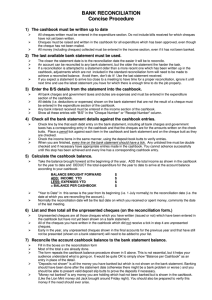

bank reconciliation procedure

advertisement

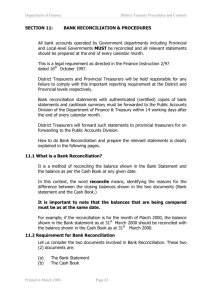

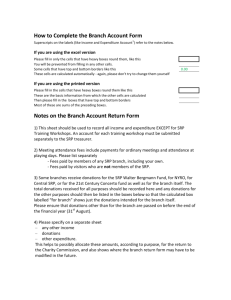

ABC Pty Ltd *SAMPLE ONLY* BANK RECONCILIATION PROCEDURE Purpose The purpose of a Bank Reconciliation is to reconcile the Bank Statement balance back to the Cashbook (or listing of cheques and deposits). WHO IS RESPONSIBLE: Accounting Support Team Members WHEN IS THIS NECESSARY: When Bank Statements need to reconcile with Cashbook Procedure Steps should be as follows: 1. Work from Bank Statements back to the Cashbook. (This is easier as the cheque numbers are out of sequence on the Bank Statements and are easier to cross reference back to the Cashbook where they are in sequence). 2. Take extreme care with the following reconciling procedures. Working from the Cashbook, cross check cheques presented on the Bank Statements back to the cheques listed in the Cash Book (or cheque listing sheet). Be careful to ensure that the amounts shown in the Bank Statement correspond exactly to the amounts shown in the Cashbook. If they do not agree, check with client. Place a small tick (or mark_ alongside the amounts as shown on both the Bank Statement AND the Cashbook, once you are satisfied they agree. This leaves a trail of the amounts that have been reconciled 3. Cross check receipts in Cashbook to deposits in Bank Statements. Again ensure amounts correspond. Total any outstanding deposits. Add up total deposits including any direct deposits or interest payments. 4. Photocopy current period Bank Statements 5. Photocopy current Period Cashbook or alternatively, write out a cheque listing from cheque butts and a deposit book for the current period. 6. Ensure the cash book is complete: Pick up and bank cheques or interest shown on the Bank Statements which may not have been included in the Cashbook. 7. Total and cross add all columns in the Cashbook. 8. Crosscheck all payments and receipts between the Cashbook and the Bank Statements. 9. After you have completed this exercise, your Cashbook and Bank Statements will be mostly covered with small ticks. 10. The amounts, which have no tick, in either the Cashbook or Bank Statement, are known as “Reconciling Items”. Page 1 of 2 533574575 ABC Pty Ltd 11. If a cheque is listed in the Cashbook, but is now shown on the Bank Statement, it is called an Unpresented Cheque. 12. If a Receipt is listed in the Cashbook, but now shown on the Bank Statement, it is called an Outstanding Deposit. 13. Add up payments from Cashbook and total. Add up any direct debits or bank charges from Bank Statements and add to payments total 14. Retrieve bank reconciliation balance from last bank reconciliation and use it as the opening cash balance. Add your receipts total and then minus your payments total. The figure calculated is your Cashbook Balance. 15. Retrieve bank balance at end o f period and use as bank balance. Subtract unpresented cheques (listed individually). The figure calculated should equal that of your Cashbook balance. For set format – refer to example attached 16. If not, repeat steps 3 – 6 to double check accuracy. USE PRO-FORMA SHEET IN WORKING PAPERS Page 2 of 2 533574575