Fall, 2000

advertisement

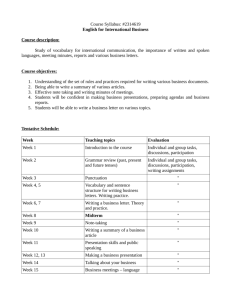

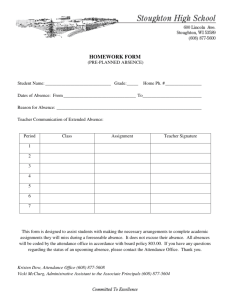

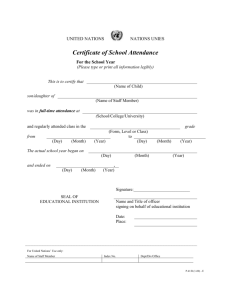

Syllabus* ECO 211 Principles of Macro-economics (3 credit hours) Fall, 2000 T-Th 9:40-11:10 Sec 01 MWF 10:20-11:20 Sec 02 MWF 1:10-2:10 Sec 03 M. J. Oliver, Jr. Assistant Professor of Economics 113 Horne Hall 252.985.5151 Office 919.202.8130 Home moliver@ncwc.edu (All e-mail to my office is forwarded to my home) Office Hours are posted on bulletin board to the right of office door Other than class communications, other communications may be made by e-mail. Check your email prior to class. Required Text Economics, McConnell and Brue, 14th ed., Irwin McGraw Hill, 1999. Web site http://www.mhhe.com/economics/mcconnell The website for the text offers much information that you will find valuable in preparing for class and examinations. You may actually test yourself on each chapter to determine if you have an understanding of the terminology, concepts, etc. A grade of 80% or less on first attempt probably indicates you need additional study of the chapter. Required Reading (subscribe to any one of the following. Student rates are available) Wall Street Journal Business Week Fortune Forbes Competencies for this Course The student should have competencies in basic mathematics and be able to solve a simple algebraic linear equation and the ability to graph simple data in a two dimensional form. Course Description An introductory survey of macroeconomics. Topics include the analysis of the market system in a democratic society, national income accounting, the interaction of house holds, firms and government and elementary monetary theory. Emphasis on the banking system and the Federal Reserve and its influence on employment, price levels and economic growth. Learning Objectives Upon completion of this course the student should be able to 1. Explain the difference between micro- and macro-economics and the areas of study in each. 2. Define “economics”. 3. Explain the difference among economic systems 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Define the law of demand and explain the difference between a change in demand and a change in quantity demanded and the factors affecting each Explain the law of supply and explain the differences between a change in supply and a change in quantity supplied and the factors affecting each. Articulate the characteristics of pure capitalism and the market system. Explain the traditional economic functions of government Distinguish the difference between public and private goods. Explain the major sources of revenues and expenditures for local, state and federal governments. Explain national income accounting and be able to define individual national income accounts. Convert nominal values into real values utilizing a price index. Explain unemployment and its various types. Explain inflation and its various types. Construct and interpret the aggregate expenditure model and the components of aggregate expenditures. Explain the investment multiplier and its impact on the economy. Explain aggregate demand and aggregate supply and the determinants of each. Explain the difference between economists’ conception of the aggregate supply curve. Define fiscal and monetary policy, the tools of each and how each work in affecting prices, employment and economic growth. Define the different definitions used in economics for money. Explain how the commercial banking system can “create” and “destroy” money. Explain the physical structure of the Federal Reserve System. Explain how the Federal Reserve System affects the economy’s money supply. Articulate the difference between classical and Keynesian economic theory Reading and Discussion Schedule The following chapters from the textbook will be discussed in class. The chapters are to be read and studied prior to classroom discussion. Chapter 1 The Nature and Method of Economics Chapter 2 The Economizing Problem Chapter 4 Pure Capitalism and the Market System Chapter 5 The Mixed Economy: Private and Public Sectors Chapter 6 The United States Global Economy Examination I (date TBA) Chapter 7 Measuring Domestic Output, National Income and the Price Level Chapter 8 Macro-economic Instability: Unemployment and Inflation Chapter 9 Building the Aggregate Expenditures Model Chapter 10 Aggregate Expenditures: The Multiplier, Net Exports and Government Chapter 11 Aggregate Demand and Aggregate Supply Chapter 12 Fiscal Policy Examination II (date TBA) Chapter 13 Money and Banking Chapter 14 How Banks Create Money Chapter 15 Monetary Policy Examination III (date TBA) Chapter 16 Extending the Analysis of Aggregate Supply Chapter 18 Economic Growth Chapter 19 Budget Deficits and the Public Debt Final Examination (See Final Exam Schedule for date and time for your particular section) Class Attendance Regular class attendance is expected. Review college attendance policy in the Student Handbook. There are no excused absences. You are in class or you are not. Excessive absences will contribute to unsuccessfully completing the course. Assignments All assignments must be completed and submitted on time. Late assignments will not be accepted. Assignments can always be scanned and emailed as attachments. Examinations Three semester examinations (15% each) Cumulative Final Examination Homework Attendance Class Contribution 45% 15% 20% 10% 10% NO MAKE-UP EXAMINATIONS ARE GIVEN. No make-up examinations are permitted. If you should, for whatever reason, miss an examination, its weight will be added to the weight of your final examinaton. Late homework assignments are not accepted.... No exceptions. If you cannot be in class to turn in an assignment, turn it in early or have a friend deliver it If you have acess to a scanner, you may email the assignment as an attachment. . So plan ahead. Two homework grades will be dropped if all assignments are turned in. Tutoring Tutoring is available for this course through your Supplemental Instructor (SI). Times and dates of sessions will be announced. Sessions are usually held three times per week. You are strongly encouraged to utilize this resource and to adjust your schedule to accommodate these sessions. Statistical data confirms that students who utilized SI generally earned at least a letter grade higher than students to did not! Class Attendance Class attendance is imperative to successfully complete this course. There are no excused absences; you are in class or you are not. Read NCWC attendance policy…. Page 69 1999-2000 catalogue Attendance will be taken at beginning of each class. If you are tardy, it is your responsibility to see me after the class to have attendance records corrected…. not at a later date. Cutting class will reduce the attendance and class participation and contribution component of your final grade. Example of Grade computation: Semester exam average Final exam Homework average No cuts Class contribution 75 X 45% = 33.75 points 80 X 15% = 12.00 90 X 20% = 18.00 100 X 10% = 10.00 85 X 10% = 8.25 Total 82.00 points Final Average 82 on 10 point Grading Scale... a B Some Helpful Hints: Don’t cut class Be on Time Have read and studied material before class Ask questions Take good notes Review notes as soon as possible after class Find a good place to study...and it isn’t your dorm room Organize your study time (remember three hours of study for each hour in class for a grade of C) Form study groups GOOD LUCK, WORK HARD AND LET’S HAVE SOME FUN LEARNING ECONOMICS! *The instructor reserves the right to adjust this syllabus as deemed necessary by time and events.