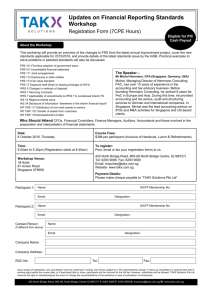

FRS 104

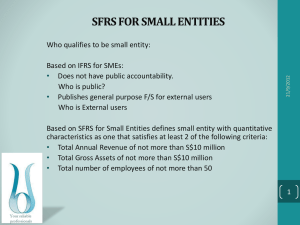

advertisement