Section I: About DFPS

advertisement

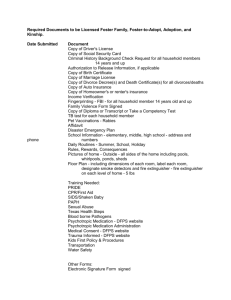

Texas Department of Family and Protective Services Client Services Contractor Reference Guide Last Updated 1/14/13 Texas Department of Family and Protective Services Contractor Guide, Page 1 V 1/14/13 Table of contents TEXAS DEPARTMENT OF FAMILY AND PROTECTIVE SERVICES ................ 1 SECTION I: ABOUT DFPS ........................................................................................................................... 3 Introduction.......................................................................................................................................... 3 DFPS Organization.............................................................................................................................. 4 SECTION II: OBTAINING A DFPS CONTRACT ............................................................................................. 5 Client Service Procurements................................................................................................................ 5 Procurement Methods .......................................................................................................................... 5 SECTION III: DFPS CONTRACT INFORMATION ........................................................................................... 8 DFPS Uniform Contract Terms and Conditions ................................................................................ 8 Incorporation by Reference ................................................................................................................. 8 Contract Document .............................................................................................................................. 8 Subrecipient Determination ................................................................................................................. 9 Methods of Payment............................................................................................................................11 DFPS Contracting Insurance Requirements .....................................................................................12 Administrative Responsibilities ...........................................................................................................12 Internal Controls .................................................................................................................................12 Internal Control Structure Questionnaire (ICSQ) .............................................................................13 Submitting an ICSQ ............................................................................................................................14 Equipment Purchases and Inventory Records for Cost Reimbursement Contracts .........................14 Procurement Management when Subcontracting .............................................................................16 Subcontracts ........................................................................................................................................16 Historically Underutilized Business (HUB) Program........................................................................18 Background Checks ............................................................................................................................19 Reporting .............................................................................................................................................19 Complaint Reporting ...........................................................................................................................19 Single Audit Requirements .................................................................................................................20 Accounting and Financial Systems and Records ...............................................................................22 Records Retention ...............................................................................................................................23 Contracts That Require Matching Funds ..........................................................................................24 Billing ..................................................................................................................................................25 Receiving Payment ..............................................................................................................................27 Changing Your Contract ....................................................................................................................27 Changes to your contract may consist of the following methods: .....................................................28 SECTION IV: DFPS MONITORING ..............................................................................................................30 Contract Monitoring ...........................................................................................................................30 Monitoring Findings ...........................................................................................................................31 Corrective Action.................................................................................................................................31 Collection.............................................................................................................................................31 Adverse Action/Contract Dispute Resolution .....................................................................................32 Vendor Performance Tracking System ..............................................................................................32 Texas Department of Family and Protective Services Contractor Guide, Page 2 V 1/14/13 Section I: About DFPS Introduction The Texas Department of Family and Protective Services (DFPS) developed the Contractor Reference Guide (Guide) in an effort to provide a source of financial, programmatic, and compliance requirements for potential and current contractors. The Guide references applicable federal and state laws, rules, policies, and billing requirements, as well as information about various procurement and contracting procedures and expectations. Contractors doing business with DFPS should use this Guide for assistance in meeting the requirements as referenced above, and to better understand the department's procurement and contracting processes. It is recommended that contractors make the Guide available to all staff members who have responsibility for program or service implementation and/or financial management. Laws, regulations, contract terms and conditions, and incorporated DFPS policies take precedence over the information in this Guide in the event of any conflict or contradiction between the Guide and: The DFPS procurement document; The DFPS contract; Federal/state laws and regulations; or Incorporated DFPS policies. The objective of this Guide is to provide an overview of procurement and contracting information and is not intended as a comprehensive review of all applicable state law(s) or a substitute for legal counsel by a licensed attorney. The information provided in this Guide is subject to change without notice at any time. An Overview of CPS and A Guide to Contracting for Residential Child Care Services was created for contractors providing residential care for children. Texas Department of Family and Protective Services Contractor Guide, Page 3 V 1/14/13 DFPS Organization DFPS serves children, families, the elderly, and people with disabilities throughout the State. The mission of DFPS is to protect children, the elderly, and people with disabilities from abuse, neglect, and exploitation by involving clients, families, and communities. We work to accomplish our mission through four programs: 1) 2) 3) 4) Child Protective Services (CPS); Adult Protective Services (APS); Child Care Licensing (CCL); and Prevention and Early Intervention (PEI). The mission of DFPS and the goals of the CPS, APS, CCL and PEI programs are supported through a wide variety of contracted goods and services. DFPS purchases goods and/or services for direct client use or benefit, as well as for support services. DFPS defines purchased client services as the services provided by outside entities under contract. As indicated on the map below, there are 12 DFPS regions throughout the State, with the state office (Region 12) located in Austin. Visit the DFPS website to obtain further information on: DFPS Contracting Policies and Forms; The CPS, APS, CCL, and PEI programs; Residential Child Care Contracts (RCC); Detailed information on each region throughout the state; The DFPS Council; Statistics and annual reports; The DFPS state plan; and Other DFPS information. Texas Department of Family and Protective Services Contractor Guide, Page 4 V 1/14/13 Section II: Obtaining a DFPS Contract Client Service Procurements DFPS develops, administers, and procures in a manner that ensures both the interests of the client and the department are achieved. Procuring client services involves various DFPS staff, including subject matter experts who purchase the client services, utilize the client services, and manage the client service contracts. Functions of the subject matter expert(s) include: Identification of client service needs; Identification of the most appropriate method to procure the needed services; and Selection of the contractor or contractors whose bid or proposal for the services requested meets the client needs and provides the best value for the citizens of Texas. DFPS procures contracts as required by state purchasing laws and department rules and policy. Factors that influence the procurement method may include: Total dollar value of the procurement; Complexity of the procurement; Number of potential contractors; Number of contracts to be awarded; Whether factors other than price or cost will be considered; and If negotiations will be required. Procurement Methods DFPS utilizes several methods to procure client goods and services. The most common methods are: Small Purchase - is used to purchase goods or services when the total dollar amount in a service delivery area is not anticipated to exceed $25,000 in any fiscal year and $100,000 in the aggregate over the life of the contract. The life of the contract includes the initial contract period and any subsequent renewals or modifications. Provider (Open) Enrollment (PEN) - is a noncompetitive method of procurement where all providers that meet qualifications or criteria for the requested service will have the opportunity to contract with DFPS. These contracts are open to any potential applicant who establishes through acceptable means (such as licensure or certification) that they meet all service standards Texas Department of Family and Protective Services Contractor Guide, Page 5 V 1/14/13 and agrees to all terms and conditions set forth in the contract, including the established rates. Provider enrollment is generally used to purchase client services when the following conditions apply: Services are readily available throughout a region of the state or similar services are available under equitable standards throughout the state; DFPS has the freedom to choose and obtain services through any applicant qualified to perform the services; Services are those for which the applicant can be required to meet defined, accepted standards (including state licensure and/or certification) before enrollment; and An equitable standard unit cost can be established for all contracts for the same service. Competitive Negotiation/Request for Proposals (RFP) - is a procurement method in which DFPS publicly solicits responses to the RFP. Negotiations are conducted with one or more of the respondents after which DFPS awards either a unit rate or cost-reimbursement contract, as appropriate. The RFP process may be used when the following conditions exist: The service to be purchased cannot be quantified and specified in terms of price alone; Applicable law, rule, or regulation authorizes negotiation; Respondent is expected to provide innovative ideas; and More than one potential contractor is capable of submitting a proposal. When RFP is chosen as the procurement method by DFPS: If the solicitation specifications permit, the respondent may suggest alternate or improved service delivery methods or products because the specifications outlined by DFPS in the RFP are general in nature; A committee evaluates all responses received using pre-determined evaluation criteria; After the evaluation, DFPS awards a contract to one or more responsive respondents who after evaluation are shown to be responsible and have the best value offer consistent with the terms and conditions of the RFP. Multiple awards must meet requirements in 1 TAC §391.171; and Negotiation of price or service is allowed within the limits of the solicitation document. Competitive Sealed Bids/Invitation for Bid (IFB) - is used to publicly solicit sealed bids from interested bidders when requirements can be clearly, accurately, and completely described. Texas Department of Family and Protective Services Contractor Guide, Page 6 V 1/14/13 The IFB process may be used by DFPS when the following conditions exist: The requirements are clearly defined; Negotiations are not necessary; Price is the major determining factor for selection and Sufficient competition is expected. When IFB is chosen as the procurement method by DFPS: There is no ability for the bidder to suggest alternate or improved service delivery requirements; All bids received are opened at the same time, read aloud, and recorded; DFPS awards the contract to the responsible bidder providing the lowest price within the pool of responsive offers; There is no negotiation of price or service; and DFPS may choose not to award a contract if none of the bids submitted represent best value to DFPS. Noncompetitive Negotiation - is used to noncompetitively solicit a response from one or more respondents. DFPS may only use noncompetitive negotiation when the award of a contract is not feasible under competitive means or when exempted by statute or Office of Management and Budget (OMB) Circular A-102. DFPS staff members conducting a noncompetitive procurement are required to obtain a formal waiver from competitive procurement requirements before proceeding. Interagency and Interlocal Contracts - are other contracting methods that use Interagency Agreements as authorized by the Interagency Cooperation Act and Interlocal Cooperation Contracts to work with other state and local entities to accomplish DFPS goals. Electronic State Business Daily - opportunities to participate in DFPS competitive procurements (RFPs and IFBs) and provider enrollments (PENs) are posted on the Comptroller’s Electronic State Business Daily (ESBD). Additional information on doing business with the state of Texas can be found at the Comptroller’s Window on State Government Procurement. Texas Department of Family and Protective Services Contractor Guide, Page 7 V 1/14/13 Section III: DFPS Contract Information DFPS Uniform Contract Terms and Conditions Contracts with DFPS are governed by the DPFS Uniform Contract Terms and Conditions, 2282UTC. It is the responsibility of the contractor to become familiar with and understand the terms and conditions in the contract, including state and federal citations. Questions related to contract terms and conditions should be forwarded to your respective contract manager. Incorporation by Reference Rather than include all contract related documents in the contract, DFPS may incorporate them by reference. Specific information, documents, or forms will be detailed in the Incorporation by Reference section of the contract. These documents are maintained on file with DFPS and are required to be on file with the contractor. Contract Document In addition to the uniform terms and conditions, DFPS contract documents usually include: The procurement document which contains the statement of work Performance measures* Budget documents, if cost reimbursement The contractor's response, if applicable Required forms and attachments, which may include: o Form 2031; Signature Authority Designation o Form 4732; Request for Determination of Ability to Contract o Form 9003; Child Support Certification o Form 2030; Budget for Purchase of Client Services (cost reimbursement contracts) o Budget Narrative (cost reimbursement contracts) o Form 9007; Internal Control Structure Questionnaire (ICSQ) or Internal Control Certification (ICC) The contract may include a requirement for the contractor to self- report performance measure data to DFPS. The Performance Management Evaluation Tool (PMET) is a web based electronic system to be used by identified contractors to self-report data for performance measures. Only contractors Texas Department of Family and Protective Services Contractor Guide, Page 8 V 1/14/13 required to self-report data for performance measures are allowed to access the system. Subrecipient Determination Prior to contract execution, DFPS staff will determine whether the relationship with the contractor is classified as a vendor or subrecipient, based on the services to be provided. This classification will determine which rules and regulations will apply to the contractor. Characteristics that may indicate a subrecipient relationship are the following: The contractor determines client eligibility to receive services/benefits. The contractor’s performance is measured by whether the federal or state program objectives are met. The contractor has responsibility for programmatic decision making. The contractor has responsibility for adherence to applicable federal or state program compliance requirements. The contactor carries out all or part of a program. The principle purpose of the contract is to carry out a public purpose of support authorized by law. In those programs where the contractor is considered a subrecipient, DFPS, the contractor, and any subcontractors must meet all federal/state requirements and statutes pertaining to the Single Audit Requirements. Subrecipient contractors are required to have a single audit, as applicable (visit: OMB Circular, A-133 for single audit requirements and information). DFPS contractors providing the following services are considered subrecipients: Community Youth Development Community Based Child Abuse Prevention Community Based Family Services Family Strengthening Post-Adoption Services Program Evaluation Recruitment Services Services to At-Risk Youth Single Source Continuum Statewide Youth Services Network Tertiary Prevention Services Texas Families: Together and Safe Title IV-E (CW - Financial) funded services Title IV-E (Legal) funded services Youth Resiliency Unaccompanied Refugee Minor Texas Department of Family and Protective Services Contractor Guide, Page 9 V 1/14/13 Note: State agencies are not considered subrecipients. Characteristics that may indicate a vendor relationship are the following: The contractor provides goods and services within its normal business operations. The contractor provides similar goods and services to many different purchasers. The contractor operates in a competitive environment. The contractor is not subject to federal compliance requirements. The contractor provides goods and services that are ancillary to the operation of the program. The primary purpose of the contract is to deliver goods and services for the direct benefit of the client. Contractors providing the following DFPS services are considered vendors: Adoption Counseling Services - APS Child Placing Agency Claims Processing Community and Parent Group County Staff Contribution Court Ordered Supervised Visitation Drug Testing Emergency Client Services Family Group Decision-Making Family-Based Services Family-Based Safety Services GRO Basic Child Care GRO Emergency Shelter GRO Therapeutic Camp Homemaker Home Screening, Reports, and Assessment Services Intensive Psychiatric Transition Program Intermittent Alternate Care Interstate Compact for Placement of Children Medical and Mental Health Assessments Non-Financial Residential Care Parent/Caregiver Training Preparation for Adult Living Program Directed Purchases Programmatic Consultation Psychological Services Texas Department of Family and Protective Services Contractor Guide, Page 10 V 1/14/13 Purchase Order for Placement Services Residential Child Care Service Levels System Title IV-E (Child Welfare – Non-Financial) Training and Technical Assistance Treatment Services Methods of Payment DFPS utilizes three primary methods of payment for client service contracts, which are described below. Rates specific to the 24 Hour Residential Child Care Rates are set by the Health and Human Services Commission (HHSC) and are updated biennially. The rates are available by visiting: http://www.dfps.state.tx.us/PCS/rates_childcare_reimbursement.asp. 1) Fee for Service Contractors are paid an established fee per defined unit of service. Rates are established internally and may be negotiated with the contractor and may apply only to that specific contract. An independent rate setting process does not exist for the contracted service. 2) Rate Based Contractors are paid at a pre-determined rate or fee per unit of service as established through a formal rate setting process. Established rates typically apply to multiple contractors who provide the services. a) Blended Foster Care Rate The blended foster care rate is the HHSC developed rate equal to the weighted average rate across all placement types that DFPS pays under a Single Source Continuum Contract for each day of service provided to a child or youth in paid foster care. b) Blended Foster Care Case Rate The blended foster care case rate is the rate paid under a Single Source Continuum Contract as measured against an established average length of stay baseline formula for each defined age category or "strata" of children/youth. DFPS applies the blended foster care case rate at the final stage of foster care redesign implementation in order to incentivize better outcomes for children/youth with rewards and remedies. Texas Department of Family and Protective Services Contractor Guide, Page 11 V 1/14/13 c) Exceptional Foster Care Rate An exceptional foster care rate applies to a limited number of days under a Single Source Continuum Contract where a child requires extraordinary care. The exceptional foster care rate is developed using historical costs of delivering similar services, where appropriate data are available, and estimating the basic types of costs of products and services necessary to deliver services meeting federal and state requirements. 3) Cost Reimbursement Contractors are reimbursed for allowable budgeted expenses incurred and paid in the provision of services which are consistent with the terms of the contract. DFPS Contracting Insurance Requirements DFPS may require insurance coverage to mitigate losses to safeguard the department and our clients. Depending on the specific aspects of the services or goods, the required insurance coverage may include: Commercial General Liability Insurance Sexual Abuse and Molestation Insurance Crime policy with a third party endorsement and employee dishonesty endorsement Professional Liability Insurance Business Automobile Liability Insurance including owned, hired, and nonowned vehicles. Administrative Responsibilities Internal Controls Every contracting entity should have an adequate system of internal controls to make certain that: Functions are segregated; Purchases and other transactions are appropriately authorized and made; Financial data are promptly and accurately recorded; and Assets are safeguarded. An entity derives its internal controls from the policies, procedures, and practices it develops and implements to: Texas Department of Family and Protective Services Contractor Guide, Page 12 V 1/14/13 Ensure financial responsibility; Reduce the opportunity for errors or dishonest acts to occur; and Detect errors or dishonesty. The extent to which internal controls are established or needed depends on the nature and size of the organization involved. A contractor’s system of internal controls should include the four major concepts listed and explained below. These explanations illustrate the principles involved in developing an adequate internal control environment. 1) Segregation of Functions - The segregation of functions or duties is an important element in any system of internal control. For accounting control purposes, incompatible functions are those that place any person in a position to both perpetrate and conceal errors or irregularities in the normal course of her/his job. For example, anyone who records disbursements could either intentionally or unintentionally fail to record a transaction. If the same person also reconciles the bank account, the omission could be concealed through a false or inaccurate reconciliation. 2) Proper Authorization - Controls ensuring that transactions are carried out as authorized require independent verification. This may be accomplished by an independent comparison of transactions with specific authorization documents. For example, requiring two signatures on a check allows more than one person to review and approve that expenditure. 3) Proper Recording of Transactions - Accounting controls as described in the Accounting and Financial Systems and Records section below. 4) Limited Access to Assets - Limiting access to assets to only those individuals having direct responsibility for them can be an important control in the safeguarding of those assets. Choosing the personnel to whom asset access is authorized should be guided by the asset’s purpose and its susceptibility to loss. Internal Control Structure Questionnaire (ICSQ) DFPS designed the ICSQ as a questionnaire to assess each contracting entity’s ability to detect fiscal errors and to reduce the opportunity for dishonesty. The ICSQ is composed of several different sections which may include some or all of the following: Financial Position - Financial statements; ongoing concerns Texas Department of Family and Protective Services Contractor Guide, Page 13 V 1/14/13 General/Accounting Controls - File maintenance, record keeping; cash receipts, cash disbursements, authorization of expenditures, financial record keeping, safeguarding of assets; and federal/state regulations. Personnel - File maintenance; cash disbursements; record keeping; and federal/state regulations Travel - Cash disbursements; file maintenance; federal/state regulations and record keeping Equipment - Cash disbursements; federal/state regulations, record keeping; and safeguarding of physical assets and physical inventory Subcontractors - Subcontracts and federal/state regulations Related-Party Transactions - Related-party transactions; conflict of interest; and federal/state regulations Level of Care Payments (applicable only to ICSQ for Residential) Payments made for residential child care services; and record-keeping Foster Care Maintenance Payments (applicable only to ICSQ for Residential) - Payments made to foster families for residential child care services; and record-keeping Submitting an ICSQ The appropriate ICSQ will be sent by the contract manager or can be obtained by visiting our Website at: http://www.dfps.state.tx.us/PCS/About_PCS/contracting_procurement_forms.asp The ICSQ must be completed and returned by the due date set by the contract manager. The contract manager maintains the ICSQ on file. An Internal Control Certification (ICC) form is required every two years, however, at the contract manager’s discretion, a new ICSQ may be requested more frequently. An ICC form or new ICSQ helps to ensure internal controls information is current and applicable to the contract. Because the ICSQ assesses the contractor's ability to detect or reduce fiscal errors and to reduce the opportunity for dishonesty, it is crucial that the entity ensure that the ICSQ is accurate and the appropriate sections are complete. Equipment Purchases and Inventory Records for Cost Reimbursement Contracts Purchases of Equipment or Other Capital Expenditures Prior approval must be obtained from DFPS when contractors determine the need to purchase equipment or make capital expenditures of $5,000 or more when DFPS funds are involved in such purchases. The contract manager must Texas Department of Family and Protective Services Contractor Guide, Page 14 V 1/14/13 review the request to ensure the purchase is reasonable, necessary and meets applicable contracting regulations, and route for appropriate internal approval. Equipment purchased through the contract is owned by the contractor but subject to an equitable claim by the state and the federal government upon contract closure or termination. Contractors are accountable for equipment purchased through the contract. Contractors must bill equipment according to federal regulations found in 45 CFR Part 74 and the OMB Circulars. DFPS retains the right to final disposition of any equipment purchased using DFPS contract funds. During the close out of the contract the contractor must: Receive DFPS approval prior to disposing of the equipment or controlled assets prior to the end of the useful life of an item; Return the value of the equitable claim on the equipment vested in the state and federal government to DFPS; Return DFPS's share of the equipment if the sale of equipment option is used; and Adhere to the American Hospital Association’s (AHA) “Estimated Useful Lives of Depreciable Assets” methodology used for establishing the useful life of equipment, except when federal or statutory requirements supersede. Disposition is at the discretion of DFPS. Disposition depends upon the value, condition, and amount of equipment and whether the equipment can be used to further serve DFPS clients, the state, or a federal program. DFPS may agree to transfer the equipment to serve another DFPS program or contract, if need is identified. Inventory Records Contractors are required to maintain inventory of equipment purchased with DFPS funds. The inventory system may include the equipment's serial or model number or tagging with its own numbering system. Since the equipment does not belong to DFPS, contractors should not tag the equipment as "State of Texas" or DFPS property. In maintaining inventory records, including the purchase of equipment, in whole or in part with DFPS funds, the records must accurately indicate the following: A description of the equipment; An equipment identification number which may include the manufacturer's serial number, model number, Federal or national stock number, or other identification number; Funding source of the equipment; Acquisition date and cost; Texas Department of Family and Protective Services Contractor Guide, Page 15 V 1/14/13 Percentage(s) of the cost of the equipment allocated to each funding source(s); Location and condition of the equipment and the date the information was reported; Unit acquisition cost; and Ultimate disposition data, including date of disposal and sales price or the method used to determine the current fair market value. Procurement Management when Subcontracting When it is determined that subcontracting will be a component to ensure service delivery, contractors must establish written policies and procedures governing the procurement of the services. The contractor’s procurement policies and procedures are subject to review by the DFPS contract manager to ensure the services are being procured per contract requirements, the contractor’s practices, and in a cost effective manner. Contractors may refer to http://www.window.state.tx.us/procurement/pub/contractguide/ for guidance on the development of policies and procedures. Considerations to be included in the awarding of the subcontract should include, but are not limited to, the following: Ability/qualifications of the respondent to provide the service; Overall experience, including historical performance of the respondent; and Financial, technical, and staff resources of the respondent. As the lowest cost is not necessarily the best value when awarding subcontracts, contractors should review detailed information by visiting this link: http://www.window.state.tx.us/procurement/pub/contractguide/ to obtain information regarding best value determination. All procurement activities must be in compliance with OMB Circular A-110, paragraphs 43-48 (for Institutions of Higher Education, Hospitals, and Other Non-Profit Organizations) or OMB Circular A-102 (for State and Local Governments), as applicable. Subcontracts DFPS may allow a party contracting with DFPS (primary contractor) to use subcontracts to provide a part or all of the services procured by the Department under a prime contract. No subcontract will relieve the contractor of its responsibility for ensuring the requested services are provided. DFPS retains the right to refuse or allow subcontracting by primary contractors. Texas Department of Family and Protective Services Contractor Guide, Page 16 V 1/14/13 DFPS contract staff review and assess the primary contractor's performance in maintaining and following its subcontracting policies and processes to meet all the terms and conditions identified in the contract. All service-related subcontractors must meet the same contractual requirements as the primary contractor and the primary contractor remains responsible for compliance with and performance of all its duties and obligations under its contract with DFPS. All activities associated with subcontracts must go through the primary contractor. If a subcontract is used to deliver any or all of the work required under a contract, the following conditions apply: Contractors must identify the proposed subcontractors to DFPS in a manner agreeable to DFPS contract staff. Subcontracting will be solely at the contractor’s expense. DFPS retains the right to check the subcontractor’s background and approve or reject the use of submitted subcontractors. Contractor will be the primary contractor for DFPS and contractor will determine a designated point of contact for all DFPS inquiries. Contractor must include a term in all of its subcontracts that incorporates the prime contract by reference and binds the subcontractor to all of the requirements, terms, and conditions of the contract related to the service being provided by the subcontractor, as well as explicitly holds that the contract controls in the event of any conflict with the subcontract. Use of any subcontractor is conditioned upon the extent that any subcontract does not conflict with any requirements of the contract between DFPS and contractor. Programs may have specific subcontracting requirements and contractors are encouraged to contact the designated DFPS contract manager for all applicable subcontracting requirements under a DFPS contract. Monitoring Subcontractors The primary contractor is responsible for contract monitoring and coordinating efforts to obtain resolution for substandard performance. When monitoring the primary contractor, fiscal transactions may lead DFPS contract managers to review documents that substantiate payments made to subcontractors which are maintained by the primary contractor. To verify the services provided and payments made, the DFPS contract manager may inquire about case specific documentation such as progress notes, treatment plans, other necessary client information and financial documentation. A DFPS subcontracting review should primarily focus on a primary contractor's ability to ensure a subcontractor meets required minimum qualifications to Texas Department of Family and Protective Services Contractor Guide, Page 17 V 1/14/13 perform and meets the standards fixed by the prime contract and its attached plans of operation. The DFPS primary contractor is responsible for oversight of a subcontractor’s fiscal, programmatic, or administrative performance. The primary contractor must formally monitor the fiscal, programmatic, and administrative performance of its subcontractors. The primary DFPS contractor must have a monitoring plan in place prior to the occurrence of monitoring. This plan should include: Written policies and procedures that can be inspected upon request; A process or method for documenting review of billings submitted by the subcontractor that include, sampling transactions prior to payment, validating the accuracy of billing and receiving, validating and maintaining support documentation prior to payment; A process or method for validating services rendered prior to payment of the subcontractor's invoice; Payment of the subcontractor's bill within ten (10) calendar days of Contractor's receipt of funds from DFPS; and A process to document and share monitoring results with DFPS and the subcontractor, as well as corrective actions and necessary follow up with the subcontractors. It is recommended that primary contractors evaluate the risk of its subcontractors by considering at a minimum the three risk factors consistent with DFPS's process: Harm to clients; Inadequate services; and Diverted resources. Historically Underutilized Business (HUB) Program The State of Texas HUB program is in place to encourage the development of businesses that historically have not had the opportunity to compete for and be awarded contracts for goods and services. Requirements: The DFPS HUB program administrator reviews all client service and administrative procurements with an expected contract expenditure to be $100,000 or greater over the life of the contract to determine if subcontracting is probable. If subcontracting is probable, the respondents will be required to submit a HUB Subcontracting Plan (HSP) with their response. Texas Department of Family and Protective Services Contractor Guide, Page 18 V 1/14/13 After award, the contractor must maintain business records documenting its compliance with the approved HSP and will be required to submit monthly progress reports to the contract manager and HUB program administrator. Documentation of the contractor’s compliance will be maintained by DFPS. Good Faith Effort: Contractors who subcontract, but are not required to have a formal HSP are encouraged to make every effort to contact HUBs when obtaining bids for goods/services necessary to carry out their DFPS contract. Background Checks To ensure the safety of our clients, background checks must be conducted concerning criminal history and DFPS abuse/neglect history on potential and current contractors, their employees, subcontractors and volunteers. The below Background Check Policy provides guidance and detailed procedures created for DFPS contract staff, but will serve as a reference for the assessment of background checks related to contractors and contract staff. The policy also references the requirements in the Child Care Licensing Policy and Procedure Handbook as well as the requirements for residential operations as outlined in 40 Texas Administrative Code Chapter 745, Subchapter F. Detailed information can be obtained by clicking on each of the bulleted subjects: DFPS Purchased Client Services Background Check Policy DFPS Automated Background Check System (ABCS) User Guide PCS Background Check Criminal History Chart PCS Background Check DFPS History Chart Reporting Contractors must submit service delivery reports, self-evaluations of performance and any other report according to DFPS reporting requirements. Reports must be submitted in the format and according to the timeline required by the contract. Complaint Reporting It is required that the contract manager notify the contractor when a complaint has been received. A determination is made whether the contract manager will conduct a review of the complaint, or coordinate with the contractor to review the complaint and require a response to the complaint. If required, the contractor must respond in writing within five (5) business days of receiving the complaint notice; unless otherwise indicated in the contract. The notice will be documented Texas Department of Family and Protective Services Contractor Guide, Page 19 V 1/14/13 in the client file, as well as maintained in a centralized "Complaint" file by the contractor. The contractor's written response must include: Name and title of person completing the review; Contact information for the person responsible for the review; Date complaint was received by contractor; Service provider's name who is the subject of the complaint; Client information will include: Name; Date of birth; Program ID number; and Caseworker name, if applicable Date of the incident, if known; Allegation(s); Detailed account of the review actions and findings; and Corrective actions taken, if applicable. Single Audit Requirements A single audit is a coordinated, formal review of an organization's financial statements and internal controls, as well as compliance with federal regulations that govern federal financial assistance programs. An independent Certified Public Accountant (CPA) must conduct the single audit. DFPS subrecipients must have a single audit conducted if the following expenditure thresholds are met during the subrecipient's fiscal year: Any contractor expending a total of $500,000 or more in federal funds from DFPS and any other funding source as stipulated in OMB Circular A133. Local governments or non-profit organizations expending a total of $500,000 or more of any state funds under federal block grants from DFPS and any other funding source in accordance with the provisions of the State of Texas Single Audit Circular as stipulated by Section IV of the Uniform Grant Management Standards. DFPS Responsibilities OMB Circular A-133 and the State of Texas Single Audit Circular list specific information that a pass-through entity (DFPS) must provide to subrecipients. To ensure compliance with this requirement, the DFPS single audit liaison will mail Federal and/or State Funding Reports which include Catalog of Federal Domestic Assistance (CFDA) numbers to each Texas Department of Family and Protective Services Contractor Guide, Page 20 V 1/14/13 subrecipient contractor. Subrecipients with fiscal year reporting periods ending between January 1 and August 31 will receive reports in October. Subrecipients with fiscal year reporting periods ending between September 1 and December 31 will receive reports in February. Subrecipient Responsibilities Subrecipients will receive a letter from the Health and Human Services Commission Office of Inspector General (HHSC-OIG) prompting the contractor to complete the on-line Single Audit Determination (SAD) form. If the SAD form determines that a single audit is required, contractors must submit a single audit report to the address indicated below within nine months of the end of the subrecipient’s fiscal year, or 30 days after the completion of the single audit, whichever is earlier. Attn: Ann Gauntt, Lead Auditor Texas Health and Human Services Commission Office of the Inspector General Compliance/Audit Mail Code 1326 P.O. Box 85200 Austin, Texas 78708-5200 Subrecipients must also send a copy of the annual single audit report to the DFPS contract manager. Subrecipients must follow up on single audit findings and be responsive to HHSC-OIG notices of non-compliance letters. Contractors that do not submit SAD forms or required A-133 Audits in a timely manner may be subject to contract sanctions. Reimbursement for Single Audit The cost of a single audit may be allowable for reimbursement by DFPS, and reimbursement is coordinated through the assigned contract manager. Subrecipients may not include the single audit costs allocable to their DFPS contract in the contract budget or incorporate the allocable cost into a unit rate. It is important to note that required single audit costs are paid outside of the contract through the use of a State of Texas purchase voucher. Costs that are not conducted in accordance with OMB Circular A-133 and/or UGMS Single Audit Circular requirements will not be reimbursed. The contract manager will request an estimate and supporting documentation of the pro rata amount that the subrecipient plans to bill to DFPS. This amount may Texas Department of Family and Protective Services Contractor Guide, Page 21 V 1/14/13 be negotiated, to ensure DFPS is billed its fair share, especially if the subrecipient is subject to single audit requirements based on award of state and/or federal funds from other entities in addition to DFPS. Single audit costs will be reimbursed only if: Funding is available and reimbursement is permitted by applicable funding sources; HHSC finds the audit to be acceptable; and If the single audit is required and the audit and reimbursement request follow DFPS policies and procedures. Financial Responsibilities It is DFPS’s responsibility to ensure funds are expended according to the contract terms and state and federal laws and regulations. DFPS holds its contractors to a high level of financial accountability, where contractors must establish financial management systems that maintain information necessary to assure DFPS that funds are used in the manner as intended. Accounting and Financial Systems and Records A contractor’s accounting system must conform to Generally Accepted Accounting Principles (GAAP) applicable to recipients of state and federal funds and comply with UGMS, Subpart C, Section 20 – Standards for Financial Management Systems if applicable. An effective accounting system will: Identify and record all valid transactions; Record transactions to the proper accounting period in which transactions occurred; Describe transactions in sufficient detail to permit proper classification; Maintain records that permit the tracing of funds to a level of detail that establishes that the funds have been used in compliance with contract requirements; Adequately identify the source and application of contract funds; and Generate current and accurate financial reports in accordance with contract requirements. Accounting records must identify, assemble, classify, record and report an entity’s transactions and maintain accountability for the related assets and liabilities. Minimum records must include: Texas Department of Family and Protective Services Contractor Guide, Page 22 V 1/14/13 Books of Original Entry that include the following journals and ledgers: Cash disbursements journal Cash receipts journal General journal Payroll journal Payroll expense distribution (of each employee) for each pay period to support journal entries General ledger (with control accounts and sub-ledgers as applicable) Permanent Records that include the following documents: Individual employee earnings records Bank statements and canceled checks Original vendor invoices and supporting documentation such as price quotes, authorization, purchase orders, receiving reports, etc. Executed contracts Accounts payable detail Accounts receivable detail Payroll authorizations, W-4's (employee federal income tax withholding information form), job descriptions, confidentiality statements, applications, transcripts, I-9's (proof of citizenship) and other related documents Individual employee time sheets Journal entries - including all documentation and calculations necessary for understanding and independent evaluation A contractor must allow DFPS and all relevant federal and state agencies or their representatives to inspect, monitor, or evaluate accounting records. The contractor and its subcontractors must make these documents available at reasonable times and for reasonable periods. Records Retention Contractors must maintain legible copies (whether in electronic or other formats) of the contract and all related documents and records for a minimum of five (5) years after the later of: The termination date of the contract; The last date on which the contractor rendered any services related to the contract; or The date of final resolution of any litigation or dispute involving the contract. Texas Department of Family and Protective Services Contractor Guide, Page 23 V 1/14/13 Upon request, contractors must provide legible records and information in compliance with DFPS's instructions that may include: Forwarding records and information concerning a DFPS client, within 14 calendar days after the request; and Any necessary records and information upon verbal request in emergency situations. Contractors must keep DFPS files and information, including clients' sensitive personal or protected information, secure and confidential. This includes information in any format (e.g., electronic or paper). If there is a breach of security regarding clients' sensitive personal information or DFPS confidential information, or if that information is lost or stolen due to contractors' purposeful action, or willful, reckless, or negligent conduct, contractors must: Notify their DFPS contract manager; and Notify the affected clients. The definitions of the above conduct are below for your reference. Purposeful action—The actor purposefully committed an act, expressly intending the resulting harm. Knowing or willful conduct—The actor knew that an act would certainly result in harm, but did not specifically intend to commit the particular harm that resulted. Reckless conduct—The actor knew that the act had an unjustifiable risk of leading to a certain result, but did not care about that risk ("reckless disregard"), and acted anyway. Reckless conduct is functionally equivalent to gross negligence. Negligent conduct—The actor did not intend to cause the result that happened, but failed to exercise reasonable care to prevent the result. Negligent conduct includes failing to become aware of the risk of that result. Contracts That Require Matching Funds Some DFPS programs require that the contractor provide matching funds. Match must comply with requirements found in the applicable OMB circulars. Matching funds may require a cash outlay, such as all or a portion of a staff person’s salary, although “in-kind” match may be allowable for certain contracted programs. In-kind matching funds may include, but is not limited to, volunteer hours (see OMB Circulars A-110, for calculation of costs for this item), donated building space, donated materials and supplies, donated professional services and so on. In-kind match may also include depreciation and use fees for buildings or Texas Department of Family and Protective Services Contractor Guide, Page 24 V 1/14/13 equipment purchased before the start of the contract period and used in the program. Such fees qualify as an in-kind contribution only when based on established cost and depreciation records maintained by the contractor. In-kind matching funds may not be: Included as match for any other program, whether that program be federally funded, funded by DFPS, or another entity; or Paid with federal monies from another program. In-kind matching funds must be: Necessary and reasonable for proper and efficient accomplishment of project or program objectives; Allowable under the appropriate cost principles; and Applicable to the period to which the matching requirement applies. In-kind matching funds should be supported by the following: A full description of the item or service If building space, a statement of the value per square foot of the area, along with the rationale for the determination of that value The name of the contributor The dates when the donations were made, along with a description of the donation or services performed on each date The fair market value of the contribution and the rationale for the determination of that value In the case of a discount given, the contributor’s signature on an affidavit of worth and a statement that the discount is based on the nature of the project and is not available to the general public Match should be verifiable by detailed and complete records, and must be shown in the contractor’s budget. If match is required by the contract, those costs are subject to DFPS monitoring as per the guidelines for monitoring other budgeted costs. Cost items entered as match not required by the contract may also be subject to DFPS monitoring. Billing For Cost Reimbursement Contracts, bills or claims for services should be submitted within: 30 days from the last day of the month in which the expense was paid; or 30 days from the last day of the month in which the service was provided, in the case of fee for service/unit rate contracts; or Texas Department of Family and Protective Services Contractor Guide, Page 25 V 1/14/13 According to the time frame as stated in the contract. Expenses are incurred at the time a service is provided, but should not be billed to DFPS until after the cost of the item/service has been both incurred and paid. In no case should billing for items/services cross contract periods. For example, if the contract period is September through August and an item/service is provided in August but the cost is not paid until September, the cost of the item should be billed as an August expense to avoid billing/paying for an item/service provided in one contract year with funds from the next contract year. Billing forms completed by the contractor will include some or all of the following, depending on the type of service provided: Form 4116x, Purchase Voucher Form 2014, Purchased Services Expenditure Report Form 2016, Delivered Services Input (supplemental to pre-bill) Pre-bill for Delivered Services forms (generated by the Form 2054 Service Authorization) Monthly billing summary document(s) Other billing forms may be applicable, depending upon the specific program. The contract manager will provide detailed information on completion of the billing forms, and any required supporting documentation. After the billing or claim is submitted to DFPS, it is reviewed for accuracy, completeness, and appropriate signatures. When approved, the billing or claim is then signed by appropriate staff and processed for payment. It is essential that contractors complete the billing forms correctly. Billings must be accurate in all aspects before the reimbursement can be processed. If no errors are noted, the Information Management Protecting Adults and Children in Texas (IMPACT) system validates and approves the billing, electronically sends the information to the Health and Human Services Administrative System (HHSAS), and finally to the Comptroller of Public Accounts for payment. Most payments are made by direct deposit to the contractor’s bank account. There are some programs where billing and payment processes have not been converted to the IMPACT system. For these programs, billings are submitted to the designated staff and are reviewed and approved. Billings are forwarded to and reviewed by the DFPS fiscal and budget divisions and, if no errors or questionable items are noted, are sent on to the Comptroller of Public Accounts for payment. DFPS staff may find it necessary to require a contractor to resubmit a billing when problems with expenses previously disallowed or other problematic Texas Department of Family and Protective Services Contractor Guide, Page 26 V 1/14/13 situations have been resolved. Rebilling should be completed and submitted as soon as all issues are resolved. These claims should be clearly marked Rebill. A contractor may find it necessary to submit a supplemental bill or claim when additional expenses are identified and a claim for the month the expenses were paid has already been submitted. Supplemental claims must be submitted immediately upon discovery of the additional expense and within the required timeframe. Contractors should make every effort to avoid submitting multiple supplemental claims for the same month, and all secondary billing should be clearly marked Supplemental and numbered within the affected month. To verify correct travel billing, contractors should visit Travel Reimbursement Rates, a website maintained by the Texas Comptroller of Public Accounts (CPA), as guidance for the State of Texas and state employees. 40 Texas Administrative Code §732.243 allows contractors to reimburse their travel expenses at the same rate as state employees. When submitting time or activity sheets for billing, contractors should use the OMB circulars and 40 Texas Administrative Code §732.240(i)(1) as guidance to verify that their time sheets are in compliance. An example of an acceptable time sheet can be found here. Receiving Payment If billings for cost reimbursement contracts have no errors, processing takes a minimum of 2-3 weeks after receipt and approval by appropriate staff. Billings that are problematic and require corrections take longer to process, as do billings that are processed manually. For residential childcare, payment processing occurs through the IMPACT system and usually takes approximately 1 week. The Texas Government Code Chapter 2251 provides for automatic interest on payments to contractors for goods and services if the payment is not made in a timely manner. This law requires DFPS to document the date that a correctly completed billing is received from a contractor. This date generates a prompt payment date that is used to calculate the interest due on the payment if reimbursement is made more than 30 days past that date. Changing Your Contract For some types of contracts, DFPS may make limited modifications to a contract to meet unanticipated needs at any point during the life of the contract. Either the contractor or DFPS may identify the need for such a change to be made. Most post-award changes to contracts require a documented request and prior written approval. Texas Department of Family and Protective Services Contractor Guide, Page 27 V 1/14/13 Any post-award contract change must be within the scope of the original procurement. If the change requested is outside the scope of the procurement the request will be denied or a new procurement is required. Examples of changes that may be outside the scope of the procurement include: Providing new or additional services that were not described in the original procurement; or Providing services in geographic areas not defined in the original procurement. The procurement and contract documents serve as the guides in establishing whether or not a change is allowable. Changes to your contract may consist of the following methods: Plan Changes Plan changes are administrative changes within the established scope of the contract that do not affect the contract's essential terms and program objectives. DFPS may authorize a plan change to revise the plan of operation, performance measures, the budget narrative, or an authorized transfer of funds between line items of the budget established in the contract. Applicable methods of requesting a plan change may include an email, letter, or other written documentation to support the administrative change. The proposed plan change must incorporate the following elements: Name of individual requesting the change; Contract number; Date when the request is submitted; Modified budget pages if appropriate; and Requirements for Programmatic and Fiscal Plan Changes are described below. Requirements for Programmatic Plan Changes: o Must obtain prior approval from DFPS; and o Cannot affect the essential terms and programs objectives. Requirements for Fiscal Plan Changes for Contracts over $100,000: o For line item transfers reaching a cumulative amount of 10% or greater for the fiscal year budget, will require: Prior DFPS approval; Copies of modified budget pages, as requested; Subject to applicable cost principles; Texas Department of Family and Protective Services Contractor Guide, Page 28 V 1/14/13 Contract managers to review and respond to the budget change within 30 calendar days of receipt. o No prior approval required when line items transfers have not reached the 10% threshold. Contractor must notify DFPS in writing within 30 days of line item transfers. Requirements for Fiscal Plan Changes for Contracts under $100,000: o No prior approval required, unless applicable by federal/state costs principles in the OMB Circulars or UGMS; o Contractor must notify DFPS in writing within 30 days of line item transfers; o Transfers must abide by applicable cost principles and regulations; and o Changes not requiring DFPS approval are subject to disallowances. Amendments/Renewals A bilateral amendment is used to incorporate substantive changes into an existing contract or change an essential term of a contract. If needed, contact your contract manager to initiate an amendment to your contract. A unilateral amendment is used to make an administrative change to an essential term in the contract. Examples include: a correction to a clerical error, new or revised Federal or State laws affecting the contract terms, or to comply with a court order. The unilateral amendment is signed by the contract manager and provided to the contractor within ten (10) days notice prior to execution of the revision. A contract renewal may be used to extend the term of an existing contract. Contract renewals take the form of a bilateral amendment to modify the terms and conditions of the existing contract, but do not alter the scope of the procurement. Consequently, renewals cannot cause the total contract period to exceed limitations established within the procurement, contract document, or any applicable statutes or department rules. The original contract and procurement must include a provision that allows a contract to be renewed in order for a renewal to take place. Texas Department of Family and Protective Services Contractor Guide, Page 29 V 1/14/13 Section IV: DFPS Monitoring Contract Monitoring Contract staff periodically monitor contracts to ensure: Contractual goals and objectives are on target to be met; Funds are expended appropriately; and Compliance with state and federal regulations. The goals of monitoring are to: Find opportunities to work with the contractor to improve service provision; Ensure that expected outcomes are met; Assess progress toward meeting program goals; Ensure compliance with regulations/policies; and Manage and mitigate risk. On an annual basis, each contract is assessed and evaluated for risk using the Risk Assessment Instrument (RAI). Risk is defined as the measurement of the likelihood that a contractor’s goals and objectives will or will not be achieved according to the terms of the contract. The results of the RAI are a factor in determining whether the contract will be monitored during the contract year. Risk factors that may indicate potential risk are: High dollar amount; Amount of funding expended by subcontractors; Payment type (cost reimbursement, fee for service, rate based); Multiple contracts with governmental entities; Significant changes in key personnel within the past year; or Subrecipient status. Contract staff conduct programmatic, fiscal, and administrative monitoring. Programmatic monitoring focuses on determining the contractor’s adherence to items such as: plan of operation, statement of work, programmatic service delivery, performance measures, eligibility, client files, and ensuring that client needs have been met. Fiscal monitoring focuses on ensuring that contractors maintain the financial records necessary to adequately account for the use of funds and that costs are reasonable, allowable, and properly allocated to the program. Texas Department of Family and Protective Services Contractor Guide, Page 30 V 1/14/13 Administrative monitoring is conducted in conjunction with either the programmatic or fiscal monitoring review. The administrative monitoring may consist of reviewing personnel records including: ensuring background checks, I-9 documentation, and appropriate training are all conducted in accordance with the contract terms. Monitoring Findings Findings found during the monitoring review will be addressed in a formal monitoring report. The contract manager will provide a timeline for the contractor to provide additional documentation in order to substantiate overturning a finding. When findings are not overturned, contractors are required to provide a corrective action plan as indicated in the monitoring report. The contract manager must approve the contractor's plan to resolve each documented finding. Follow-up activities may be determined necessary to correct identified deficiencies. If a contractor fails to respond adequately or complete a required corrective action plan, adverse action may be taken by contract staff. Corrective Action Contractors may be required to implement a corrective action plan in order to resolve findings resulting from the monitoring review. The contractor, in coordination with the contract manager, is primarily responsible for the development of the corrective action plan. In certain situations, the contract manager may insist on specific actions being included in the plan. The contract manager will follow up to determine actions identified in the plan that have been taken and that deficiencies have been or are on target to be corrected. A corrective action plan must contain: Description of the finding/deficiency which must be corrected; Criteria for the completion of the corrective action plan; Description of how to address the deficiency; A method for determining when the plan is successfully completed; and Identification of staff that is responsible for the requirements of implementing, reviewing, and the overall outcome(s) of the plan. Collection During routine contract management functions, billing reviews, and monitoring activities there maybe indication that DFPS has overpaid contractors due to Texas Department of Family and Protective Services Contractor Guide, Page 31 V 1/14/13 improper billing, accounting practices, or failure to comply with contract terms. Determination of overpayment(s) and disallowed previous cost(s) will be verified based on federal, state, and local laws and rules, department procedures, contract provisions or statistical data compiled from paid claims. When the determination of overpayment has been verified, the contract manager will initiate the collection process to recover the overpayment. The contractor will be notified in writing of the discrepancies which resulted in the overpayment, the method of computing the dollar amount to be refunded, as well as other actions DFPS may take. Collection methods may include one of the following: Adjustment of a future invoice; Repayment of the full amount by check or money order made payable to DFPS; or Establishment of a DFPS pre-approved repayment plan, depending on the circumstances. Adverse Action/Contract Dispute Resolution Adverse action is any action in which DFPS, before the contract expiration date, denies, terminates, or suspends a contract or payments to a contractor. Refusing to place children with a contractor, disallowing previous costs, or collection of improper payments is considered an adverse action. Contract managers have the responsibility for making reasonable attempts to keep contractors informed of compliance issues and resolving, whenever possible, compliance issues through corrective action before formal adverse action becomes necessary. In certain circumstances, DFPS is not required to implement corrective actions before taking an adverse action. The contractor will be sent a notice of adverse action. The notice will include information on the contractor's noncompliance with the provisions of the contract or other basis for the adverse action. The notice also will inform the contractor that it has the right to contest the adverse action by sending a written request to the DFPS representative identified in the notice. Contract dispute resolution is a term that refers to a number of processes that can be used for resolving a contract dispute without having a state or federal judge or jury decide the dispute in a trial. DFPS contracts require that the dispute resolution process described in Chapter 2260 of the Texas Government Code be used to resolve contract disputes. Vendor Performance Tracking System Texas Department of Family and Protective Services Contractor Guide, Page 32 V 1/14/13 The Texas Comptroller of Public Accounts (CPA) maintains a Vendor Performance Tracking System (VPTS) and state agencies are required to provide information regarding a contractor’s performance, in accordance with Texas Government Code §2155.073-77. VPTS provides the state procurement community with a comprehensive tool for evaluating vendor performance to reduce risk in the contract award process. DFPS will report unsatisfactory vendor performance on contracts and purchases of $25,000 and greater to CPA through the VPTS. Texas Department of Family and Protective Services Contractor Guide, Page 33 V 1/14/13