EY Case Competition Exec Summary

advertisement

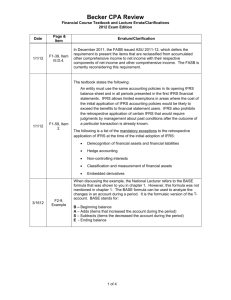

Executive Summary Facts Marshall Industries was founded in 1998 and is one of the world’s largest coal producers, representing roughly 12% of the Farrlandic coal supply. They operate seven mines in two of the three low sulfur coal producing regions of Farrlandia. They are trying to determine the risks and rewards of the two adoption dates of IFRS (International Financial Reporting Standards). Marshall Industries is a forward looking company who likes to be up to date and has a great staff. Their staff is experienced in GAAP and not IFRS. Farrlandia has just adopted IFRS from GAAP. Marshall Industries will have to convert from GAAP to IFRS but they also have the option to voluntarily adopt it early by January 1, 2014 or wait until mandatory adoption on January 1, 2016. There is a grace period if the Company decides to adopt early. They are granted limited liability protecting them from fees and fines and certain limited investor suits. Problem Determine whether Marshall Industries should adopt IFRS early to make use of the grace period or wait until mandatory adoption in order to delay investment expenditures. Identify the two or three key ongoing differences between GAAP and IFRS and the implications the migration to IFRS will have on the Company’s system, people, and business. Additionally, identify two key elections or exceptions under IFRS-1. Unknowns The amount Marshall Industries is willing to spend to be ready by the grace period. The exact costs of training employees, converting the IT department, the effect of business processes etc. to IFRS. The productivity lost because of diverting focus from doing their job to the learning of IFRS. Assumptions Marshall Industries is willing to adopt early if it is feasible. The staff is competent enough to balance between learning how to make the transition from GAAP to IFRS while focusing on their actual job. Solutions Marshall Industries should wait to adopt IFRS until the mandatory date of January 1, 2016. Prior to that date, on January 1, 2015, the Company will begin preparing a quarterly reconciliation of its US GAAP balance sheet to an IFRS balance sheet in order to prepare for the transition. Reasons By waiting two more years, Marshall Industries will have more time to train its employees and convert its IT systems. There will need to be a considerable amount of time budgeted to train employees and implement new IT systems. We estimate about 18-24 months should be given to fully implement the new IT systems. By waiting, underestimating time allowed for employee training and IT implementation will not be a potential problem for the Company. In January 2015, the staff will have to run both GAAP and IFRS financials each quarter, but only report one (GAAP) until the mandatory adoption date. Voluntarily adopting IFRS will only allow 4 months to prepare employees for running both GAAP and IFRS financials. Additionally, waiting will give the Company more time to communicate to investors and rest of firm of the transition to IFRS. This will help reduce confusion between investors in regards to changes in market price and stated income. When waiting until the mandatory adoption date, the Company will also have more time to capitalize and amortize its costs associated with IT implementation, helping reduce large up-front costs. Implications System- There will need to be significant changes to the Company’s accounting system with the transition to IFRS. We will need to analyze which of our IT system will need to be modified to support the new IFRS accounting processes. The system will need to change certain calculations and measurements due to the changes that will come about with the adoption of IFRS. If we are able to centralize and streamline our processes, the conversion process will be easier and more cost efficient. Costs will also include training for current employees in accounting department in IFRS methods. The EY team is prepared to assist with this training to help minimize the Company’s costs if they were to use an outside resource. People- Company has 2900 employees. Most of the employees will be relatively unaffected. The accountants will have to put in the time and work necessary to understand and be ready for the IFRS adopt in 2016. If they are not ready, many more employees may be affected by their poor decision making and preparation. The upper management needs to be encouraging and coaching with the staff. Additionally, the company may either need to consult or hire more IT personnel in order to implement the necessary changes to the company’s IT system in preparation for the transition. Business- The company’s operations should remain relatively unchanged. The company will still mine coal as usual and the business processes will not need to change with the implementation of IFRS. The things about the business that will change is how the company reports their financial information to the FEC and to investors as a whole. The stock prices will be affected when investors hear of the company’s plan to want until the mandatory adoption date. We believe that investor’s will react positively to the news of the delayed adoption, however. Additionally, the company may experience large up-front costs since there will be a need to train staff and convert IT systems to IFRS but, as the Farrlandia Ministry of Finance pointed out, the long term business implications of the IFRS conversion should be largely beneficial. Key Differences and Exemptions Ultimately, GAAP is a rules based accounting standard and IFRS is a principles based accounting standard. There are many principle differences (over 200) but we have identified two key ongoing differences between the two standards. One of the key differences is how depreciation of PP&E is treated. Under GAAP, significant part depreciation is allowed but not currently applied by the Company. Under IFRS, significant part depreciation is required. This will likely require the company to revamp IT systems to include this change, redo useful lives of asset components, and depreciate assets into significant parts. Additionally, straight-line depreciation is the only method allowed under IFRS so you will have to change how preparation plants and loadouts are currently depreciated. Another key ongoing difference that will affect the Company is how inventory is accounted for. Currently under GAAP inventory is valued at the lower of cost or market. Under IFRS, inventory is valued at the lower of cost or net realizable value, not market. This could affect the balance sheet value of inventory, which is a significant portion of current assets. Additionally, under GAAP a reversal of inventory writedowns is strictly prohibited but is allowed under IFRS. Additionally, while goodwill and measurement of pension liabilities are important exemptions and exceptions under IFRS-1, the two most important items are ARO and PP&E. Normally under IFRS, an item of PP&E is initially recorded at cost, if cost is reliably measureable. However, IFRS-1 allows first-time adopters the choice of how to value their PP&E at the date of transition. The company may elect to treat the fair value of PP&E as the deemed cost for IFRS. Additionally, IFRS-1 also offers an exemption that allows the use of a previous valuation of an item of PP&E at or before the transition date as the deemed cost for IFRS. If they choose to use a previous valuation they must depreciate the item of PP&E from that measurement date forward. Making the choice about whether or not to use this exemption is important because PP&E accounts nearly half of the Company’s total assets at $1.48 billion. Another key exemption relates to the treatment of changes in cost estimates or discount rates associated with AROs are different between GAAP and IFRS. Under GAAP, a liability is not re-measured for changes in the risk-free rate. IFRS requires the discount rate used to estimate the liability to be based on current discount rates at each balance sheet date. Subsequently, using the current discount rate based at each balance sheet date can considerably change the timing and amount of AROs. The exemption offered through IFRS-1 allows a first time adopter to measure the ARO and related depreciation effects at the date of transition to IFRS, rather than recalculating the effect of changes in the risk-free rates throughout the life of the obligation. Recalculating the effect of changes in risk-free rates throughout the life of the AROs would require substantial time and resources so the exemption might be a good idea. AROs are one of the company’s largest liabilities at over $300 million. This exemption is likely to provide a practical way for the company to determine the amount at which to record such assets and liabilities in its opening IFRS balance sheet.