................................................... 53

Andrews (The “Trilogy”): Overview of Methodology ......................................................... 53

Lump Sums: Finality vs. Accuracy........................................................................................ 54

Advantages and Disadvantages ............................................................................................................54

Discounting ..........................................................................................................................................54

Theoretical basis: ............................................................................................................................54

The Trilogy Mistake: .......................................................................................................................54

Law and Equity Act ........................................................................................................................55

Non-Pecuniary Losses ............................................................................................................. 55

The “Insurance Crisis”: ........................................................................................................................55

New Theoretical Basis – The Functional Approach ............................................................................56

As Opposed To:...............................................................................................................................56

Basics of the Functional Approach .................................................................................................56

The Cap ......................................................................................................................................56

Logical Conclusions of the Functional Approach ...........................................................................57

Problems with the Canadian Approach ...........................................................................................57

Alternatives .....................................................................................................................................57

Pecuniary Losses: Lost Future Earnings .............................................................................. 58

Step 1: Estimate the level of earnings .............................................................................................58

Step 2: Consider length of working life ..........................................................................................58

Lost Years ..................................................................................................................................59

Step 3: Factor in Contingencies: .....................................................................................................59

3

Step 4; Account for Residual Earnings ...........................................................................................59

Step 5: Deduct for Any Overlap with Cost of Care .........................................................................59

Step 6: Factor in Collateral Benefits ...............................................................................................59

Step 7: Discount to Present Value ...................................................................................................59

Note: Issue of Taxation ........................................................................................................................60

Theoretical Justification ..................................................................................................................60

Practical Justification ......................................................................................................................60

Past Loss .........................................................................................................................................60

Compensating Future Losses of Children & πs who did Unpaid Work ...............................................60

Issues of Fairness ............................................................................................................................61

Addressing these Issues:..................................................................................................................61

Compensating Household Services: ................................................................................................62

Compensating Unwaged Work (or Underemployment) ..................................................................62

Charitable and Religious Organizations .....................................................................................63

Turenne ..................................................................................................................................63

Cost of Care ............................................................................................................................. 63

Step 1: Assessment of Need .................................................................................................................63

Step 2: Determination of Standard by Which Needs should be Met ....................................................63

Mitigation ........................................................................................................................................63

Test of Reasonable Expenditure ......................................................................................................63

General Notes on Determination of Standard .................................................................................64

Step 3: Project Need and Standard into Future ....................................................................................64

Contingencies re Needs and Levels .................................................................................................64

Step 4: Deductions and Adjustments ...................................................................................................65

Mitigation ................................................................................................................................. 65

Objective Test: Assessing What a Reasonable Person Would Do .......................................................65

Thin Skull Situations ............................................................................................................................66

Collateral Benefits ................................................................................................................... 66

Categories of Collateral Benefits: ........................................................................................................67

1. Voluntary Family Care ................................................................................................................67

2. Charity .........................................................................................................................................67

3. Private Insurance .........................................................................................................................67

4. Employment-Based Benefits .......................................................................................................67

5. Public Benefits ............................................................................................................................68

(a) Social Welfare .......................................................................................................................68

MB v. BC [SCC] ...................................................................................................................68

(b) Publicly Funded Care Programs ...........................................................................................68

(c) Health Care Costs .................................................................................................................68

(d) Employment Insurance – Repayment ..................................................................................69

Subrogation ..........................................................................................................................................69

How Does it Work? .........................................................................................................................69

Structured Settlements as an Alternative to the Lump Sum .................................................................72

Fatal Accidents ........................................................................................................................ 73

Basics ...................................................................................................................................................73

Theory of Compensation ......................................................................................................................74

Who Can Recover? ..............................................................................................................................74

Valuing the Dependency ......................................................................................................................75

Non-Pecuniary Losses .........................................................................................................................75

IV. Injunctions ................................................................................................................. 76

Introduction ............................................................................................................................. 76

Framework: Categories of the Law of Remedies .................................................................................76

Liability Rules .................................................................................................................................76

4

Property Rules .................................................................................................................................77

Inalienability Rules .........................................................................................................................77

Timing of Injunctions – Three Options: ...............................................................................................77

Scope of Injunctions: Three Options....................................................................................................77

Quia Timet ............................................................................................................................... 78

Mandatory Injunctions ........................................................................................................... 79

Permanent Injunctions

Injunctions to Protect Property Interests ................................ 79

Possible Alternatives to Permanent Injunctions in Real Estate Cases: ................................................80

1. Live and Let Live ........................................................................................................................81

2. Modify the Property Rights .........................................................................................................81

3. Remedial Alteration ....................................................................................................................81

4. Statutory Intervention

BC Property Law Act .........................................................................82

Injunctions to Address Nuisance ........................................................................................... 82

Injunctions to Address Public Rights .................................................................................... 84

1. Who Can Seek an Injunction to Enforce Public Rights? ..................................................................84

2. How Will Courts Exercise Their Discretion re Whether to Grant Injunctions in This Context? .....85

Concerns..........................................................................................................................................85

When Can a Public Rights Injunction be Obtained? .......................................................................85

AGAB v. Plantation Indoor Plants ........................................................................................85

Robinson v. Adams [1924, ON] ............................................................................................85

AGBC v. Couillard ................................................................................................................85

AGNS v. Beaver ....................................................................................................................86

Reconciling Couillard and Beaver ? ................................................................................................86

Interlocutory Injunctions ....................................................................................................... 86

General .................................................................................................................................................86

Introduction & Context ...................................................................................................................87

Jurisdiction & Procedures ...............................................................................................................87

Law and Equity Act s. 39 ...........................................................................................................87

BC Supreme Court Civil Rules: .................................................................................................87

New Approach: Balancing the Risks ...............................................................................................88

American Cyanamid ..............................................................................................................88

Test for Interlocutory Injunction per American Cyanamid : ............................................................89

Nuanced Analysis of the Situation – Other things to Consider .......................................................89

Final Determination ....................................................................................................................89

Pure Question of Law .................................................................................................................90

Mandatory Injunctions [see below] ............................................................................................90

Restrictive Covenants [see below] .............................................................................................90

Free Speech ................................................................................................................................90

No Undertaking ..........................................................................................................................90

Assessing “Irreparable Harm” .........................................................................................................90

Yule Inc v. Atlantic Pizza Delight Franchise .........................................................................91

David Hunt Farms Ltd. v. Canada (Minister of Agriculture) [1994, FCA] ...........................91

Mandatory Interlocutory Injunctions ...............................................................................................92

Undertakings ...................................................................................................................................92

Injunctions in Relation to Contract Law ..............................................................................................93

Contract Injunctions Generally .......................................................................................................93

Yule v. Atlantic Pizza ............................................................................................................93

What about at Trial? ...................................................................................................................94

Questions about Fothergill Set the Stage for More Assertive Injunctions: .................................94

Vancouver Island Milk Producers v. Alexander [1922 BCCA] ............................................94

Metropolitan Electric Supply v. Ginder .................................................................................95

Thomas Borthwick ................................................................................................................95

5

How does this Mesh With the Concept of Efficient Breach? ................................................96

Assessing whether to grant a K Injunction: ................................................................................96

Using Injunctions to Enforce Restrictive Covenants .......................................................................96

Restrictive Covenants in Sale-of-Business Contracts .................................................................96

Cantol v. Brodi Chemicals Ltd. .............................................................................................97

Towers v. Cantin ....................................................................................................................97

Other reasons why injunctions are more readily given in this context: ......................................97

Restrictive Covenants in Employment Contracts .......................................................................97

Lumley v. Wagner [1852, Eng.] ............................................................................................98

Warner Brothers v. Nelson [1937, Eng.] ...............................................................................98

Detroit Football Club v. Dublinski [1955, ONHC] ...............................................................99

Page One Records v. Britain ..................................................................................................99

Legal Architecture ......................................................................................................................99

Special Situations – Some Discrete Issues in Interlocutory Injunctions ..............................................99

Speech .............................................................................................................................................99

Canada Metal Co. v. CBC [1974, ON HC]............................................................................99

Canadian Tire v. Desmond ..................................................................................................101

Procedural notes about CBC: ...................................................................................................101

Medical Treatment ........................................................................................................................101

Key Differences that Help Courts Make these Decisions:........................................................102

Rasouli .................................................................................................................................103

Environmental Disputes and Aboriginal Interests .........................................................................103

MacMillan Bloedel v. Simpson [1996, SCC] ......................................................................103

Platinex v. Kitchenuhmaykoosib Inninuwug First Nation ...................................................104

Constitutional Cases ......................................................................................................................105

AG MB v. Metropolitan Stores: ..........................................................................................105

RJR MacDonald v. Canada ..................................................................................................105

Mareva Injunctions ............................................................................................................................106

The Established Rule .....................................................................................................................106

Lord Denning to the Rescue – Mareva ..........................................................................................106

The Reception in Canada: Aetna ...................................................................................................107

Jurisdiction ....................................................................................................................................108

Extraterritorial effect: ...............................................................................................................108

Protections for ∆ ............................................................................................................................108

Third parties ..................................................................................................................................108

Anton Piller Orders ............................................................................................................................109

Red Hot Video .....................................................................................................................110

6

I. Damages

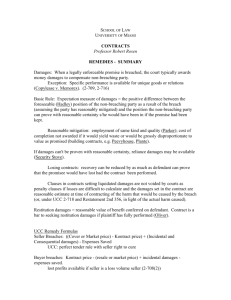

Basic Process for Assessing Damages:

1.

Select

interest that deserves vindication a.

Restitution i.

Idea that people should live up to bargains. A victim of a breached bargain should at least get their money back. ii.

Restitution is measured by benefit to ∆

designed to deprive wrongdoer of ill-gotten gains b.

Reliance i.

Compensates

for expenditures made in reliance on promise by ∆ ii.

Restores status quo prior to promise being made c.

Expectation i.

Puts

in position they would have been in had the bargain been fulfilled ii.

∆ must either keep promise (specific performance) or provide monetary equivalent of keeping promise (damages)

2.

How do you apply the measure of damages?

3.

Are there any relevant principles that moderate/limit the damages award, to balance out ∆ legitimate interests? a.

Mitigation b.

Remoteness

Expectation Damages

General Principles & Lost Profits

Theory and Background (from Fuller & Perdue)

In some ways, restitution and reliance damages are easy to accept as appropriate remedies in contract law

they are about redressing the balance between

and ∆, and are easy to line up with shared moral values. o The idea is that people shouldn’t make promises then break them, especially when you know someone will waste time and effort as a result.

Expectation damages are different: not restoring the harm, but giving

the value of the promise. This is a moral concept, but perhaps one not so commonly shared.

Expectation damages didn’t originally exist in K law o They become important in the planning done by individuals through private interactions.

To achieve stability in a complex capitalist economy, we need certainty, future planning, credit.

It’s about giving planners in the marketplace the security to trade. o Reliance and restitution don’t sufficiently facilitate these interests.

Restitution doesn’t give you anything extra

Reliance would require

to prove all the minute ways in which

had relied on ∆ promise, which are just generally included in expectation

7

damages.

Note: if you include opportunity costs in reliance damages, and went through the whole minute assessment, people could essentially get expectation damages through reliance damages anyway.

Economic and Juristic Rationales o Administrative: facilitating reliance o Economic: allows trading on present value of the K.

Claiming Lost Profits

Canlin Ltd v. Thiokol Fibres Canada [1983, ONCA]

An example of a court protecting the expectation interest, despite arguments of remoteness and perhaps certainty of damage

Default: you get the difference b/w goods paid for and goods received; but this is predicated on a duty/ability to mitigate. Where that can’t be done, the presumption is rebutted.

Facts:

bought product from ∆ to manufacture swimming pool covers. Material defective, shreds into customers’ pools.

Issue/Arguments: o ∆ argues, per presumption stated in s. 56(3) of the Sale of Goods Act, that the proper measure of damages should be limited to the difference between actual value and value goods would have had if ≠ defective. o

claims for lost profits in addition, because their business suffered as a result of the damage to their reputation.

Held: for

. Entitled to lost profits as well as difference in value.

Reasons: s. 56(3) of SoG Act doesn’t apply here.

An assumption behind the provision: if defect is discovered early enough and buyer acts quickly enough (as obligated to mitigate), then the buyer can find new materials, replace the defective product and move on with their business.

Under this assumption, ∆s are normally only liable for the notional cost that would have been incurred to buy new materials. However, in this case the defect wasn’t discovered soon enough and s were shut out of the market for a few years as a result of the fiasco.

This is sufficient “evidence to the contrary” as required to avoid the application of s. 56(3)

that provision wouldn’t give them what they lost.

Problems of Determining the Value of a Bargain: Avoiding Double Recovery

R. G. McLean Ltd. v. Canadian Vickers Ltd. [1971, ONCA]

Avoiding double recovery

Facts:

printing co bought new printing press from ∆, didn’t work properly. TJ awarded damages for lost profits and the cost of the press.

Issues/Arguments: o (1) ∆ argued that TJ award was double compensation. o (2) What happens when

doesn’t have sufficient funds to mitigate?

8

Held: TJ overruled; sent back for new trial o Re

inability to mitigate:

∆ shouldn’t be saddled with burden; the level of risk of a vendor of machinery should not vary depending on who they sell to.

It’s different from the thin skull rule in tort, likely because of the commercial context. o The true measure of expectation damages is putting

in position they would have been in had the K been performed.

would have earned profit, but would have had to incur an expenditure to acquire the press.

CA refers back to new trial to determine the amount of profit after expenditure

BUT: this isn’t enough

would have spent $ on the press, but then also would have had a working press.

So, consider the depreciation value of the press in the two year delay, then calculate profit by deducting that depreciation.

Alternately, consider the cost of buying a new press.

Note: realistically,

had paid $15,000 already, which is likely roughly equivalent to the depreciated cost, so really the TJ did award net profits in the end.

The CA was right about the rule generally, but you shouldn’t deduct 100% of the value of equipment from a claim of lost profits over only two years. o Mitigation: ∆ offered to take back press and refund, but

declined. Obligation to mitigate.

M.G. Baer, “The Assessment of Damages for Breach of Contract – Loss and Profit”

Gross profits include your expenses

Doctrine of Election

Profit or Capital

THE ISSUE: Double Counting o In McLean , the press didn’t work so they claimed lost profits. But hadn’t paid for the press, and TJ didn’t deduct cost of press from lost profits. o Doctrine of Election means you can’t get both. That would be double-counting, because if

had actually earned the profits, they would also have paid for the press. It’s about putting

in the position as if K had actually been performed.

Note: CA applied the doctrine too broadly in McLean . o Yes,

would have to pay for press to earn the profit, but had K been performed they would also have had a valuable press. o So, can’t deduct the whole cost of the press

just deduct the depreciated value.

Assess the proportion of the working life of the press that is attributable to the time period for which profits are being claimed, and

9

deduct that proportion of the press’ value from the profits.

Overlap of Expenditures and Lost Profits

In McLean , the CA also overturned the TJ’s method of calculating lost profits in relation to expenditures.

General principle : you can either claim the money wasted or sue for the profit you should have had. Can’t have both – that would be overlap.

Also, you can’t claim wasted expenditures in excess of the amount you would have had to spend to make the profit.

In McLean , the TJ awarded net profit, not gross profit. So, really, even though he included profit and expenditures, his calculation was actually in keeping with the doctrine of election. So, they SHOULD have been allowed to claim lost profit and expenditures.

Waddams: profit must be net profits, not gross potential income

Problems of Proof

CA in McLean found that the lost profits claimed were exaggerated.

Don’t calculate profit solely on the theoretical productive capacity of the machine must also consider the actual likely work that was available and/or would have been done. o This puts a significant burden of proof on the

, but courts won’t hold ∆s to the assumption that every party they deal with is running the best possible business

(most competitive, most profitable) in that industry.

Rather, a court will consider industry averages and projections, and compare with

’s actual track record to try to establish some kind of ratio.

Ticketnet Corp v. Air Canada [1998, ONCA] – Laskin JA

Doctrine of Election: gets the whole “net vs. gross profits” thing right.

The burden of proof is on

to prove damages, but where ∆ wrong has prevented precise proof,

can rely on projections (discounted to reflect certain contingencies)

Facts o

created an online ticket-booking software, made a deal w/ ∆ to jointly develop it and share revenues for a set period. o ∆ repudiated and at first

expected to get the software back but ultimately ∆ never returned it. o

entered into new K with American Airlines. Different terms, but involved payment to

of 750k for the software. When it became clear they weren’t getting the software back,

had to renegotiate their K with American Airlines, and lost out on the 750k.

Issue/Arguments:

sued ∆ for lost profits and lost business opportunity. o (1)

claimed $12 million in lost profits. ∆ accepted breach but argued damages should be limited to 750k, the difference between the first and second AA agreements.

10

o (2)

also sought additional expenses not allowed at trial

Held: Damages NOT limited to 750K; TJ ruling on additional expenses upheld.

Reasons o Issue (1) – Damages limited to 750k?

Arguments:

∆ argued the only value lost was the value of the asset. Had managed to parlay the repudiated agreement into a new agreement with AA, but then the lost software meant they lost

$750k.

Argued that lost capital is better representative of the lost profit

∆ said that since AA was willing to buy and

was willing to sell for $750k, that is an accurate measure of the damages suffered.

The concern is against double-recovery: lost profits are logically contained in the value of the assets. The value of a business asset is the discounted stream of revenue that will be earned by that asset.

In principle, this argument is sound. If there is a radical difference between the value an asset is sold for and the damages claimed for it, something is amiss.

But in this case, there is a difference: the price of a share sale conducted by shareholders under financial pressure (due to ∆ actions) and eager to mitigate is NOT a proper measure of the value of the company.

∆ shouldn’t profit from the poor bargaining position it left

in.

Plus,

wasn’t seeking damages for the past/present value of the software, only for the lost business opportunity due to ∆ breach of agreement and subsequent injunction. o Issue (2) – calculation of lost profits: inclusion of expenses in damages

Arguments

argued they should be awarded damages for expenses incurred before the repudiation, and for all (not just some) expenses incurred after the repudiation. Not to do so,

argued, would double count the expenses in favour of ∆, and would fail to put

back in original position.

Numbers:

Expected Revenue: 15 million

Actual expenditures: $2 million

Additional anticipated expenditures (if there hadn’t been a breach): $3 million

So, expectation damages should be $12 million

would have had

$10m had everything worked out, but lost $2 million was wasted expenditure.

TJ interpreted the report as calculating

lost profits separately from expenses, by deducting projected expenses and taxes from projected

11

revenues (not including the out-of-pocket expenses), then added the actual expenses (pre- and post-repudiation) to the lost profit projections.

argued that the actual expenditures were wasted expenditures, because they didn’t generate offsetting revenue and b/c software had no residual value.

argued these expenses must be added to damage award to avoid double counting against them.

TJ declined to add the claimed amount back in, because it was included in the projected revenues per his interpretation of the report. CA said ≠ included in projected revenues, because close reading of the expert report shows they deducted it then added it back in afterward.

Generally, a party seeking damages for breach of K must elect between claiming lost profits or wasted expenditures – cannot claim both, as this would be overlap [ Anglia v. Reed (1971, Eng.

CA)]. However, in this case the actual expenses are not included in the projected profits, and thus are two separate forms of damage, not overlapping.

Have to add back in the amount that was actually spent, since it had no corresponding revenue as was expected.

TJ basically just phrased things differently

he interpreted the report such that the projected expenses referred to the remaining expenses projected (i.e. those that hadn’t been spent yet), when in reality it left those out of the initial calculation then added them back in. But he still came to the conclusion that $12 million was the right number.

So, TJ should have considered the actual and projected expenses separately. But his award was ok anyway, so nothing was changed.

Damages for Breach of K w/ Alternative Modes of Performance

Expectation damages are not necessarily the

’s actual expectation, but what

has a right to expect.

What if a party could have performed K duties in more than one way, but failed to perform at all? o It has been argued that we should measure the damages based on how ∆ would most likely have performed the K. o However, in 2004 the SCC unanimously rejected that argument:

Hamilton v. Open Window Bakery [2004, SCC]

Stands for: minimum performance principle

Facts: o K for 3 years, but termination provision to allow either party to terminate with

3 months notice o ∆ terminated with no notice due to a misunderstanding (so, wrongful repudiation). o TJ awarded damages for full 36 months of K, less 25% to reflect the possibility that ∆ might have validly exercised the termination right at some point.

12

Reasons – Arbour J. o General principle is that you adopt the mode of performance that is least profitable to

and least burdensome to ∆, and calculate damages on that basis. o SCC upheld CA: Early termination clause with three months’ notice constituted the minimum guaranteed benefits under the K. As such, this was considered to be the maximum liability to which ∆ could be exposed, and the appropriate measure of damages. o Note: much of the litigation in this area is trying to confine the rule and find exceptions to it. o Policy

Can allocate risk in K

if they have set up their reasonable expectations in the K, it’s fair to enforce that.

Durham Tees Valley Airport Ltd. v. bmibaby Ltd. [2010, Eng. CA]

Facts: ∆ agreed to fly two airplanes out of the airport for a 10-year term, but then stopped.

Issue: ∆ wants to take advantage of minimum performance rule – say they agreed to fly two airplanes but never specified how many times/day they would fly. Thus, argues damages are zero under the minimum performance rule

you assume the minimum possible. o TJ said this wasn’t even a K and declined to enforce it.

Held: CA did enforce the K, but rejected zero minimum. o Where parties have not specified, court says the K must still have meaning. o Since parties have not specified a range of possible performance, no room for operation of the minimum performance rule

it would be absurd to assume the

understood zero flights to be an option, because that is commercially ridiculous. o So, back to the old rule: what would the parties have actually done?

Reasonable amount of damages.

Ditmars v. Ross Drug Co. [1971, NBQB]

Facts: Wrongful dismissal action

won, received severance and also sought a bonus that he would have earned had he not been fired.

Issues/Arguments: Employer argued that K said maybe bonus, but did not obligate them to pay a bonus. o K specifies that it is discretionary, which implicitly assumes zero as a possibility.

Held: Court awarded

a bonus o Adds requirement of a bonus as a term of the K (says “virtual” but that word isn’t really necessary

it’s a straight up term of the K now) o Through practice and continual renewals, it’s not unrealistic to say that the K has been changed by the parties over time. o All other pharmacists in industry had been getting salary increases, but in this case they were just getting bonuses instead, to keep them up to industry practice.

So : courts can avoid the minimum performance principle, and then a judge can put in

13

whatever figure he thinks is reasonable.

Lewis v. Lehigh Northwest Cement Ltd. [2009, BCCA]

Facts: wrongful dismissal.

claiming for anticipated annual increase in salary (had received ~3%/year for the previous five years). Argues implied term in K.

Held: Increased salary ≠ awarded.

Reasons: o Judge ≠ bound to find that

would have received a discretionary salary increase during the notice period. o

had been on extended medical leave during which he had no job performance to assess and had made no contribution to ∆ financial performance.

Cost of Performance or Lost Market Value

Posner – Economic Analysis of Law

Efficiency

Sometimes it makes more sense to breach a K than to perform it. o Holmes’ view: the law simply requires a party to choose between performing the K and compensating the other party for any injury resulting from failure to perform. o A remedy that induces the wronged party to complete the K after the breach may be wasteful

Hence the doctrine of mitigation, and the preference for damages as a remedy over specific performance.

What if the cost to ∆ of making good the wrong exceeds the value to

of doing so?

Sometimes there is an incentive to breach where the profit expected from breaching is greater than the profit expected from performance, even considering the losses of the other party that will be taken out in damages. o So, the law, and remedies, are structured to facilitate the efficient allocation of resources.

Efficiency is defined as arrangements of resources to their most highly valued use. o “Value”: measured by parties’ willingness to pay o “Trade”: maximizes welfare and efficiency moves items to more highly valued uses as measured by a party’s willingness to pay. o “Contract”: allows for complex trades

Economic Analysis and Damages

Expectation damages encourage the performance of Ks when they are efficient and discourage their performance when they are inefficient.

When is performance of a K inefficient? o (a) When cost to ∆ of performance exceeds the losses from non-performance o (b) When alternate opportunities to ∆ are more valuable than

loss

Efficiency explains the requirement of mitigation: reduction of joint costs of breach

14

Efficiency explains why courts should not award less than expectation damages. o E.g. reliance damages won’t give an incentive to carry our K even if it is efficient.

Efficiency explains why courts should not award more than expectation damages, and should generally avoid specific performance: o We don’t want to encourage the performance of inefficient Ks

BUT, efficiency also shows why specific performance is sometimes available: because it is the only way to measure the value of the K. o Where goods are fungible, SP won’t be available. o SP may be available if there is no functioning market in the goods, or if for some reason the market isn’t the right indicator of value

E.g. consumer surplus, sale of unique property o Note: even if the law gets it wrong on this, a post-judgment bargain may bring things back into balance.

Lost Value vs. Cost of Performance

Posner: Efficiency generally points toward “ lost value

” rather than “ cost of performance

” o Don’t encourage performance of Ks where cost exceeds benefit, and don’t penalize K-breaker for avoiding waste.

The Old Approach: Wigsell v. School for the Indigent Blind , as cited in Radford v.

DeFroberville , and McGregor on Damages

Facts:

partitioned property and sold half to build a school; part of the deal was that buyer would build a fence between the partitions. School never built, no more need for fence, and it never got built. No evidence that ∆ land was worth any more with or without the fence, but the cost of building was several thousand pounds.

Held: court awarded lost value.

Note: Posner would say that building the fence was an inefficient use of the resources.

Megarry V-C in Tito v. Waddell, Four Propositions on Cost of Performance Awards:

[Cited in Radford v. DeFroberville ]

1. The principle is to compensate

by putting him as much as possible in same pos’n as had he not suffered the wrong. It’s not about making the ∆ pay what he has saved, but about compensating the

.

2. If

has suffered monetary loss, then that is obviously recoverable. If ∆ has saved $ by not doing what he K’d to do, that is irrelevant to the calculation of damages, as it was not a loss by the

.

3. If

can establish that his loss includes the cost of doing work ∆ failed to do (in breach of K), then that sum is recoverable. Onus is on

to establish what his loss was.

4.

has a number of ways to establish that loss includes cost of work: o Work was done before action brought. o OR, work will/must be done. This Can be indicated through:

An action for specific performance,

Or by the fact that

is obligated to a 3 rd

party to complete the

15

work,

Or perhaps by the existence of a statutory obligation;

Could also be indicated simply by

proving he wants/intends to complete the work.

Radford v. DeFroberville [1977]

Facts o

sued for breach of K to erect a wall on ∆ property. o

sold adjoining property to ∆ in consideration for an agreement to build a wall between them. But, ∆ never completed the wall. o Absence of physical barrier didn’t devalue the land; in fact, ∆ argued higher value than if wall were completed.

Held:

gets cost of performance.

Reasons: o The principle is to put

(as far as money can) in the same pos’n he would have been in had the K been fulfilled.

Note: this is not necessarily the same as putting

in as good a financial position. o Distinguishes Wigsell : in this case, there was convincing evidence that

did have a real interest in having a fence. o To assess whether a

wants to complete the work:

1. Does

have genuine/serious intention of doing the work?

2. Is carrying out the work reasonable for the

to do? o In this case:

1. Court found the requisite ‘fixity of intention’. Plus

gave undertaking anyway. Court accepted that

wanted to do work and found that the appropriate measure of damages was the cost of completion.

2. Reasonable to carry out work?

This is really a question of mitigation. ∆ argued prefab fence would be just as effective and less expensive.

But, court did not accept this argument: o Prefab fence ≠ permanent and

would have to maintain it o Prefab fence ≠ what the

asked for. o Although ∆ argued future owner might not want a fence there, so they could build another house in a corner of the lot, court said there was no indication of that, and in fact thought it might not be possible to get planning permission anyway.

“A plaintiff may be willing to accept a less expensive method of performance, but I see nothing unreasonable in his wishing to adhere to the contract specification.”

Note: Court asked a third question: Does it matter that

is not personally living on the land but wants to do the work for benefit of

16

his tenants?

Apparently not.

Cotter

Facts: mining companies, ∆ breached K to drill well,

seeks cost of drilling well

Held: In cases like this,

can only get proven economic loss suffered, not cost of performance. o The only loss proven was $1000 for not having well.

claimed $25k for cost to drill the well, but court said this would be oppressive.

Sunshine Exploration Ltd. v. Dolly Varden Mines Ltd. [1970, SCC]

Stands for: Cotter isn’t a hard rule; depends on the circumstances

Facts o Similar to Cotter. JV;

(DV) holds lease to mining territory in northern ON. ∆ takes half interest and commits to doing a bunch of work, but then only does part and abandons the project. o

claims the cost of completing the work. o ∆ argues

Cotter , you only get proven economic losses.

Held:

gets cost of completion. Cotter ≠ hard rule – it depends.

Reasons o The rule is expectation damages. What those amount to varies depending on the circumstances. o In this case, ∆ had done almost nothing under the K, and full consideration had passed from

.

∆ now owned half the property – took all the benefit from

, and then didn’t do what they promised. Sense of unjust enrichment. o The decision looks to the true expectation: the loss was actually the information on whether or not to mine, and

didn’t get that, so they didn’t get the value sought from the K.

Groves v. John Wunder Co. [1939, Minn. SC]

Facts: ∆ K with

to remove fill; ∆ only took the good fill to its own advantage, leaving the land unusable and in worse condition than when it began. Cost of performance =

$60k, max overall value of land = $12k.

Damages were awarded for cost of performance, even though that was grossly disproportionate to the value of the land.

Posner critiques Groves : o Real preference was to maintain land value, not have flat land. Thus, Posner says the decision is wrong. o Majority said if

wants a certain situation, court shouldn’t enforce the price of the land as a cap on that preference. BUT, these were commercial operators;

owned land for an investment, and it’s highly unlikely that the

would actually spend $60k to level the land if he knew it would only sell for $12k. o If

pockets the $60k then turns around and sells the property, the court hasn’t protected expectation

just conferred a massive windfall. But if

lives on the

17

land and has personal/family connection etc., then maybe it can be argued that

$12k isn’t the appropriate valuation. o SO...

we examine the nature of

interest in the K: is it economic or personal?

In Groves, there was basically a windfall built into the K for one side or the other: o Even if the outcome was inefficient, ∆ shouldn’t be unjustly enriched by failing to perform, and should be punished for their egregious behaviour. o So, where a windfall must be given to one party, for moral reasons the judge decided it should be the

who benefited in this case.

Peevyhouse v. Garland Coal Mining Co. [1963, Oklahoma SC]

Facts o Farmers, lived on farm for generations. Leased land to coal mining company to strip-mine their land, with promise to restore farm. o But they didn’t restore. o Cost of restoration: $25k. Diminished value: $300.

Held: Court awarded diminished value. o Cost of performance uneconomic, would be windfall to

.

Comments: o But in this case, the

s were family people and probably had legitimate reasons for wanting the land restored. Plus, they built that requirement into the

K. o So...maybe both Groves and Peevyhouse are wrong. o Probably the court and jury in Peevyhouse were bothered by the serious disparity between cost of performance and the value of the property

you could buy several farms for that price.

Ruxley Electronics and Construction Ltd. v. Forsyth [1996, HL]

Stands for: consumer surplus

court can consider the personal/subjective value over a straight market-value assessment

Facts o ∆ built pool for

, but 6 inches shallower than K called for. o ≠ effect on value of pool, or utility (can still dive into it)

no functional difference. o Zero lost value in commercial terms. Fixing the problem means rebuilding the whole pool, at a cost of ~£30k.

Held: Award of £2000 for loss of amenity

higher than nothing, but less than full cost of performance

Reasons o Court believes

wanted a deeper pool, but won’t award the full cost of performance.

Doubtful that the award would actually be used to build a deeper pool, and thinks it’s unreasonable. o Policy concern: protect

interest w/o imposing undue liability on ∆ (who was pretty much innocent in this case.) o Court acknowledges loss of amenity

the personal satisfaction

would have

18

had if pool were made to spec. o In most cases of this sort, neither alternative is really satisfactory

there’s always going to be a significant windfall or punishment if you choose absolutely between cost of performance and lost market value. SO...we don’t stop with market value. Can consider an individual’s personal valuation.

Consumer surplus the amount by which a party values a transaction over and above the market price.

It’s usually hidden or irrelevant because a consumer can mitigate, thus making the loss measurable by market price (difference in what’s paid)

But, sometimes, the market won’t work.

E.g. no replacement available.

In these cases, court awards the value of lost amenity as an estimate of what the true loss to

is.

Wilson v. Sooter [1988, BCCA]

Facts: o K for wedding photos. o K price = $399, but we can assume wedding pictures have a much higher consumer surplus value. o Photographer showed up drunk, took terrible pictures, and

s didn’t find out until the pictures were developed. o ∆ argued measure of damages should be the market value, $399

give them their money back. o s wanted the cost of redoing the whole wedding – $7000.

Held:

s awarded ~$2000

Reasons o Court knew there was subjective value, but the cost of redoing the entire wedding and flying people back from Brazil etc. was just too high. o The goal: find an amount that compensates

without unduly penalizing ∆. o Courts want to enforce performance of Ks, when they are efficient, but not to penalize people for breaching a K when performance doesn’t make sense

idea of waste.

Miles v. Marshall [1975, ON]

Facts: damages for tenant failure to give land back in good repair. Some repairs ≠ necessary for enjoyment of property.

Held: Awarded diminution in market value

Reasons o Cited Joyner v. Weeks [1891]: two ways to measure cost of damages for repair

(1) cost of doing repair

(2) cost of diminution in market value o Court says that generally, the rule is #2: we look at diminution of market value. o Basically, the rule in Radford exists, but we’re going back to Wigsell . o Comment: this was decided after Sunshine , but that was an SCC case so maybe we should trust that.

19

Summary of Factors re Cost of Performance v. Lost Market Value

Starting Points

Expectation principle

Balance of interests

Enforcement of Ks

Avoidance of waste and inefficiency ( Jacobs )

Factors

Assessment of

’s true interest

Nature of K

commercial or consumer [ Ruxley ]

Centrality of the obligation (e.g. building K or incidental provision)

Problem of “waste” [

Jacobs ; Ruxley ]

Problem of unjust enrichment of ∆ vs. windfall to

[ Groves , Peevyhouse ]

Claim to specific performance?

Owner’s intent to do work

Reasonableness of work

size disparity b/w cost of performance and benefit achieved

Non-Pecuniary (Aggravated) Damages for Breach of K

Basics

A common claim in tort law/personal injury cases

it’s often reasonably foreseeable that if you injure someone they will suffer non-pecuniary harm.

In K law, the starting point is the exclusionary rule: non-pecuniary losses are presumptively not recoverable in breach of K

(unless it’s also a tort/causes physical injury).

Addis v. Gramophone [1909, HL]

Facts:

was fired in a mean way

Held: damages for breach of K are limited to financial losses, absent ability to prove an independent actionable wrong

This set the general rule.

Vorvis v. ICBC [1989, SCC]

Facts:

fired summarily in breach of K, suffered mental distress

Held: SCC reaffirmed the rule: absent an independent tort or other cause of action, the mere breach of K does not attract non-pecuniary damages.

Policy Concerns

K law is generally assumed to be about trade/exchange

economic values. o Non-economic values and risks are not normally part of the trade.

There is an administrative/evidentiary concern as we move away from pecuniary losses, dealing w/ subjective harms that are difficult to prove and likely prone to overstatement/exaggeration.

Issue of causation:

20

o Particularly in employment cases o Primary distress suffered by an employee is caused by an employer exercising their contractual rights. The breach of K, if any, arises solely from the way the employer exercises those rights. Usually it’s because the employer fails to properly calculate the notice period. o The loss of notice is generally not the reason for the mental distress. Have to establish a causal connection between a breach and the distress suffered.

Exceptions to the General Rule: Situations in Which Courts WILL Award Non-

Pecuniary Damages

1. Where Breach of K Causes Significant Physical Inconvenience

To some extent, this is an expansion on the usual tort idea. If you’re physically injured, you can have damages.

For a long time, courts have allowed a slightly wider scope of stress and physical inconvenience.

Hobbs v. Southeastern Railway [1875]

Facts: Train stopped early,

had to get off and walk 10 miles in the rain. Significant physical discomfort as a result of the breach of K.

Held: court awarded monetary damages for the physical inconvenience.

Warton [BCCA]

Follows Hobbes

Facts:

bought a Cadillac, but it made a buzzing noise. Kept trying and failing to fix it.

Held: Compensated for the breach and the distressing buzzing, as well as for inconvenience of repeatedly taking the car in to the dealer to have it fixed.

Comments: probably the fancy nature of the car enhanced the foreseeability of the buzzing being a problem for

.

2. Psychological Deliverables

Where the purpose of the K is to deliver a non-economic benefit, which is not delivered.

Brings the question back to a consumer surplus analysis. o Recall Wilson v. Sooter : central to the K for wedding photos was a promise to deliver an intangible benefit (wedding memories etc.)

Jarvis v. Swan Tours [1972, Eng. CA]

Lord Denning

Facts: disappointed vacationer sues for loss of enjoyment of vacation. ∆ offers to reimburse payment, but

claims above that.

Held: the compensation/expectation principle requires more than just reimbursement, because he expected the psychological benefit of a vacation.

Farley v. Skinner [2002, HL]

21

Facts:

argues house is worth less than it should be, due to airplane noise. Sues ∆ surveyor for damages.

Held: no compensation for economic difference in value, but psychological deliverable is compensable - $10k.

Reasons: o Airplane noise was there when he bought the house.

Note: in the market, even if

can prove he would have bargained for a lower price, the owner would have sold it to someone else at the market price.

No economic loss in this case. So, the only loss he can get would be disappointment/mental distress. o Psychological deliverable: specifically negotiated w/ surveyor for the information on airplane noise, which made it specifically deliverable as part of the K. o Goes beyond previous cases: object of K no longer has to be primarily a psychological deliverable

it can be a secondary aspect of the K. o Court gives $10k, and says that’s the top end of an award of this type.

Fidler v. Sun Life [2006, SCC]

Facts: Disability payments should have been made,

had to go to court to get them.

Claimed damages for mental distress.

Held: $20k awarded.

Reasons: o Subtext/secondary purpose of insurance Ks is peace of mind.

Not just to protect against the financial risk, but so you don’t have to worry about that risk in the meantime.

Psychological benefit of having peace of mind while the K is in place. o Basically adopts Hadley v. Baxendale foreseeability requirements for determining whether psychological harm is compensable.

But, to apply the foreseeability rule, you look at the object of the

K/what was promised.

so, it’s not really a huge step forward.

Comments: note that the award is roughly equivalent to that in Farley

still relatively modest. o And it was supported by medical evidence in this case. o It’s not just about missing the psychological security of having an insurance K, but getting more sick by having to live without disability benefits.

Aggravated Damages

Can mean ambiguously one of two things: o 1. Damages over and above your pecuniary damages

aggravated in the sense that they are more than pecuniary. o 2. Damages where the loss is greater than it otherwise would have been because of aggravating behaviour by the ∆

Most common in wrongful dismissal cases, where damages are caused by aggravating behaviour. E.g. not only did employer fail to give notice, but abused employee on the way out.

22

Turczinski v. Dupont Heating and Air Conditioning [2004, ONCA]

Facts o Heating contractor didn’t do the job right. o All parties agreed that it cost $10k to fix the problem/clean up the mess. o But

also claimed loss of rent for three years, and mental distress. Argues special negotiations. o Had previously undiagnosed depression, bi-polar disorder, OCD

the experience w/ the heating contractor triggered an episode that lasted for three years.

Held: no mental distress award. Lost rent for 1 year awarded as reasonable mitigation period.

Reasons o Mental distress claim rejected:

∆ didn’t have special knowledge to the threshold necessary to put them on notice.

may not have fully known, as it was undiagnosed at the time.

Policy: fairness. Unfair to hold a heating contractor to that level of risk in entering into Ks with customers.