10_2013PTS_2013.10.21_Explanation for fluctuation in

advertisement

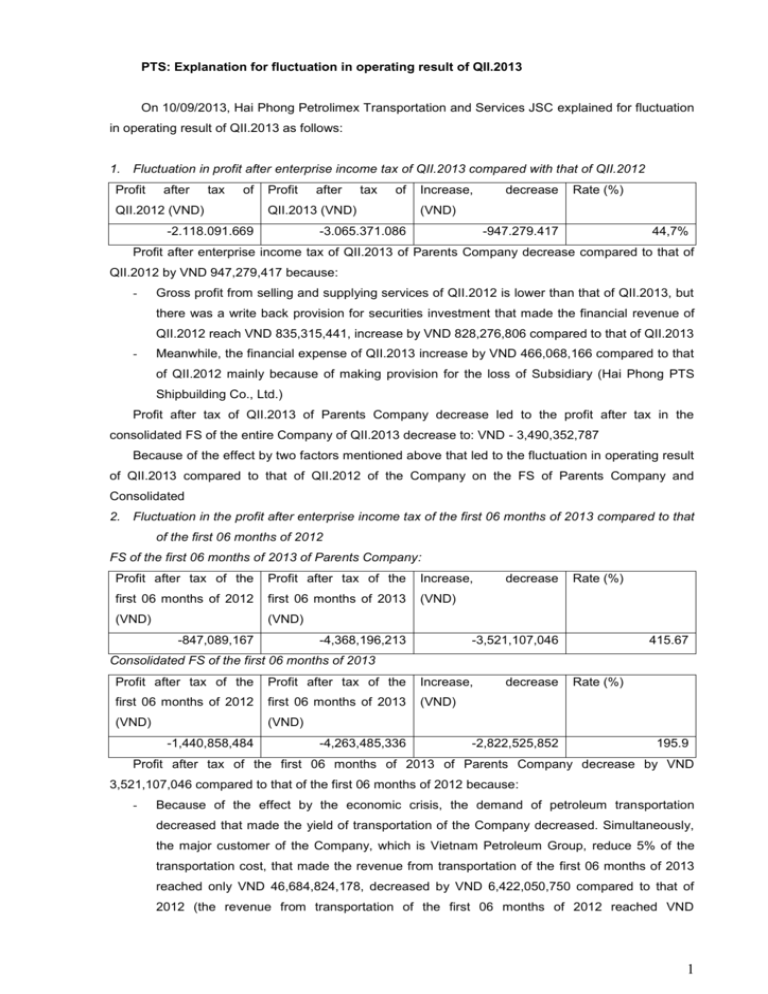

PTS: Explanation for fluctuation in operating result of QII.2013 On 10/09/2013, Hai Phong Petrolimex Transportation and Services JSC explained for fluctuation in operating result of QII.2013 as follows: 1. Fluctuation in profit after enterprise income tax of QII.2013 compared with that of QII.2012 Profit after tax of QII.2012 (VND) Profit after tax of QII.2013 (VND) -2.118.091.669 Increase, decrease Rate (%) (VND) -3.065.371.086 -947.279.417 44,7% Profit after enterprise income tax of QII.2013 of Parents Company decrease compared to that of QII.2012 by VND 947,279,417 because: - Gross profit from selling and supplying services of QII.2012 is lower than that of QII.2013, but there was a write back provision for securities investment that made the financial revenue of QII.2012 reach VND 835,315,441, increase by VND 828,276,806 compared to that of QII.2013 - Meanwhile, the financial expense of QII.2013 increase by VND 466,068,166 compared to that of QII.2012 mainly because of making provision for the loss of Subsidiary (Hai Phong PTS Shipbuilding Co., Ltd.) Profit after tax of QII.2013 of Parents Company decrease led to the profit after tax in the consolidated FS of the entire Company of QII.2013 decrease to: VND - 3,490,352,787 Because of the effect by two factors mentioned above that led to the fluctuation in operating result of QII.2013 compared to that of QII.2012 of the Company on the FS of Parents Company and Consolidated 2. Fluctuation in the profit after enterprise income tax of the first 06 months of 2013 compared to that of the first 06 months of 2012 FS of the first 06 months of 2013 of Parents Company: Profit after tax of the Profit after tax of the Increase, first 06 months of 2012 first 06 months of 2013 (VND) (VND) (VND) -847,089,167 -4,368,196,213 decrease Rate (%) -3,521,107,046 415.67 Consolidated FS of the first 06 months of 2013 Profit after tax of the Profit after tax of the Increase, first 06 months of 2012 first 06 months of 2013 (VND) (VND) (VND) -1,440,858,484 -4,263,485,336 decrease -2,822,525,852 Rate (%) 195.9 Profit after tax of the first 06 months of 2013 of Parents Company decrease by VND 3,521,107,046 compared to that of the first 06 months of 2012 because: - Because of the effect by the economic crisis, the demand of petroleum transportation decreased that made the yield of transportation of the Company decreased. Simultaneously, the major customer of the Company, which is Vietnam Petroleum Group, reduce 5% of the transportation cost, that made the revenue from transportation of the first 06 months of 2013 reached only VND 46,684,824,178, decreased by VND 6,422,050,750 compared to that of 2012 (the revenue from transportation of the first 06 months of 2012 reached VND 1 43,106,874,928), equivalent to the decrease of 14.9%. Meanwhile the price of materials increased (increase by 2.81% of revenue in particular) and a series of expense such as Social Insurance, Health Insurance, Unemployment Insurance, electric and water cost also increased that led to the ratio of COGS/revenue in this field increased by 3.66%, so the profit from this field decreased by VND 1,337,639,479 - Revenue from petrol trading of the first 06 months of 2013 reached VND 87,677,056,587, increase by VND 2,138,936,329 compared to that of the first 06 months of 2012 (The revenue from petrol trading of the first 06 months of 2012 reached VND 85,538,120,258), but in 2013, because the sale discount was reduced so the gross profit of this field reached only VND 1,540,630,532, decreased by VND 434,817,534 compared to that of 2012 (the gross profit from petrol trading of the first 06 months of 2012 reached VND 1,975,448,066) led to the profit from petrol trading decreased by VND 229,727,409. - Financial revenue of the first 06 months of 2013 is lower than that of 2012 is VND 612,492,532 because there is a write back provision for securities investment. - Financial expense of the first 06 months of 2013 increase by VND 280,081,868 mainly because of making provision for the loss of subsidiary. Profit after tax of the first 06 months of 2013 of Parents Company decreased led to the decrease of profit after tax on the consolidated FS of the Company 2