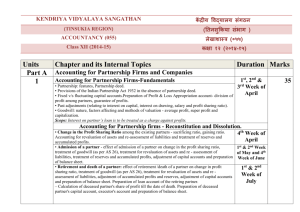

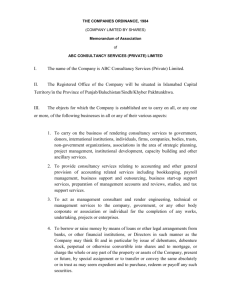

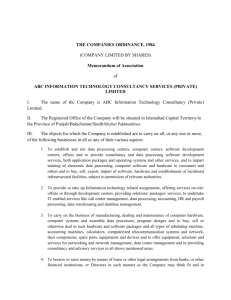

Information Memorandum

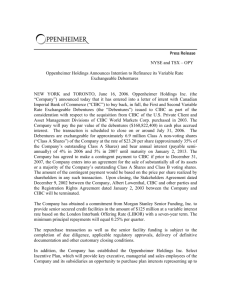

advertisement