ACT 4497 - the Sorrell College of Business at Troy University

advertisement

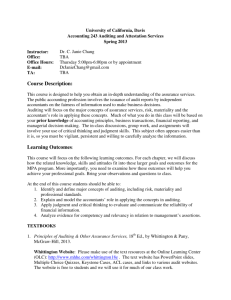

TROY UNIVERSITY SYLLABUS SORRELL COLLEGE OF BUSINESS ACT 4497 TAWA Auditing Summer 2012 Prerequisites ACT 3392. Description Auditing theory as contained in the official pronouncements with emphasis on professional ethics, audit engagement, internal control, audit sampling, evidence gathering, business cycles and auditors’ reports. Accounting majors must complete this course with a grade of C or better. Objectives On completion of the course, the student should be able to: 1. 2. 3. 4. Demonstrate an understanding of essential audit standards, objectives, compliance, and substantive procedures. Demonstrate an understanding of the professional guidance and issues related to the major facets of the attest function as it is performed by independent, internal, and governmental auditors. Demonstrate an understanding of the transaction cycles, revenue cycles, expenditure cycles, and cash balances. Demonstrate an understanding of professional ethics as it relates to the activities of independent auditors. Purpose To introduce students to the fundamental concepts of auditing. Approved Texts Boynton, W. C., & Johnson, R. N. Modern auditing: Assurance services and the integrity of financial reporting (8th ed. or current). Hoboken, NJ: Wiley. Supplements (Optional) AICPA (Current). Codification of statements on auditing standards. New York, NY: American Institute of Certified Public Accountants. Use the AICPA web site when you need additional reading materials. Mission & Vision Statements Troy University Mission Statement: Troy University is a public institution comprised of a network of campuses throughout Alabama and worldwide. International in scope, Troy University provides a variety of educational programs at the undergraduate and graduate levels for a diverse student body in traditional, nontraditional and emerging electronic formats. Academic programs are supported by a variety of student services which promote the welfare of the individual student. Troy University's dedicated faculty and staff promote discovery and exploration of knowledge and its application to life-long success through effective teaching, service, creative partnerships, scholarship and research. SCOB Mission Statement: Through operations that span the State of Alabama, the United States, and the world, Sorrell College of Business equips our students with the knowledge, skills, abilities and competencies to become organizational and community leaders who make a difference in the global village and global economy. Through this endeavor, we serve students, employers, faculty, and Troy University at large as well as the local and global communities. SCOB Vision Statement: Sorrell College of Business will be the first choice for higher business education students in their quest to succeed in a dynamic and global economy. Sorrell College of Business will create the model for 21st century business education and community service. School of Accountancy Mission Statement: The mission of the School of Accountancy is to advance the accounting profession by providing quality accounting education to both undergraduate and graduate students, publishing quality research and providing service to the professional community. We prepare students for successful careers with increasing professional and managerial responsibility in public accounting as well as government and industry and prepare undergraduate students for admission to graduate programs in accounting and business. Instructor: Stan Lewis, DBA, CPA, CFE, CCEA Office Location & Hours: 119 Bibb-Graves Hall. Weekly you may contact me in person during the following days and time periods: Monday –Thursday 9:30 a.m. - 10:30 a.m. I'm available by email at any time or by telephone during my office hours (US CST/CDT). Contact Information Telephone: 334-808-6164; 334-670-3136 (Administrative Assistant Ms. Patsy Brown); and 334-670-3592 (FAX). Email: sxlewis@troy.edu Class Location & Time: Bibb Graves Hall (BG) 222, 10:30 a.m. - 12:50 p.m. MTWTH Exams: There are three exams for the course. The dates are provided in the Course Schedule section (see below). Each exam will be closed book/closed notes and will consist of multiple choice questions. You may use a calculator and/or an English translation dictionary during the exam. You may not talk to other students during the exam. You must present a valid photo ID or the equivalent at the beginning of each exam. Assignments: These assignments are provided to you in the Course Schedule section below. Each assignment should be prepared in a style consistent with that used in your undergraduate accounting and business courses and with expectations for documentation that are found in the professional workplace. The senior assessment exam is a portion of the assignments in this course and is completed during the designated final exam period. You must present a valid photo ID or the equivalent at the beginning of the senior assessment exam. Grading Methods: Exams- 75 points (75 percent) divided among the listed exams. Assignments and the Senior Assessment Exam – 25 points (25 percent) Bonus Points – come from attendance, participation senior assessment exam & assignments. The Total Percent possible is 100 percent (the maximum percent that can be achieved is 100% by an individual). The Grading Scale used is: 90%-100% A; 80%- 89% B; 70%- 79% C; 60%- 69% D; and below 60% F Class Procedure and Requirements: Americans With Disabilities Act (ADA): The student will be expected to: (a) punctually attend all scheduled lectures (class periods). Students who arrive at class after roll call will be counted absent and (b) be penalized on assignments selected for bonus points. Any student whose disabilities fall within ADA must inform the instructor at the beginning of the term of any special needs or equipment necessary to accomplish the requirements for this course. Students who have or may be dealing with a disability or learning difficulty should speak with the instructor and contact the Office of Adaptive Needs Program at call 670-3221/3222. Various accommodations are available through the Adaptive Needs Program. Attendance Policy: Physical class meetings are part of this course; participation is expected and is integral to any bonus points available in the course. Make-up Work Policy: Missing any part of this schedule may prevent completion of the course. If you foresee difficulty of any type (i.e., an illness, employment change, etc.) which may prevent completion of this course notify the instructor as soon as possible. See “Attendance Policy,” above. Assignments - These are bonus points and are selected at random during class periods. Late submissions are not accepted for any reason. The Senior Assessment Exam is included in your Assignment points in the course. Exams – Not made up. I will average your other exam scores for the replacement of a missed exam less a 10% penalty. For a second exam missed that average less 20% becomes the replacement score. A third one – a zero is recorded. You may not use an average of the first two exams for the final or third exam. You must take the final exam or a grade of F will be recorded. A failure to take and complete the last or final exam will result in a course grade of F. Incomplete Grade Policy: Any incomplete work at the end of the term will not be accepted unless the student can provide acceptable and clear documentation prior to grades being submitted to the Registrar. Cheating Policy: If you are caught cheating, you will get a course grade of "F." See Student Handbook for the definition and university policy on cheating. Plagiarism is a form of cheating as is copying another’s assignments. Photo ID Required: For each exam and the senior assessment exam you must present a student ID or the equivalent. COURSE SCHEDULE: Dates May 29 – 31 June 4 – 7 Notations & Assignments Chapter 1 – Auditing and the Public Accounting Profession-Integrity in Financial Reporting Chapter 2 -Auditors Responsibilities and Reports Chapter 3 – Professional Ethics Chapter 4 – Auditor’s Legal Liability Chapter 5 – Overview of the Financial Statement Audit Assignment: Be prepared to discuss those related to these chapters Chapter 5 – Overview of the Financial Statement Audit Chapter 6 – Audit Evidence Chapter 7 – Accepting the Engagement and Planning the Audit Assignment: Be prepared to discuss those related to these chapters June 11 – 14 Exam 1: Chapter 1 – 7 Chapter 8 – Materiality Decisions and Analytical Procedures Chapter 9 – Audit Risk, Including the Risk of Fraud Chapter 10 – Understanding Internal Control Chapter 11 – Audit Procedures in Response to Assessed Risks: Tests of Controls Chapter 12 – Auditing Procedures in Response to Assessed Risks: Substantive Tests Chapter 13 – Audit Sampling Chapter 14 – Auditing the Revenue Cycle Exam 2: Chapters 8 – 14 June 18 – 21 June 25 Assignment: Be prepared to discuss those related to these chapters Chapter 15 – Auditing the Expenditure Cycle Chapter 16 – Auditing the Production and Personnel Services Cycles Chapter 17 – Auditing the Investing and Financing Cycles Chapter 18 – Auditing Investments and Cash Balances Chapter 19 – Completing the Audit/Post-audit Responsibilities Chapter 20 – Attest and Assurance Services and Related Reports Chapter 21 – Internal, Operational, and Governmental Auditing Exam # 3 – Chapters 15 – 21 (June 18) Assignment: Be prepared to discuss those related to these chapters Senior Assessment Exam (10:30am – 12:30pm)