medical rebate - Smith & Jennings

advertisement

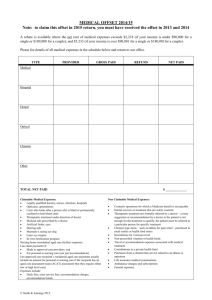

MEDICAL OFFSET 2013/14 Note: to claim the offset in your 2014 return, you must have received the offset in 2013 A rebate is available where the net cost of medical expenses exceeds $2,162 (if your income is under $88,000 for a single or $176,000 for a couple); and $5,100 (if your income is over $88,001 for a single or $176,001for a couple). Please list details of all medical expenses in the schedule below and return to our office. TYPE PROVIDER GROSS PAID REFUND NET PAID Medical Hospital Dental Optical Chemist Other TOTAL NET PAID Claimable Medical Expenses: Legally qualified doctors, nurses, chemists, hospitals Opticians, optometrists Carer who looks after a person who is blind or permanently confined to bed/wheel chair Therapeutic treatment under direction of doctor Medical aids prescribed by a doctor Artificial limbs, eyes Hearing aids Maintain a seeing eye dog Laser eye surgery In-vitro fertilisation program Nursing home (residential aged care facility) expenses: Can claim payments if: Made to approved care providers; and For personal or nursing care (not just accommodation) (An approved care recipient’s residential aged care payments usually include an amount for personal or nursing care if the recipient has an aged care assessment team (ACAT) assessment that they require either low or high level care) Expenses include: Daily fees, extra service fees, accommodation charges, accommodation bonds. © Smith & Jennings 2014 $ _____________ Non Claimable Medical Expenses: Cosmetic operations for which a Medicare benefit is not payable Dental services or treatment that are solely cosmetic Therapeutic treatment not formally referred by a doctor – a mere suggestion or recommendation by a doctor to the patient is not enough for the treatment to qualify; the patient must be referred to a particular person for specific treatment Chemist-type items – such as tablets for pain relief – purchased in retail outlets or health food stores Inoculations for overseas travel Non-prescribed vitamins or health foods Travel or accommodation expenses associated with medical treatment Contributions to a private health fund Purchases from a chemist that are not related to an illness or operation Life insurance medical examinations Ambulance charges and subscriptions Funeral expenses. © Smith & Jennings 2014