End of year letter 2015

advertisement

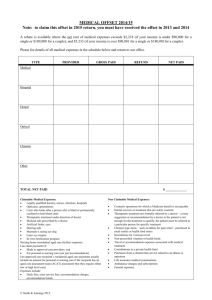

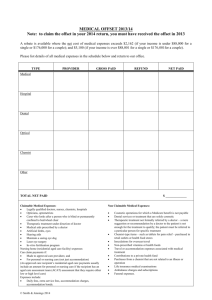

TOLTON & CO. PTY. LTD. ABN 93 009 447 634 Business and Taxation Consultants Quality Assured by the Australian Society of CPA’s 72B Hale Road Forrestfield WA 6058 Unit 4, 264 Kalamunda Road Maida Vale WA 6057 Unit 8, 3 Canning Road Kalamunda WA 6076 Postal : PO Box 126 Forrestfield W.A. 6058 Telephone: (08) 9359 1011 Fax: (08) 9453 1735 Email: accountants@tolton.com.au Web: www.tolton.com.au R.B. Tolton BBus(WAIT),PGradDipBus(Curtin),FCPA,FTIA 2015 INCOME TAX RETURNS The 2015 financial year has now come to an end. So once again it is time to gather your papers together so that we can complete your tax returns. We have attached your personal income tax returns and business checklists to help prepare your 2015 income tax information. Please provide your information in our preferred format. Please complete our checklist which can be found on our website, www.tolton.com.au. See clients, current information, 2015 individual income tax return checklist. Once you have completed the form please email it to us or bring it with you for your interview. 2015 TAX RETURN CHANGES Tax Rates have not changed for the 2015 year. Individual resident tax rates are as follows: Tax rates 2014-15 Taxable income Tax on this income $1 – $18,200 Nil $18,201 – $37,000 19c for each $1 over $18,200 $37,001 – $80,000 $3,572 plus 32.5c for each $1 over $37,000 $80,001 – $180,000 $17,547 plus 37c for each $1 over $80,000 $180,001 and over $54,547 plus 45c for each $1 over $180,000 Medicare Levy From 1 July 2014 the basic medicare levy percentage has increased by 0.5% to 2%. Also, for taxable incomes over $180,000, there will be an additional 2% payable for the Temporary Budget Repair Levy. This takes effect for 3 years from 1 July 2014 to 30 June 2017. Low Income Tax Offset The full amount is $445 reducing by 1.5 cents in the dollar, for every dollar of taxable income over $37,000 such that it cuts out at $66,667. The effect is that no tax is payable up to an income of $20,542. Dependent Spouse Offset From 1 July 2014 taxpayers who were previously able to claim the dependent spouse offset, including under the calculation for zone offset, will no longer be able to claim the dependent spouse offset. The legislation has yet to be passed by Parliament. Taxpayers with a dependent who is genuinely unable to work due to a carer obligation or disability will continue to be able to claim the Dependent (Invalid and Carer) Tax Offset. Mature Age Workers Tax Offset This is not available from 1 July 2014. Net Medical Expenses Offset Phase-out Taxpayers who received the offset in their income tax return for both 2013 and 2014 will continue to be eligible for the offset in the 2015 year if they have eligible out-of-pocket medical expenses above the relevant claim threshold. Those who receive the tax offset for the 2015 year will continue to be eligible for the 2016 year. Taxpayers with an adjusted taxable income above $90,000 for singles or $180,000 for a couple or family in 2015 year will be able to claim a reimbursement of 10% for eligible out of pocket expenses incurred in excess of $5,233. Taxpayers with an adjusted taxable income below these thresholds will be able to claim a reimbursement of 20% for net medical expenses over $2,218 when they lodge their tax return. Taxpayers who did not claim an offset last year will only be eligible to claim for disability aids, attendant care or aged care expenses. Small Business Accelerated Depreciation With effect from 12 May 2015 to 30 June 2017 the immediate write-off limit for each small business asset purchased is increased from $1,000 to $20,000. From 12 May 2015 farmers will get accelerated deductions for water facilities (100%), fodder storage (3 years) and fencing (100%). Superannuation Contributions Caps From 1 July 2014 the concessional contributions cap is $35,000 for people age 49 and over on 30 June 2014. Otherwise the cap is $30,000. Concessional contributions are essentially those contributions which are tax deductible, and include employer contributions and personal contributions claimed by the selfemployed. Super Guarantee From 1 July 2014 the superannuation guarantee percentage increased to 9.5% from 9.25%. This will remain at 9.5% until 30 June 2021. AUDIT ACTIVITY The ATO has advised that it continues to expand its audit coverage of individual taxpayers by using more sophisticated compliance techniques to identify areas requiring specific attention. In fact, the ATO has recently announced new data-matching activities for individuals as a means of further expanding and improving its data and information matching activities. For the 2015 income year, based on claims identified in previous years, it is likely that a broader range of areas will receive greater compliance attention from the ATO, such as the following: Work-related expense claims – The ATO has advised that it will be using extensive date analysis to identify areas requiring attention across all work-related expense claims, regardless of the occupation concerned. In particular, the ATO will be paying particular attention to work-related expense claims relating to the following: Claims for travel expenses relating to overnight travel. Reasonable travel allowance expense claims. Claiming the work-related proportion of computers and similar devices eg iPads. Rental properties – The ATO has also advised that it will be increasing its compliance focus on rental property deductions, with a particular focus on the following: Claiming purchase-related costs for a rental property. Claiming deductions for properties that are not genuinely available for rent, or which are only available for rent for part of the income year (eg holiday homes). Claiming deductions before a rental property is actually rented or available for rent. The 6-month overlap rule for changing main residences – it has been identified that the 6-month overlap rule for changing main residences may be incorrectly applied where a taxpayer acquires a new dwelling (which is to become their main residence), and still owns their existing dwelling for a period of time (eg there is a delay in selling the existing dwelling or the existing dwelling is rented out to tenants). CGT issues with “granny flats” and other similar backyard arrangements – with the rise in Australian property prices, together with Australia’s aging population, there has been an increase in the number of people using a granny flat or a similar unit of accommodation as part of their family home (ie in the backyard). However, the CGT treatment of such arrangements can be quite confusing, thereby potentially creating audit traps for individuals who use a granny flat (or similar unit of accommodation) as part of their family home. Small business On 30 June 2014, the ATO released its compliance program for 2015, which, not surprisingly, shows its remained focus on the following key areas with regards to business taxpayers: Property developers Property related transactions remain a focus of the ATO as they announce an audit assault on property developers and profits. APPS Sage Point and Claim This is a free smartphone app which records your receipts. The app will allow you to: Photograph a receipt using your smartphone Automatically extract the data and categorize the receipt using optical character recognition technology Confirm receipt data Append warranty details View saved receipts in your secure online portal Export the data to us and/or share via email Australian Taxation Office The Australian Taxation Office app puts tax help in your hand, making it easier for you to conduct your personal or business tax affairs. If you are an individual or small business owner you can track, work out, calculate and find relevant tax information and tools in one place. You can: Search for lost super Discover new ways to lodge your 2014 individual income tax return online Track the progress of your individual income tax return after you have lodged Work out if your worker is eligible for super guarantee (SG) and calculate SG contributions Calculate fuel tax credit entitlements you can claim on your business activity statement Work out if your worker is an employee or contractor for tax and super purposes Search Small Business Assist to find information on a range of topics or book an after-hours callback Calculate the amount of tax to withhold from salary and wage payments See how quickly you can pay off a tax debt with a payment plan View income tax rates for the current financial year Also, get answers to common questions and find out what’s new or what’s changed. ATO Tax Calculator A simple tax calculator. Now includes a tax refund calculator. If you have been offered a new job, been given a yearly rate and want to calculate what will end up in your pocket then this app is for you. Also, maybe you know what you get paid each fortnight but need to calculate your yearly gross income, then again, this app is for you. CHANGES AT TOLTON & CO Web Site Our new web site is now live! Please check it out at www.tolton.com.au. Bookkeeping Services If you are struggling to maintain your business records we can help by providing bookkeeping services at a cost of $50 per hour plus GST. We can assist you in maintaining live records accessible via the internet using either your own software or we can provide this for you. Our services include preparation of BAS statements, tax records, payroll, debtors, and creditors. OFFICE HOURS Availability at offices, generally. FORRESTFIELD - Office hours are 9.00am to 5.00pm MAIDA VALE - Office hours are 9.00am to 4.00pm KALAMUNDA - Office hours are 9.00am to 3.00pm After hours appointments are available at the above offices depending on demand. The latest appointment available Monday to Friday is 8.00pm and Saturdays at 3.00 pm. Appointments can be made by ringing 9359 1011. Rob is away until Tuesday the 18th of August 2015 and up until this time Martin will take appointments on Saturdays but there will be no after hours appointments. When Rob returns he will be the only person available to take after hours appointments, including Saturdays and Sundays, but will not be taking interviews during the day. STAFF Rob, Diana, Sharon, Martin, Ros, Belinda, Genny, Tessa and Sandra continue on from last year. Sandy has returned to us after having a baby boy last August. BANKFEEDS The BankFeeds system which is attached to our current ledger software, HandiLedger, allows us to receive your bank statements electronically. By using this system we can transfer a large amount of the recurring transactions automatically into your accounts – don’t you love technology! BankFeeds will benefit those clients who don’t like doing their own bookwork. If we think you would benefit from this system we will send out authorization forms for you to sign when we prepare your financial statements. IMPORTANT INFORMATION - FEES Remember that Tolton & Co charges on a time basis. To help lower your accounting costs please provide us with all necessary documentation in a presentable manner. By doing some of the basic clerical work yourself these costs can be further minimized. Please note that our payment terms will be strictly 7 days. Payment can be made by cash, cheque, and credit card or via the completion of our fee from refund authority. For individual returns, if you are not paying on completion of your return you must sign a trust account engagement. If payment is not received before refund is received, it will automatically be deposited into our trust account and your fee will be deducted. Please remember that an administration fee of $22.00 (GST included) is charged for this service. We look forward to seeing you soon and wish you the very best of luck in the new financial year. Kind Regards From all the team at TOLTON & CO PTY LTD Robert Tolton Sharon Schussler Martin Muriuki Roslyn Armstrong Belinda Tangney Sandy Hu Genny Tangney Tessa Campbell Diana Bullock Sandra Preisig Principal – BBus, PGradDipBus, CTA, FCPA, NTAA, Tax Agent Senior Accountant – AdvDip(Acc), CTA, Tax Agent Accountant – BBus, AdvDip(Acc), CPA, Tax Agent Accountant – BBus, CPA Accountant –Bbus, CPA Accountant – DipComm, BCom(Acc), CPA Taxation Consultant Taxation Consultant Office Administrator Receptionist PERSONAL INCOME TAX RETURNS - CHECKLIST Please provide the following information for the period 1 July 2014 to 30 June 2015 INCOME Yes N/A Payment Summaries Details of foreign employment income Unemployment and pension income statements Interest received with details of bank, branch and account numbers Statements of dividends received showing any imputation credits Statements of Termination Payments received from employers and funds Details of casual earnings and any other income Details of tax-free pensions Details of any sales of real estate, stocks, shares or other investment property We also require dates of acquisition and details of costs. DEDUCTIONS The following is a list of common claims. This is not a comprehensive list and there may be other claims you are entitled to Gifts over $2 to registered gift recipients and approved school building funds Subscriptions to trade unions and professional bodies Personal sickness and accident insurance premiums Self education expenditure connected with your employment. Claims include Travel, fees (but not HECS), books and stationary. Tools and equipment. Any replaced tool under $300 can be claimed outright And over $300 can be depreciated. We will need the date purchased for items over $300. Uniform and protective clothing costs Motor vehicle expenses. Home office expenses. Travel expenses in relation to the completion of your tax return. Provide details of kilometers traveled to our office during the year. Sunscreen, hats and sunglasses expenses. SPOUSE OFFSET From 1 July 2014 taxpayers who were previously able to claim the dependent spouse offset, including under the calculation for zone offset, will no longer be able to claim the dependent spouse offset. The legislation has yet to be passed by Parliament. Taxpayers with a dependent who is genuinely unable to work due to a carer obligation or disability will continue to be able to claim the Dependent (Invalid and Carer) Tax Offset. ZONE OFFSET If you lived or were traveling in a remote area of Australia for a total of 183 days or more you may be able to claim a zone rebate. We will require name of township, dates and number of days spent in zone areas. You will be able to claim a notional spouse rebate, if claiming a zone rebate. MEDICAL EXPENSES OFFSET Taxpayers who received the offset in their income tax return for both 2013 and 2014 will continue to be eligible for the offset in the 2015 year if they have eligible out-of-pocket medical expenses above the relevant claim threshold. Taxpayers who did not claim an offset last year will only be eligible to claim for disability aids, attendant care or aged care expenses. We will require details of relevant medical expenses including reimbursements received to determine your claim. SUPERANNUATION CONTRIBUTIONS ON BEHALF OF YOUR SPOUSE OFFSET A rebate is available if you have made any superannuation contributions on behalf of a low income earning spouse. In order to claim this rebate for you we would require details of the contributions made and your spouse’s income. MEDICARE LEVY SURCHARGE A Medicare levy surcharge still applies to those high income earners who do not have the appropriate health insurance. If you do have private health insurance we will require: Name of health fund Membership number Details of your dependants and whether they are covered by your health fund Period of cover A private health insurance rebate is still available for eligible taxpayers that have private health cover that have not already received a reduction in premiums. Your Health Fund should send you a statement at the end of the financial year that will contain all the information we need. Please provide this statement to us. This rebate is income tested. PRIVATE HEALTH CARE REBATE CHILD MAINTENANCE EXPENDITURE Deductible child maintenance expenditure is the amount of child support you pay to another person to maintain your natural or adopted child following separation. This is used in calculating your adjusted taxable income. From 1 July 2009 this will be used to work out your entitlement to any dependant tax offset. Do not include any amounts you paid or provided to a person to acquire goods or services. RENTAL INCOME If you own a rental property, please provide the following information; Agent’s statements or details of rent receipts. Details of non-agent collections and inspections Statements of interest charged on monies borrowed Details of all payments in respect to advertising, repairs, maintenance, rates and taxes etc If you bought or sold a property during the year, we will require a copy of the offer and acceptance forms, copies of settlement statements and details in connection with a new loan taken out or a loan discharged. If you bought a property during the year that was built after 18 July 1985, we will require details of the cost of building the property. MOTOR VEHICLE EXPENSES Cents per Kilometers Method If you have used your vehicle for work, you can claim on a cents per kilometer basis using rates supplied by the tax office. Please supply the following details: Make of vehicle; Engine capacity; and Number of business kilometers travelled in the year. You can use this method to claim your expenses up to a maximum limit of 5,000 km. Note that you must be able to show how you calculated the kilometers travelled. YES N/A One-third of actual expenses method or log book method If you have travelled more than 5,000 km for work related travel during the year you can claim one-third of your vehicle running costs or a higher proportion established by a log book. A log book must be completed for a period of 12 weeks and used to calculate a reasonable estimate of your business use. If you have completed a log book in a previous year and have already determined a business percentage, and business use has not altered by more than 10%, then you can use the percentage previously determined PLEASE NOTE THAT NEW LOG BOOKS MUST BE COMPLETED EVERY 5 YEARS. Please ensure that your log book details are still current. You should keep odometer readings for the beginning and end of the year and provide us with amounts expended in the year for: YES N/A Fuel and oil; Repairs and maintenance; Registration and insurance; and Loan or hire purchase interest. HOME OFFICE EXPENSES If a room is maintained at home specifically for work or study, you can claim the additional running expenses incurred. If claiming by this method we will require total expenses for the following: YES N/A Electricity at 34c per hour Telephone a percentage used for work Cleaning Repairs to room If items of fixtures and fittings have been purchased for use in the office please provide cost price and date of acquisition. Alternatively, you can use a fixed rate of 34cents per hour for home office expenses instead of keeping details of actual costs. Diary records are acceptable evidence and it is recommended that you keep diary records during a representative period and for a reasonable time, for example at least 4 weeks. If your place of business is at home we will also require statements of the mortgage loan and details of insurance, rates and any rent paid. SUBSTANTIATION The tax office demands that records are kept for all business expenses. Severe substantiation rules apply to claims for motor vehicle expenses and travel expenses; therefore it is essential that you keep all your receipts for these claims. You must also keep your tax invoices if you are claiming a credit for GST paid on purchases. WORK-RELATED EXPENSES You must keep a receipt, invoice or similar document showing the following information: the date the expense was incurred, the name of the person or business who supplied the goods or services, the date of the document, the nature of the goods and services supplied. If you are making claims for work-related expenses, it is essential that you keep receipts or diary records. If your work-related claims for the year (excluding motor vehicle expenses and expenses relating to allowances covered by special rules i.e. overtime meal allowance, travel allowances and award transport payments) are less than $300 no substantiation is required. However, if your total claim exceeds $300, inclusive of laundry expenses, you must substantiate all the non-laundry expenses. You may be required to produce the evidence to substantiate any claims if requested by the Commissioner of Taxation and failure to do so will result in the loss of the deduction. The failure does not constitute a prosecutable offence but additional tax may be imposed. The relevant documentation is required to be maintained for a period of five years from the date of lodgment of your returns. BUSINESS INCOME TAX RETURNS – CHECKLIST Please provide the following information for the period1 July 2014 to 30 June 2015 If you prepare your details on accounting software such as MYOB or Quickbooks please provide us with a backup file by email or disk drive. Otherwise we will require the following reports: YES N/A Detailed general ledger printout Summarised general ledger printout Bank statements (if not reconciled) Copy of bank statement as at 30 June (if bank account reconciled) Trial balance Profit and loss and balance sheet as at 30 June Reconciliation of accounts payable (creditors) Reconciliation of accounts receivable (debtors) Bank reconciliation as at 30 June Please check these printouts prior to giving them to us to ensure that the reports are reconciled. If you don’t use accounting software to prepare your business records we will require: Manual cash books/computer records/record of income and expenses Bank reconciliation statement Bank statements A schedule of all debtors (money owed to you) as at 30 June, including details of all bad debts, the amount of debtors should include any amounts owing for goods on lay-by. A schedule of all creditors (money owed by you) as at 30 June. We will require details of the amount owing for each category of expense. This includes wages, group tax, sales tax and payroll tax due at that date together with an estimate of any accrued holiday pay. Details of any deposits which are not sales Bank statements for loans showing interest and bank charges It is of considerable assistance to this firm and a cost benefit to you if your records can be analyzed, added and reconciled to the bank statements prior to presentation. Other details required (if applicable) Stock on hand at 30 June, valued at the lower of cost, or net releasable value. (excluding GST) Details of any plant or motor vehicles disposed of or scrapped during the year Odometer readings at the beginning and end of the year for all the vehicles Plant or motor vehicle acquisitions during the year including: Trade in values Hire purchase details Loan contract details and bank statements Where a business was purchased or sold during the period we will require: Offer and acceptance form for the purchase and or sale of the business Settlement statements Plant & equipment list New loan/discharge details