positive law and prima facie law difference

advertisement

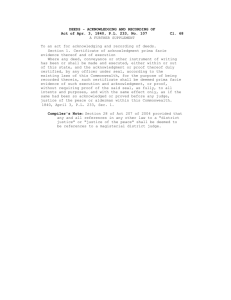

positive law and prima facie law difference The point in discussing the difference between “positive law” and “prima facie” law, involves simply a rule of construction that the Courts will use. If you can’t understand that, then any case you take to the courts will be out before you realize it. A particular code goes from “prima facie” evidence of the law to being the law (positive law) when the Congress, in the enabling provisions of the Code, during its enactment, repeals the general laws in the statutes-at-large and the revised statutes. Now if a particular code is only prima facie evidence of the law, such as the 1954/1986 Internal Revenue Codes and there is a conflict between a provision in that Code a general law on the same subject, it is the general law that will prevail. It is the Internal Revenue Code of 1939 that is currently the general law for most of the tax laws. As I said in one of my previous posts, go to the Statutes-at-Large in which the 1939 Code was enacted. The enabling act of the 1939 Code, I believe it was Section 10, but I am not positive of the section number said, and I paraphrase, that all provisions found in the Statutes-at-Large and the Revised Statutes involving the same subjects of the provisions now found in this title are hereby repealed. That is how a code is in and of itself enacted into “positive law.” The same was done with several other titles such as Title 18 and Title 28 at the time they were enacted into there current organization in 1948. You can find the list of all the titles that have been enacted into “positive law” at the front of every book in the United States Code Annotated. If Title 26 were enacted into positive law as John Gliha states, then it would be listed. It is not. Therefore, it is only prima facie evidence of the law, and if any provision of the 1986 Code is in conflict with the a particular provision 1939 Code on the same subject, the 1939 Code prevails. It is that simple to understand. You will not find the same repealing provisions in the enabling act for either the 1954 or the 1986 Internal Revenue Codes. What I am trying to tell you is that there are substantial conflicts between the provisions of the current 1986 Code and the 1939 Code. In many cases the conflicts are in our favor when we resort to the 1939 Code to resolve the conflict. One of them I pointed out yesterday was the provisions requiring a warrant for distraint. But another one is an assessment statute. Did anyone know that under the 1939 Code there was a requirement for the Commissioner to send a certified assessment list to the then Collector of Internal Revenue (now District Director) of all those who were to be assessed by the assessment officer in that local district? It’s in there (just like Praego [sic] spagetti sauce). The requirement for the certified assessment list is not in the 1954 or 1986 Code, but neither of them repealed the provisions of the 1939 Code. I am not going to give you the section number. All of you need to get down to your local law library, find a copy of the 1939 Code and look up the assessment provisions. You are going to have to do a little work, that is the only way you are going to remember these things is to do some of it yourself. There are less than 20 published decisions involving the construction of a statute after reorganization and realignment, 7 or so decisions are from the supreme court and all of them are consistant with the principle that the entire legislative history, including the previous law must be used to determine the intent. Think about it. g’day John Wilde