2_Managing the Money_US

advertisement

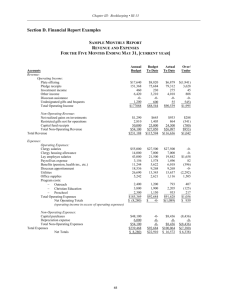

Managing the Money MCC Resource for Treasurers of Our Local Churches US Edition Table of Contents Basic Accounting Principles For Non-Profits …………………………………… 001 Review Of Accounting Software How To Use A Simple Spreadsheet (e.g., Excel) Double-Entry Bookkeeping Understanding The Difference Between The Budget And The Balance Sheet, Income And Expense Statement, And Statement Of Cash Flow Budget Balance Sheet Balance Sheet Assets Balance Sheet Liabilities Balance Sheet Net Assets Unrestricted Temporarily Restricted Permanently Restricted Income Statement Income Statement Revenue Income Statement Expense Cash Flow Statement Cash Flows Operating Activities Investing Activities Financing Activities How To Prepare A Balance Sheet, Income And Expense Statement, And Statement Of Cash Flow Balance Sheet Preparation Income Statement Preparation Cash Flow Preparation Web Resources and References Forms A MCC Resource for Treasurers US Edition A MCC Resource for Treasurers US Edition Basic Accounting Principles For Non-Profits Whether your church is large or small, effective financial management is an ongoing process featuring a cycle of good management habits. Sound procedures and internal controls help ensure accurate accounting and high-quality reporting. Evaluation of the information in the reports then informs planning and facilitates good management decisions. Regular evaluation of the process leads to consistent improvement in financial management. The diagram above and the following basic overview give some general perspective on the basic processes involved in non-profit financial management. The following activities described below occur regularly as part of the yearly accounting cycle or more frequently as circumstances dictate. The accounting cycle includes bookkeeping, generating financial statements and analyzing information from the statements. Bookkeeping is basically recording various financial transactions. Bookkeeping activities can often be done by someone responsible for basic clerical work in the church. However, the Treasurer usually oversees and approves the bookkeeping system. The Board develops and authorizes a set of standard operating procedures (SOPs) which outline how the church shall manage its finances, including how the following activities are carried out within the church. The Treasurer usually coordinates development of the SOPs, including a regular review and update. The Board and Senior Pastor should make every effort to ensure compliance with the SOPs. See Sample Financial Operating Procedures below. A MCC Resource for Treasurers US Edition Basic Accounting Principles For Non-Profits …………………………………… 001 Review Of Accounting Software Accounting starts with basic record keeping (or bookkeeping). When a church is just getting started, its bookkeeping system will probably be based on what is called cashbasis accounting, rather than an accrual-basis accounting system. Many young churches use the cash-basis system and a checkbook to track transactions. In the “memo” portion of the checkbook or register, the amount is noted as Revenue or Expense and includes the source or destination of the funds. As a church grows, it should begin to use ledgers (journal) to track transactions. For example, cash receipts should be posted to a Cash Receipts Journal and checks written should be posted to a Cash Disbursements Journal. As a church continues to grow and begins using the accrual method, those responsible for bookkeeping will likely need more types of journals, for example, a Cash Receipts Journal, a Cash Disbursements Journal, a Fixed Assets Journal, a Fund Raising Journal, Journal a Payroll Journal, an Accounts Receivable Ledger, an Accounts Payable Ledger, a Sales Journal, a Purchases Journal and a General Ledger. In an accrual-basis system, entries are posted when money is earned and when money is owed. Small churches usually do not have the resources to use an accrual-based system. However, financial statements are prepared on an accrual basis. As a compromise, many churches use cash-based principles to record entries in journals, but get help to convert to an accrual-based approach in order to generate financial statements. Accounts and Chart of Accounts: Each entry should be posted according to the category—or account―of the transaction. Each account will be associated with an account number. These numbers are referenced when developing financial statements (more on those later). A Chart of Accounts indicates which account number to use when posting a particular entry. Charts of Account can be designed specifically for each church, including developing unique account numbers. The account numbers developed should depend on the particular kinds of revenues and expenses a church expects to have most frequently. A Chart of Accounts usually has five categories covering the following areas: assets, liabilities, net assets or equity (including specific fund balances), revenues, and expenses. However, non-profits must report account activity according to the classifications of Functional (or Programs) and Natural (or Supporting). Functional transactions are those directly related to providing services to clients, members, etc. Natural transactions are those common to all programs, for example, general management costs, etc. Budgets (Financial Forecasting): A church will have an operating budget (or annual budget), which provides the Treasurer projected revenue and expenses, usually for the coming year. Budget amounts are usually divided into major categories such as A MCC Resource for Treasurers US Edition salaries, benefits, computer equipment, office supplies, etc. Cash budgets, which depict the cash a church expects to receive and pay over the near term, for example, a month, may also be provided. A Treasurer also might be provided capital budgets, which depict expenses to obtain, develop, operate, or maintain facilities or major pieces of equipment such as buildings, automobiles, computers, furniture, etc. Usually, a Treasurer will prepare a monthly comparison of actual revenue and expenses to the approved budget. This allows a comparison between planned revenue and expenses to actual revenue and expenses, providing the Treasurer with a good idea as to whether the church is operating financially according to plan or not, as well as indicating areas which may need attention such as trimming expenses or bolstering revenue. Petty Cash: A church usually has many small, recurring expenses that need immediate attention, for example, computer power cords, stamps, etc. This will most likely necessitate a petty cash fund. This is a small amount of available cash which can be generated by writing a check to the church, from a church account and noting on the check that the cash received from the bank goes to the “petty cash” fund. Money can be withdrawn from the fund upon submission and approval of a voucher that describes who received the money, the amount received, the purpose for which the cash was used, and on what date the money being reimbursed was spent. Usually the Treasurer or bookkeeper requests the store receipt or bill of purchase for the item or service obtained be attached to the submitted voucher in order to verify the purchase. Trial Balances: The Treasurer, or the bookkeeper with the Treasurer’s assistance, will often do a monthly trial balance. This activity usually starts by totaling the entries from the journal(s) into a general ledger. When using double-entry accounting, totals on both sides of the ledger are added up to make sure that total debits equal total credits. The Treasurer should ensure that the individual postings and totals in the ledger are correct by comparing each to its accompanying documentation. For example, the recording of cash disbursements should be compared to the monthly checking statement received from the bank that indicates what checks have been drawn from the church’s account during the month and post Petty Cash receipts. The recording of cash disbursements should also be compared to accompanying invoices and other forms of billing submitted to the church for the purpose of verifying there was a need for each check written. Internal Controls: The church should have in place various forms of internal controls to ensure it is properly following its financial plan. Internal controls also minimize the likelihood of accounting mistakes and help avoid employee theft, etc. There are a wide range of internal controls. Some examples of internal controls include careful hiring practices (performing background checks or requiring an employee be bonded), establishing checks and balances or double oversight for a particular function, and creating carefully controlled lists of people who are responsible for various functions and clearly outlining what authorization each has in regards to accessing information and/or A MCC Resource for Treasurers US Edition different secured areas of the facilities (who collects the offering, who counts the offering, who has access to the on-site safe, who makes bank deposits). As mentioned above, totals from various financial reports, will be reviewed against each other to determine if a church’s financial activities are progressing according to the approved plan or not. As also noted, internal controls to minimize employee theft should be established, among which, the church’s mail should be opened by one person only who logs in each check that is received. This person must be someone other than the person who deposits the checks to the bank. Disbursements of large cash amounts, for example, over $500, should probably require a secondary signature, for example, from the Treasurer. Should the check be made payable to any of the two authorized signees, a third signee should have been previously established who can sign in place of the payee, thus assuring a large check is always signed by two authorized persons other than the payee. Another form of financial control is an audit. An audit is a comprehensive analysis, by a professional from outside the church, of your financial management procedures and activities. The auditor produces a report which contains a variety of supplemental information that indicates how well your church is managing its resources. Some nonprofits are required to have external audits. It is usually good practice to have a periodic audit, whether you are required to or not. Note: External audits are need to procure outside funding (i.e. mortgage). A MCC Resource for Treasurers US Edition How To Use A Simple Spreadsheet (e.g., Excel) A basic record keeping system will be based on a manual entry system, most likely using a simple Microsoft Excel spreadsheet. Excel is a spreadsheet program that analyzes, organizes, solves, and charts information. Excel’s most powerful features are the ability to create formulas, lists, and charts. An Excel spreadsheet consists of a grid made from columns and rows (see Fig 1). Fig. 1 A MCC Resource for Treasurers US Edition Cell The small rectangle container that can hold numbers, text, formulas, etc. Active Cell Cell that is selected and has a border around it. Also called selected or highlighted cell. In the above example, A1. Cell Reference The cell address that is used in a formula to specify which cell(s) are used Cell Address Identifies a cell’s location. The default style in Excel uses letters to denote columns and numbers to denote rows. A1 refers to Column A and Row 1 Range Two cell references that are separated by a colon. Example (B5:D13) will find all cells between B5 and D13―including B5, B6,…B13, C5, C6, …C13, and D5, D6, …D13. Worksheet The document area in Excel. A page of cells that are arranged in rows and columns. Worksheets can contain text, charts, formulas, and files. Default is three worksheets; the maximum number of worksheets is limited to the computer’s memory. Workbook A collection of worksheets. File extension is .xls. It is an environment that can make number manipulation easy and somewhat painless (see Fig. 2). Fig. 2 Record keeping and accounting systems may eventually evolve to a computer-based system, which greatly automates entry of transactions, updating of ledgers, generation of financial statements and financial analysis (more later on these, and generation of reports needed for filing taxes, etc.) For more information, please refer to http://en.wikipedia.org/wiki/Microsoft_Excel. A MCC Resource for Treasurers US Edition Double-Entry Bookkeeping Postings can be done using a single-entry or double-entry method. Double-entry works from a basic accounting equation “Assets = Liabilities + Equity”. The double-entry method makes sure that the financial books are always in balance. Every transaction has two journal entries, a debit and a credit. Each transaction affects both sides of the equation.* Each posting might refer to accompanying documents that should be kept in an easily accessible and understood file somewhere. For example, postings about cash receipts might refer to invoices sent to a client which prompted the client to write checks to the church (checks which were posted as cash receipts). Or, in another case, postings about cash disbursements might refer to invoices that were sent to the church which required checks be written to a vendor (checks which were posted as cash disbursements). The deposit receipts received from the bank should always be kept in in a file. In order to know how the church is doing, the Treasurer will be responsible for doing ongoing financial planning and analysis. In this planning and analysis, a cash flow statement, a statement of activities (sometimes called income statement or income and expense statement) and a statement of financial position (also referred to as a balance sheet) will be generated from the bookkeeping information tracked in the ledgers and journals. A cash flow statement depicts changes in the church’s cash during the year. A statement of activities depicts the changes in the church’s assets over the past year, which includes both cash and other assets such as the building and capitalized equipment. This statement is particularly useful to indicate if the church is operating with extra money or at a deficit, as it gives a fairly good indication of the church’s rate of revenue intake and spending outflow. This can help signal areas of concern. A statement of financial position depicts the overall value of the church at a given time (usually at the end of the year). It is generated by recording the church’s total assets, subtracting its total liabilities and reporting the resulting net assets (capital). Net assets are reported in terms of unrestricted, temporarily restricted and permanently restricted assets. By themselves, numbers usually don’t mean much. But when compared to certain other numbers, they can inform a Treasurer and Board about how their church is doing. As mentioned, the planned expenses depicted on the church’s budget can be compared to the actual expenses paid out by the church in order to see if spending is on track. This is a one-to-one comparison of a projected number to an actual number. Another form of comparison is by using ratios. A ratio is a comparison made by mathematically dividing one number by the other. For example, nonprofits are expected to keep administrative costs down in order to make more money available for programs and services. Dividing program expenses by the total expenses for the church indicates A MCC Resource for Treasurers US Edition the amount of administrative overhead used to run the programs. The interpretation rendered from the results of various types of comparisons will always depend on the nature of the nonprofit. To be fiscally responsible, a church’s Board should require regular financial reports at each Board meeting. The Board may request additional information such as a statement of financial position or statement of activities be presented at each meeting, as well as requesting descriptions of finances for each program or of affordability for upcoming major initiatives. They may request information prior to filing taxes, and they will certainly need to see any results from financial audits. The Treasurer should prepare and present accurate and complete financial reports to the Board. A MCC Resource for Treasurers US Edition Understanding The Difference Between The Budget And The Balance Sheet, Income And Expense Statement, And Statement Of Cash Flow Budget Balance Sheet Balance Sheet Assets Balance Sheet Liabilities Balance Sheet Net Assets Unrestricted Temporarily Restricted Permanently Restricted Income Statement Income Statement Revenue Income Statement Expense Cash Flow Statement Cash Flows Operating Activities Investing Activities Financing Activities The Budget shows the church’s projected expenses and revenues for a given period of time. Basic budgeting should be integrated into the church’s programs and services to determine planning steps, evaluation methods, timing of events, and costs related to achieving the church’s mission. There are five key steps in budgeting: 1. 2. 3. 4. Estimating expenses Estimating potential sources of income Bringing projected expenses in line with projected income The final proposed budget must then be reviewed and approved by the Board of Directors after fine-tuning. 5. During the year, the budget must be evaluated periodically to determine whether projected and actual income and expenses are in line. (If not, and if the varianceamounts over or under budgetare substantial, then the budget must be updated and revised if it is to be of any use at all.) When a church plans a budget it must estimate what the revenues and expenses will be for certain programs over a fixed period of time. The basic premise on which to base budgeting revenues and expenses is a well-laid out plan of activities for the next year. These predictions or forecasts can be made from historical data or, if none exists, from similar information garnered from other churches with similar parameters. If a church delivers multiple programs, the staff and Board must determine the viability of each program and the revenues and costs associated with each. Variances between the actual and the projected budgets that appear throughout the year will be indicators of change within in the church. A MCC Resource for Treasurers US Edition The heart of budgetary control is studying and investigating the cause of variances between budgeted figures and actual income and expenses. The Balance Sheet (Fig. 3) is one of the most fundamentally important documents a nonprofit can provide for use in its internal management. The balance sheet is a “snapshot” at a given point in time of the church’s value. The balance sheet establishes financial information to external entities. The balance sheet is often referred to as the Statement of Financial Position and complements the cash flow statement. It describes what you own, such as equipment and cash (assets), compared to what you owe, such as loans (liabilities). Note: It is also recommended that a church keep on hand at least one (1) month of expenses as a cash balance in accounts for cash flow purposes. A MCC Resource for Treasurers US Edition Fig. 3 A MCC Resource for Treasurers US Edition Balance Sheet Assets Cash balance on the date of the balance sheet: Liquid funds or funds such as U.S. Treasury bonds on deposit in the bank or petty cash. An audited financial statement requires that restricted cash (or any other asset) with a donor- imposed restriction which limits its long-term use must be classified in a temporarily restricted or permanently restricted account. Pledges or grants receivable (amounts due to the church or receivables): These are amounts that have been committed by an outside or external donor to the organization. Pledges and grants should be recorded as the amount the nonprofit expects to receive or the net realized value. Nonprofits should not report the full or gross amount because the line item could be overstated. Nonprofits should report the amount entitled to up to and included in the date, also referred to as accounts receivable. Investments: This refers to valuation of the organization’s stocks and bonds. The amount that should be recorded is the fair market value on the date that the financial statements are prepared. However, on a tax return, this amount can be the historical cost of the investments, the lower fair market value or historical cost, or the normal fair market value that is indicated on the financial statements. Expenses paid in advance for future service or prepaid expenses: These are costs paid in advance for receiving goods, services, or benefits for the organization. This type of asset will decline in value as the asset is consumed by the organization. The church’s fixed assets: This category includes all property and equipment owned by the organization. Fixed assets are generally not sold and the balance sheet does not reflect the fair market value of the asset or the cost of replacing the items. Instead, the fixed asset line item includes the net book value of the assets. The net book value is the historical cost of the long-term assets less depreciation. In general, fixed assets depreciate year to year as the organization records a non-cash depreciation expense or use of the item. This depreciation often follows the straightline method, which reduces the asset’s worth by equal increments over the estimated useful life of the asset. Balance Sheet Liabilities Accounts payable: This line item includes unpaid bills from vendors and creditors for goods and services delivered. If specific items such as wages, taxes, and grants are significantly large, they can be reported separately or integrated into this line item. Amounts owed for services rendered or accrued expenses Grants payable: These are grant amounts promised to individuals or other organizations. Refundable advances: This is also known as deferred revenue. Included in this line item are grants received from donors that are not considered or recognized as revenue because the conditions of the grant have not been met Dues to third parties: These are dues transferred to a third party through another organization. An example is United Way, a federated membership organization which acts as a transfer agent collecting contributions from one group and A MCC Resource for Treasurers US Edition disbursing the funds to a third party. The intermediary party has no power to change the recipient of the funds, so the funds are considered liabilities. Short- and Long-term debt: This is the principal and interest owed to a creditor. Examples of long-term debt are bank loans, mortgages, publicly traded bonds, or privately arranged debt financing. Balance Sheet Net Assets (Three Categories) Unrestricted: These are funds unrestricted by the donor. Temporarily restricted: These are funds that are limited by donor stipulations. These stipulations can either be met by the actions of the organization or expire over time. Permanently restricted: These funds are similar to temporarily restricted funds, but the donor stipulations do not expire over time or by the actions of an organization. An example of permanently restricted funds is the principle of an endowment. The principle of the endowment must remain intact into perpetuity Once a church has reviewed its assets and liabilities, it can address several important areas: solvency, resources, and outstanding liabilities. A church is solvent if the current (12 months or less) assets are greater than the current (12 months or less) liabilities. A good rule of thumb is to maintain a current ratio of 2:1, assets to liabilities. When liabilities are greater than assets, it is an indication that the church is in, or headed toward, severe financial problems. The second step in reviewing the balance sheet should be to look at the resources owned by the church. By reviewing its resources, a Board, with the Treasurer’s guidance, can determine if there are any assets that could potentially be used to supplement the payment of maturing debts. Finally, there should be careful scrutiny of what the church owes, especially with respect to determining when these outstanding liabilities are due. The Income Statement (Fig. 4) is a description of how the organization’s equity or operations (financial activities) have changed over a specific period of time. This change in net assets is expressed through the general equation: Revenues minus Expenses equals Change in Net Assets. This change in net assets reflects either a surplus or a deficit. The income statement is often referred to as the Income and Expense Statement or the Statement of Activity. The revenue portion of the income statement is generally divided into three categories: unrestricted, temporarily restricted, and permanently restricted funds. When a church receives funds—or revenues—it must determine the intent of the donor, which is then reflected and categorized under unrestricted, temporarily restricted, or permanently restricted funds. If a donor imposes a restriction on the funds, then the use of the funds is limited according to that donor’s request. However, the donor cannot ask for the return of the donation. A MCC Resource for Treasurers US Edition An asset can be moved from the temporarily restricted to the unrestricted column if the restriction is removed. Upon removal from the temporarily restricted column, an organization can use the funds as needed. Permanently restricted funds cannot be moved unless the time allotted for the funds expires or the full intent of donor is carried out by the organization (such as meeting all the donor’s stipulations). A donor may also impose a condition when donating monies. A donation is considered a liability until the condition is met as the donor requested. The money is considered a liability because the donation can be rescinded until the condition is met by the church. It cannot record the donation as revenue until the condition or liability is eliminated (i.e. a capital donation made to purchase a labyrinth). A MCC Resource for Treasurers US Edition Fig. 4 Income Statement Revenues Contributions: These are unconditional transfers of assets to a nonprofit, cancellation of a liability or settlement of a voluntary nonreciprocal transfer. This line item can include future unconditional promises to pay cash or other assets. Contributions are recorded at fair- market value when the gift is received. If contributions are paid in installments, the nonprofit can record only the amount A MCC Resource for Treasurers US Edition received, not the gross amount of the gift. The interest compounded over the length of the gift can be recorded as a gift to the organization. If the organization fears delinquency of payments, the organization can reduce the value of amount given by the anticipated defaults of payments. In-kind goods and services are not generally recorded on the Income Statement. Collections do not have to be recorded under revenues in certain situations, but in-kind professional services can be recorded if the service increases or creates a non-financial asset. Program service revenue: This is revenue generated when the church provides a service in exchange for cash or another asset. Miscellaneous income: This is revenue that is generated for miscellaneous services that the church provides. Special events revenue: This is revenue from special events (i.e., fundraising events) that are recorded separately from contributions. The church should record the gross revenue of the event and offset this amount by recording the costs associated under the line item for fundraising expenses. Investment income: This is income earned from the investment portfolio. This includes dividends on stock as well as interest on bonds. GAAP accounting requires that investment income includes changes in the market value of the investments. Income Statement Expenses Program expenses: These are costs for the delivery of goods and services that are associated with the church’s mission. Fundraising expenses: These are costs associated with publicizing and conducting fundraising campaigns. These may include: maintaining donor mailing lists, conducting special fund-raising events, preparing and distributing fund-raising manuals, and other activities involved in soliciting contributions or memberships. Administrative expenses: These are costs associated with general and managerial expenses such as oversight (i.e., salaries and benefits), business management, record keeping, budgeting, financing and related administrative activities. A Cash Flow Statement (Fig. 5) enables a nonprofit to determine where it spent its money and where the money came from. The cash flow statement is different from an operating statement because it reflects the cash situation of the church in its entirety, whereas the operating statement reflects a current given period of a church’s activities as reflected by their revenues and expenses. Cash flow statements can easily be prepared by analyzing the beginning balance sheet with the ending balance sheet covering a specific time period. Subtracting the beginning balance sheet from the ending balance sheet will indicate the changes in the balances for each period, also referred to as the cash flow for the church. Cash or gifts of any kind with a restricted purpose must be segregated from those that are general or unrestricted assets and from temporarily restricted funds. A MCC Resource for Treasurers US Edition Fig. 5 Cash Flow Statement Breakdown of Cash Flows Cash Flows from Operating Activities: This area details the unrestricted and temporarily restricted funding of the church. This includes unrestricted and temporarily restricted cash inflows and outflows. The main body of the BookGood A MCC Resource for Treasurers US Edition Nonprofit cash flow statement is an example of the direct method of accounting that restates the temporarily and unrestricted income on a cash basis. The reconciliation at the bottom of the figure is an example of the indirect method of accounting. This method begins with the change in net assets from the Statement of Activities (Income Statement or Operating Statement) and converts the amounts from the accrual method to cash basis accounting. Most nonprofits will utilize the indirect format to depict the church cash. Cash Flows from Investing Activities: This area depicts the cash inflows and outflows that arise from long-term assets and investments. Cash Flows from Financing Activities: This area depicts the church’s cash inflows and outflows from financing activities such as receipts and repayments to creditors or donors. This area is for permanently restricted funds that have a set of requirements that need to be completed by the church before the money may be used. When and church completes the three sections of the cash flow statement the net increase/decrease in income explains how the cash has changed during the given period of time and shows the current churchs current cash balance. A MCC Resource for Treasurers US Edition How To Prepare A Balance Sheet, Income And Expense Statement, And Statement Of Cash Flow Balance Sheet Preparation Income Statement Preparation Cash Flow Preparation How to Prepare a Balance Sheet (See Figure 3 above.) 1. Prepare a spreadsheet document to receive four columns of data―a text list with subsections “Assets,” “Liabilities” and “Fund balance” to the far left—and three columns of figures to the right 2. Summarize and subtotal all church assets. a. These will include all cash accounts, investment accounts and property that is on the church books. List these in the “Assets” section of the church balance sheet. b. Place the summarized figures in the second column from the left. c. Place a subtotal on the next line in the far right column and label this line “Total Assets.” d. Place a double underline on this figure; it represents the first half of the church balance sheet. 3. Summarize and subtotal all church liabilities. a. List these in the “Liabilities” section of the church balance sheet. b. Place the summary figures in the second column from the left. c. Place a subtotal on the next line, in the far right column of the balance sheet. 4. List your church’s fund balances in the “Fund Balance” section. a. The first line item in this section will be “General Fund”—consult your accounting records for a beginning general fund balance. b. The second line will be “Designated Funds”—take this figure from the “Total Designated Funds” line on the fund balances report you prepared in Section 2. c. The third line item will be “Excess Income Over Expenses.” This figure will be found at the bottom of your statement of income and expenses. d. Place all these figures in the column second from the right. e. Subtotal these figures in the far right column. Label this line item “Total Fund Balance.” Underline this figure. 5. Calculate the sum of “Total Liabilities” and “Total Fund Balance.” a. Place this sum at the bottom of your balance sheet, in the far right column; double underline this figure. b. This total should be exactly the same as the number under “Total Assets.” How to Prepare an Income Statement (See Figure 4 above.) A MCC Resource for Treasurers US Edition 1. Prepare a spreadsheet document to record a column of text descriptions to the far left and three columns of figures to the right. 2. Summarize and subtotal the church’s general fund income (undesignated donations) for the accounting period to be reported on the church financial statements. a. List these in far right column of the document under the heading “General Fund.” b. Place the summary figures in the second column from the right. c. Place a “Total Income” subtotal line directly beneath these, with the subtotal figure in the far right column. 3. Summarize and subtotal the church's expenses for the same period. a. List these in the far left column under the heading “Expenses.” b. Place the summary figures in the column second from the left. c. Group like expenses together, and place subtotals for each group of expenses in the column second from the right. d. Place a total of all expenses on a separate line labeled “Total Expenses,” with the amount in the far right column. 4. Calculate the difference between “Total Income” and “Total Expenses.” a. Place this amount in the far right column as a separate line item labeled "Excess Income Over Expenses.” How to Prepare a Cash Flow Statement (See Figure 5 above.) 1. Assemble all church accounting records showing cash disbursements and cash receipts for the accounting period being reported on the church’s financial statements. a. Verify that all bank accounts have been reconciled to church accounting records. 2. Record a beginning cash balance, then a summary of cash disbursements, a summary of cash income and, finally, an ending cash balance. a. More or less detail can be shown on the cash flow statement, depending on the preference of board members. 3. Prepare a fund balances report, listing all designated funds, a beginning balance, total debits and total credits, and an ending balance for each fund. a. A grand total of all designated funds will be at the end of the report. b. The report may also show the general fund balance. A MCC Resource for Treasurers US Edition References and Resources www.Dicitionary.reference.com www.investopedia.com www.Investorwords.com Microsoft Excel Spreadsheet http://en.wikipedia.org/wiki/Microsoft_Excel No Lo Law For All http://www.nolo.com/dictionary Wikipedia.org http://en.wikipedia.org *See Quick Reference Guide: How Debits and Credits Work A MCC Resource for Treasurers US Edition FORMS A MCC Resource for Treasurers US Edition Financial Operating Procedures (Sample 1) Church finances shall be under the ultimate direction of the congregation. The Finance Committee shall make monthly reports to the church. This Church shall be wholly supported by the voluntary tithes and offerings of members and friends of the church. This Church shall operate with a unified budget with one treasury. All funds received for any and all purposes must be accounted for by the Finance Committee. Financial statements will be made available to members each month. The fiscal year shall begin on January 1 and end on December 31. The Finance Committee shall begin the budget making process, drawing on the input of all the ministries and teams of the church. The Personnel Committee shall make recommendations concerning paid employees of the church. The Finance Committee shall present the budget to the Deacons and then to the church. Copies of the proposed budget shall be distributed to the church members at least one week prior to its adoption during the December business meeting. Once an expenditure is approved by inclusion into the church budget, no other approval is needed – unless due to the church being in a tight economy, the Finance Committee shall announce a need for prior approval of expenses. Designated funds must be approved by the church. No one may establish a "designated fund" simply by the giving. Requests for creating a new fund must first be submitted to the Finance Committee. If the proffered gift is outside the scope of the current budget or ministry of the church, they shall bring recommendations concerning the offer to the congregation for approval. No tangible property may be received by the church without first being accepted by the Finance Committee. Separate persons shall be responsible for having custody of church offerings. These persons will consist of money counters and a depositor. A minimum of three church members is required to count church offerings at any time. There will be a requirement of two signatories on all checks. There will be no staff members participating in the collecting, counting or depositing of church offerings. A MCC Resource for Treasurers US Edition All requests for reimbursements will be submitted on a "Request for Sundry Disbursement" form which will be submitted to the treasurer with the proper signature approvals. A MCC Resource for Treasurers US Edition Financial Operating Procedures (Sample 2) A. All financial accounts of _________ MCC will have al l members of the Board of Directors as signatories. In the event that the Treasurer performs the accounting functions of the church, the Treasurer shall not be a signatory on the account. B. The counting of all offerings will be done by two persons, as directed by the Board of Directors, and the offerings shall be deposited into the appropriate church bank account. C. Cash offerings shall not be used to cash personal checks. D. All requests for funding outside of the budget with the exception of designated gifts, shall be in writing and shall include a written detailed estimate. The funding is subject to Board approval and the Board shall determine the source account for the funding. E. An audit of the church’s finances shall be accomplished annually. Such an audit shall be conducted by an independent third party selected by the Board of Directors. F. A budget shall be prepared by the Finance Committee and presented to the Board of Directors at a regular Congregational Meeting annually and shall be approved by a simple majority. The budget may be changed as required at any Congregational Meeting. A MCC Resource for Treasurers US Edition Financial Operating Procedures (Sample 3) 1. Authorization for signatures necessary on contracts, checks, and orders for payment, receipt or deposit or withdrawal of money, and access to securities of ___ MCC shall be provided by resolution of the Board. 2. Any individual authorized to purchase goods and/or services for the ___ MCC shall follow the procedures set forth in these policies and the Internal Control Procedures Manual. 3. The finance committee shall be responsible for reviewing and recommending an annual operating and a capital budget to the Board for review and sending to the Congregational Meeting. 4. The Congregational shall be responsible for approving the annual operating and capital budgets. 5. No expense shall be incurred in excess of the total budgetary appropriations without prior approval of the Board. A MCC Resource for Treasurers US Edition Quick Reference Guide: How Debits and Credits Work in Accounting How Debits (Dr) and Credits (Cr) affect accounts: For Asset accounts, debits increase the balance and credits decrease the balance. For Liability accounts, debits decrease the balance and credits increase the balance. For Equity accounts, debits decrease the balance and credits increase the balance. For Income accounts, debits decrease the balance and credits increase the balance. For Expense accounts, debits increase the balance and credits decrease the balance. Account Type Debit Credit Asset + - Liability - + Equity - + Income - + Expense + - A MCC Resource for Treasurers US Edition