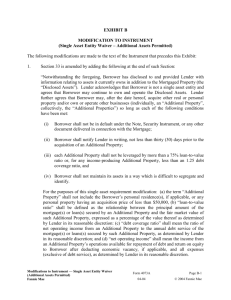

Sample Promissory Note and Related Documents

advertisement