ECG704 - North Carolina State University

advertisement

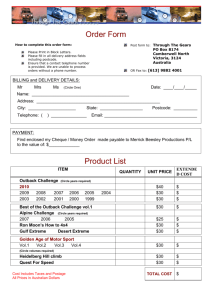

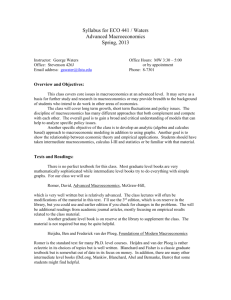

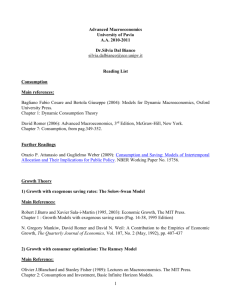

NORTH CAROLINA STATE UNIVERSITY GRADUATE COURSE ACTION FORM NOTE: Click once on shaded fields to type data. To check boxes, right click at box, click “Properties”, and click “Checked” under Default Values. TYPE OF PROPOSAL DEPARTMENT/PROGRAM Economics COURSE PREFIX/NUMBER ECG 704 PREVIOUS PREFIX/NUMBER ECG 704 DATE OF LAST ACTION 9/12/1991 COURSE TITLE Macroeconomics I ABBREVIATED TITLE MACROECONOMICS I SCHEDULING Fall Spring Alt. Year Odd COURSE OFFERED CREDIT HOURS CONTACT HOURS Studio New Course Drop Course Course Revision Dual-Level Course REVISION Content Prefix/Number Title Abbreviated Title Credit Hours Contact Hours Grading Method Pre-Corequisites Restrictive Statement Description Scheduling Summer Every Year Alt. Year Even Other BY DISTANCE EDUCATION ONLY ON CAMPUS ONLY BOTH ON CAMPUS AND BY DISTANCE EDUCATION 3.0 Lecture/Recitation 3.0 Seminar Independent Study/Research Laboratory Problem Internship/Practicum/Field Work GRADING ABCDF S/U INSTRUCTOR (NAME/RANK) John J. Seater, Professor Graduate Faculty Status Associate ANTICIPATED ENROLLMENT Per semester 25 PREREQUISITE(S) ECG 561, 703, MA 241 or equivalents COREQUISITE(S) type course numbers here PRE/COREQUISITE FOR type course number(s) here RESTRICTIVE STATEMENT type BRIEF statement here CURRICULA/MINORS Required Qualified Elective type program name here type elective name here PROPOSED EFFECTIVE DATE Fall 2006 Max.Section Full Multiple sections Yes No APPROVED EFFECTIVE DATE __________________________ CATALOG DESCRIPTION (limit to 80 words): Rigorous examination of basic macroeconomic theory, including household choice of consumption demand and labor supply, capital accumulation and economic growth, government purchases, taxation, government debt, investment, consumption and investment under uncertainty, real business cycle models. Throughout the course, the connection between economic intuition and formal mathematical analysis is emphasized. The level of mathematical rigor is high. DOCUMENTATION AS REQUIRED Please number all document pages Course Justification Proposed Revision(s) with Justification Student Learning Objectives Enrollment for Last 5 Years New Resources Statement RECOMMENDED BY: _______________________________________________________________________ Department Head/Director of Graduate Programs Date ENDORSED BY: _______________________________________________________________________ Chair, College Graduate Studies Committee Date Consultation with other Departments Syllabus (Old and New) ________________________________________________________________________ College Dean(s) Date Explanation of differences in requirements of dual-level courses APPROVED: _______________________________________________________________________ Dean of the Graduate School Date Proposed Revisions ECG 704 REVISION IN TITLE/ABBREVIATED TITLE: Current Title: Advanced Income and Employment Theory Current Abbreviated Title: ADV INC EMPL THEO Proposed Title: Macroeconomics I Proposed Abbreviated Title: MACROECONOMICS I Justification: We propose a title change to better reflect the content and sequencing of the course. REVISION IN PREREQUISITES: Current Prerequisites: ECG 703 Proposed Prerequisites: ECG 561, 700, 703, MA 242 or equivalents Justification: We propose a change in prerequisites to more accurately reflect the necessary preparation needed to excel in the course. In most cases, a student who has completed ECG 703 will have taken the accompanying prerequisites; however, we felt it would better serve the students to explicitly outline our expectations of students taking the course. REVISION IN DESCRIPTION: Current Description: Analysis of forces determining level of income and employment; a review of some of the theories of economic fluctuations; and a critical examination of a selected macroeconomic system. Proposed Description: Rigorous examination of basic macroeconomic theory, including household choice of consumption demand and labor supply, capital accumulation and economic growth, government purchases, taxation, government debt, investment, consumption and investment under uncertainty, real business cycle models. Throughout the course, the connection between economic intuition and formal mathematical analysis is emphasized. The level of mathematical rigor is high. Justification: We propose a description change to better reflect the content of the course. REVISION IN SYLLABUS: There is no change in the syllabus of the course. Five-Year Enrollment History ECG 704 Advanced Income and Employment Theory (Proposed Title: Macroeconomics I) 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 Fall 21 17 15 25 23 24 Spring 0 0 0 0 0 0 Summer 0 0 0 0 0 0 NORTH CAROLINA STATE UNIVERSITY Department of Economics Prof. John J. Seater 4146 Nelson Hall Ext. 3-2697 email: john_seater@ncsu.edu Office Hours: Tue & Thu 1:45pm-2:45pm or by appointment Fall 2005 ECG 704 Advanced Income and Employment Theory This course will examine rigorously the foundations of macroeconomic behavior. Macroeconomics is nothing but the study of how microeconomic units (households, firms) interact, so our approach will be microeconomic in orientation, showing how the behavior of individuals leads to the macroeconomic behavior we observe. The course will link macro and micro economics in a practical as well as intellectually satisfying way. The course has several objectives: introduction to macroeconomic topics and an understanding of what the issues are, development of economic intuition, and presentation of some of the tools needed for formal analysis of economic problems. There is not time for detailed discussions in class of all the course material, so class time will be used to introduce topics and explain the basic points, to discuss particularly difficult or subtle parts of the material, and to summarize each topic. You are responsible for reading the assignments, understanding their details, and figuring out how they are related to each other and to the classroom discussion. Much of the discussion both in class and in the readings will be in mathematical terms, for three reasons. First, mathematics is precise, making both the presentation of an idea and the idea itself unambiguous and well considered. Second, because of its precision, mathematics is compact and efficient. Third, a mathematical presentation allows one to derive and prove results rather than merely guess and assert them based on intuition. Wonderful as it is, intuition usually will not convince a skeptic, and anyway intuition can be developed only by formally deriving results repeatedly. There are two kinds of problem sets: Exercises and Problems. Exercises are for practice; problems are more advanced and involve non-trivial use of the course material or interesting extensions of it. Problems often require you to use the course material in ways not explicitly discussed in class or in the readings. A professional must be able to use his knowledge, not simply repeat back what was taught in some course. I will distribute written answers to all Exercises on the "due" days shown in the course schedule below. Answers to all Problems will be available in the red folders in room 4149 Nelson Hall. You can take unlimited notes on the Problem answers, but you cannot make xerox copies of them. (This is so that next year’s class won’t have the answers ahead of time.) Neither Exercises nor Problems will be graded, and you don’t have to hand in anything. Nonetheless, I strongly urge you to write out answers to all Exercises and Problems and to compare your answers with those I hand out. If my answers differ from yours in any way, figure out why. If you think I have made a mistake in an answer, come tell me about it. You are probably right. You can find the Exercises and Problems on my web site: http://www4.ncsu.edu/~jjseater There will be two in-class exams (each about 50 minutes long, one or two questions) and a final exam, which will determine your course grade. The first in-class exam counts 20% of your grade, the other counts 35%, and the final counts 45%. The final exam is cumulative, so a performance on it that is much stronger than on the two in-class exams increases the weight I give the final exam, according to my judgement when I compute the course grades. That allows students who have trouble at first to catch up later. There is no required textbook for this course because no existing text covers the course material at the appropriate level (see the next paragraph optional texts). You will find most of the course material in two places - the class notes and assigned readings. You should buy a copy of my notes for the course, available for about $20 from Sir Speedy, 2526 Hillsborough Street (across from the D. H. Hill library). The notes are copies of my class notes. They will save you the trouble of copying the large amount of mathematics I put on the blackboard, allowing you to concentrate more on my explanation of what is going on. The assigned readings consist of journal articles and chapters from books. All are available on the internet; details are given in the reading list below. These readings present important material that extends or supplements what is covered in class. Some are theoretical; others are empirical. Many are classics that any well-educated economist would be expected to have read. You may find the articles hard to read because they use new notation, assume you have lots of background, and generally are written for people who already have their doctorates. However, reading them becomes easier as the semester progresses and you acquire human capital. A full list of the readings is attached to this syllabus. I will not have time to discuss all the readings in class; nevertheless, you are expected to be familiar with them. There also are some books on reserve in the library that provide background in macroeconomics, optimal control theory, and time series models: (1) Intuition of macroeconomics. Barro's book gives an introductory treatment of macroeconomics and is excellent for getting intuition into what is going on; it is totally lacking in formalism and rigorous empirical evidence. Chapters 2 through 5 are required; many of the remaining chapters are recommended as background reading. You should spend some time figuring out how to recast Barro's intuitive discussion in terms of the formal models presented in class. If you can do that, you understand basic macro theory. Advanced Macroeconomics by David Romer can be considered an optional text for the course. I used to require it, but I took a poll of graduate students from several classes in which the nearly unanimous opinion was that Romer's book should be optional, not required. Romer's book stands between Barro's totally informal treatment and the very formal treatment in my class notes. (2) Optimal control. Dixit gives an outstanding informal and highly intuitive introduction to optimization methods and their application to economics. Arrow and Kurz give an intuitive introduction to optimal control, and Chow expands on their approach, doing everything in terms of Lagrange multipliers. Chiang gives a more complete treatment, and Kamien and Schwartz give the most formal and most complete treatment of all. (3) Time series models. Pindyck and Rubinfeld contain a good introductory discussion of time series models. COURSE OUTLINE AND SCHEDULE Readings with a double asterisk (**) are books for your reference that you should consult only as you feel necessary, readings with a single asterisk (*) are material whose methods and conclusions you should understand well but whose every detail you need not know, and readings with no mark at all are material you should master thoroughly. Readings in the second category (one asterisk, *) mostly are empirical, and I expect you to understand what the results are and what they mean. I do not expect you to understand the details of the estimation procedures used, the serial correlation properties of the errors, and other such econometric details. Those details are important, but they can wait until your second year. #_: delimits the material to be covered on Short Exam #_. Date Topic Problems/Exercises Due Aug 18 #1 Household choice. Lagrange multipliers. Aug 23 Continued. Properties of the solution. Aug 25 Discrete time optimal control. Household choice again. Aug 30 Continued. Sep 1 Permanent income. Micro evidence. Sep 6 General equilibrium. Sep 8 Continued. Sep 13 Capital. Solow growth model. Sep 15 Continuous time optimal control. Cass growth model. Sep 20 Continued. Sep 22 #1 Aggregate evidence on household choice. Sep 27 #2 Government purchases Readings Barro: Ch.2,3 **Romer: Ch.7, sections 1,4,6 **Dixit: Ch.1-4,8 Friedman: "The methodology..." **Dixit: Ch.10 **Arrow & Kurz: pp.33-51 **Kamien & Schwartz: Part II, Sections 1-9 **Dorfman: "An Economic Interpretation..." E1-2 Friedman: "A Theory ..." Ch. 1-3 *DeJuan & Seater: "Testing the permanent..." *Attanasio&Browning: "Consumption over ..." P1-2 E3-4 P3-4 Barro: Ch.4,5 **Barro: Ch.9,11 **Romer: Ch.1 Solow: "Technical Progress..." Phelps: "Golden Rules of ..." pp.3-20 Blanchard and Fischer: pp. 39-58 Seater: "An optimal control solution..." **Romer: Ch.2, sections 1-7 E5-8 P5-6 E9-11 P7-10 Darby: "The permanent...", pp. 228-242 *Campbell and Mankiw: "Consumption..." *Zeldes: "Consumption and ..." Hall: "Stochastic implications..." Seater: "Testing the..." Mankiw: "Government..." **Barro: Ch.12 Barro: "Output Effects..." *Ahmed: "Temporary and ..." *Aschauer: "Is public..." Sep 29 FIRST EXAMINATION. Continued. Oct 4 Taxes and debt. Oct 6 No Class - Fall Break Oct 11 Overlapping generations model. Oct 13 Continued. Oct 18 Endogenous growth. Oct 20 Continued. Oct 25 Investment with adjustment costs. Oct 27 Continued. Nov 1 Continued. Nov 3 **Barro: Ch.13,14 **Romer: Ch. 11, sections 1-4 Seater: "Ricardian equivalence" plus "Corrections" *Seater & Mariano: "New tests..." Stephenson: "Average marginal ..." *Akhand & Liu: "Marginal income..." Barro: "On the Determination..." E12-13 P11-13 **Romer: Ch.3, sections 1-7, 12 Barro & Sala-i-Martin: pp.63-68, 205-211 Dawson: "Recent..." **Romer: Ch.8, sections 1-5 *Maccini and Rossana: "Investment..." Lucas: "Optimal Investment..." *Nadiri & Rosen: "Interrelated..." Hayashi: "Tobin's Marginal q and ..." Kydland and Prescott: "Time to build..." pp. 1345-1352 E14-16 P14-16 #2 Dynamic programming. Household choice under uncertainty. Nov 8 Investment under uncertainty. Nov 10 SECOND EXAM. Money demand. Nov 15 Continued. IS-LM model. Nov 17 Time series analysis. Nov 22 Business cycles. Blanchard and Fischer: pp. 91-114 **Romer: Ch.2, sections 8-12 Barro & Sala-i-Martin: pp. 179-186 *Abel et al: "Assessing Dynamic ..." **Romer: Ch.7, sections 2,3,5 Blanchard and Fischer: pp. 275-291 **Dixit ch. 5, 9, 11 *Dynan et al: "Do the Rich Save More?" P17-20 **Romer: Ch.8, section 6 Blanchard and Fischer: pp. 291-301 McCallum and Nelson: "An Optimizing..." E18-19 P21-22 **Pindyck & Rubinfeld: Ch.16,17 *Nelson and Plosser: "Trends..." *Murray & Nelson: "The Uncertain..." Hodrick & Prescott: "Postwar U.S. ..." Cogley & Nason: "Effects of the Hodrick ..." *Flavin: "The Adjustment of Consumption..." *Mankiw and Shapiro: "Trends..." **Romer: Ch. 4 Long and Plosser: "Real..." *Cooley and Ohanian: "The cyclical..." *Blanchard & Quah: "The Dynamic ..." Stadler: "Real Business Cycles" Cogley & Nason: "Output Dynamics..." *Baxter: "Are Consumer Durables ..." Seater: "Invention and Business Cycles" Nov 24 No Class - Thanksgiving Nov 29 Continued. Dec 1 Continued. E20 P23 Readings The following books are on reserve in the Library's Reserve Room: 1. Kenneth J. Arrow and Mordecai Kurz, Public Investment, the Rate of Return, and Optimal Fiscal Policy 2. Robert J. Barro, Macroeconomics (also online at the course website; see below) 3. Alpha Chiang, Elements of Optimization Methods... 4. Gregory Chow, Optimization in (or and) Economics 5. Avinash K. Dixit, Optimization in Economic Theory 6. Morton Kamien and Nancy Schwartz, Dynamic Optimization, the Calculus of Variations, and Optimal Control in Economics and Management 7. Robert Pindyck and Daniel Rubinfeld, Econometric Models and Economic Forecasts Articles published within the last 5 years are vailable through the Library catalog for the journal (start at http://www.lib.ncsu.edu/); articles older than that are available through JSTOR (http://www.jstor.org/cgi-bin/jstor/listjournal): 1. Andrew B. Abel, N. Gregory Mankiw, Lawrence H. Summers, and Richard J. Zeckhauser, "Assessing Dynamic Efficiency: Theory and Evidence," REStud, vol.56, January 1989, pp. 1-20 2. Shaghil Ahmed, ''Temporary and Permanent Government Spending in an Open Economy: Some Evidence for the United Kingdom,'' JME, vol. 17 (March 1986), pp. 197-224 3. H. Akhand and H. Liu, "Marginal income tax rates in the United States: a non-parametric approach," JME 49, Mar 2002, pp. 383-404 4. David Alan Aschauer, "Is Public Expenditure Productive?" JME, vol. 23, March 1989, pp. 177-200 5. Orazio Attanasio and M. Browning, "Consumption over the life cycle and over the business cycle," AER, December 1995. 6. Robert J. Barro, "On the Determination of the Public Debt," JPE, October 1979 7. Robert J. Barro, "Output Effects of Government Purchases," JPE, December 1981. 8. Marianne Baxter, "Are Consumer Durables Important for Business Cycles?" REStat, vol. 78, February 1996, pp. 147-55 9. Olivier J. Blanchard and Danny Quah, "The Dynamic Effects of Aggregate Demand and Aggregate Supply Shocks," AER, vol. 79, September 1989, pp. 655-673 10. Timothy Cogley and James M. Nason, "Output Dynamics in Real Business Cycle Models," AER, vol. 85, June 1995, pp. 492-511 11. Timothy Cogley and James M. Nason, "Effects of the Hodrick-Prescott filter on trend and difference stationary time series: Implications for business cycle research," JEDC, vol. 19, 1995, pp. 253-278 12. Thomas F. Cooley and Lee E. Ohanian, "The Cyclical Behavior of Prices," JME, vol. 28, August 1991, pp. 25-60 13. Michael R. Darby, "The Permanent Income Theory of Consumption - A Restatement," QJE, vol. 88, May 1974, pp. 228-242 14. Robert Dorfman, "An Economic Interpretation of Optimal Control Theory," AEReview 59, December 1969, pp. 817-31. 15. Karen E. Dynan, Jonathan Skinner, and Stephen P. Zeldes, "Do the Rich Save More?" JPE, vol. 112, April 2004, pp. 397-444 16. Stanley Fischer, "Anticipations and the Nonneutrality of Money," JPE, vol. 87, April 1979, pp. 225-230 17. Marjorie A. Flavin, "The Adjustment of Consumption to Changing Expectations About Future Income," JPE 89,(Oct., 1981), pp. 9741009. 18. Robert E. Hall, "Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence," JPE, vol. 86, December 1978, pp. 971-987 19. Fumio Hayashi, "Tobin's Marginal q and Average q: A Neoclassical Interpretation," Econometrica, vol. 50, January 1982, pp. 213-224 20. Robert J. Hodrick and Edward C. Prescott, "Postwar U. S. Business Cycles: An Empirical Investigation," JMCB, vol. 29, February 1997, pp.1-16 21. Finn Kydland and Edward Prescott, "Time to Build and Aggregate Fluctuations," Econometrica, vol. 50, November 1982, pp. 1345-1352 22. John B. Long and Charles I. Plosser, "Real Business Cycles," JPE, vol. 91, February 1983, pp. 39-69 23. Robert. E. Lucas, Jr., "Optimal Investment Policy and the Flexible Accelerator," IER, vol. 8, February 1967, pp. 78-85 24. Louis J. Maccini and Robert J. Rossana, "Investment in Finished Goods Inventories: An Analysis of Adjustment Speeds," AER, vol. 71, May 1981, pp. 17-22 25. N. Gregory Mankiw, "Government Purchases and Real Interest Rates," JPE, vol. 95, April 1987, pp. 407-419 26. N. Gregory Mankiw and Matthew D. Shapiro, "Trends, Random Walks, and Tests of the Permanent Income Hypothesis," JME, vol. 16, September 1985, pp. 165-174 27. Bennett J. McCallum and Edward Nelson, "An Optimizing IS-LM Specification for Monetary Policy and Business Cycle Analysis," JMCB, vol. 31, August 1999, pp. 296-316 28. C. J. Murray and C. R. Nelson, "The Uncertain Trend in U.S. GDP," JME 46, August 2000, pp. 79-95 29. M. Ishag Nadiri and Sherwin Rosen, "Interrelated Factor Demand Equations," AER, September 1969, pp. 457-471 30. Charles R. Nelson and Charles I. Plosser, "Trends and Random Walks in Macroeconomic Time Series," JME, vol. 10, September 1982, pp. 139-162 31. John J. Seater, "Ricardian Equivalence," JEL, vol. 31, March 1993, pp. 142-190. 32. John J. Seater, "An Optimal Control Solution to the Liquidity Constraint Problem," Economics Letters 54, February 1997, pp. 127-134. 33. John J. Seater and Roberto S. Mariano, "New Tests of the Life Cycle and Tax Discounting Hypotheses," JME 15, March 1985, pp. 195215. 34. Robert M. Solow, "Technical Change and the Aggregate Production Function," REStat 39, August 1957, pp. 312-20 35. George W. Stadler, "Real Business Cycles," JEL, vol. 32, December 1994, pp. 1750-1783 36. E. F. Stephenson, "Average marginal tax rates revisited," JME 41, Apr 1998, pp. 389-409 37. Stephen P. Zeldes, "Consumption and Liquidity Constraints: An Empirical Investigation," JPE, Vol. 97, No. 2. (Apr., 1989), pp. 305-346. The following articles and book chapters are available through the Library's page for this course (start at http://www.lib.ncsu.edu/rbr/): 1. Robert J. Barro, Macroeconomics, 5th edition, MIT Press: Cambridge, MA. 2. Robert J. Barro and Xavier Sala-i-Martin, Economic Growth, 2nd Edition, MIT Press 2004, pp. 63-68, 179-186, 205-211 3. Olivier Blanchard and Stanley Fischer, Lectures on Macroeconomics, MIT Press: Cambridge, MA, 1989, pp. 37-58 from Chapter 2, pp. 91-114 from Chapter 3, pp. 275-301 from Chapter 6 4. John Y. Campbell and N. Gregory Mankiw, "Consumption, Income, and Interest Rates: Reinterpreting the Time Series Evidence," NBER Macroeconomics Annual 1989, O. J. Blanchard and S. Fischer, eds., Cambridge: MIT Press., pp. 185-216 5. John W. Dawson, "Recent Contributions to the Theory of Growth," Unpublished. 6. Milton Friedman, A Theory of the Consumption Function, Princeton University Press: Princeton, NJ, 1957, Chapters 1-3 (pp. 3-37) 7. Roberto S. Mariano and John J. Seater, "New Tests of the Life Cycle and Tax Discounting Hypotheses," Journal of Monetary Economics, vol. 15, March 1985, pp. 195-215 8. Edmund S. Phelps Golden Rules of Economic Growth, W. W. Norton: New York 1966, pp. 3-20 9. John J. Seater, "Testing the Permanent Income Hypothesis with Aggregate Data," Macroeconomic Dynamics, vo. 2, September 1998, pp. 401-425 The following articles are available through John Seater’s web page (http://www4.ncsu.edu/~jjseater): 1. John J. Seater, "Correction to 'Ricardian Equivalence" (go to Published Papers page, link to "Corrections" under entry for "Ricardian Equivalence" in the JEL) 2. Joseph P. DeJuan and John J. Seater, "Testing the Permanent Income Hypothesis with Classification Methods" 3. John J. Seater, "Invention and Business Cycles" Class Policies Attendance 1. Excuses for anticipated absences must be cleared with the instructor before the absence. Examples of anticipated situations where a student would qualify for an excused absence are: a. The student is away from campus representing an official university function, e.g., participating in a professional meeting, as part of a judging team, or athletic team. These students would typically be accompanied by a University faculty or staff member. b. Required court attendance as certified by the Clerk of Court. c. Religious observances as verified by Parents & Constituent Services (515-2441). For more information about a variety of religious observances, visit the Diversity Calendar. d. Required military duty as certified by the student's commanding officer. 2. Excuses for emergency absences must be reported to the instructor as soon as possible, but not more than one week after the return to class. Examples of emergency absences are: a. Illness or injury when certified by an attending physician. Physicians on the Student Health Service staff do not provide written excuses. Because of student confidentiality, information can only be released directly by the Counseling Center or Student Health Services in case of crisis or with the student's written authorization. b. Death or serious illnesses in the family when documented appropriately. An attempt to verify deaths or serious illness will be made by Parents & Constituent Services (515-2441) at the request of the instructor. For a full statement of the University Attendance Policy, see http://www.ncsu.edu/policies/academic_affairs/pols_regs/REG205.00.4.php Disabled Students: In accordance with Section 504 of the Rehabilitation Act of 1973 (“Rehab Act”), the Americans with Disabilities Act of 1990 (“ADA”), and state law, North Carolina State University (hereinafter NC State) is required to accommodate an otherwise qualified individual with a disability by making a reasonable modification in its services, programs, or activities. This regulation addresses the eligibility of students for academic accommodations in educational programs, services, and activities at NC State, as well as the provision of such accommodations to students with various types of disabilities. For a full review of NCSU’s policy toward students with disabilities, please see: http://www.ncsu.edu/policies/academic_affairs/courses_undergrad/REG02.20.1.php Academic Integrity/Student Conduct: This course will be held in accordance with the University’s academic integrity standards as outlined in the Code of Student Conduct. Please review the Code in its entirety at: http://www.ncsu.edu/policies/student_services/student_discipline/POL11.35.1.php .