Daily Closing and Balancing Procedures 11.8.05 (post date 2/12

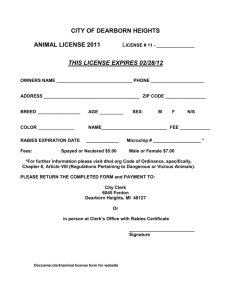

advertisement

TAXATION AND REVENUE DEPARTMENT DAILY BALANCING, REPORTING & SUBMISSION OF PAYMENT REQUIREMENTS TABLE OF CONTENTS March 2016 Revised (11/8/05) TABLE OF CONTENTS SECTION 1: INTRODUCTION TO BALANCING / AUDITING PROCEDURES INTRODUCTION ……………………………………………………………………………………………………………………………..3 BALANCING / AUDITING PROCEDURES ……………………………………………………………………………………….3 OTHER NOTES AND REQUIREMENTS. ………………………………………………………………………………………….5 REFERENCES …………………………………………………………………………………………………………………………………….6 SECTION 2: OPENING PROCEDURES INTRODUCTION ………………………………………………………………………………………………………………………………8 OPENING PROCEDURES ………………………………………………………………………………………………………………….8 SECTION 3: CLOSING PROCEDURES INTRODUCTION ……………………………………………………………………………………………………………………………..10 CLOSING PROCEDURES………………………………………………………………………………………………………………….10 PREPARING THE DAILY CASH BALANCE SHEET ………………………………………………………………………….11 RECONCILE CASH TO TRANSACTION REPORT …….……………………………………………………………………12 OVERS AND SHORTS ………………………………………………………………………………………………………………………13 CLOSING OUT REPORTS ………………………………………………………………………………………………………………..14 PREPARING THE BANK DEPOSIT ………………………………………………………………………………………………….14 REFERENCES ……………………………………………………………………………………………………………………………………15 DAILY CASH BALANCE SHEET ……………………………………………………………………………………………………...16 SECTION 4: PROCEDURES FOR PREPARATION & SUBMISSION OF PAYMENT DOCUMENTS INTRODUCTION ……………………………………………………………………………………………………………………………..18 ENVELOPE PREPARATION FOR CASH CONTROL ………………………………………………………………………...18 DOCUMENT PREPARATION FOR CASH CONTROL ENVELOPE …………………………………………………..19 ENVELOPE PREPARATION FOR IMAGE PROCESSING …………………………………………………………………..20 DOCUMENT PREPARATION FOR DRIVER TRANSACTION ENVELOPE ………………………………………21 ENVELOPE PREPARATION FOR DRIVER TRANSACTIONS …………………………………………………………...22 DOCUMENT PREPARATION FOR VEHICLE TRANSACTION ENVELOPE …………………………………….23 ENVELOPE PREPARATION FOR VEHICLE TRANSACTIONS …………………………………………………………24 1 TAXATION AND REVENUE DEPARTMENT INTRODUCTION TO BALANCING / AUDITING PROCEDURES March 2016 Revised (11/8/05) TABLE OF CONTENTS INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -3 BALANCING / AUDITING PROCEDURES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .-3 OTHER NOTES AND REQUIREMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5 REFERENCES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6 2 TAXATION AND REVENUE DEPARTMENT INTRODUCTION TO BALANCING / AUDITING PROCEDURES March 2016 Revised (11/8/05) INTRODUCTION State statute requires that all department employees or agents for the department remit all funds collected on a daily basis. As a clerk you are responsible for ensuring that you collect the correct fees for processed transactions on behalf of the state. This means that you are responsible for the cash, checks and all other funds you collect. You must balance your drawer at the end of each day to the transactions that you process. As a manager, supervisor or assigned clerk, you are responsible for ensuring that all clerks balance their cash to the daily transactions. You are also charged with ensuring that all funds are deposited as required by statute. This means that you must deposit all funds received by your office no later then the close of the next business day (24 hours). This not only includes making the deposit or remitting payment to the department but also remitting all supporting documents for the transactions processed for that day to the department by the close of the next business day. You are also charged with insuring that the transactions are processed properly. You must audit your clerks and ensure that the transactions have been processed correctly and funds have been collected properly. This section discusses the balancing and auditing procedures as well as other employee notes and requirements. BALANCING / AUDITING PROCEDURES Clerk Each clerk is responsible for the daily balancing of his or her cash drawer and all paperwork is to be organized as described in the closing procedures. Manager As the office manager, supervisor or assigned clerk, you are responsible for Supervisor or verifying the cash with each clerk, reconciling the daily transactions to the Assigned Clerk deposit and making the deposit on a daily basis. You are also responsible for the daily auditing of the clerks work. All voids and no-fee corrections must be approved by a manager or supervisor. As the office manager or supervisor, you are responsible for reviewing all clerks’ work to ensure that they did not void a transaction or process a no-fee correction without proper approval. Systems is in the process of creating secure “void and no-fee correction” passwords for all managers and supervisors, as well as a dropdown menu of reasons for voiding a transaction or processing a no-fee correction. 3 TAXATION AND REVENUE DEPARTMENT INTRODUCTION TO BALANCING / AUDITING PROCEDURES March 2016 Revised (11/8/05) Until Systems has completed that process, use the MVD-provided spreadsheets. To facilitate ease of verifying that all voids and transactions had been approved by a manager or supervisor, create a daily void spreadsheet and no-fee correction spreadsheet for each employee. This is what you will use to compare each clerk’s individual transaction report against. The extent of the daily audit will depend on several factors: New employee: The manager should take extra time with a new employee’s work to ensure that the employee understands the transactions he/she is performing. The manager should go through the work line by line until he/she is satisfied that the new employee is completing all work within department guidelines. Repeated failure to balance: The manager should take extra time when he/she notices a pattern of over/short by the employee. Whether the employee has been there one year or ten years, failure to balance could mean there is something wrong and the employee’s work should be reviewed line by line. Large or busy office: The size of an office or a large number of customers should not deter you from completing “quick” audits on every employee. When there is time you can perform a more thorough audit, but every employee’s work should be reviewed daily. WHAT TO LOOK FOR: 1. 2. 3. Do random transaction research: Pick one or two transactions and check the system to see if the information has been updated on the system. Form Review: Review forms for signatures, ensure all fields are completely filled in and any supporting documentation is attached. Make sure all numbers on forms are in numerical order: If a form is missing, an explanation must be submitted in its place. Use a blank sheet of paper and record the missing form number, write a brief explanation of what happened and include the name of the bureau chief or OIG employee that you reported it to, for microfilming. 4 TAXATION AND REVENUE DEPARTMENT INTRODUCTION TO BALANCING / AUDITING PROCEDURES March 2016 Revised (11/8/05) OTHER NOTES AND REQUIREMENTS CLERK Transactions must be keyed as they are received. Transactions should never be held until the end of the week or until there is “enough” to key. You must never process a transaction for anyone who is going to come by and pick it up and pay later. All voids and no-fee corrections must be approved by a manager or supervisor. Conversion of state funds for personal use is illegal. Therefore, money from your drawer should NEVER be borrowed and returned even if it is the same day. You may never convert a personal check for cash or make change from your own cash drawer for any reason. Failure to comply with any of the procedures as required will result in disciplinary action by the department and/or civil or criminal prosecution. Manager All reports must be reconciled and all corrections must be made prior to printing Supervisor the final Revenue Summary and All Clerk’s Transaction Summary Reports for the Assigned Clerk day. If applicable, all samba users must transmit their report at the end of the day. There should be a report for every day of the week, even if it is a zero report and there were no transactions. The daily deposit must be made at the end of the day or no later then the close of the next business day per statute. A check or deposit slip (direct deposit accounts) must be remitted to Cash Control for that day’s transactions at the end of the day or no later then the close of the next business day. The check or deposit must balance to the Revenue Summary Report and All Clerk’s Transaction Reports. Conversion of state funds for personal use is illegal. Therefore, money should NEVER be borrowed and returned even if it is the same day. 5 TAXATION AND REVENUE DEPARTMENT INTRODUCTION TO BALANCING / AUDITING PROCEDURES March 2016 Revised (11/8/05) You may never convert a personal check for cash or make change from your own cash drawer, the daily deposit or any other office funds for any reason. Failure to comply with any of the procedures as required will result in disciplinary action by the department and/or civil or criminal prosecution. REFERENCES Appointment of agents; termination: Motor Vehicle Code [66-2-14. NMSA 1978 Subsections A & B] Agents or Department Employees to remit money received; bonds for agents or department employees: Motor Vehicle Code [66-2-15 NMSA 1978] Administrative service fees; collection; remittance; payment; optional service fees; appropriation: Motor Vehicle Code [66-2-16. NMSA 1978 Subsection A, B, C & E] Motor Vehicle suspense fund created; receipts; disbursements: Motor Vehicle Code [66-6-22.1 NMSA 1978 Subsection B & D] 6 TAXATION AND REVENUE DEPARTMENT OPENING PROCEDURES March 2016 Revised (11/8/05) TABLE OF CONTENTS INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -8 OPENING PROCEDURES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .-8 7 TAXATION AND REVENUE DEPARTMENT OPENING PROCEDURES March 2016 Revised (11/8/05) INTRODUCTION Each clerk is responsible for ensuring that his or her beginning cash allotment stays in balance. Although the cash allotment is verified when the drawer is balanced at the end of the day, the clerk should also balance the allotment prior to opening for the day. In order to ensure that the clerk is prepared to start the day, he or she should also insure that all forms, titles, and supplies are available. OPENING PROCEDURES Clerk The cash allotment must be counted and verified before beginning the day. If the beginning cash allotment does not balance to the correct total that should be in the drawer, the clerk must report this to his or her supervisor regardless of the amount prior to opening for the day. All forms, titles and supplies should be available before opening for the day. Manager If the clerk’s cash does not balance to the allotted cash, the supervisor must file Supervisor or an incident report. Assigned Clerk 8 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) TABLE OF CONTENTS INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -10 CLOSING PROCEDURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .-10 PREPARING THE DAILY CASH BALANCE SHEET. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11 RECONCILE CASH TO TRANSACTION REPORT. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12 OVERS AND SHORTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13 CLOSING OUT REPORTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 PREPARING THE BANK DEPOSIT. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 REFERENCES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15 DAILY CASH BALANCE SHEET. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16 9 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) INTRODUCTION This section was created to assist you in closing out your daily transactions, balancing your cash to your transaction reports and preparing your daily deposit. Please note that you are required to deposit daily and submit your reports and payments no later then the close of the next business day to the department as required by statute. Failure to comply with any of the procedures as required will result in disciplinary action by the department and / or civil or criminal prosecution. CLOSING PROCEDURES Clerk At the end of each day you must balance your transactions for that day to the cash, checks and credit card transactions in your drawer. You should make sure all documents are in order. Title applications and Driver’s license applications must be sorted in numerical order from lowest to highest for microfilming. Bundle your daily work with a rubber band and give it to the manager, supervisor or assigned clerk at the end of the day. The work should be in the following order: All supporting documents for driver transactions including any voids. Action Update Documents with supporting documents Penalty Assessment Documents. Supporting documents should be with the transaction they support. Driver License Application. Supporting documents should be with the transactions they support. Any other supporting documents related to driver transactions. All supporting documents for vehicle transactions including any voids. Miscellaneous Applications with supporting documents. Boat applications. Supporting documents should be with the transaction they support. Vehicle Title Applications. Supporting documents should be with the transaction they support. Any other supporting documents related to vehicle transactions. Please note that all voided transactions should remain in numeric order with all supporting documents. The voided document MUST remain in your work. Do Not destroy or discard your voided application, title or any other documentation. Please provide explanation for the void. 10 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) PREPARING THE DAILY CASH BALANCE SHEET Clerk / Manager Supervisor or Assigned Clerk Together with the manager, supervisor or assigned clerk, you must prepare the “Daily Cash Balance Sheet” as the money in the drawer is verified. Attach the calculator tape to the Balance Sheet copy. You must enter the information in all fields and insure that the form is complete. Once the total has been verified with the manager, supervisor or assigned clerk, you both must sign and date the “Daily Cash Balance Sheet.” Any necessary corrections or adjustments must be made at this time. The first step is to enter the INFORMATION in Section 1 of the Daily Cash Balance Sheet. All fields on the Daily Cash Balance Sheet must be complete: 1. 2. 3. 4. “Clerk name and ID” “Date” “Field Office / POE” “Report Number” Next, you will verify the total cash, checks and credit card payments from your cash drawer with the manager, supervisor or assigned clerk. The information will be entered in the TOTALS FROM CASH DRAWER in Section 2 of the Daily Cash Balance Sheet. Cash - Count and verify all the cash and coins in the cash drawer. (This includes the beginning cash allotment.) 1. Enter the count of each denomination and the total value. 2. Add all totals of the cash and coin and enter the new total in the “Total Cash in Drawer”. 3. Enter the beginning cash allotment in the “Less: Beginning Cash”. 4. Subtract the total in the “Less: Beginning Cash” from the total in the “Total Cash in Drawer”. 5. Enter the total in the “Cash in Drawer”. Checks – Count and verify the checks in the cash drawer. Run a tape on the adding machine of all checks in your drawer. Enter the total of your checks in the “Total Checks in Drawer”. Credit Cards - Count and verify the credit card payments in the cash drawer. 1. Run a tape on the adding machine of all credit card transactions in your drawer. 1. 2. 11 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) 2. Enter the total of your credit card transactions in the “Total Credit Card”. You will also want to: a. Quickly audit the checks to verify that all checks are signed, dated, and payable to “New Mexico Motor Vehicle Division”. b. Quickly audit the legally written amount (Thirty and no/100) to verify that it matches the numeric amount (30.00). Manager Once the clerk’s cash drawer has been verified the beginning cash allotment should Supervisor or be separated and locked in the clerk’s drawer or bank bag in the safe. The Assigned Clerk remainder of the funds collected that are to be deposited should be placed and locked in the deposit bag or lock box. RECONCILE CASH TO TRANSACTION REPORT Clerk/ Manager Supervisor or Assigned Clerk Print the clerk’s daily transaction report. The actual cash, checks and credit card totals are then balanced against the clerk’s daily transaction report. The manager/supervisor or assigned clerk collects all of the paperwork from each clerk. Together the clerk and the manager, supervisor or assigned clerk will verify: Cash - Enter the cash total from your transaction summary report on the TOTAL CASH line of section 3 “Totals from Report “ on your Daily Cash Balance Sheet. This total should match the total listed as “Cash in Drawer” in section 2 of your Daily Cash Balance Sheet. Checks - Enter the checks total from your transaction summary report on the TOTAL CHECKS line of section 3 “Totals From Report” on your Daily Cash Balance Sheet. This total should match the total listed as “Total Checks in Drawer” in section 2 of your Daily Cash Balance Sheet. Credit Cards - Enter the credit card total from your transaction summary report on the TOTAL CREDIT CARD line of section 3 “Totals From Report” on your Daily Cash Balance Sheet. This total should match the total listed as “Total Credit Card” in section 2 of your Daily Cash Balance Sheet. You will also want to quickly audit the reports and verify that the transactions match the supporting documents for each transaction. 12 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) OVERS AND SHORTS Clerk / If there is a difference between the report totals and the cash, checks or credit card Manager totals, list the difference in the “Over” or “Short” box for that section (cash, Supervisor or checks, credit card) on section 4 of your Daily Cash Balance Sheet. If there is an Assigned Clerk over or short, the clerk and his or her manager, supervisor or assigned clerk must determine the reason for the outage. The clerk and manager, supervisor or assigned clerk must try to or locate the source of the problem and should do so by: 1. Verifying that the receipts were counted accurately. 2. Verifying that the proper amounts were charged and collected for all transactions. 3. Verifying that all documents have been correctly accounted for. 4. Verifying that all documents that were voided show as voids on the transaction report. 5. When the error(s) is (are) located, make the proper correction and, if necessary, indicate on the Daily Cash Balance Sheet as “Over” or “Short”. 6. Show the error to the clerk and have the clerk initial any “Over” or “Short” amount on the Daily Cash Balance Sheet. 7. If the error(s) cannot be located, indicate on both the Daily Cash Balance Sheet and the adjusted transaction report printout the amount of the overage or shortage. The cashier and manager, supervisor or assigned clerk must initial both. Manager When all clerk drawers have been counted, the manager/supervisor or assigned Supervisor or clerk must complete the “Cash Over/Short Detail Report” (MVD form-22068). Assigned Clerk Advise your employees that unexplained “Overages” or “Shortages” may result in disciplinary action. 13 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) CLOSING OUT REPORTS Manager At the end of the day, you should have balanced each clerk’s cash drawer to the Supervisor or daily transaction report with each clerk. After all clerk’s are in balance and any Assigned Clerk adjustments have been made, you will: 1. Print out the “Revenue Summary Report” for the day. 2. Print out the “All Clerk’s Transaction Summary Report” for the day. 3. Verify that the totals on the “Revenue Summary Report” match those on the “All Clerk’s Transaction Summary Report”. All reports must be reconciled and all corrections must be made prior to printing the “Revenue Summary Report” and “All Clerk’s Transaction Summary Report”. PREPARING THE BANK DEPOSIT Manager The manager/supervisor or assigned clerk collects all cash, checks and coin from Supervisor or clerks, minus the starting balance for each drawer and prepares the deposit. Assigned Clerk 1. Enter the date of the deposit in proper location on the deposit slip. 2. Write the report number and field office number on the deposit slip. 3. Run a tape on the adding machine of all checks. Enter the total on the deposit slip under “Checks”. 4. Run a tape on the adding machine of all cash and enter it on the deposit slip under “Cash”. 5. Run a tape on the adding machine of all coin and enter the total on the deposit slip under “Coin”. 6. Add the total “Checks, Cash and Coin” and enter the total on the deposit slip under “Total Deposit”. 7. Place the completed deposit slip with all checks, cash and coin in a lock bag or sealed security deposit bag (from the bank) and take the deposit to the bank or lock the deposit in the safe (which must be secure) to be deposited or picked up by the courier (if applicable). Per New Mexico State Statutes you are required to submit all reports and payments (or deposits) to the department no later than the close of the next business day. 14 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) REFERENCES Appointment of agents; termination: Motor Vehicle Code [66-2-14. NMSA 1978 Subsections A & B] Agents or Department Employees to remit money received; bonds for agents or department employees: Motor Vehicle Code [66-2-15 NMSA 1978] Administrative service fees; collection; remittance; payment; optional service fees; appropriation: Motor Vehicle Code [66-2-16. NMSA 1978 Subsection A, B, C & E] Motor Vehicle suspense fund created; receipts; disbursements: Motor Vehicle Code [66-6-22.1 NMSA 1978 Subsection B & D] 15 TAXATION AND REVENUE DEPARTMENT CLOSING PROCEDURES March 2016 Revised (11/8/05) 16 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) TABLE OF CONTENTS INTRODUCTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -18 ENVELOPE PREPARATION FOR CASH CONTORL. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. .-18 DOCUMENT PREPARATION FOR CASH CONTROL ENVELOPE. . . . . . . . . . . . . . . . . . . . . . . . . . . . .19 ENVELOPE PREPARATION FOR IMAGE PROCESSING. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 DOCUMENT PREPARATION FOR DRIVER TRANSACTION ENVELOPE . . . . . . . . . . . . . . . . . . . . . .21 ENVELOPE PREPARATION FOR DRIVER TRANSACTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 DOCUMENT PREPARATION FOR VEHICLE TRANSACTION ENVELOPE . . . . . . . . . . . . . . . . . . . . .23 ENVELOPE PREPARATION FOR VEHICLE TRANSACTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 17 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) INTRODUCTION As discussed in the Closing Procedures, by statute, you are required to submit all reports and payments to the department no later than the close of the next business day. This section was created to assist you in preparing the documents and envelopes correctly for submission of the reports, payments and supporting documents. ENVELOPE PREPARATION FOR CASH CONTROL Manager An envelope should be prepared and sent to Cash Control at the main office in Supervisor or Santa Fe. Assigned Clerk The envelope MUST list: 1. Your Field Office and Address. 2. Attention: Cash Control Section. 3. The Report Number in the upper left corner. 4. MUST be addressed in the format listed below in the example. EXAMPLE: 01A Santa Fe MVD 2544 Camino Edward Ortiz Santa Fe, New Mexico 87507 Attention: Cash Control Section Report # 250 Mail To (Field office) (Address) (Attention: Cash Control) (Report Number) State of New Mexico Motor Vehicle Division P.O. Box 1028 Santa Fe, New Mexico 87504 18 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) DOCUMENT PREPARATION FOR CASH CONTROL ENVELOPE Manager Supervisor or Assigned clerk The Cash Control Envelope should contain the following documents in the following order: A copy of the deposit slip or a check for the total amount of the Revenue Summary. 1. Both MUST contain the field office number and the report number. 2. The amount MUST balance with the amount of the deposit and the total on the “All Clerk’s Revenue Summary Report” and “All Clerk’s Transaction Summary Report”. All state operated offices set up on direct deposit will not have a check to submit but will have a deposit slip. All other offices must submit a check for payment. “All Clerk’s Revenue Summary Report”, which has a printed (legible) name, signature and contact telephone number. “All Clerk’s Transaction Summary Report”. Any manual voids must have a written explanation of why the void occurred and the transaction must be highlighted. “Cash Over/Short Detail Report” (if applicable). All documents are to be staple and paper clip free. 19 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) ENVELOPE PREPARATION FOR IMAGE PROCESSING Manager The second envelope (sample below) is to be sent to Image Processing and should Supervisor contain two smaller envelopes: Assigned Clerk One envelope will contain the “Driver Transactions” with all supporting documents (Example on page 22). The other will contain the “Vehicle Transactions” with all supporting documents (Example on page 24). The envelope MUST list: 1. Your Field Office and Address. 2. Attention: Image Processing. 3. The Report Number in the upper left corner. 4. MUST be addressed in the format listed below in the example. EXAMPLE: 01A Santa Fe MVD 2544 Camino Edward Ortiz Santa Fe, New Mexico 87507 Attention: Image Processing Report # 250 Mail To (Field office) (Address) (Attention: Image Processing) (Report Number) State of New Mexico Motor Vehicle Division P.O. Box 1028 Santa Fe, New Mexico 87504 20 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) DOCUMENT PREPARATION FOR DRIVER TRANSACTION ENVELOPE Manager Supervisor or In clerk order (Z9901, Z9902, Z9903 etc…) separate the paperwork into Vehicles Transactions and Drivers Transactions. Assigned Clerk Prepare documents for Image Processing. 1. All documents are to be staple free. 2. Sort documents by clerk and keep in clerk order. 3. Rubber band each clerks paperwork together. 4. If the bundle is small you can use one paperclip to hold the work together, but do not use a paperclip in any other place within the clerks work. 5. Documents must be in sequential order. 6. Green bar printouts (if applicable) should be separated and folded in half, printed side out. 7. All documents should be faced forward and all facing the same direction top to bottom. 8. Voided Driver’s Licenses and Vehicle License Plates are not to be sent in. Prepare documents for imaging in the following order, by clerk, in clerk order for Driver Transactions. 1. 2. 3. 4. “Revenue Summary Report” (all totals). “All Clerk’s Transaction Summary Report” (All totals). Individual clerk’s Transaction Summary Report. All supporting documents for driver transactions including any voids. Action Updates with supporting documents. Penalty Assessment Documents in numeric order. Supporting documents should be with transaction they support. Driver License Applications in numeric order by application number. Supporting documents should be with the transactions they support. Any other Miscellaneous forms and/or supporting documents related to driver transactions. 21 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) ENVELOPE PREPARATION FOR DRIVER TRANSACTIONS Manager Prepare envelope for imaging of driver transactions. The information should be Supervisor or listed on the flap of the envelope: Assigned Clerk 1. List the office number. 2. List the office name. 3. “Drivers”. 4. Report number. 5. Number of envelopes. 6. Envelope MUST be addressed in the format listed below in the example. EXAMPLE: O2B – Winrock (“Drivers”) (Office #)(Office Name) DRIVERS 1 of 2 Report #251 (Report #) (Envelope 1 of 2) 22 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) DOCUMENT PREPARATION FOR VEHICLE TRANSACTION ENVELOPE Manager Prepare documents for Image Processing. Supervisor or 1. All documents are to be staple free. Assigned Clerk 2. Sort documents by clerk and keep in clerk order. 3. Rubber band each clerks paperwork together. 4. If the bundle is small you can use one paperclip to hold the work together, but do not use a paperclip in any other place within the clerks work. 5. Documents must be in sequential order. 6. Green bar printouts (if applicable) should be separated and folded in half, printed side out. 7. All documents should be faced forward and all facing the same direction top to bottom. 8. Voided Driver’s Licenses and Vehicle License Plates are not to be sent in. Prepare documents for imaging in the following order, by clerk, in clerk order for Vehicle Transactions. 1. “Revenue Summary Report” (All totals). 2. “All Clerk’s Transaction Summary Report” (All totals). 3. Individual clerk’s Transaction Summary Report. 4. All supporting documents for vehicle transactions including any voids. Miscellaneous transactions with supporting documents. Boat applications in numeric order. Supporting documents should be with transaction they support. Vehicle Title application in numeric order by application number. Supporting documents should be with the transactions they support. Any other supporting documents related to vehicle transactions. 23 TAXATION AND REVENUE DEPARTMENT PROCEDURES FOR PREPRATION & SUBMISSION OF PAYMENTS & DOCUMENTS March 2016 Revised (11/8/05) ENVELOPE PREPARATION FOR VEHICLE TRANSACTIONS Manager Supervisor or Prepare envelope for imaging of vehicle transactions. The information should be listed on the flap of the envelope: Assigned Clerk 1. 2. 3. 4. 5. 6. List the office number. List the office name. “Vehicles”. Report number. Number of envelopes. Envelope MUST be addressed in the format listed below in the example. EXAMPLE: O2B – Winrock (“Vehicles”) Vehicles (Office #)(Office Name) Report #251 1 of 2 (Report #) (Envelope 1 of 2) 24