File - CS Study Point

advertisement

EMPLOYEES' PROVIDENT FUNDS AND

MISCELLANEOUS PROVISIONS ACT, 1952

The Employees’ Provident Funds and Miscellaneous Provisions Act, provides for compulsory contributory fund for the future of

an employee after his/her retirement or for his/her dependents in case of his/her early death. Its applicability: It extends to the

whole of India except the State of Jammu and Kashmir and is applicable to:

a)

b)

c)

every factory engaged in any industry specified in Schedule 1 in which 20 or more persons are employed;

every other establishment employing 20 or more persons or class of such establishments which the Central Govt. may

notify;

any other establishment so notified by the Central Government even if employing less than 20 persons.

Every employee, including the one employed through a contractor (but excluding an apprentice engaged under the Apprentices

Act or under the standing orders of the establishment and casual laborers), who is in receipt of wages up to Rs.6,500 p.m., shall be

eligible for becoming a member of the funds. The condition of three months’ continuous service or 60 days of actual work, for

membership of the scheme, has been done away.

Workers are now eligible for joining the scheme from the date of joining the service.

1.

The Act provides for three schemes viz.,

A. EMPLOYEES' PROVIDENT FUND SCHEME, 1952

An employee who is in receipt of pay up to Rs.6500/-p.m. is eligible for membership of the Fund. The contribution is 12

percent/10 percent of the monthly wages.

B. EMPLOYEES' PENSION SCHEME, 1995

Under this scheme, family members, of the employees who died in harness, were given monthly family pension. This

scheme is funded by diverting 8.33% of the wages of the employees out of the employers' contributions to the Provident

Fund. The Central Government contributes at the rate of 1-1/6% of the wages of the employees.

C. EMPLOYEES' DEPOSIT LINKED INSURANCE SCHEME, 1976

The employer shall pay such amount not being more than 1% of the basic wages dearness allowance and retaining

allowance (if any). The employer shall pay into the Insurance Fund such further sums not exceeding ¼% of the

contribution above to meet all the expenses in connection with administration of the Insurance Scheme. No contribution is

payable by the employee.

2.

The employer is required to contribute the following amounts towards Employees’ Provident Fund and Pension Fund:

a. In case of establishments’ employing less than 20 persons or a sick industrial (BIFR) company or ‘sick

establishments’ or any establishment in the jute, beedi, brick, coir or gaur gum industry. –the employer contribution is

10% of the basic wages, dearness allowance and retaining allowance, if any.

b. In case of all other establishments’ employing 20 or more person- the employer contribution is 12% of basic wages,

dearness allowance and retaining allowance, if any.

A part of the contribution is remitted to the Pension Fund and the remaining balance continues to remain in Provident

Fund account.

Where, the pay of an employee exceeds Rs.6,500 p.m., the contribution payable to Pension Fund shall be limited to

the amount payable on his pay of Rs.6,500/- only.

“Basic wages" means all emoluments which are earned by an employee while on duty or on leave or on holidays with

wages in either case in accordance with the terms of the contract of employment and which are paid or payable in cash

to him but does not include:

(i) the cash value of any food concession;

(ii) any dearness allowance, house-rent allowance, overtime allowance, bonus, commission or any other similar

allowance.

(iii) any presents made by the employer;

For the purposes of this section dearness allowance shall be deemed to include also the cash value of any food

concession

allowed

to

the

employee.

Retaining allowance means an allowance payable for the time being to an employee of any factory or other

establishment during any period in which the establishment is not working for retaining his services.

3.

The contribution to the fund is to be deposited by the employer by 15th of the next month.

4.

Payment of contributions.

(1) The employer shall, in the first instance, pay both the contribution payable by himself and also, on behalf of the

member employed by him directly or by or through a contractor, the contribution payable by such member.

(2) In respect of employees employed by or through a contractor, the contractor shall recover the contribution payable by

such employee and shall pay to the principal employer the amount of member’s contribution so deducted together with an

equal amount of contribution and also administrative charges.

(3) It shall be the responsibility of the principal employer to pay both the contribution payable by himself in respect of the

employees directly employed by him and also in respect of the employees employed by or through a contractor and also

administrative charges.

5.

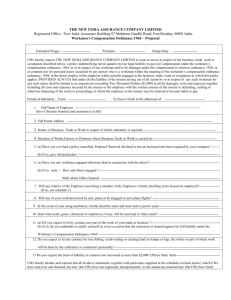

Recovery of damages for default in payment of any contribution.

Where an employer makes default in the payment of any contribution to the fund, or in the transfer of accumulations

required to be transferred by him under sub-section (2) of section 15 or sub-section (5) of section 17 of the Act or in the

payment of any charges payable under any other provisions of the Act or Scheme or under any of the conditions specified

under section 17 of the Act, the Central Provident Fund Commissioner or such officer as may be authorised by the Central

Government, by notification in the Official Gazette in this behalf, may recover from the employer by way of penalty,

damages at the rates given below:—

Period of default

(a)

(b)

(c)

(d)

6.

Less than two months

Two months and above but less than four months

Four months and above but less than six months

Six months and above

Rate of damages (% of arrears per

annum)

17

22

27

37

Duties of employers

(1)

Every employer shall send to the Commissioner within fifteen days of the close of each month a return—

(a)

in Form 5, of the employees qualifying to become members of the Fund for the first time during the

preceding month together with the declarations in Form 2 furnished by such qualifying employees, and

(b)

in prescribed form of the employees leaving service of the employer during the preceding month:

(2)

Every employer shall maintain an inspection note book in prescribed form for an Inspector to record his

observation on his visit to the establishment.

(3)

Every employer shall maintain such accounts in relation to the amounts contributed to the Fund by him and by his

employees as the Central Board may, from time to time, direct, and it shall be the duty of every employer to assist

the Central Board in making such payments from the Fund to his employees as are sanctioned by or under the

authority of the Central Board.

(4)

Every employer in relation to a factory or other establishment to which the Act applies on the date of coming into

force of the Employees’ Provident Funds (Tenth Amendment) Scheme, 1961, or is applied after that date, shall

furnish in duplicate to the Regional Commissioner in Form No. 5A annexed hereto, particulars of all the branches

and departments, owners, occupiers, directors, partners, manager or any other person or persons who have the

ultimate control over the affairs of such factory or establishment and also send intimation of any change in such

particulars, within fifteen days of such change, to the Regional Commissioner by registered post and in such other

manner as may be specified by the Regional Commissioner:

Provided that in the case of any employer of a factory or other establishment to which the Act and the Family Pension

Scheme, 1971, shall apply the aforesaid Form may be deemed to satisfy the requirements of the Employees’ Family

Pension Scheme, 1971, for the purpose specified above.

7.

Duties of contractors

Every contractor shall, within seven days of the close of every month, submit to the principal employer a statement

showing the recoveries of contributions in respect of employees employed by or through him and shall also furnish to him

such information as the principal employer is required to furnish under the provisions of the Scheme to the Commissioner.

8.

I.

Withdrawal from the Fund

Under the following circumstances withdrawal from the Fund is permitted.

(i)

For the purchase of a dwelling house/flat including a flat in a building owned jointly with others (outright or on

hire purchase basis),or for the construction of a dwelling house including the acquisition of a suitable site for the purpose

from the Central Government, the State Government, a co-operative society, and institution, a trust, a local body or a

Housing Finance Corporation (hereinafter referred to as the agency/agencies);(ii) for purchasing a dwelling site for the

purpose of construction of a dwelling house or a ready-built dwelling house/flat from any individual;(iii) for purchasing

dwelling house/flat on ownership basis from a promoter governed by the provisions of any Flats or Apartments Ownership

Act or by any other analogous or similar law of the Central Government or the State Government as may be in force in any

State or area for the time being and who intends to construct or constructs dwelling house or block of flats and the member is

required to pay to the said promoter in advance for financing the said construction of the house/flat (iv) for the construction

of a dwelling house on a site owned by the member or the spouse of the member or jointly by the member and the spouse, or

for completing/continuing the construction of a dwelling house already commenced by the member or the spouse, on such

site or for purchase of a house/flat in the joint name of the member and the spouse under clauses (i) and (ii) above.

(ii)

On an application from a member in the prescribed form the Commissioner or any authorized office may sanction

withdrawal from the amount standing to the credit of the member in the fund.

a) The amount of withdrawal for the purpose of purchase of a site for construction of house thereon shall not exceed the

member’s basic wages and dearness allowance for twenty-four months or the member’s own share of contributions,

together with the employer’s share of contributions with interest thereon or the actual cost towards the acquisition of

the dwelling site, whichever is the least.

b) The amount withdrawal for the purpose of acquisition of a ready built house/flat or for construction of a house/flat,

shall not exceed the member’s basic wages and dearness allowance for thirty-six months or the member’s own share

of contributions, together with the employer’s share of contributions, with interest thereon, or the total cost of

construction, whichever is the least.

No withdrawal under this paragraph shall be granted unless:

(i)

the member has completed five years’ membership of the Fund;

(ii)

the member’s own share of contributions with interest thereon in the amount standing to his credit in the

Fund is not less than one thousand rupees;

(iii)

a declaration from the member that the dwelling site or the dwelling house/flat or the house under

construction is free from encumbrances and the same is under title of the member and/or the spouse

II.

For repayment of loans in special cases.

(i)

The Commissioner or any authorized officer may on an application from a member, sanction from the amount

standing to the credit of the member in the Fund, withdrawal for the repayment, wholly or partly, of any outstanding

principal and interest of a loan obtained in the name of the member or spouse of the member or jointly by the member and

spouse from a State Government, registered co-operative society, State Housing Board, Nationalised banks, public

financial institutions, Municipal Corporation or any body similar to the Delhi Development Authority solely for the

purposes specified in (1)(i) above.

(ii)

The amount of withdrawal shall not exceed the member’s basic wages and dearness allowance for thirty-six

months or his own share of contributions together with the employer’s share of contributions, with interest thereon, in the

member’s account in the Fund or the amount of outstanding principal and interest of the said loan, whichever is least.

(iii)

No withdrawal shall be sanctioned under this paragraph unless—

(a)

the member has completed ten years’ membership of the Fund; and

(b)

the member’s own share of contributions, with interest thereon, in the amount standing to his credit in the

Fund, is one thousand rupees or more; and

(c)

the member produces a certificate to such other documents, as may be prescribed by the Commissioner or

where so authorised by the Commissioner, any officer subordinate to him, from such agency, indicating the

particulars of the member, the loan granted, the outstanding principal and interest of the loan and such other

particulars as may be required.

(iv)

The payment of the withdrawal under this paragraph shall be made direct to such agency on receipt of an

authorisation from the member

III.

Advance from the Fund for illness in certain cases.

i)

A member may be allowed non-refundable advance in cases of (a) hospitalisation lasting for one month or more,

or (b) major surgical operation in a hospital, or (c) suffering from T.B., leprosy, paralysis, cancer, mental

derangement or heart ailment and having been granted leave by his employer for treatment of the said illness.

(ii)

The advance shall be granted if the employer certifies that the Employees’ State Insurance Scheme facility and

benefits there under are not actually available to the member or the member produces a certificate from the

Employees’ State Insurance Corporation to the effect that he has ceased to be eligible for cash benefits under the

Employees’ State Insurance Scheme; and a doctor of the hospital certifies that a surgical operation or, as the case

may be, hospitalisation for one month or more had or has become necessary or a registered medical practitioner,

or in the case of a mental derangement or heart ailment, a specialist certifies that the member is suffering from

T.B., leprosy, paralysis, cancer, mental derangement or heart ailment.

(iii)

A member may be allowed non-refundable advance from his account in the fund for the treatment of a member of

his family who has been hospitalised, or requires hospitalisation, for one month or more for.

(a)

a major surgical operation, or

(b)

the treatment of T.B., Leprosy, paralysis, cancer, mental derangement or heart ailment:

Provided that no such advance shall be granted to a member unless he has produced—

a certificate from a doctor of the hospital that the patient has been hospitalised or requires hospitalisation for

one month or more, or that a major surgical operation had or has become necessary, and

a certificate from his employer that the Employees’ State Insurance Scheme facility and benefits are not

available to him for the treatment of the patient.

IV.

Advance for marriages or post-matriculation education of children.

(i)

(ii)

A non-refundable advance not exceeding fifty per cent of his or her own share of contribution with interest

thereon, standing to credit in the Fund of the member , on the date of such authorisation, for his or her own

marriage, the marriage of his or her daughter, son, sister or brother or for the post-matriculation education of his

or her son or daughter. Not more than three advances shall be admissible to a member under this paragraph.

No advance under this paragraph shall be sanctioned to a member unless—

(a)

he has completed seven years’ membership of the Fund; and

(b)

the amount of his own share of contributions with interest thereon standing to his credit in the

Fund is rupees one thousand or more.

V.

(1)

Grant of advances in abnormal conditions.

A non-refundable Advance may be given to a member whose property, movable or immovable, has been damaged by a

calamity of exceptional nature, such as floods, earthquakes or riots, authorise payment to him from the provident fund

account, a non-refundable advance, of rupees five thousand or fifty per cent of his own total contribution including

interest thereon standing to his credit on the date of such authorisation, whichever is less, to meet any unforeseen expenditure:

(2)

No advance under sub-paragraph (1) shall be paid unless—

(i)

the State Government has declared that the calamity has affected the general public in the area;

(ii)

the member produces a certificate from an appropriate authority to the effect that his property (movable or

immovable) has been damaged as a result of the calamity];

(iii)

the application for advance is made within a period of 4 months from the date of declaration referred to in subpara (i).

VI.

Grant of advance to members who are physically handicapped.

A physically handicapped member may be allowed a non-refundable advance from his account in the Fund, for purchasing an equipment required to minimise the hardship on account of handicap.

VII.

Withdrawal within one year before the retirement.

A member may be permitted to withdraw of up to 90 per cent of the amount standing at his credit, at any time after

attainment of the age of 54 years or within one year before his actual retirement on superannuation, whichever is later.

VIII.

Option for withdrawal at the age of 55 years for investment in Varishtha Pension Bima Yojana.

A member may be permitted withdrawal of up to 90 per cent of the amount standing at his credit at any time after

attaining the age of 55 years, which is to be transferred to the Life Insurance Corporation of India for investment in

Varishtha Pension Bima Yojana.

9.

Dispute, Determination and Recovery

In case, where a dispute arises regarding applicability of the Act, the Central Provident Fund Commissioner or any other

officer (to whom the powers of determination have been delegated), may decide the dispute and determine the amount due

from an employer, under the Act or the schemes framed there under. Before making any order the officer shall conduct

such inquiry as he may deem necessary and shall allow a reasonable opportunity to the employer for representing his case.

Further, where an officer has reason to believe that an amount due from the employer has escaped determination, he may

re-open the case within five years and re-determine the amount due from the employer.

Interest

The employer shall be liable to pay simple interest @ 12% p.a. on any amount due from him under the Act, from the date

on which it becomes due till the date of its actual payment.

Modes Of Recovery

Any amount of contribution, damages, accumulations required to be transferred, or administrative charges, due from an

employer, may be recovered from him in any of the following modes

attachment and sale of the movable or immovable property of the establishment/employer;

arrest of the employer and his detention in prison;

appointing a receiver for the management of the movable or immovable properties of the establishment/employer.

The Recovery Officer pursuant to a recovery certificate issued by the authorised officer specifying shall make the

recovery the amount of arrears.

Stay Of Recovery Proceedings

The authorised officer may grant time for the payment of the amount, and thereupon the Recovery Officer shall stay the

proceedings until the expiry of the time so granted.

EMPLOYEES’ STATE INSURANCE ACT, 1948

1.

It applies to all factories (including Government factories but excluding seasonal factories) employing 10 or more persons

and carrying on a manufacturing process with the aid of power or employing 20 or more persons and carrying on a

manufacturing process without the aid of power and such other establishments as the Government may specify.

2.

A factory or other establishment to which this Act applies, shall continue to be governed by its provisions even if the

number of workers employed therein falls below the specified limit or the manufacturing process therein ceases to be

carried on with the aid of power, subsequently.

3.

Every employee (including casual and temporary employees), whether employed directly or through a contractor, who is

in receipt of wages upto Rs. 6,500 p.m. is entitled to be insured under the E.S.I. Act. However, apprentices engaged under

the Apprentices Act are not entitled to the E.S.I. benefits. Coverage of part time employees under the ESI Act will depend

on whether they have contract of service or contract for service with the employer. The former is covered whereas the

latter are not covered under the E.S.I Act.

4.

An employer/establishments covered under the E.S.I. Act is exempt from the provisions of Maternity Benefit Act and

Workmen’s Compensation Act.

5.

The employer is required to contribute at the rate of 4.75% of the wages paid/payable in respect of every wage period.

The employees are also required to contribute at the rate of 1.75% of their wages, except when the "average daily wages

in a wage period" are equal to or less than Rs. 50. Employees earning less than and upto Rs. 50 per day are exempted from

payment of contribution.

"wages" means all remuneration paid or payable, in cash to an employee, if the terms of the contract of employment,

express or implied, were fulfilled and includes any payment to an employee in respect of any period of authorised leave,

lock-out, strike which is not illegal or lay -off and other additional remuneration, if any, paid at intervals not exceeding

two months, but does not include-

(a) any contribution paid by the employer to any pension fund or provident fund, or under this Act;

(b) any traveling allowance or the value of any traveling concession;

(c) any sum paid to the person employed to defray special expenses entailed on him by the nature of his employment; or

(d) any gratuity payable on discharge.

6.

It is the employer’s responsibility to deposit his own as well as employee’s contributions in respect of all employees

including the contract labour, into the E.S.I. Account up to 21st of the next month.

The employer shall be liable to pay simple interest at the rate of twelve per cent per annum or at such higher rate as may

be specified in the Scheme in case of delay.

Provided that higher rate of interest specified in the Scheme shall not exceed the lending rate of interest charged by any

scheduled bank.

A.

OBLIGATIONS OF EMPLOYERS

The employer should get his factory or establishments registered with the E.S.I. Corporation within 15 days after the

Act becomes applicable to it, and obtain the employer’s Code Number.

The employer should obtain the declaration form from the employees covered under the Act and submit the same

along with the return of declaration forms, to the E.S.I. office. He should arrange for the allotment of Insurance

Numbers to the employees and their Identity Cards.

The employer should furnish a Return of Contributions along with the challans of monthly payment, within 30 days of

the end of each contribution period.

The employer should cause to be maintained the prescribed records/registers namely the register of employees, the

inspection book and the accident book.

The employer should report to the E.S.I. authorities of any accident in the place of employment, within 24 hours or

immediately in case of serious or fatal accidents. He should make arrangements for first aid and transportation of the

employee to the hospital. He should also furnish to the authorities such further information and particulars of an

accident as may be required.

The employer should inform the local office and the nearest E.S.I. dispensary/hospital, in case of death of any

employee, immediately.

The employer must not put to work any sick employee and allow him leave, if he has been issued the prescribed

certificate.

The employer should not dismiss or discharge any employee during the period he/she is in receipt of

sickness/maternity/temporary disablement benefit, or is under medical treatment, or is absent from work as a result of

illness duly certified or due to pregnancy or confinement.

B.

DUTIES OF EMPLOYERS

To pay compensation for an accident suffered by an employee, in accordance with the Act.

To submit a statement to the Commissioner (within 30 days of receiving the notice) in the prescribed form, giving the

circumstances attending the death of a workman as result of an accident and indicating whether he is liable to deposit

any compensation for the same.

To submit accident report to the Commissioner in the prescribed form within 7 days of the accident, which results in

death of a workman or a serious bodily injury to a workman.

To maintain a notice book in the prescribed from at a place where it is readily accessible to the workman.

To submit an annual return of accidents specifying the number of injuries for which compensation has been paid

during the year, the amount of such compensation and other prescribed particulars.

C.

EMPLOYEES’ BENEFITS :-

I)

SICKNESS BENEFIT

Every insured employee is entitled to the cash benefit for the period of sickness occurring during any benefit period and

certified by a duly appointed medical practitioner if the contributions in respect of him were payable for not less than (78

days) in the corresponding contribution period.

However, in the case of a newly appointed employee, eligible for the first time who has got shorter contribution period of

less than 156 days, he shall be entitled to claim sickness benefit if he pays contribution for not less than half the number of

days available for working in such contribution period. The benefit is payable at the standard benefit rate, corresponding

to his daily average wages. The benefit is, however, not payable for any day on which the employee works, remains on

leave, holiday or strike, in respect of which he receives wages.

Sickness benefit shall be allowed to an employee for any day on which he remains on strike, if:

he is receiving medical treatment and attendance as an indoor patient in any E.S.I. hospital or a hospital recognised by

the E.S.I. Corporation for such treatment; or

he is entitled to receive extended sickness benefit for any of the diseases for which such benefit is admissible; or

he is in receipt of sickness benefit immediately preceding the date of commencement of notice of the strike given by

the Employees’ Union to the Management of the factory/establishment.

No sickness benefit shall be payable for the first two days of sickness following, at an interval of not more than 15 days,

after the sickness in respect of which sickness benefits were last paid.

Further no sickness benefit shall be payable to any person for more than 91 days in any two consecutive benefit periods.

CONDITIONS TO BE OBSERVED

Any person in receipt of sickness benefit:

II)

shall remain under medical treatment at the ESI dispensary or hospital and carry out the instructions of the medical

officer;

shall not do anything which retards or reduces his chances of recovery;

shall not leave the area where medical treatment is provided without medical officer’s permission;

shall get himself examined by the medical officer.

MATERNITY BENEFIT

A periodical cash benefit is payable to an insured woman employee, in case of confinement, miscarriage, medical

termination of pregnancy, premature birth of a child, or sickness arising from pregnancy, miscarriage, etc., occurring or

expected to occur in a benefit period, if the contributions, in respect of her were payable for at least (70 days) in the two

immediately preceding contribution periods.

The benefit is payable at twice the standard benefit rate or Rs. 20, whichever is higher, for all days on which the she does

not work for remuneration during the period prescribed as under.

III)

MEDICAL BOUNS

Rs.250 on account of confinement expenses shall be paid to an insured woman and an insured person in respect of his

wife, if confinement occurs at a place where necessary medical facilities under ESI Scheme are not available.

IV)

DISABLEMENT BENEFIT

Disablement benefit is payable in the form of cash installments, to an employee who is injured in the course of his

employment and is, permanently or temporarily, disabled, or contacts any occupational disease. It is sufficient if it is

proved that the injury was caused by an accident arising out of, and in the course of employment, no matter when it

occurred, and where it occurred.

The accident shall be deemed to have arisen out of and in the course of employment unless there is evidence to the

contrary,

where an accident happens while the employee is travelling in employer’s transport, to or from his place of work;

where an accident happens in or about any premises at which the employee is employed for the purposes of his

employer’s trade or business, while the employee is taking steps, in an emergency, to rescue, secure or protect persons

who are injured or imperilled or to avert or minimize serious damage to property;

where the employee is at the time of the accident acting in contravention of any law or any safety rules and

instructions, if the employee is acting for the purpose of, and in connection with, the employer’s trade or business.

The employee claiming any disablement benefit is required to furnish a medical certificate as prescribed under the

regulations. The employee is also required to observe certain conditions as to medical examination etc., as prescribed for

sickness benefit.

The benefit for temporary disablement is, however, not payable for any day on which the employee works, remains on

lease, holiday or strike, in respect of which he receives wages.

However, disablement benefit for temporary disablement shall be allowed to an employee for any day on which he

remains on strike, if:

he is receiving medical treatment and attendance as an indoor patient in any ESI hospital or a hospital recognised by

the ESI corporation, for such treatment; or

he is in receipt of such disablement benefit immediately preceding the date of commencement of notice of the strike

given by the Employee’s Union to the management of the factory/establishment.

NOTICE OF INJURY

The insured employee who sustains an employment injury should give a notice of the same to the employer or manager or

supervisor or foreman, etc., by means of entry in the Accident Book or otherwise in writing or even orally. This notice is

very important for claiming the disablement benefit.

ACCIDENT REPORT BY THE EMPLOYER

In case of an accident in the establishment, the employer should prepare an ‘Accident Report’ in Form 16 (in triplicate)

and submit to the local office and the Insurance Medical Officer. The third copy is the office copy. The reports are to be

submitted within 48 hours in ordinary cases and immediately in death cases.

EMPLOYER TO ARRANGE FIRST AID

The employer shall make arrangements for the first aid and medical treatment and transport as an insured person may

require, in case of an accident.

BENEFITS NOT TO BE COMBINED

An employee shall not be entitled to receive for the same period

both sickness benefit and maternity benefit; or

both sickness benefit and disablement benefit for temporary disablement; or

both maternity benefit and disablement benefit for temporary disablement.

The employee shall be entitled to choose any one of the aforesaid benefits, at his option.

ABSTENTION VERIFICATION

The employer should furnish and verify the particulars in Form 28, in respect of the abstention of an employee from work,

for which sickness/maternity/temporary disablement benefit has been claimed.

D.

PAYMENT OF BENEFIT IN CASE OF DEATH

If an employee dies during any period for which he is entitled to a cash benefit, the amount of such benefit shall be

payable up to and including the day of his death. The amount of benefit shall be paid to the nominee or, where there is no

nomination, to the heir or legal representative of the deceased employee.

FUNERAL EXPENSES

If an insured employee dies, the eldest surviving member of his family or the person who incurs the expenditure of funeral

of the deceased employee, is entitled to reimbursement of such expenditure subject to a maximum of Rs. 1,500. The claim

for the payment of funeral expenses should be submitted in the prescribed form along with prescribed documents within 3

months of the death of the insured employee.

DEATH REPORT

In case of the death of an insured employee at the place of employment, the employer should immediately report to the

local office and to the nearest E.S.I dispensary or hospital.

E.

DISPUTES & REMEDIES

Any dispute arising under the Act shall be decided by the Employees Insurance Court and not by a Civil Court. It is

constituted by the State Government for such local areas as may be specified and consists of such number of judges, as the

Government may think fit. It shall adjudicate on the following disputes and claims.

Disputes as to –

Whether an employee is covered by the Act or whether he is liable to pay the contribution, or

The rate of wages or average daily wages of an employee, or

The rate of contribution payable by the employer in respect of any employee, or

The person who is or was the principle employer in respect of any employee, or

The right to any benefit an the amount and duration thereof, or

Any direction issued by the Corporation on a review of any payment of dependents’ benefit, or

Any other matter in respect of any contribution or benefit or other due payable or recoverable under the Act.

Claims as to –

Recovery of contributions from the principle employer,

Recovery of contributions from a contractor,

Recovery for short payment or non-payment of any contribution under section 68,

Recovery of the value or amount of benefits received improperly under section 70,

Recovery of any benefit admissible under the Act

No dispute shall be admitted unless the employer deposits with the Court 50% of the amount due from him as claimed by

the Corporation.

APPEAL

An appeal shall lie to the High Court within 60 against an order of the Employees’ Insurance Court if it involves a

substantial question of law.

FACTORIES ACT, 1948

Objective & Applicability

The Factories Act, 1948 has been enacted to consolidate and amend the law regulating the workers working in the

factories. It extends to whole of India and applies to every factory wherein 20 or more workers are ordinary employed.

Since the aim and object of the Act is to safeguard the interest of workers and protect them from exploitation, the Act

prescribes certain standards with regard to safety, welfare and working hours of workers, apart from other provisions.

Factory

Means any premises including the precincts thereof where ten or more persons are working in any manufacturing

process being carried on with aid of power and where twenty or more workers are working without the aid of power.

Health

Every factory should be kept dean and free from effluvia arising from any drain, privy or other nuisance.

{Section 11}

Effective arrangements should be made in every factory for the treatment and effluents due to the

manufacturing process carried on therein, so as to render them innocuous, and for their disposal. {Section12}

Effective and suitable provisions should be made in every factory for securing and maintaining in every

workroom; adequate ventilation by the circulation of fresh air; and such a temperatures will secure to workers

therein reasonable conditions of comfort and prevent injury to health. {Section 13}

Effective measures should be taken to prevent inhalation of dust to prevent inhalation of dust and fume that may

produce in the course of manufacturing process. {Section 14}

In any factory where the humidity of air is artificially increased, the State Government may make rules

prescribing standards of humidification; regulating the methods used for artificially increasing humidity of the

air; and directing prescribed test for determining the humidity of the air to be correctly carried out and recorded;

and prescribing methods to be adopted for securing adequate ventilation and cooling of the air in the

workrooms. {Section 1S}

No room in any factory should lie overcrowded to an extent injurious to the health of the workers employed

therein. {Section 16}

In every part of a factory where workers are working or passing, there should be provided and maintained

sufficient and suitable lighting, natural or artificial, or both. {Section 17}

In every factory effective arrangements should be made to provide and maintain at suitable points conveniently'

situated for all workers employed therein a sufficient supply of wholesome drinking water. {Section 18}

In every factory sufficient latrine and urinal accommodation of prescribed types should be provided

conveniently situated and accessible to workers, separately for male and female workers, at all times while they

are at the factory. {Section 19}

In every factory there should be provided a sufficient number of spittoons in convenient places and they shall be

maintained in a clean and hygienic condition. {Section 20}

Safety

The machinery in every factory should be properly fenced. {Section 21}

Only the trained adult male worker, wearing tight fitting clothing which should be supplied by the Occupier,

should be allowed to work near the machinery in motion. {Section 22}

No young person shall be employed on dangerous machinery, unless he is fully instructed as to the danger

arising in connection with the machine and the precautions to be observed and he has received sufficient

training in work at the machine. {Section 23}

Suitable arrangements should be made to provide striking gear and devices for cutting off power in case of

emergencies. {Section 24}

Sufficient precautions should be taken with regard to self-acting machines to avoid accidents. {Section 25}

To prevent danger, all machinery driven by power should be encased and effectively guarded. {Section 26}

Woman worker and children should not be employed in any part of the factory for pressing cotton in which a

cotton-opener is at work. {Section 27}

Hoists and Lifts in a factory should be periodically inspected by the Competent Person. {Section 28}

Lifting Machines, Chains, Ropes and Lifting Tackles in a factory should be periodically inspected by the

Competent Person. {Section 29}

Where process of grinding is carried on, a notice indicating the maximum safe working peripheral speed of

every grind-stone or abrasive wheel etc., should be fixed to the revolving machinery.{Section 30}

Where any plant or machinery or any part thereof is operated at a pressure above atmospheric pressure,

effective measures should be taken to ensure that the safe working pressure of such plant of machinery or part is

not exceeded.{Section 31}

Floors, stairs and means of access should be soundly constructed and properly maintained. {Section 32}

Pits, sumps opening in floor etc., should be either securely covered or fenced. {Section 33}

No workman shall be employed in any factory to lift, carry or move any load so heavy as to be likely to cause

him injury. {Section 34}

Necessary protective equipment should be provided to protect the eyes of the workman, where the working

involves risk of injury to the eyes. {Section 35}

Suitable precautionary arrangements should be taken against dangerous fumes, gases etc. {Section 36}

Every practicable measures should be taken to prevent any explosion where the manufacturing process produces

dust, gas, fume or vapour etc. {Section 37}

Every practicable measures should be taken to prevent the outbreak of fire and its spread, both internally and

externally. {Section 38}

The Inspector of Factories can ask the Occupier or the Manager of the Factory to furnish drawings, specification

etc., of any building, machinery or a plant, in case he feels that condition of such building, machinery or the

plant may likely to cause danger to human life. {Section 39}

The Inspector of Factories can suggest suitable measures of steps to take by the Occupier or Manager for

implementation, when he feels the condition of any building, machinery or a plant may likely to cause danger to

human life. {Section 40}

Wherein 1000 or more workmen are employed in a factory, the Occupier should appoint a Safety Officer to

look after the safety aspects of the factory. {Section 40-B}

Welfare

Adequate and suitable 'washing facilities' should be provided in every factory. {Section 42}

Provision should be made to provide suitable places for keeping clothing not worn during working hours and

for the drying of wet clothing.{Section 43}

In every factory, suitable arrangements for sitting should be provided and maintained for all workers obliged to

work in a standing position, in order that they may take advantage of any opportunities for rest which may occur

in the course of their work.{Section 44}

First-Aid Boxes with the prescribed contents should be provided and maintained so as to be readily accessible

during all working hours at the rate of at least one Box for every 150 workmen. {Section 45}

In every factory wherein more than 500 workers are employed there should be provided and maintained an

Ambulance Room of the prescribed size, containing the prescribed equipment and in the charge of such medical

and nursing staff. {Section 45(4)}

The Occupier should provide a canteen for the use of workers in every factory, where the number of workmen

employed is more than 250.{Section 46}

In every factory wherein more than 150 workers are employed adequate and suitable shelters or rest rooms and

a suitable lunch room, with provision for drinking water, where workers can eat meals brought by them, should

be provided and maintained for the use of the workers. {Section 47}

In every factory wherein more than 30 women workers are ordinarily employed there should be provided and

maintained a suitable room for the use of children under the age of six years of such women. {Section 48}

In every factory wherein more than 500 or more workers are employed, the Occupier should employ in the

factory such number of Welfare Officers as may be prescribed. {Section 49}

Working Hours of Adult Workers

Ordinarily, a worker should not be allowed to work in a factory for more than 48 hours in any week. {Section

51}

The workman should have one holiday for a whole day in a week. Where he was asked to work on his

scheduled weekly holiday, he should be given compensatory holiday within three days of his scheduled weekly

holiday. {Section 52}

After obtaining approval from the Inspector of Factories, the workman shall be allowed to avail the

compensatory holidays unavailed by him, within that month during which the compensatory holidays are due or

within two months immediately following that month. {Section 53}

Subject to the provisions of Section 51 no worker should be allowed to work more than nine hours in a day.

{Section 54}

The timings of work should be fixed in such a way that no worker should be required to work continuously for

more than five hours; and he should be allowed to avail an interval for rest of at least half-an hour during his

work in a day. {Section 55}

The period of work of a workman should be so arranged that inclusive of his interval for rest under Section 55

should not spread over more than ten and a half hours in any day. {Section 56}.

General Duties of the Occupier

a)

Every Occupier should ensure, so far is reasonably practicable the health, safety and welfare of all workers

while they are at work in the factory.

b)

Without prejudice to the generality of the provisions of sub-section (1), the matters to which such duty extends,

include the provisions and maintenance of plant and systems of work in the factory that are safe and without risks to

health; .

the arrangements in the factory for ensuring safety and absence of risks to health in connection with the use,

handling, storage and transport of articles and substance;

the provision of such information, instruction, training and supervision as are necessary to ensure .the health

and safety of all workers at work;

the maintenance of all places of work in the factory in a condition that is safe and without risks to health and

the provision and maintenance of such means of access to, and egress from, such places as are safe and

without such risks;

the provision, maintenance or monitoring of such working environment in the factory for the workers that is

safe, without risks to health and adequate s regards facilities and arrangements for their welfare at work.

c)

Except in such cases as may be prescribed, every Occupier should prepare, and, so often as may be appropriate,

revise, a written statement of his general policy with respect to the health and safety of the workers at work and

the organization and arrangements for the time being in force for carrying out that policy, and to bring the

statement and any revision thereof to the notice of all the workers in such manner as may be prescribed.

{Section 7-A}

MINIMUS WAGESACT, 1948

The Act provides for fixing minimum rates of wages in certain employments.

1.

“Wages" means all remuneration, capable of being expressed in terms of money, be payable to a person employed and

includes house rent allowance, but does not include(i)

the value of- (a) any house, accommodation, supply of light, water, medical attendance, or (b) any other amenity

or any service excluded by general or special order of the appropriate government;

(ii)

any contribution paid by the employer to any pension fund or provident fund or under any scheme of social

insurance;

(iii)

any travelling allowance or the value of any travelling concession;

(iv) any sum paid to the person employed to defray special expenses entailed on him by the nature of his employment; or

(v)

any gratuity payable on discharge;

2.

"Employee" means any person who is employed for hire or reward to do any work, skilled or unskilled, manual or

clerical, in a scheduled employment in respect of which minimum rates of wages have been fixed; and includes an outworker to whom any articles or materials are given out by another person to be made up, cleaned, washed, altered,

ornamented, finished, repaired, adapted or otherwise processed for sale for the purposes of the trade or business of that

other person where the process is to be carried out either in the home of the out-worker or in some other premises not

being premises under the control and management of that other person; and also includes an employee declared to be an

employee by the appropriate government; but does not include any member of the Armed Forces of the, Union.

3.

Fixing of minimum rates of wages

(i)

The appropriate government shall, (a)

fix the minimum rates of wages payable to employees employed in an employment specified in Part I or

Part II of the Schedule and in an employment added to either Part by notification

(b)

review at such intervals as it may think fit, such intervals not exceeding five years, the minimum rates of

wages.

The appropriate government may refrain from fixing minimum rates of wages in respect of any scheduled

employment in which there are in the whole State less than one thousand employees engaged in such

employment.

(ii)

In fixing or revising minimum rates of wages under this section, different minimum rates of wages may be fixed for-

(iii)

different scheduled employments;

different classes of work in the same scheduled employment;

adults, adolescents, children and apprentices;

different localities;

minimum rates of wages may be fixed by any one or more of the following wage periods, namely:

a) by the hour,

b) by the day,

c) by the month, or

d) by such other larger wage-period as may be prescribed;

and where such rates are fixed by the day or by the month, the manner of calculating wages for a month or for a day, as

the case may be, may be indicated:

PROVIDED that where any wage-periods have been fixed under section 4 of the Payment of Wages Act, 1936 (4 of

1936), minimum wages shall be fixed in accordance therewith.

5.

"Adolescent" means a person who has completed his fourteenth years of age but has not completed his

eighteenth year;

6.

"Adult" means a person who has completed his eighteenth years of age;

7.

Minimum rate of wages

(1) Any minimum rate of wages fixed or revised by the appropriate government may consist of(a)

a basic rate of wages and cost of living allowance; or

(b)

a basic rate of wages with or without the cost of living allowance, and the cash value of the concessions in respect

of supplies of essential commodities at concessional rates, where so authorised; or

(c)

an all-inclusive rate allowing for the basic rate, the cost of living allowance and the cash value of the concessions,

if any.

8.

Where in respect of any scheduled employment a notification under section 5 is in force, the employer shall pay to every

employee engaged in a scheduled employment under him wages at a rate not less than the minimum rate of wages fixed

by such notification for that class of employees in that employment without any deductions except as may be authorized

within such time and subject to such conditions as may be prescribed.

Where an employee is employed on piecework for which minimum time rate and not a minimum piece rate has been fixed

under this Act, the employer shall pay to such employee wages at not less than the minimum time rate.

8.

Time & Conditions of Payment of wages and deductions

(i) The wage period with respect to any scheduled employment for which

one month and the wages of a worker in such employment shall be paid—

wages have been fixed shall not exceed

(a)

in the case of establishments in which less than one thousand persons are employed, before the expiry of

(b)

the seventh day, and

in the case of other establishments before the expiry of the tenth day, after the last day of the wage period

in respect of which the wages are payable.

(ii)

Where the employment of any person is terminated by or on behalf of the employer, the wages earned by him

shall be paid before the expiry of the second working day after the day on which his employment is terminated.

(iii)

The wages of an employed person shall be paid to him without deduction of any kind except those authorised by

or under these rules.

(iv)

Deductions from the wages of a person employed in a scheduled employment shall be of one or more of the

following kinds, namely :—

a) fines;

b) deductions for absence from duty;

c) deductions for damage to or loss of goods expressly entrusted to the employed person for custody, or for loss of

money for which he is required to account, where such damage or loss is directly attributable to his neglect or

default;

d) deductions for house accommodation supplied by the employer;

e) deductions for such amenities and services supplied by the employer as the Central Government may, by general

or special order, authorise.

Explanation.—The words ‘amenities and services’ in this clause does not include the supply of tools and

protectives required for the purposes of employment;

f) deductions for recovery of advances or for adjustment of over payments of wages :

Provided that such advances do not exceed an amount equal to wages for two calendar months of the employed

person and, in no case, shall the monthly instalment of deduction exceed one-fourth of the wages earned in that

month;

g) deductions of income-tax payable by the employed person;

h) deductions required to be made by order of a court or other competent authority;

i)

j)

deductions for subscriptions to, and for repayment of advances from any provident fund to which the Provident

Fund Act, 1925, applies or any recognised provident fund as defined in section 58A of the Indian Income-tax Act,

1922, or any provident fund approved in this behalf by the Central Government during the continuance of such

approval;

deductions for payment to co-operative societies or deductions for recovery of loans advanced by an employer

from out of a fund maintained for the purpose by the employer and approved in this behalf by the Central

Government or to a scheme of insurance approved by the Central Government;

k) deductions for recovery or adjustment of amounts, other than wages, paid to the employed person in error or in

excess of what is due to him;

l)

deductions made with the written authorisation of the employed persons (which may be given once generally and

not necessarily every time a deduction is made), for the purchase of securities of the Government of India or of

any State Government or for being deposited in any Post Office Savings Bank in furtherance of any savings

scheme of any such Government;

m) deductions made with the written authorisation of the employed person for contributions to the National Defence

Fund or the Prime Minister’s National Relief Fund or to any Defence Savings Scheme approved by the Central

Government or to such other Fund as the Central Government may, by notification in the Official Gazette, specify

in this behalf; and

n) deductions for recovery of loans granted for house building or other purposes approved by the Central

Government, and for the interest due in respect of such loans, subject to any rules made or approved by the

Central Government regulating the extent to which such loans may be granted and the rate of interest payable

thereon.

(v)

Notwithstanding anything contained in these rules, the total amount of deductions, which may be made in any

wage period, from the wages of an employee shall not exceed—

a) 75 per cent of such wages in cases where such deductions are wholly or partly made for payments to Consumer

Co-operative Stores run by any Co-operative Society under clause (x) of sub-rule (2); and

b) 50 per cent of such wages in any other case:

Provided that where the total amount of deductions which have to be made in any wage period from the wages of any

employee exceeds the limit specified in clause (i), or, as the case may be, clause (ii) of this sub-rule, the excess shall

be carried forward and recovered from the wages of succeeding wage period or wages periods as the case may be, in

such number of instalments as may be necessary.

(vi)

Any person desiring to impose a fine on an employed person or to make a deduction for damage or loss caused by

him shall explain to him personally and also in writing the act or omission or the damage or loss, in respect of which the

fine or deduction is proposed to be imposed or made and give him an opportunity to offer any explanation in the presence

of another person. The amount of the said fine or deduction shall also be intimated to him. The amount of fine or

deduction for damage or loss shall be subject to such limits as may be specified in this behalf by the Central Government.

All such fines imposed and deductions made shall be recorded in the registers maintained in Forms I and II, respectively.

These registers shall be kept at the workspot and maintained upto-date. Where no fine or deduction has been imposed or

made on or from any employee in a wage period, a ‘nil’ entry shall be made across the body of the relevant register at the

end of the wage period, indicating also in precise terms the wage period to which the ‘NIL’ entry relates.

Every employer shall send annually a return in Form III so as to reach the Inspector not later than the 1st February

following the end of the year to which it relates.

The amount of fine imposed shall be utilised only for such purposes beneficial to the employees as are approved by the

Central Government.

9.

Number of hours of work, which shall constitute a normal working day.

The number of hours, which shall constitute a normal working day shall be—

in the case of an adult, 9 hours;

10.

in the case of a child, 4 hours.

The working day of an adult worker shall be so arranged that inclusive of the intervals for rest, if any, it shall not

spread over more than twelve hours on any day.

The number of hours of work in the case of an adolescent shall be the same as that of an adult or a child according

as he is certified to work as an adult or a child by a competent medical practitioner approved by the Central

Government.

No child shall be employed or permitted to work for more than 4½ hours on any day.

Extra wages for overtime

(1)

When a worker works in an employment for more than nine hours on any day or for more than forty-eight hours

in any week, he shall, in respect of such overtime work, be entitled to wages at double the “ordinary rate of wages”.

Explanation.—The expression “ordinary rate of wages” means the basic wage plus such allowances including the cash

equivalent of the advantages accruing through the concessional sale to the person employed of food grains and other

articles as the person employed is for the time being entitled to but does not include a bonus.

(2)

A register of overtime shall be maintained by every employer in Form IV in which entries under the columns

specified therein shall be made as and when overtime is worked in any establishment. The register shall be kept at the

work spot and maintained up-to-date. Where no overtime has been worked in any wage period, a ‘nil’ entry shall be made

across the body of the register at the end of the wage period indicating also in precise terms the wage period to which the

‘NIL’ entry relates.

11.

Register

A Register of Wages shall be maintained by every employer at the work spot in Form X.

(i) Every employer shall, in respect of each person employed in the establishment, complete the entries pertaining to a

wage period—

(a)

in columns 1 to 15 of Form X, before the date on which the wages for such wage period fall due ;

(b)

in columns 16 and 17 of the said Form, on the date when payment is made, and obtain the signature or

thumb impression of the employee in column 18 of the said Form on the date when payment is made.

(ii)

A Wage Slip in Form XI shall be issued by every employer to every person employed by him at least a day prior

to the disbursement of wages.

(iii)

Every employer shall get the signature or the thumb impression of the every person employed on the Register of

wages and wage slip.

(iv)

Entries in the Register of Wages and wage slip shall be authenticated by the employer or any person authorised by

him in this behalf.

(v)

A muster roll shall be maintained by every employer at the work spot in Form V and the attendance of each

person employed in the establishment shall be recorded daily in that Form within 3 hours of the commencement of the

work shift or relay for the day, as the case may be.

12.

Offences by Companies

(1)

If the person committing any offence under this Act is a company, every person who at the time the offence was

committed, was in charge of, and was responsible to, the company for the conduct of the business of the company as well

as the company shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished

accordingly:

Provided that nothing contained in this sub-section shall render any such person liable to any punishment provided in this

Act if he proves that the offence was committed without his knowledge or that he exercised all due diligence to prevent

the commission of such offence.

(2)

Notwithstanding anything contained in (1) above , where an offence under this Act has been committed by a

company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any

neglect on the part of, any director, manager, secretary or other officer of the company, such director, manager, secretary

or other officer of the company shall also be deemed to be guilty of that offence and shall be liable to be proceeded

against and punished accordingly.

PAYMENT OF WAGES ACT, 1936

(A)

Application: It applies to persons employed in any factory, to persons employed (otherwise than in a factory) upon any

railway by a railway administration or, by a person fulfilling a contract with a railway administration, and to persons

employed in an industrial or other establishment.

(B)

Nothing in this Act shall apply to wages payable in respect of a wage-period which over such wage-period, average 1600

rupees a month or more.

(C)

“Industrial or other establishment” means any(a) tramway service , or motor transport service engaged in carrying passengers or goods or both by road for hire or

reward;

(b) air transport service other than such service belonging to, or exclusively employed in the military, naval or air forces

of the Union or the Civil Aviation Department of the Government of India;

(c) dock, wharf or jetty;

(d) inland vessel, mechanically propelled;

(e) mine, quarry or oil-field;

(f) plantation;

(g) workshop or other establishment in which articles are produced, adapted or manufactured, with a view to their use,

transport or sale;

(h) establishment in which any work relating to the construction, development or maintenance of buildings, roads, bridges

or canals, or relating to operations connected with navigation, irrigation, or to the supply of water or relating to the

generation, transmission and distribution of electricity or any other form of power is being carried on;

(i) any other establishment or class of establishments which the Central Government or a State Government may,

specify, by notification in the Official Gazette.

(D)

“Wages” means all remuneration expressed in terms of money(a)

any remuneration payable under any award or settlement between the parties or order of a court;

(b)

(c)

(d)

any additional remuneration payable under the terms of employment (whether called a bonus or by any other

name);

any sum which by reason of the termination of employment of the person employed is payable under any law,

contract or instrument which provides for the payment of such sum, whether with or without deductions, but does

not provide for the time within which the payment is to be made;

any sum to which the person employed is entitled under any scheme framed under any law for the time being in

force,

but does not include

any bonus (whether under a scheme of profit sharing or otherwise) which does not form part of the

remuneration payable under the terms of employment or which is not payable under any award or settlement

between the parties or order of a court;

the value of any house-accommodation, or of the supply of light, water, medical attendance or other

amenity or of any service excluded from the computation of wages by a general or special order of the State

Government;

any contribution paid by the employer to any pension or provident fund, and the interest which may have

accrued thereon;

any travelling allowance or the value of any travelling concession;

any sum paid to the employed person to defray special expenses entailed on him by the nature of his

employment; or

(d).

any gratuity payable on the termination of employment in cases other than those specified in sub-clause

(E)

Every person responsible for the payment of wages under section 3 shall fix periods (in this Act referred to as wageperiods) in respect of which such wages shall be payable and no wage-period shall exceed one month.

(F)

Due date of Payment of Wages

The wages of every person employed upon or in(a)

any railway, factory or industrial or other establishment] upon or in which less than one thousand persons are

employed, shall be paid before the expiry of the seventh day,

(b)

any other railway, factory or industrial or other establishment, shall be paid before the expiry of the tenth day,

after

the

last

day

of

the

wage-period

in

respect

of

which

the

wages

are

payable:

Where the employment of any person is terminated by or on behalf of the employer, the wages, earned by him shall be

paid before the expiry of the second working day from the day on which his employment is terminated:

PROVIDED that where the employment of any person in an establishment is terminated due to the closure of the

establishment for any reason other than a weekly or other recognised holiday, the wages earned by him shall be paid

before the expiry of the second day from the day on which his employment is so terminated.

(G)

Mode of Payment

All

wages

shall

be

paid

in

current

coin

or

currency

notes

or

in

both.

PROVIDED that the employer may, after obtaining the written authorisation of the employed person, pay him the wages

either by cheque or by crediting the wages in his bank account.

(H)

Deductions

Deductions from the wages of an employed person shall be made only in accordance with the provisions of this Act, and

may be of the following kinds only, namely:

(a)

(b)

fines;

deductions for absence from duty;

(c) deductions for damage to or loss of goods expressly entrusted to the employed person for custody, or for loss of money

for which he is required to account, where such damage or loss is directly attributable to his neglect or default;

(d) deductions for house-accommodation supplied by the employer or by government or any housing board set up under any

law for the time being in force (whether the government or the board is the employer or not) or any other authority engaged in

the business of subsidising house- accommodation which may be specified in this behalf by the State Government by

notification in the Official Gazette;

(e) deductions for such amenities and services supplied by the employer as the State Government or any officer specified by

it in this behalf] may, by general or special order, authorise.

(f) deductions for recovery of advances of whatever nature (including advances for travelling allowance or

conveyance allowance), and the interest due in respect thereof, or for adjustment of over-payments of wages;

(g) deductions for recovery of loans made from any fund constituted for the welfare of labour in accordance with the

rules approved by the State Government, and the interest due in respect thereof;

(h) deductions for recovery of loans granted for house-building or other purposes approved by the State Government

and the interest due in respect thereof;]

(i) deductions of income-tax payable by the employed person;

(j) deductions required to be made by order of a court or other authority competent to make such order;

(k) deductions for subscriptions to, and for repayment of advances from any provident fund to which the Provident

Funds Act, 1925 (19 of 1925), applies or any recognised provident fund as defined in section 58A of the Indian

Income Tax Act, 1922 (11 of 1922)], or any provident fund approved in this behalf by the State Government,

during the continuance of such approval;

(l) deductions for payments to co-operative societies approved by the State Government 15[or any officer specified by

it in this behalf] or to a scheme of insurance maintained by the Indian Post Office, and

(m) deductions, made with the written authorisation of the person employed for payment of any premium on his life

insurance policy to the Life Insurance Corporation Act of India established under the Life Insurance Corporation

Act, 1956 (31 of 1956), or for the purchase of securities of the Government of India or of any State Government or

for being deposited in any Post Office Savings Bank in furtherance of any savings scheme of any such government.

(n) deductions, made with the written authorisation of the employed person, for the payment of his contribution to any

fund constituted by the employer or a trade union registered under the Trade Union Act, 1926 (16 of 1926), for the

welfare of the employed persons or the members of their families, or both, and approved by the State Government

or any officer specified by it in this behalf, during the continuance of such approval;

(o) deductions, made with the written authorisation of the employed person, for payment of the fees payable by him

for the membership of any trade union registered under the Trade Union Act, 1926 (16 of 1926);

(p) deductions,

for

payment

of

insurance

premium

on

Fidelity

Guarantee

Bonds;

(q) deductions for recovery of losses sustained by a railway administration on account of acceptance by the employed

person of counterfeit or base coins or mutilated or forged currency notes;

(r) deductions for recovery of losses sustained by a railway administration on account of the failure of the employed

person to invoice, to bill, to collect or to account for the appropriate charges due to that administration whether in

respect of fares, freight, demurrage, wharfage and cranage or in respect of sale of food in catering establishments

or

in

respect

of

sale

of

commodities

in

grain

shops

or

otherwise;

(s) deductions for recovery of losses sustained by a railway administration on account of any rebates or refunds

incorrectly granted by the employed person where such loss is directly attributable to his neglect or default;]

(t) deductions, made with the written authorisation of the employed person, for contribution to the Prime Minister’s

National Relief Fund or to such other Fund as the Central Government may, by notification in the Official Gazette,

specify;]

(u) deductions for contributions to any insurance scheme framed by the Central Government for the benefit of its

employees.

Notwithstanding anything contained in this Act, the total amount of deductions, which may be made in any wage-period from

the wages of any employed person shall not exceed

in cases where such deductions are wholly or partly made for payments to co-operative societies ,

seventy-five per cent of such wages, and

in any other case, fifty per cent of such wages:

PROVIDED that where the total deductions authorised exceed seventy five per cent or, as the case may be, fifty per cent

of the wages, the excess may be recovered in such manner as may be prescribed.

(I)

Imposition of Fine

No fine shall be imposed on any employed person save in respect of such acts and omissions on his part as the

employer, otherwise than by notice.

The total amount of fine, which may be imposed in any one wage-period on any employed person shall not exceed an

amount equal to three per cent of the wages payable to him in respect of that wage-period.

No fine shall be imposed on any employed person who is under the age of fifteen years.

No fine imposed on any employed person shall be recovered from him by installments or after the expiry of sixty days

from the day on which it was imposed.

(J)

Payment of undisbursed wages in cases of death of employed person.

(1)

Subject to the other provisions of the Act, all amounts payable to an employed person as wages shall, if such

amounts could not or cannot be paid on account of his death before payment or on account of his whereabouts not being

known,—

(a)

(b)

(2)

be paid to the person nominated by him in this behalf in accordance with the rules made under this Act; or

where no such nomination has been made or where for any reasons such amounts cannot be paid to the person so

nominated, be deposited with the prescribed authority who shall deal with the amounts so deposited in such

manner as may be prescribed.

Where, in accordance with the provisions of sub-section (1), all amounts payable to an employed person as

wages—

(a)

(b)

are paid by the employer to the person nominated by the employed person; or

are deposited by the employer with the prescribed authority, the employer shall be discharged of his liability to

pay those wages.

(K)

Registers & Records

Every employer shall maintain such registers and records giving such particulars of persons employed by him, the work

performed by them, the wages paid to them, the deductions made from their wages, the receipts given by them and such

other particulars and in such form as may be prescribed.

Every register and record required to be maintained under this section shall, for the purposes of this Act, be preserved for

a period of three years after the date of the last entry made therein.

(L)

Penalty for offences under the Act.

1)

Whoever being responsible for the payment of wages to an employed person contravenes any of the provisions

of any of the following sections, namely, section 5 except sub-section (4) thereof, section 7, section 8 except

sub-section (8) thereof, section 9, section 10, except sub-section (2) thereof, and sections 11 to 13, both

inclusive, shall be punishable with fine which shall not be less than two hundred rupees but which may extend

to one thousand rupees.

Whoever contravenes the provisions of section 4, sub-section (4) of section 5, section 6, sub-section (8) of

section 8, sub-section (2) of section 10 or section 25 shall be punishable with fine, which may extend to five

hundred rupees.

2)

3)

Whoever being required under this Act to maintain any records or registers or to furnish any information or return—

a)

b)

c)

d)

4)

fails to maintain such register or record; or

wilfully refuses or without lawful excuse neglects to furnish such information or return; or

wilfully furnishes or causes to be furnished any information or return which he knows to be false; or

refuses to answer or wilfully gives a false answer to any question necessary for obtaining any information

required to be furnished under this Act,

e) shall, for each such offence, be punishable with fine which shall not be less than two hundred rupees but which

may extend to one thousand rupees.

Whoever—

a) wilfully obstructs an Inspector in the discharge of his duties under this Act; or

b) refuses or wilfully neglects to afford an Inspector any reasonable facility for making any entry, inspection, examination, supervision, or inquiry authorised by or under this Act in relation to any railway, factory or industrial or other

establishment; or