Revenue Generation Report

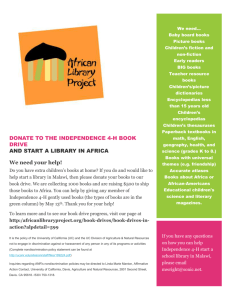

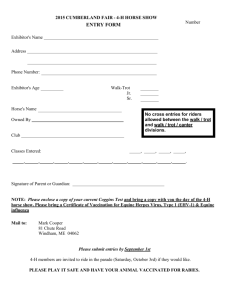

advertisement